10.08.2024

Market Insight – 10/8/24

Wholesale Prices, Week Ending October 5th, 2024

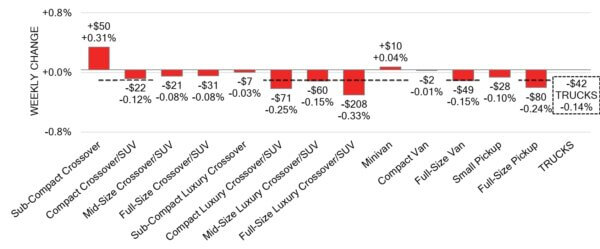

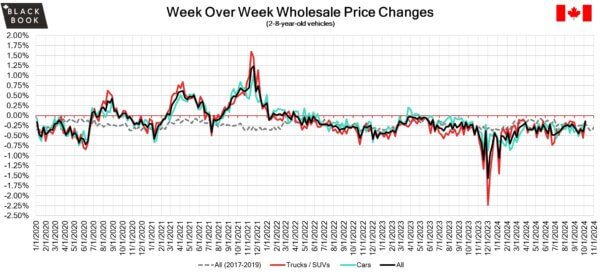

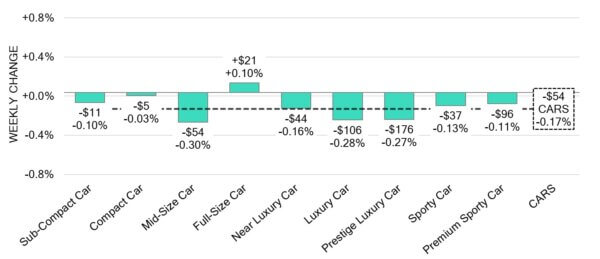

The Canadian used wholesale market experienced a decline of –0.15% in pricing for the week. Car segments prices decreased by –0.17% while the Truck/SUVs segments dropped -0.14%. The most improved segments of the week have been Sub Compact Crossover with +0.31% followed by Full-Size Car with +0.10%. The largest declines in the car segments were seen in Mid-Size Car with –0.30% followed by Luxury Car at –0.28%. The largest declines in the Truck/SUV segments were Full-Size Luxury Crossover/SUV at -0.33% followed by Compact Luxury Crossover/SUV -0.25%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.17% | -0.23% | -0.19% |

| Truck & SUV segments | -0.14% | -0.56% | -0.20% |

| Market | -0.15% | -0.40% | -0.19% |

Car Segments

- Last week there was an overall decrease of -0.23% across Car segments. This decrease was noted across all nine segments.

- The Compact Car (-0.04%), Sporty Car (-0.09%) and Luxury Car (-0.14%) segments showed the smallest declines.

- The largest decreases were seen from Prestige Luxury Car (-0.72%), Mid-Size Car at (-0.22%) and Prestige Sub-Compact Car at (-0.21%).

Truck / SUV Segments

- Truck segments reflected an overall depreciation of–0.14% last week. Eleven of the thirteen truck segments showed a decline.

- Full-Size Luxury Crossover/SUV (-0.33%), Compact Luxury Crossover/SUV (-0.25%) and Full-Size Pickup (-0.24%) had the largest depreciations.

- Two segments reflected an increase. Those were Sub-Compact Crossover (+0.31%) and Minivan (+0.04%).

Wholesale

The Canadian markets a downward trend comes to a slow, with a decline significantly less than its previous week. Only 13% of market segments experienced an average value change of more than ±$100, indicating a much lower rate than the previous week. Among these, Truck segments experienced a decline 42% less than compared to the previous week. Monitored auction sale rates ranged from 9 to 87% averaging at 49.1% The fluctuations in sale rates across various lanes can be attributed several factors including the ongoing decline in floor prices. An increase in supply entering the wholesale market has been noted, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

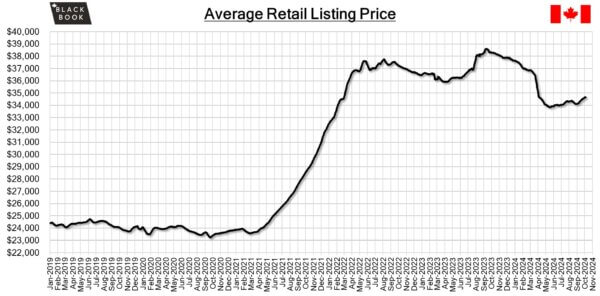

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,600. This analysis is based on

approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In September 2024, Canada’s Ivey Purchasing Managers Index jumped to 53.1,

rising from a three and a half year low of 48.2 in August and exceeding market

predictions of 50.2. - The S&P/TSX Composite Index increased by 0.8% on Friday, reaching a record

high of 24,163. This marked a weekly gain of 0.9% for the Toronto exchange,

primarily fueled by strong performances in the financial and energy sectors. Key

financial institutions such as RBC, TD Bank, Brookfield, Scotiabank, BMO,

Manulife, and CIBC all exceeded expectations, with their gains ranging from 0.5%

to 2.2%. - The yield on the Canadian 10-year government bond increases to 3.25%.

- The Canadian dollar is around $0.735 this Monday morning, representing a slight

decrease from $0.739 a week prior.

U.S. Market

- Last week saw accelerated depreciation and increased market uncertainty, stemming from unclear factors like the duration of the dock workers’ strike and speculation about the extent of vehicle flooding caused by Hurricane Helene. Floor prices rose at many auction locations, leading to more no-sales. Although the dock workers’ strike has concluded with a tentative agreement, the full impact of flooded vehicles in the Southeast is yet to be determined.

Industry News

- With September’s end, we close off Q3 in 2024 auto sales where we sit 8.1% over last year. September itself was a down month YoY with roughly 157,000 units sold, 3.6% lower than last year. A comparison we expect to lose out over last year over the next few months as in 2023, this timing is when most brand’s new car volumes were finally picking up.

- The 2025 Ford Expedition redesign has just broke cover, highlighting a new appearance along with greater in-car tech advancements leading with a 24-inch panoramic display, as well as a split opening tailgate, 40/20/40 split folding 3rd row, sliding center console, and an offroad Tremor trim to name just a few updates.

- In a survey conducted by the Canadian Taxpayers Federation (CTF), it found that 59% of Canadians do not want a federal ZEV sales mandate that will enforce manufacturers to sell only zero-emission vehicles by 2035. Only 29% say that they support the ban on ICE vehicles, but in the demographic ages 18-34 and urban residents, the approval rate rises to 37%.

- The market sees ZEV rebate claims hit a high in August as Quebec, the largest provincial EV market relaxes its incentive starting in 2025. This brought that region to claim 60% of rebate requests where it typically sells 25% of new vehicles Nationally.

- The hotly anticipated Chevrolet Equinox EV finally went on sale in Canada. With Chevrolet dealers claiming 1,853 rebates for the new crossover; the highest for any electric model, outpacing the Tesla Model3 for the first time.

- Starting October 1st, Electric and Hybrid vehicle imports from China will be applied a 100% higher surtax at customs, bringing the total to 106.1%. This immediately changes the eligibility of Tesla, Volvo, and Polestar.