01.16.2024

Market Insights – 1/16/2024

Wholesale Prices, Week Ending January 13th

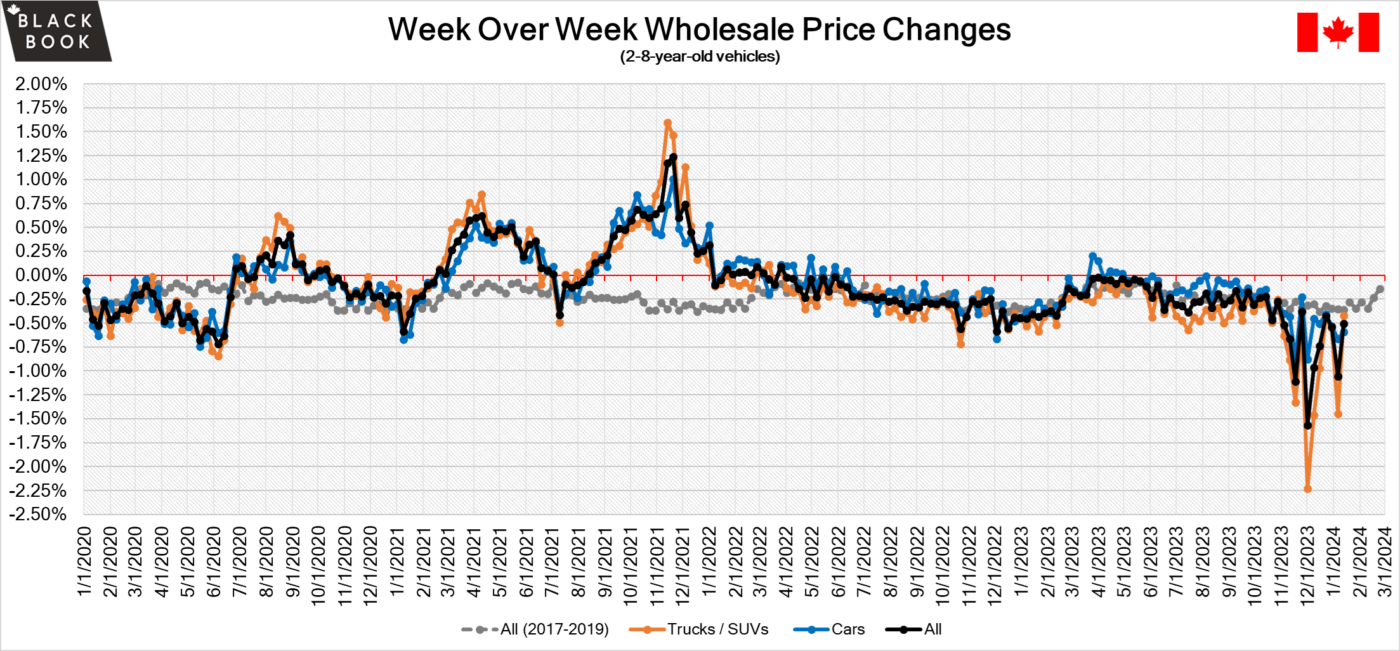

The Canadian used wholesale market saw a decline in prices for the week at –0.51%. The Car segment fell by -0.59% and the Truck/SUVs segment prices declined –0.42%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Sub-Compact Crossover at –1.74% followed by Sub-Compact Luxury Crossover at –1.23%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.59% | -0.67% | -0.40% |

| Truck & SUV segments | -0.42% | -1.45% | -0.33% |

| Market | -0.51% | -1.06% | -0.36% |

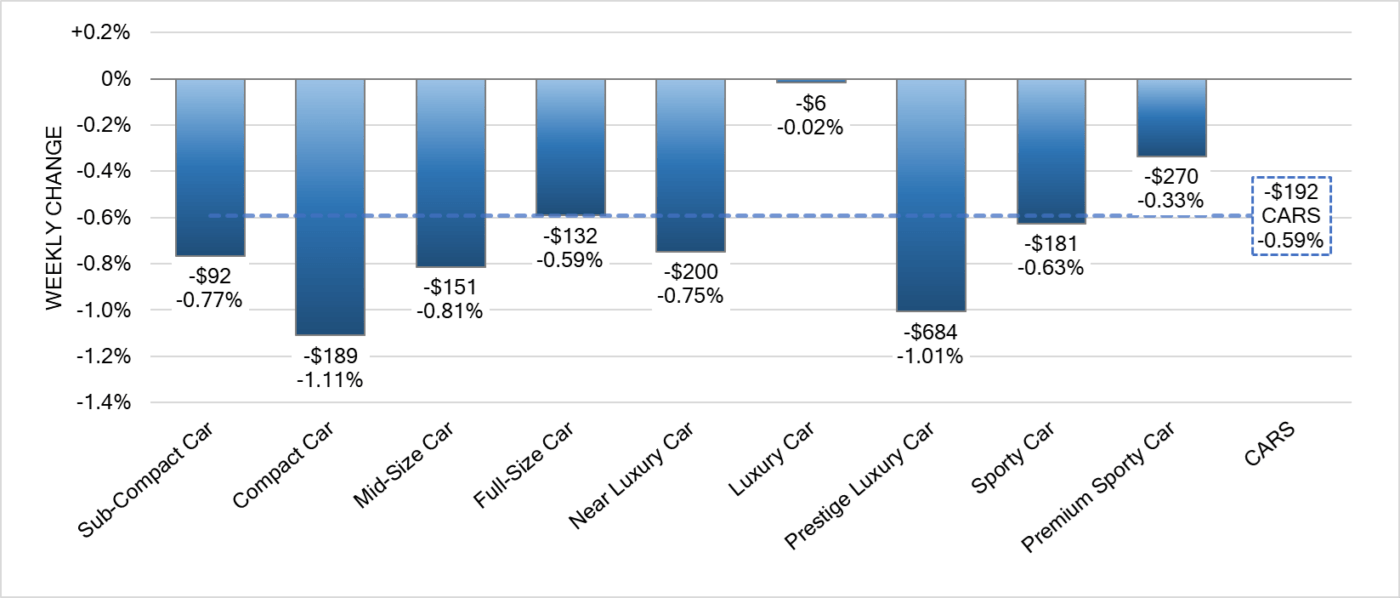

Car Segments

- Last week there was an overall decrease of -0.59% seen in Car segments.

- Luxury Car showed minimal decline with a (-0.02%) change in pricing followed by Premium Sporty Car at (-0.33%).

- The most significant decline was observed was in Compact Car at (-1.11%), followed closely by Prestige Luxury Car at (-1.01%).

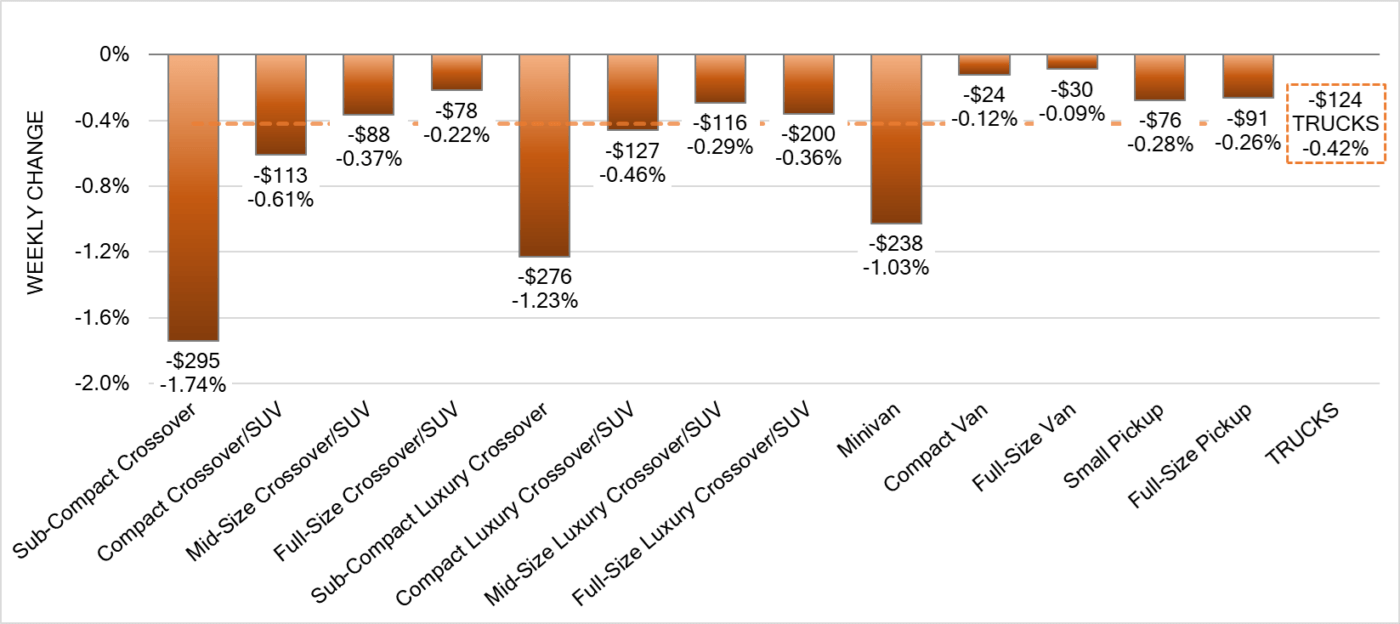

Truck Segments

- There was an overall decrease of -0.42% in truck segments last week.

- All segments showed a depreciation. Those with the largest declines were Sub-Compact Crossover (-1.74%), Sub-Compact Luxury Crossover (-1.23%) and Minivan (-1.03%).

- Segments with the smallest decrease were Full-Size Van (-0.09%) and Compact Van (-0.12%).

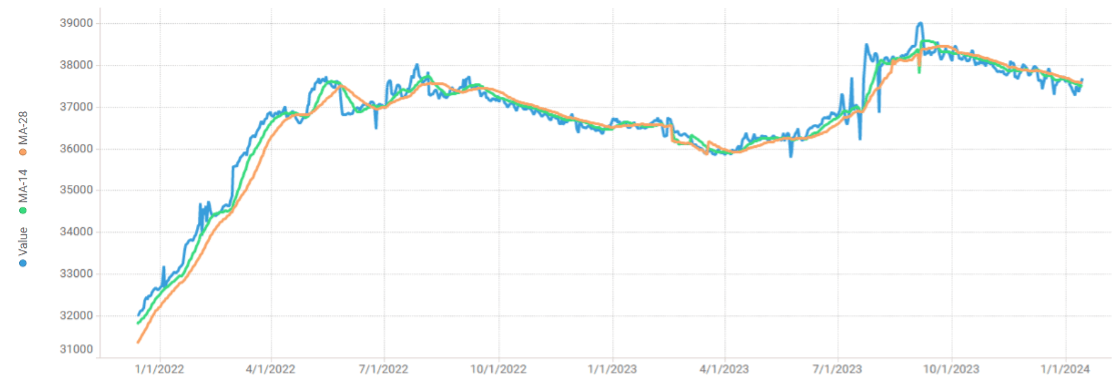

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,600. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines around 50% more than the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 3% and as high as 70% but most were between 20-40%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada recorded a trade surplus of $1.6 billion in November of 2023, narrowing considerably from the $3.2 billion surplus in the previous month and under market expectations of $2 billion.

- Wholesale sales in Canada rose by 0.9% month-over-month to $82.5 billion in November 2023, rebounding from a 0.5% decline in the previous month and surpassing market expectations of a 0.8% rise.

- The yield on the Canadian 10-year government bond increased slightly to 3.3%.

- The Canadian dollar is around $0.744 this Monday morning down from $0.748 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.63% last week; the prior week decreased by -0.68%.

Volume-weighted Car segments decreased -0.39%, compared to the prior week’s -0.49% decrease:

- The 0-to-2-year-old Car segments were down -0.37% and 8-to-16-year-old Cars declined -0.20%.

- Eight of the nine Car segments decreased last week, with only one segment reporting a decline exceeding 1%. Sub-Compact Car depreciated -1.05%, an increase in depreciation from the prior week’s decline of -0.78%.

- Compact Car depreciation dramatically slowed down at the end of last year and continued into the new year before moving into positive territory last week with a small gain of +0.03%. This is in sharp contrast to the last week of November when the segment dropped -4.32% in a single week.

- Three of the nine Car segments aged 8-to-16-years-old reported increases last week and included Compact, Luxury, and Sporty Cars.

Volume-weighted Truck segments decreased by -0.73%; the previous week decreased -0.77%:

- The 0-to-2-year-old models declined -0.65% on average and the 8-to-16-year-olds decreased by -0.76% on average.

- Twelve of the thirteen Truck segments declined last week, with one segment reporting a small increase. The Full-Size Luxury Crossover/SUV segment increased +0.002%.

- The Compact Luxury and Mid-Size Crossover/SUV segments reported the largest declines last week, -0.94% and -0.93%, respectively.

- Not only did the Full-Size Luxury Crossover segment show minimal positive movement last week, the non-luxury Full-Size Crossover/SUV segment also reported a slowdown in depreciation. The segment declined -0.24% last week after nine consecutive weeks of declines exceeding 1%.

Industry News

- As Manufacturers battle with the investment needed to participate in regional auto shows, Stellantis officially backed out of the 2024 CIAS last week but did empower its dealer body by giving them the opportunity to maintain a presence at this year’s show, which they have confirmed that they will.

- With many alternative powertrains developed in tandem with one another, Toyota has said it still sees a role for internal combustion engines “as a practical means of achieving carbon neutrality”, contrary to many strategies other manufacturers released to the public over the last couple of years.

- After months of waiting for the facelifted Tesla Model 3 to reach North American shores, the smallest and least expensive vehicle in Tesla’s lineup is here and will start (for now) at a base price of $55,990 before federal rebates.

- For 2024, KPMG reported from its Global Automotive Executive Survey that profitability and supply chain issues specifically for electric vehicles are still a predominant concern for 45% of the industry’s leaders outside of China regarding access to materials such as Lithium and Cobalt and the control this region has over every other in the industry.