01.23.2024

Market Insights – 1/23/2024

Wholesale Prices, Week Ending January 20th

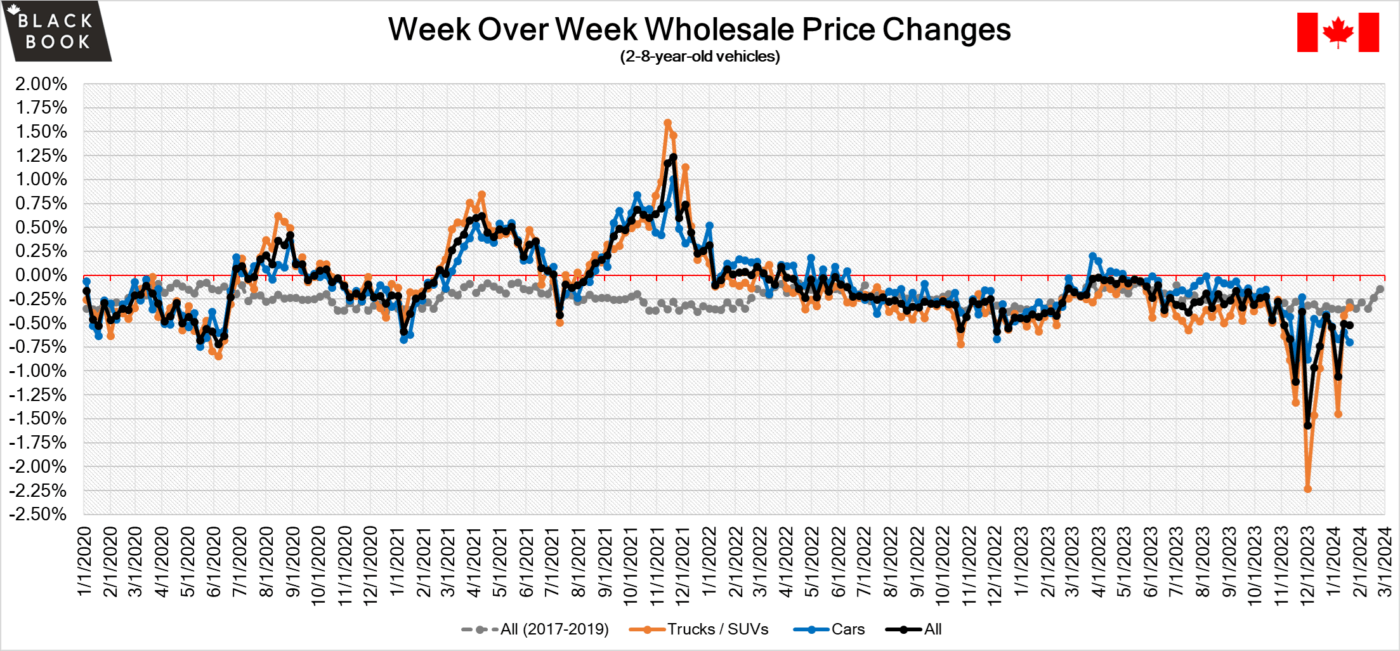

The Canadian used wholesale market saw a decline in prices for the week at –0.52%. The Car segment fell by -0.70% and the Truck/SUVs segment prices declined –0.34%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Sub-Compact Car at –1.27% followed by Sporty Car at –1.24%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.70% | -0.59% | -0.36% |

| Truck & SUV segments | -0.34% | -0.42% | -0.20% |

| Market | -0.52% | -0.51% | -0.28% |

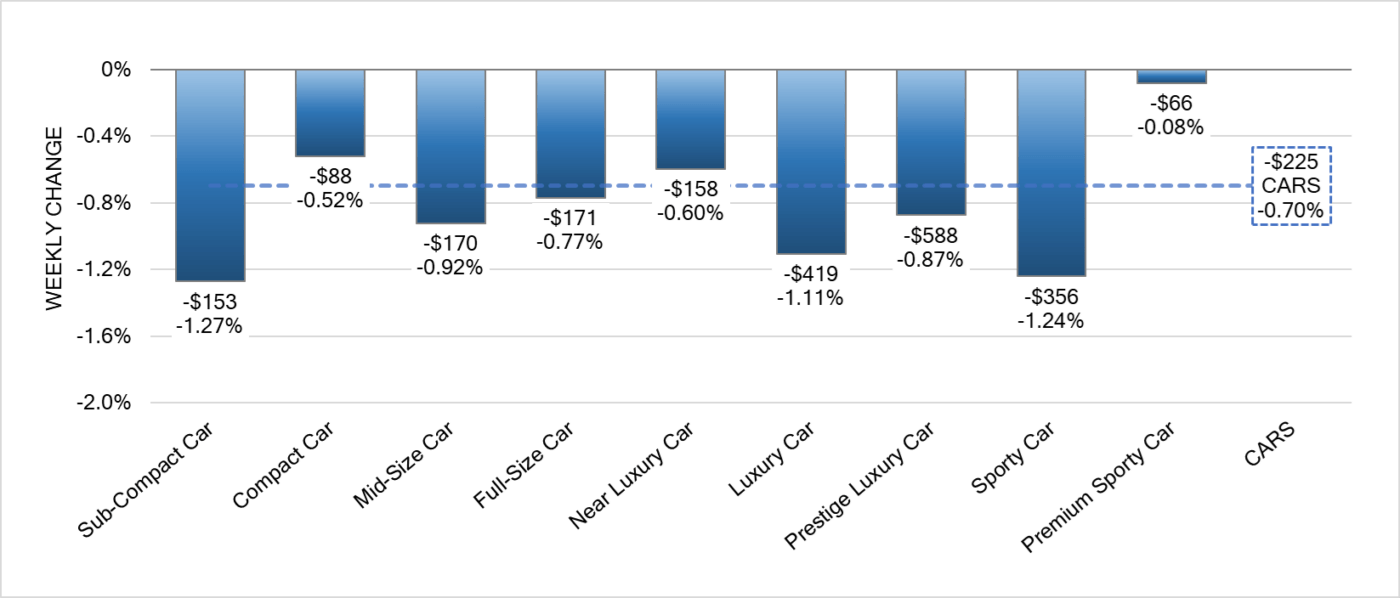

Car Segments

- Last week there was an overall decrease of -0.70% seen in Car segments.

- Premium-Sporty Car showed minimal decline with a (-0.08%) change in pricing followed by Compact Car at (-0.52%).

- The most significant decline observed was tied between Sub-Compact Car and Sporty Car at (-1.27%).

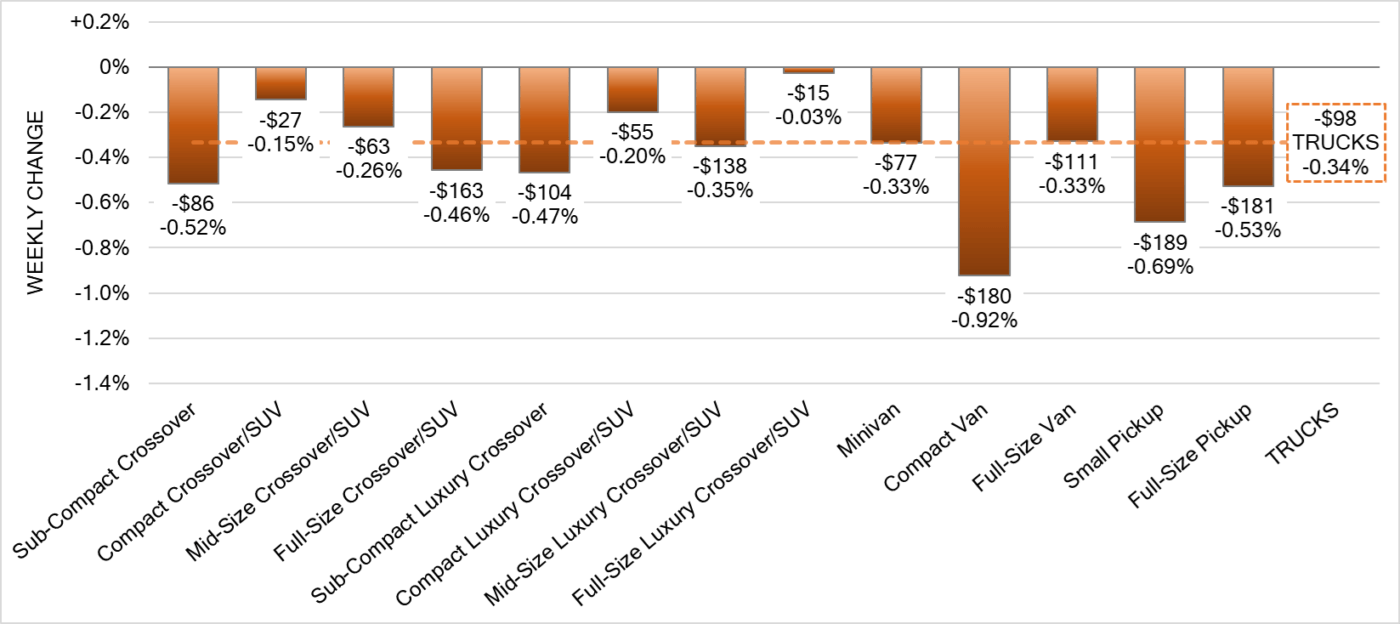

Truck Segments

- Truck segments saw an overall decrease of -0.34% last week.

- All segments showed a depreciation. Those with the largest declines were Compact Van (-0.92%) and Small Pickup (-0.69%).

- Segments with the next largest decreases were Full-Size Pickup (-0.53%) and Sub-Compact Crossover (-0.52%).

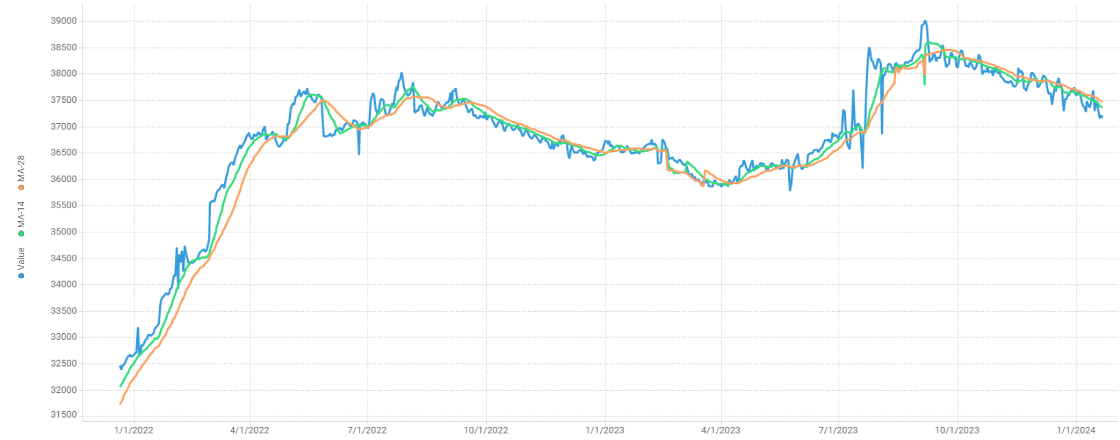

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,400. Analysis is based on approximately 208,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines around double than the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which we have not seen in many weeks. Conversion rates were quite low this past week with some observed sell rates were as low as 11% and as high as 59% but most were between 25-45%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The annual inflation rate in Canada rose to 3.4% in December of 2023 from 3.1% in the previous month, aligned with market expectations.

- Retail sales in Canada are expected to have surged by 0.8% from the previous month in December of 2023, implying the sharpest increase in 11 months, according to preliminary estimates.

- Consumer Confidence in Canada increased to 49.46 points in January from 46.57 points in December of 2023 according to an Ipsos survey.

- The yield on the Canadian 10-year government bond increased slightly to 3.44%.

- The Canadian dollar is around $0.743 this Monday morning similar to $0.744 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.49% last week; the prior week decreased by -0.63%.

Volume-weighted Car segments decreased -0.37%, compared to the prior week’s -0.39% decrease:

- The 0-to-2-year-old Car segments were down -0.36% and 8-to-16-year-old Cars declined -0.18%.

- Three of the nine Car segments increased last week.

- Only one of the Car segments reported a large decline; Sub-Compact Car decreased -1.79%, an increase in depreciation from the prior week’s decline of -1.02%.

- The Compact Car segment increased for a second consecutive week, up +0.02% after the prior week’s +0.03% increase. The Full-Size (+0.01%) and Sporty (+0.06%) Car segments also reported increases last week.

- Four of the nine 8-to-16-year-old Car segments increased, Compact (+0.38%), Full-Size (+0.36%), Sporty (+0.23%), and Premium Sporty (+0.001%).

Volume-weighted Truck segments decreased by -0.53%; the previous week decreased -0.73%:

- The 0-to-2-year-old models declined -0.38% on average and the 8-to-16-year-olds decreased by -0.46% on average.

- All thirteen of the Truck segments declined last week, but only one had a decline exceeding 1%. The Minivan segment continues to report large depreciation, dropping -1.05% last week; the segment has averaged -0.99% depreciation over the last 16 weeks.

- Full-Size Pickup depreciation slowed down last week, declining -0.15%, compared with the prior week’s decline of -0.63%. This was the smallest single week decline since June 2023.

- In sharp contrast to the Full-Size Pickup segment, the Small Pickups are continuing to decline, increasing the depreciation last week to -0.91% vs the prior week’s drop of -0.62%.

Industry News

- A new GM Canada President has been named following Marissa West’s promotion to oversee GM of North America. Kristian Aquilina will head the brand in Canada, effective immediately, leaving his post as VP of Sales and Marketing.

- Once again we see highest sales volume numbers from Ford and Toyota nameplates in Canada for 2023, as the F-Series pickups top the charts for best-selling Truck, while Toyota’s Rav4 and Corolla take the top spot for best-selling SUV and Passenger Car, respectively.

- As the Commercial EV world heats up, Stellantis will be bringing its Ram EV ProMaster to the market, touting 261km of city driving range to compete with Ford’s eTransit and the incoming Mercedes-Benz eSprinter. Amazon will be receiving deliveries of the ProMaster EV as the first commercial customer.

- As many of the supply chain woes become a distant memory for the Canadian car market, a new issue is pending out of the Port of Halifax, with Unifor workers at the Halifax autoport now preparing to strike if resulting negotiation talks do not prove successful. The Port of Halifax handles about 185,000 vehicles per year, mostly of European vehicles – threatening operations of those brands early in 2024.

- With the current slowdown of North American interest in EV’s, Ford’s Rouge Electric Vehicle Center, which makes the F-150 Lightning has slowed its production output of the electric pickup, informing 1,400 plant employees of possible forced retirement or move to another facility to reallocate resources.