02.24.2025

2025 Canadian Black Book Market Preview

2024 Recap

The Canadian auto industry experienced a transformative 2024, marked by significant shifts in vehicle availability, pricing, and market dynamics. In the New car market, we saw inventories continue to recover, supporting vehicle availability last seen prior to the pandemic. Only this time, prices have risen upwards of 30% on average with interest rates at decade highs. Multiple brands felt the impact, particularly in the entry-level and mid-tier luxury segments, where consumer resistance to high costs became evident.

Economic Factors & Market Adjustments

With North American economic variables needing to be reined in, Canada in due course rectified increased inflation levels by quantitative easing, lowering our overnight interest rate in the second half of the year by 175 basis points from the eye-watering 5% as of June (remember, we’re coming up from 0.25%). This pushed monthly payment sensitive consumers to consider new cars with high but more palatable pricing. These actions also effectively disabled our ability to strengthen the Canadian Exchange Rate, and with U.S. consumer demand returning caused further inability to keep quality vehicles within Canadian borders.

Used Car Market & Retained Values

As retained values fell for most of 2024, our Used car market only corrected pricing down by 8% year-over-year, as the allure of our inventory to U.S. buyers stopped the bleeding of our vehicle values towards the last quarter of the year. This provided support for larger Crossovers and SUVs in the luxury space as well as Full Size Pickups. What also kept values from falling in our market was the high interest for hybrid and plug-in hybrid electric vehicles, that spurred on as fully electric vehicles lost favour in most marketplaces. These electrified models have become more heavily the flavour of the week in Canada as they provide a much more acceptable balance of fuel efficiency, affordability, and convenience as the stopgap (however long this may be) to adoption of fully electric vehicles becomes more akin to what consumers want.

Looking Ahead: What to Expect in 2025

As we shift our focus to 2025, industry projections must consider a range of economic, political, and technological factors. While 2024 provided a roadmap for market expectations, ongoing U.S. and Canadian political volatility and the uncertain trajectory of the electrified vehicle market have already introduced new challenges.

Throughout the past year, industry discussions revolved around EV adoption, new vehicle pricing trends, residual value forecasting, and overall market sensitivities. One recurring theme echoed across the sector: “pivot.”

With shifting consumer preferences, regulatory developments, and economic fluctuations, the ability to pivot remains critical. Over the next 10 months, market players must once again demonstrate adaptability and strategic agility to navigate the evolving automotive landscape.

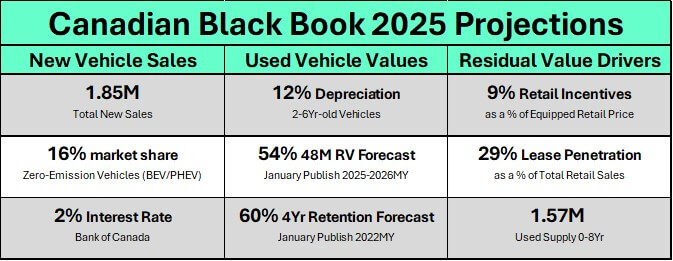

2025 Canadian Black Book Projections

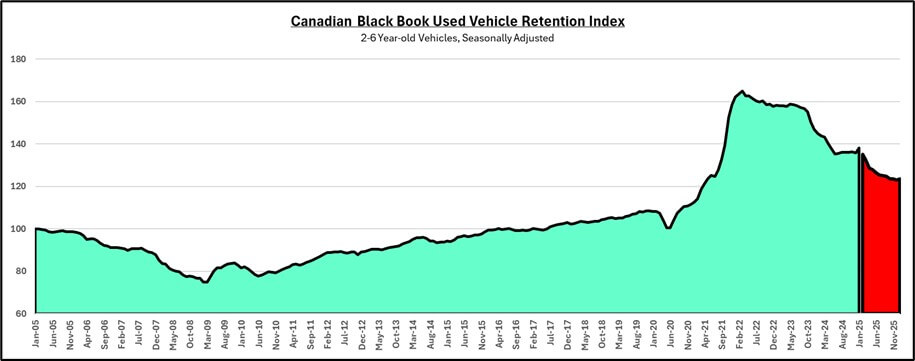

Canadian Black Book Used Vehicle Retention Index

The Used Vehicle Retention Index stabilized in the second half of 2024, ending the year at 135.7, down 7.8% in 2024 and 21.6% down from the market peak in March 2022. With anticipated volatility over the next 6 months in wholesale values due to proposed U.S. tariffs of 25%, the market could respond in a couple of different ways. The Canadian market will realize decreasing used car pricing, but with current pressure from the U.S. on used vehicle demand, this has the capacity to soften price decreases with those buyers keeping their U.S. dollars stateside. As well, with a decrease in late model used vehicle supply resulting from production constraints on new vehicles, we will see limited value elasticity over 2025. Canadian Black Book anticipates the Index to continue its decrease, representing retention to be forecasted at 123.1, a 9.3% average decrease over the next 10 months.

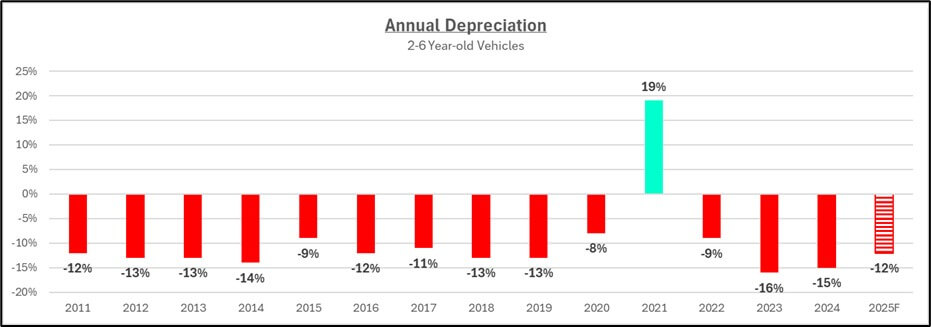

Used Vehicle Depreciation (2-6 year old vehicles)

Last year’s depreciation of 15% marked a marginal improvement as the return to historical norms in 2023 continued after three tumultuous years at the start of the decade. Canadian Black Book expects that, like the year before, 2025 will be heavily influenced by a shrinking supply of late model used vehicles, which will prop values up before further declines in 2026 and 2027 bring used vehicle values closer to long-term historical norms. This will translate its effect providing a forecasted overall level of depreciation that is less than the last 24 months as 12% depreciation is expected for two-to-six-year-old vehicles this year.

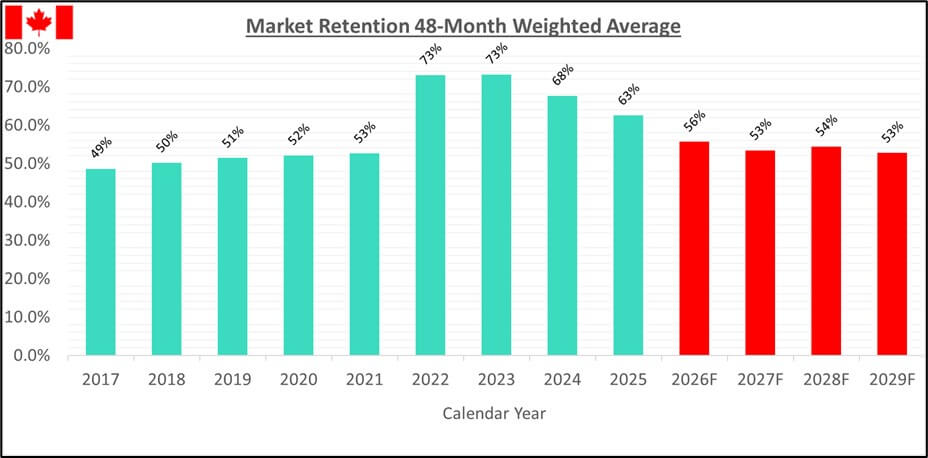

4-Year-Old Retained Value Forecast (2025MY returning in 2029)

Canadian Black Book forecasts retention to decrease again this year, with an average retained value of 63% based on a vehicles’ original Equipped Retail (ERT) price for a model returning to the secondary market after 48 months in operation. The expectation is that values continue decreasing throughout the second half of the decade as manufacturer and consumer behavior gradually migrate to pre-pandemic levels.

Although we’ll witness decreasing percentage retention, the average dollar value each year will stay relatively flat as we register significant pricing increases that have preceded from 2022-2025.

Fleet Sales

Fleet volume has been recovering since new car production began to normalize in 2023. The slowdown of vehicles flowing into circulation required inventory to stay active much longer than planned, but these businesses have rejuvenated their fleets to support swelling Days’ Supply for brands with vehicles to move. As market dynamics change with multiple brands weaning off their need to sell models as Fleet over the last few years, the business model has adapted to support managing the type and time for models to enter and remain active. The push to electrify these fleets has been turned off for most outfits, but where net-zero strategies are employed, we see a gravitation to hybrid/plug-in hybrid alternatives, especially within Government fleets.

With incentives continuing to rise, sales into fleets are a compelling alternative to brand-damaging and costly consumer-facing incentives, allowing automakers to protect residual values and offload excess production. In 2025, daily rental sales are expected to continue improving volume, while commercial/government sales will hold relatively steady.

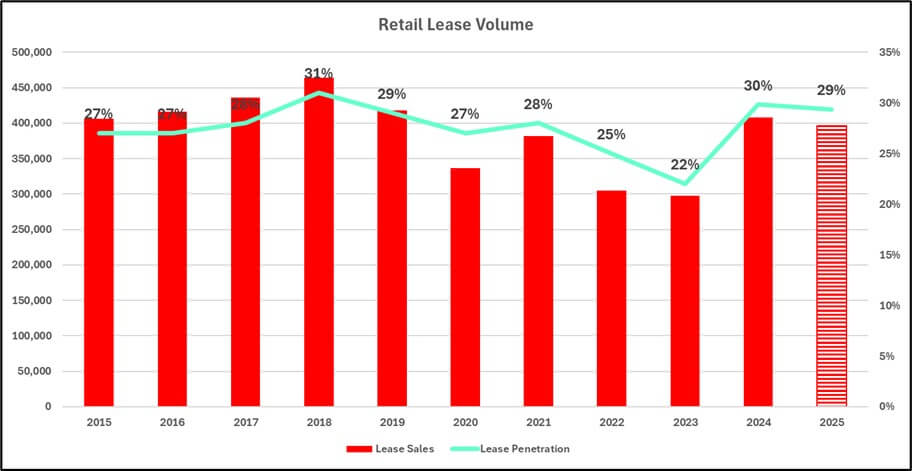

Lease Penetration

Coming off of lower-than-normal levels of lease penetration since 2020, we’ve seen a resurgence on leasing in the retail market for Canada, now that interest rates are easing, and payment driven consumers are accepting of the reality on the new normal of vehicle pricing. Historically, lease penetration has been positively correlated with incentive spending. With discounting expected to grow in 2025, lease penetration is anticipated to follow suit, with 29% of all retail transactions being leases. This is still short of the pre-2020 levels of just over 30%, but Canadian Black Book believes these numbers will be achieved in the coming years as consumers revert to leasing as a viable acquisition channel, amidst the turmoil in the new car market settling down in the future.

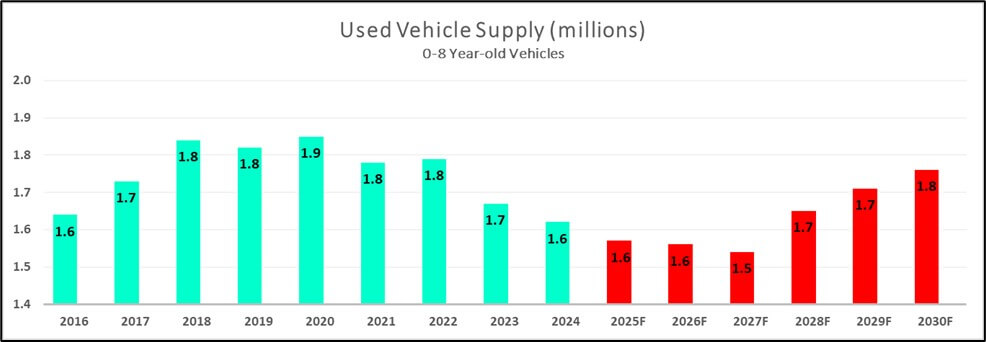

Used Vehicle Supply (0–8-Year-old Vehicles)

The primary factors influencing volatility in the late model used vehicle supply forecast are overall sales and lease penetration from the previous four years. In 2025, supply of used vehicles up to eight years old is expected to decrease by 3.2% to 1.57M units. This decline is on the backs of reduced overall sales between 2020 and 2023 of roughly 1.2M vehicles while lease originations during this time reached a low of 18%.

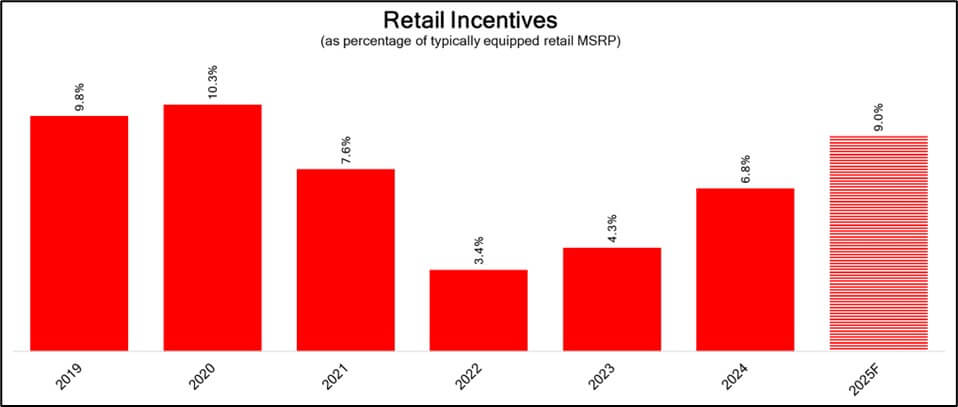

Incentive Spending

After reaping the benefits of low incentive spend in the previous 2 years, 2024 was an unfortunate return to a normalized level, for both Dealers and Manufacturers, financially. With new vehicle inventory unconstrained on supply and sales pacing more slowly due to unaffordability of vehicle pricing, incentives averaged 6.8% last year, up from 4.3% in 2023. With room still to grow in 2025, Canadian Black Book expects another increase as interest rates remain elevated in tandem with 20-30% increases in vehicle MSRPs over the last few years. This increase is measured to reach 9.0% this year, closing in on levels last seen pre-2021. The environment for new vehicle sales is highly concerned over the monthly payment shock consumers are realizing when returning to the showroom. Even with the trend of incentives supporting unaffordability, consumers have relegated to increasing leasing and financing terms as well as come down-market on either premium nameplates and/or vehicle sizing on top of the market being dealt another blow through the removal of Provincial and Federal iZEV rebates. Many factors are now in limbo for 2025 as we measure the risks through scenarios around tariffs, electrified vehicle rebates, and the overall increasing unaffordability of the market.

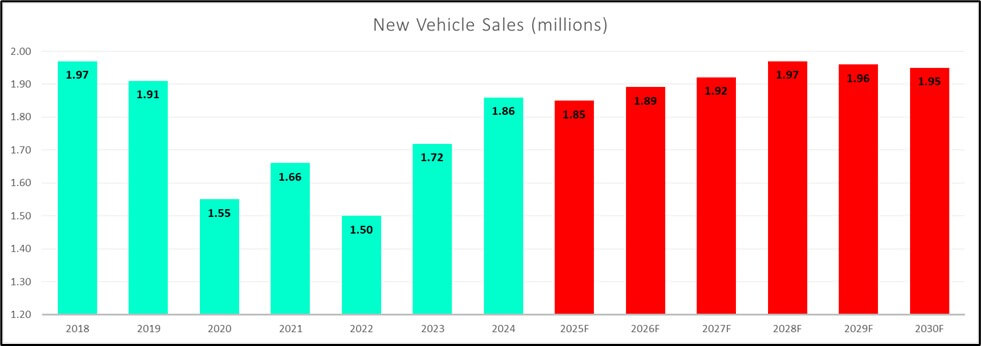

New Light-Duty Vehicle Sales

2025 will be littered with uncertainty around new vehicle sales volume as risks of tariffs loom large on the industry and model electrification plans fall further from immediate sales planning. New vehicle launches are currently being redirected in hopes of better timing as affordability issues are addressed to lure consumers back to the dealership. With financial turmoil for some manufacturers bringing rumors around bankruptcy or acquisition, there will be urgency to turn things around amidst news of further difficulty for current (legacy or start-up) OEMs. Canadian Black Book expects 2025 sales volume to remain relatively flat at 1.85M units as the long-term forecast continues to improve annual volume, returning to pre-pandemic market size. With from the Bank of Canada forecasting rates to decrease to 2% by the year’s end, this will work to offset inflationary action from any tariffs that are imposed.

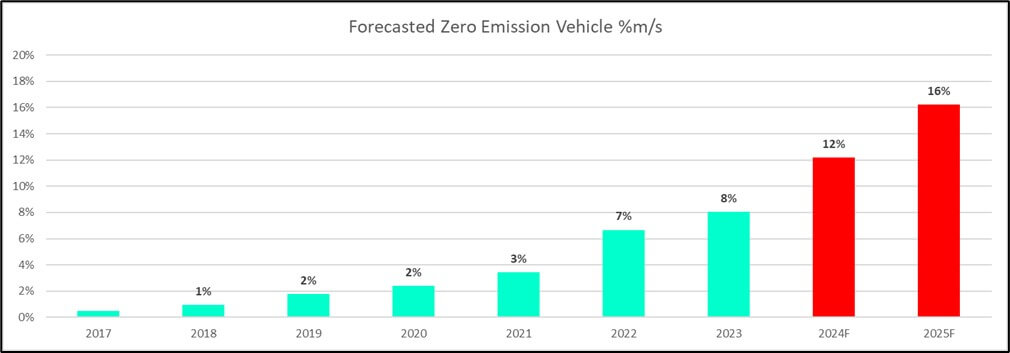

Zero-Emission Vehicle (ZEV) Share

What has driven Zero-Emission Vehicle sales forward has been a surge of new vehicles entering the Canadian marketplace. Since 2020 vehicles have started catering more to the average consumer through entering higher volume market segments, like Compact Crossovers, along with increasing range and charging capability of current and all-new entrants each year. With the overall trend on price as a significant sticking point, the iZEV rebate program which has subsidized battery-electric and plug-in hybrid-electric vehicles in Canada, helped our market achieve adoption growth year after year, with 2024 reaching upwards of 12% which is more than 223,000 units sold (final numbers have not yet been confirmed), a high-watermark for market share in North America.

As the landscape changes yet again for our market, electric vehicles or otherwise, Canadian Black Book forecasts that ZEV share continues to increase to 16% in 2025. With uncertainty around Federal and Provincial support through rebates, manufacturers have taken it upon themselves to reinstate that financial support for a limited time, but more importantly most of them have structured their pricing to be irrespective of rebates in market. Therefore, the pricing they have today is intended to remain tomorrow and perhaps decline further as the cost to produce these vehicles drops. As more mainstream vehicles enter the market and break down obstacles to mass market adoption, the dependency on rebates is also reduced. Current mandates have not been said to be receiving any adjustment in light of recent events and will come with significant penalties if they are not met. EV adoption will maintain course, but the rate of growth has been forecasted to slow with a greater ratio of hybrids and plug-in hybrids to fill the gap.

2025 Automotive Industry Closing Thoughts

The year ahead will undoubtedly be tumultuous as variables we lean on for market certainty are continuously in flux. As we battle through political change and emerging markets affecting the automotive space, we continue to monitor and war game the challenges evolving before us. Whether forecasting trends and growth around electrification, mitigating new price volatilities, or speaking with our industry partners who help to us gain further insight and assurances behind market assumptions, we look at our industry “as the crow flies”, minimizing the impacts of the complications currently at hand. This lens provides a bellwether to guide the level of volatility that should predicate our market. Dealing with the obstacles our industry has had to pivot against, what is echoed throughout recent recoveries is the resiliency of our Dealers, Manufacturers, Financial partners, and Technology providers in overcoming the market narrative, maintaining business in a positive way. We are looking forward to 2025 building on that resiliency, continuing our development of a more adaptive and agile automotive industry. Black Book has the data, tools and insights to help successfully navigate the years ahead. As always, please visit canadianblackbook.com to get in touch with our team and learn more.

Summary

About Canadian Black Book

For 60 years, Canadian Black Book has been the trusted and unbiased Canadian automotive industry source for vehicle values. Today the company has grown into a leading data provider of vehicle valuations, residual value forecast solutions and VIN decoding. Canadian Black Book tools and information are considered ‘The Authority’ for vehicle values, not only by car dealers and manufacturers, but also the leasing, finance, insurance, and wholesale sectors. In 2021, Canadian Black Book is bringing to market its Enhanced Vehicle Matching (EVM) solution, which will allow the industry to more consistently decode 17-digit VINs down to a specific trim package, allowing a more precise vehicle valuation.

Posted in: In the News