06.20.2023

Market Insight – 6/20/23

Wholesale Prices, Week Ending June 17th

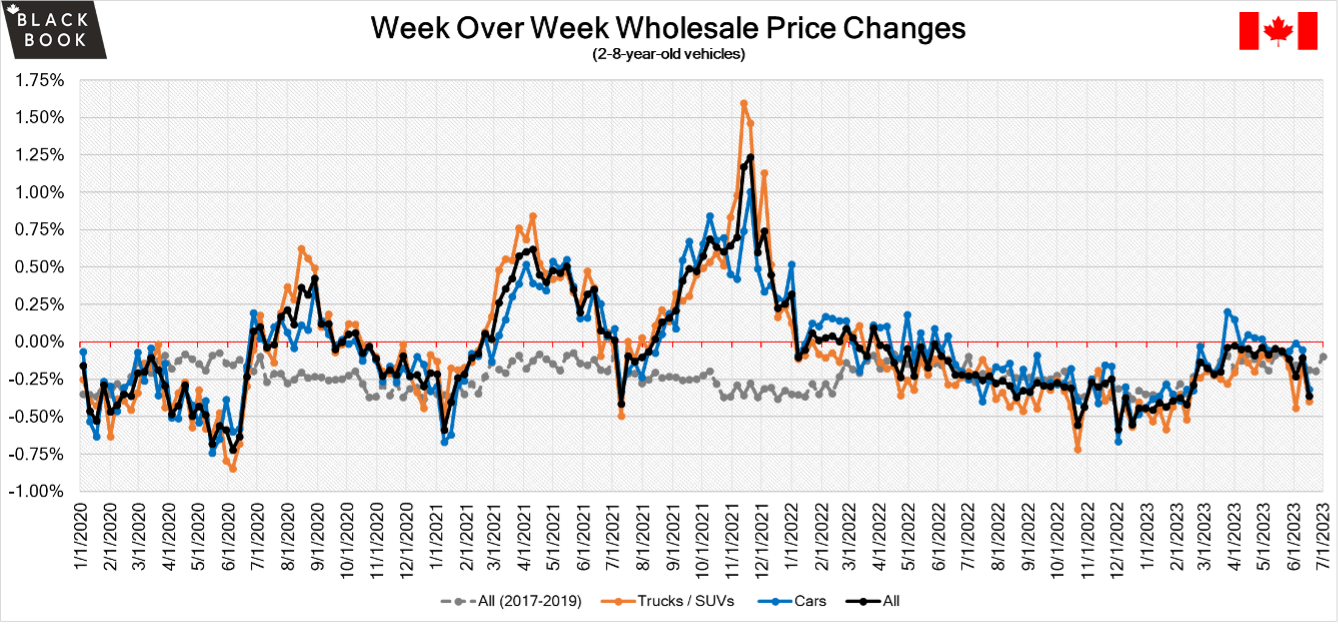

The Canadian used wholesale market saw a decline in prices for the week at -0.36%. The Car segment fell by -0.36% and the Truck/SUVs’ segment prices declined -0.40%. 4 out of 22 segments’ values have increased for the week. Compact Van-leads with +1.50% and Subcompact Car follows behind at +0.22%. The segments with the largest declines were Sub-Compact Crossover and Mid-Size Luxury Crossover/SUV (-0.97%) followed by Mid-Size Crossover/SUV (-0.59%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.32% | -0.05% | -0.10% |

| Truck & SUV segments | -0.40% | -0.15% | -0.28% |

| Market | -0.36% | -0.10% | -0.19% |

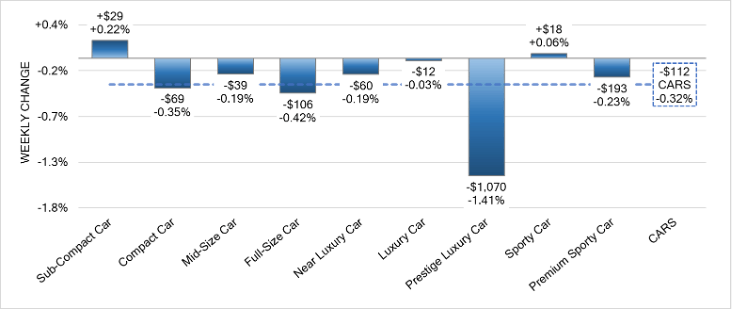

Car Segments

- There was a significant decrease of (-0.32%) in Car segment prices last week.

- Only two of the nine segments showed an increase in pricing. The largest increase being Sub-Compact Car at (+0.22%), followed by Sporty Cars (+0.06%).

- The segments with the largest decline in pricing were Prestige Luxury Car (-1.41%), followed by Full-Size Car at (-0.42%) & Compact Car at (-0.35%) The segment with the lowest decline was Luxury Car at (-0.03%).

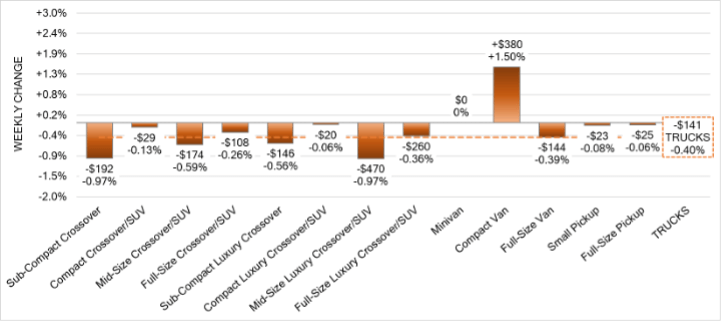

Truck Segments

- Overall truck segments decreased on average by -0.40% last week.

- Eleven of the thirteen segments showed a decrease. Sub-Compact Crossover and Mid-Size Luxury Crossover/SUV had the same depreciation (-0.97%). Mid-Size Crossover/SUV (-0.59%) and Sub-Compact Luxury Crossover (-0.56%) had the next largest downturns.

- Only one segment experienced an increase. That segment was Compact Van (+1.50).

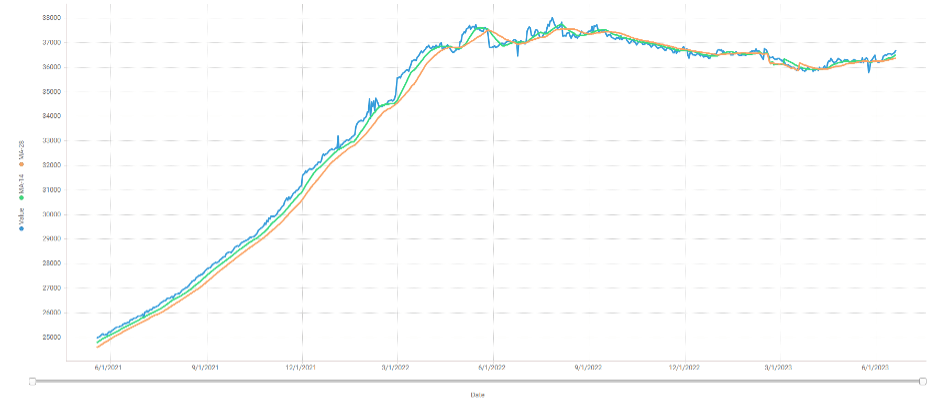

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $36,475. Analysis is based on approximately 185,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the market sees the largest drop since February. Conversion rates were quite varied. Some observed sell rates were as low as 21% but most were in the 35-50% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canadian housing starts fell by 23% in May over the previous month to 202,494 units below the market expectation of 235,000 unis affording to the Canada Mortgage and Housing Corporation.

- Foreign investments in Canadian securities increased by 13.52 billion in April of 2023 which was the most in 2023 so far.

- 10-year Canadian government bondyieldsrose3.4% in the third week of June as markets correctly anticipated interest rate hikes by the Bank of Canada.

- The Canadian dollar is around $0.757 this Monday morning up from $0.750 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.38% last week; the prior week decreased by -0.37%.

Volume-weighted Car segments decreased -0.41%, compared to the prior week’s -0.45% decrease:

- All nine Car segments increased last week.

- Sub-Compact Car reported the largest drop last week, down -0.75%. The prior week the segment also had the largest decline, with a depreciation of -0.89%.

- Sporty Car went negative last week by -0.18%, compared with the minimal gain the prior week of +0.04%.

Volume-weighted Truck segments decreased by -0.37%; the previous week decreased -0.34%:

- Twelve of the thirteen Truck segments reported a decrease last week.

- Small Pickup was the only segment to report an increase last week, up +0.11% after the prior four weeks of declines that averaged a weekly decrease of -0.27%.

- Compact Van reported the largest decline at -1.36%. The segment is small, so it does not take much to report a large percentage change.

Industry News

- The ongoing discussion of whether internal combustion engines will remain strong within the marketplace are currently being bolstered by UAW discussions with General Motors at contract negotiations, as both parties expect gasoline powered pick-ups and large SUVs to continue earning large profits for years to come – backing a commitment of $2 Billion USD towards building the next generation of GM pick-ups and SUVs.

- In another effort to move more product, Tesla is now offering free charging again for 3 years to Model X and S customers, or 3 months for Model 3 customers who take delivery before June 30th.

- After both GM and Ford announced that they will have access and provide the ability to charge at Tesla’s Superchargers with their EVs, Stellantis is evaluating this as an option as well for its upcoming electric models – if they decide to do so, Stellantis would be the last of the “Big 3”, but an early adopter among manufacturers to adopt this charging infrastructure.

- Dealers for a long time have been hoping to see the end of wet signatures in the car-buying process, and with the Canadian Automobile Dealers Association (CADA), the Motor Vehicle Retailers of Ontario (MVRO), and the Canadian Financing and Leasing Association (CFLA) putting collective efforts together towards an industry white paper on the specific issues regarding electronic signatures, we could see this requirement step aside in the near-term.