06.13.2023

Market Insight – 6/13/23

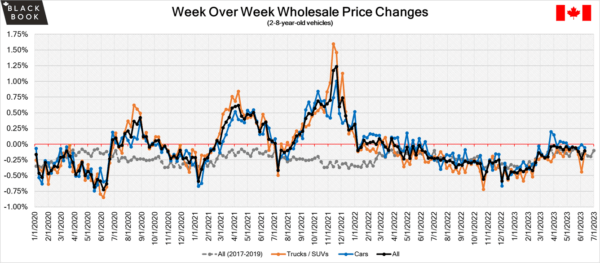

Wholesale Prices, Week Ending June 10th

The Canadian used wholesale market saw a decline in prices for the week at -0.10%. The Car segment fell by –0.05% and the Truck/SUVs’ segment prices declined –0.15%. 5 out of 22 segments’ values have increased for the week. Full-Size Pick–up leads with +0.24% and Subcompact Car follows behind at +0.23%. The segments with the largest declines were Compact Van (-0.79%) and Minivan (-0.49%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.05% | -0.01% | -0.12% |

| Truck & SUV segments | -0.15% | -0.44% | -0.11% |

| Market | -0.10% | -0.23% | -0.12% |

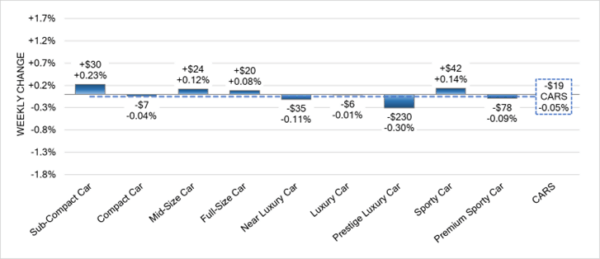

Car Segments

- There was a decrease of (-0.05%) in Car segment prices last week.

- Four of nine segments showed an increase in pricing. The largest increase being Sub-Compact Car at (+0.23%), followed by Sporty Cars (+0.14%) & Mid-Size Cars at (+0.12%).

- The segments with the largest decline in pricing were Prestige Luxury-Car at (-0.30%), followed by Near Luxury Car at (-0.11%) & Premium Sporty Car with (-0.09%).

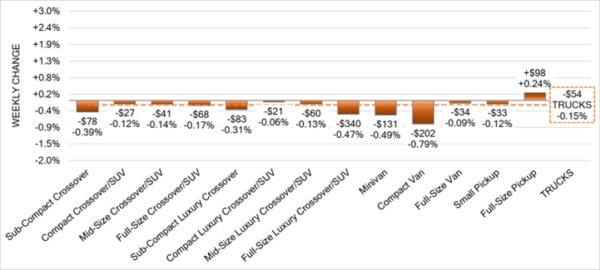

Truck Segments

- Last week, truck segments decreased on average overall by -0.15%.

- Twelve of the thirteen segments showed a decrease. Those with the largest declines were Compact Van (-0.79%), Minivan (-0.49%) and Full-Size Luxury Crossover/SUV (-0.47%).

- Only one segment experienced an increase. That segment was Full-Size Pickup (+0.24%).

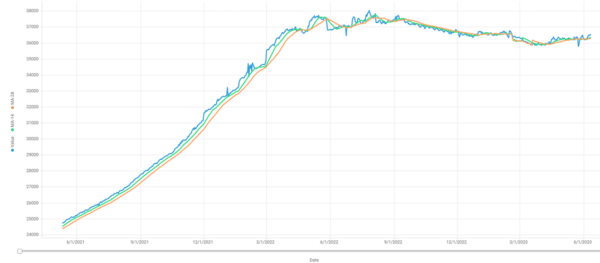

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $36,275. Analysis is based on approximately 185,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $50 this week as the market continues to stabilize.

Conversion rates were quite varied. Some observed sell rates were as low as 20% but most were in the 30-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s trade surplus was 1.94 billion in April 2023 as exports jumped 2.5% to 64.8 billion.

- The unemployment rate in Canada rose to 5.2% in May of 2023 after remaining at 5% for the five previous months, above market estimates of 5.1% to mark the first monthly increase in the unemployment rate since August 2022.The Canadian economy shed 17.3K jobs in May of 2023, the first decline in nine months, and compared to forecasts of a 23.2K rise.

- The Bank of Canada raised the target for its overnight rate by 25bps to 4.75% in June

- The Canadian dollar is around $0.750 this Monday morning up from $0.744 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.37% last week; the prior week decreased by -0.31%.

Volume-weighted Car segments decreased -0.45%, compared to the prior week’s -0.26% decrease:

- Only one of the nine Car segments increased last week.

- Sporty Car increases are slowing, up a minimal +0.04% last week, compared with +0.38% the prior week.

- Sub-Compact Car reported the largest decline last week, dropping -0.89%. In comparison to the prior week, Sub-Compact Car also had the largest Car segment decline of -0.63%.

Volume-weighted Truck segments decreased by -0.34%; the previous week decreased -0.34%:

- All thirteen Truck segments reported a decrease last week.

- Minivans had increased for fifteen consecutive weeks, but the last two weeks have the segment finally showing signs of softening. Last week, the segment declined a very minimal -0.002%, compared with the prior week’s also small decline of -0.02%.

- The Mid-Size Luxury Crossover segment reported the largest Truck segment decline last week, down -0.73%.

Industry News

- For the first time, Tesla’s charging network will be open to Ford and now GM electric vehicles, which will utilize Tesla connectors that will be adopted by both manufacturers at assembly; this gives access to almost the entire 17,000 charger network within North America and vastly opens the charging capability and infrastructure for both organizations.

- After the successful return of the Canadian International Auto Show in Toronto this past February, regional auto shows look to make a comeback in 2024, as Vancouver, Calgary and Ottawa show strong support from local dealers as well as through significant manufacturer commitments.

- Lexus has just launched two new large SUV’s to the market; one that has been synonymous with Lexus for years, and the other a completely new model. The Lexus GX returns to the market as a redesigned and even more rugged looking body-on-frame SUV for loyalists who were hoping for a necessary update. But the first-ever Lexus TX is a 3-row SUV based on the recently released Toyota Grand Highlander, which will serve as a more family friendly model in the Lexus lineup to combat the Acura MDX, Lincoln Aviator, and Infiniti QX60 more squarely.

- Volvo has released its first-ever EX30 electric small-SUV, which is aimed at younger buyers with a limited budget; a part of the market not many EV’s have focused on prior. Volvo has been able to do this by utilizing their Sustainable Experience Architecture (SEA) over a full breadth of models to scale down the overall cost. The EX30 will be able to deliver as much as 440km (275 miles) on a single charge