01.22.2025

Market Insights – 1/21/25

Wholesale Prices, Week Ending January 18th, 2025

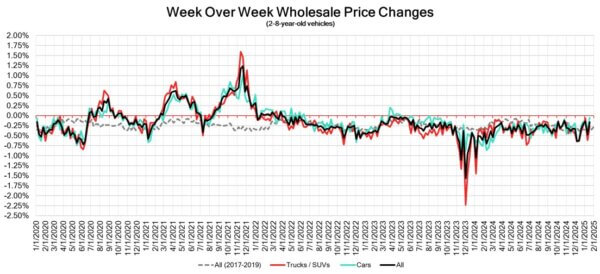

The Canadian used wholesale market experienced a decline of –0.17% in pricing for the week. Car segments prices decreased by –0.05% while the Truck/SUVs segments dropped -0.27%. The largest increases were seen in Mid-Size Car at +0.35% and Sub-Compact Crossover at +0.25%. The largest declines in the car segments were seen in Compact Car at -0.34% and Sub-Compact Car with -0.32%. The largest declines in the Truck/SUV segments were Full-Size Pickup at -0.72% followed by Compact Van with -0.57%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.05% | -0.32% | -0.36% |

| Truck & SUV segments | -0.27% | -0.62% | -0.20% |

| Market | -0.17% | -0.48% | -0.28% |

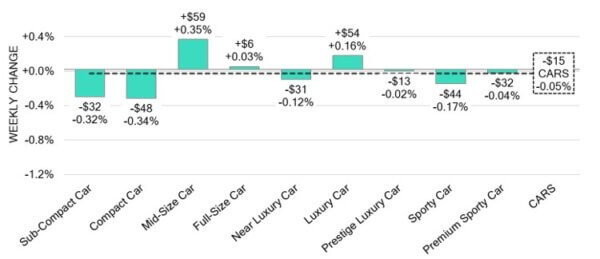

Car Segments

- Six out of nine car segments declined last week, with an average drop of -0.05%.

- The segments that increased were Mid-Size Car (+0.35%), Full-Size Car (+0.03%), and Luxury Car (+0.16%)

- The largest decreases were seen from Compact Car (-0.34%), Sub-Compact Car (-0.32%), and Sporty Car (-0.17%)

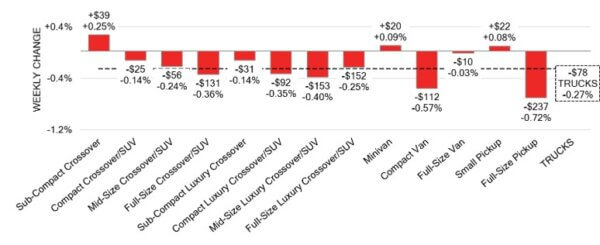

Truck / SUV Segments

- An overall depreciation of –0.27% was seen in truck segments last week. Ten of the thirteen segments reflected this downturn.

- Segments with the greatest declines were Full-Size Pickup (-0.72%), Compact Van (-0.57%), Mid-Size Luxury Crossover/SUV (-0.40%) and Full-Size Crossover/SUV (-0.36%).

- Three segments showed an increase. Those were Sub-Compact Crossover (+0.25%), Minivan (+0.09%) and Small Pickup (+0.08%).

Wholesale

The Canadian market remains on a downward trend, with a decline far less pronounced than in its previous week. Just under 23% of market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell by 35%, while that of the car segments dropped by 27%. Monitored auction sale rates ranged from 19.1 to 75.7% averaging at 46.2%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the recent adjustments to interest rates and the ongoing gradual decline/change in floor prices. The increase in supply entering the wholesale market has increased in comparison to previous weeks, however upstream channels continue to gain early access. As the new year continues, so does the high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,950. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s annual inflation rate decreased to 1.8% in December 2024, down from

1.9% in the previous month. This was slightly lower than market expectations,

which anticipated it would stay at 1.9%, marking the slowest rate of price growth

since September. - Housing starts in Canada dropped by 13.35% from the previous month to

231,500 units in December 2024. This marks the lowest level in three months and

fell short of market expectations of 245,000 units, as reported by the Canada

Mortgage and Housing Corporation. - Manufacturing sales in Canada increased by 0.8% in November 2024 compared

to the previous month, surpassing initial projections of 0.5% and building on a

2.1% rise recorded in October. - The yield on the Canadian 10-year government bond slightly increased to 3.24%.

- The Canadian dollar is around $0.701 this Monday morning, representing a slight

decrease from $0.694 a week prior.

U.S. Market

- After a significant depreciation two weeks ago, the overall depreciation rate slowed to 0.57% last week, down from the previous week’s 0.81%, but still above the pre-pandemic average of 0.43%. During this same week in 2020, just before the pandemic began, the market showed early signs of a spring market, with a low depreciation rate of -0.11% and some segments beginning to appreciate in value.

Industry News

- As of this past week on January 13th, the Government of Canada abruptly paused the Federal iZEV rebate program for Canadians who purchased a fully electric or plug-in hybrid vehicle. This ends a successful program launched in May 2019 that helped roughly 546,000 ZEVs into the hands of consumers.

- The Honda Civic has returned as the #1 selling passenger car in Canada after falling to 2nd spot in 2022 and 2023 to the Toyota Corolla. Before 2022, the Civic had claimed that spot for the past 24 consecutive years.

- Concluding the news around the Federal iZEV rebate pause, there have been 5 automakers (Hyundai, Nissan, Ford, GM, VW) who communicated that they will honor the $5,000 incentive offered to consumers in Canada. Most have set the support to end, January 31st.

- Acura is resurrecting the RSX nameplate for its next EV, and the first one to be developed on its own, in-house. The new RSX will be an electric compact crossover with sloped coupe-like roofline with production scheduled to start in 2026.

- A Norway battery-materials company named Vianode is looking to build a synthetic graphite plant with signs that it has chosen a location in Canada after the company confirmed a multibillion-dollar supply agreement with GM.

- The Montreal Auto Show begins January 17th, and multiple brands will be providing a first look at their new vehicles, such as Lucid with its Gravity electric crossover and the all-new Dodge Charger and Ram HD Trucks.