06.27.2023

Market Insight- 6/27/2023

Wholesale Prices, Week Ending June 24th

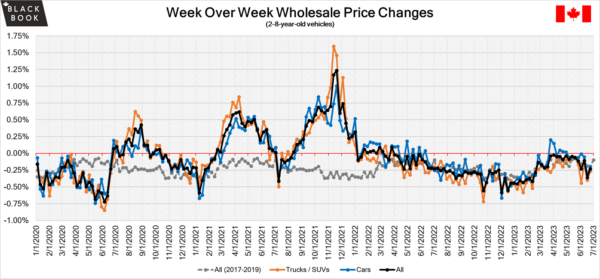

The Canadian used wholesale market saw a decline in prices for the week at -0.23%. The Car segment fell by -0.20% and the Truck/SUVs’ segment prices declined -0.26%. 3 out of 22 segments’ values have increased for the week. Minivan-leads with +0.28% and Luxury Car follows behind at +0.07%. The segments with the largest declines were Compact Van (-1.96%) followed by Full Size Car (-0.55%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.20% | -0.32% | -0.14% |

| Truck & SUV segments | -0.26% | -0.40% | -0.24% |

| Market | -0.23% | -0.36% | -0.19% |

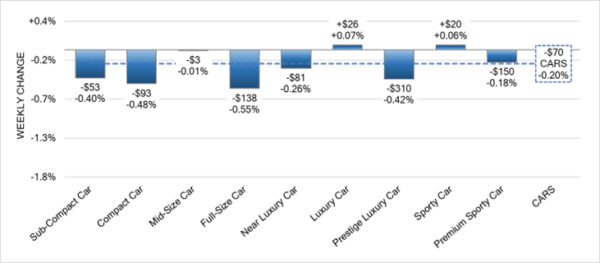

Car Segments

- Last week Car segment prices decreased overall by –0.20%.

- Two of the nine car segments showed an increase in pricing. Luxury Cars led the way with a (+0.07%) increase, followed closely by Sporty Cars at (+0.06%).

- The segments with the largest decrease in pricing were Full-Size Car at a (-0.55%) decrease, followed by Compact Car at (-0.48%). The segments with the least decline were Mid-Size Car (-0.01%) and Premium Sporty Car (-0.18%).

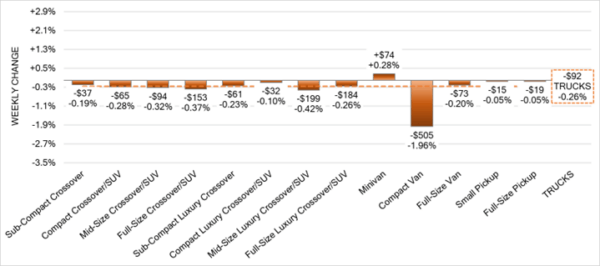

Truck Segments

- Overall truck segments decreased on average by -0.26% last week.

- All except one of the thirteen truck segments had a decrease. Compact Vans had the most significant decline (-1.96%). The next largest was Mid-Size Luxury Crossover/SUV (-0.42%) followed by Full-Size Crossover/SUV (-0.37%).

- Only one segment experienced an increase. That segment was Minivan (+0.28%).

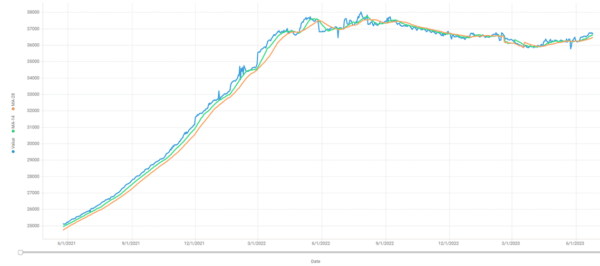

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $36,600. Analysis is based on approximately 184,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the market sees the largest drop since February. Conversion rates were quite varied. Some observed sell rates were as low as 26% but most were in the 35-50% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- 384,000 Canadians received Employment Insurance benefits in April which mirrored the month of March.

- Canadian new home prices crept up 0.1% month over month in May after a 0.1% drop the prior month.

- Retail sales increased 1.1% to $65.9 billion in April 2023.

- Natural resources real gross domestic product falls in the first quarter by 0.2%.

- The Canadian dollar is around $0.760 this Monday morning up from $0.757 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.42% last week; the prior week decreased by -0.38%.

Volume-weighted Car segments decreased -0.44%, compared to the prior week’s -0.41% decrease:

- The other age units we track had similar trends last week with the 0-to-2-year-old and 8-to-16-year-old Cars declining -0.41%.

- All but one of the nine Car segments decreased last week.

- Sporty Car was the only segment to increase last week, but it was a minimal +0.05%. The segment has been up and down in recent weeks, but overall, the segment is reporting stability with an average weekly change over the past month of +0.01%.

Volume-weighted Truck segments decreased by -0.41%; the previous week decreased -0.37%:

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.29%), as did the 8-to-16-year-olds that declining -0.24%.

- All thirteen Truck segments reported a decrease last week.

- The Full-Size Luxury Crossover/SUV segment had the largest decline last week, down -0.68%. This is the largest single week decline for the segment since mid-January.

Industry News

- Lithium production is coming online from a much larger number of suppliers than in the past, but the pace is too slow as experts warn of delays on permits for mine operations, shortages of staffing, and even the effects of inflation that will keep production from outpacing demand out passed 2030.

- Don’t forget about suppliers in their shift to electric vehicles; construction is scheduled on a Gigacasting plant which Linamar is planning to break ground on in 2025 , Magna plans to build 2 plants to manufacture EV battery enclosures, Bosch intends to acquire chip maker TSI Semiconductors and spend $1.5 Billion to meet EV specific semiconductor demands – just to name a few.

- Tesla is turning to incentives to move vehicles, on top of the enhancement it’s advertised on free charging, the EV maker is applying as much as $9,800 on their most expensive Tesla S and X models.

- As supply chain woes look to take a back seat, complications at the ports are making waves as the Port of Vancouver has been quoted as operating a “logistical nightmare” where it sees offloading delays lasting as long as a month. Some automakers have rerouted vessels down to the US to unload and cross the Canadian border from there as a quicker option, making way for higher transport costs reflected in retail prices.

- Canadian-based EV charging manufacturer, FLO, is going to adopt the North American Charging Standard (NACS) used by Tesla, in an effort to standardize charging ports across Northern America.