01.28.2025

Market Insights – 1/28/25

Wholesale Prices, Week Ending January 25th, 2025

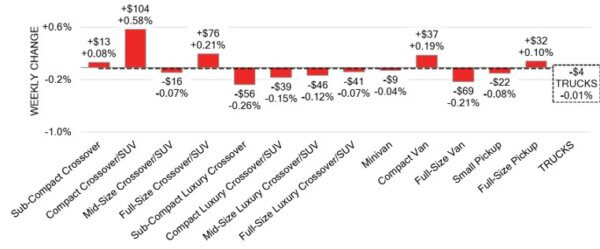

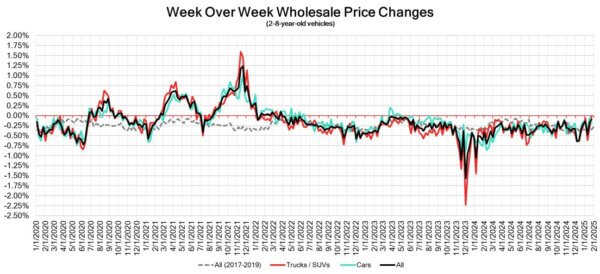

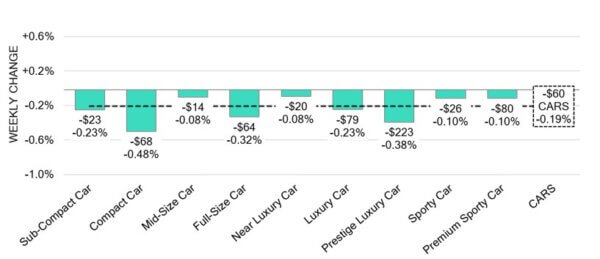

The Canadian used wholesale market experienced a decline of –0.10% in pricing for the week. Car segments prices decreased by –0.19% while the Truck/SUVs segments dropped -0.01%. The largest increases were seen in Compact Crossover/SUV at +0.58% and Full-Size Crossover/SUV at +0.21%. The largest declines in the car segments were seen in Compact Car at -0.48% and Prestige Luxury Car with -0.38%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -0.26% followed by Full-Size Van with -0.21%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.19% | -0.05% | -0.28% |

| Truck & SUV segments | -0.01% | -0.27% | -0.42% |

| Market | -0.10% | -0.17% | -0.35% |

Car Segments

- All nine car segments declined last week, with an average drop of -0.19%.

- The segments with the smallest declines were Mid-Size Car (-0.08%), Full-Size Car (-0.32%), and Sub-Compact Car (-0.23%)

- The largest decreases were seen from Compact Car (-0.48%), Luxury Car (-0.23%), and Near Luxury Car (-0.08%)

Truck / SUV Segments

- There was an overall slight depreciation of –0.01%seen in truck segments last week. Eight of the thirteen segments reflected this movement.

- Those with the largest declines were Sub-Compact Luxury Crossover (-0.26%), Full-Size Van (-0.21%) and Compact Luxury Crossover/SUV (-0.15%).

- The five segments that showed an increase were Compact Crossover/SUV (+0.58%), Full-Size Crossover/SUV (+0.21%), Compact Van (+0.19%), Full-Size Pickup (+0.10%) and Sub-Compact Crossover (+0.08%).

Wholesale

The Canadian market remains on a downward trend, with a decline far less pronounced than in its previous week. Just over 9% of market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell by 26%, while that of the car segments rose by 14%. Monitored auction sale rates ranged from 19 to 74.6% averaging at 49.2%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent adjustments to interest rates. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. As the new year continues, so does the high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In December 2024, new home prices in Canada dropped by 0.1% compared to

the previous month. This followed a 0.1% rise in November and fell short of

market forecasts, which anticipated a 0.2% increase. - Industrial producer prices in Canada increased by 0.2% month-over-month in

December 2024, following a 0.6% rise in October and falling short of market

expectations for a 0.6% gain. - Retail sales in Canada are projected to rise by 1.6% month-over-month in

December 2024, marking the largest increase since May 2022, according to

preliminary estimates. - The yield on the Canadian 10-year government bond slightly decreased to 3.21%.

- The Canadian dollar is around $0.695 this Monday morning, representing a slight

decrease from $0.701 a week prior.

U.S. Market

- The current market is best characterized as “stable,” with depreciation slowing in alignment with pre-pandemic trends. Last week, we saw our first segment slightly gain positive ground. Following an inventory increase post-holidays, we are now witnessing the anticipated impact of a low used supply for this year, leading to a weekly decline in total available inventory at auctions.

Industry News

- Tesla reported that it will be increasing the prices of its model lineup as of February 1st. Model S, X, and Y will see increases up to $4,000 while the Model 3 sedan will see a larger increase up to $9,000. Tesla did not comment on the reasoning behind the price hike.

- An historic snowfall in New Orleans has caused massive disruption for the 2025 National Auto Dealers Association conference held in the state this past week. Causing hundreds of attendees to suffer flight cancellations, reroutes, and even long drives as the event’s organizers reorganized the schedule to accommodate the change in travel plans.

- The Lucid Gravity luxury mid-size electric crossover is launching shortly in Canada and the brand has shared its starting price of $113,500 for the Touring trim and $134,500 for the Grand Touring. The Gravity will be capable of travelling up to 720km on a single charge and can seat up to 7 passengers as the brands first crossover.

- TD Economics released a report geared towards the repercussions of President Trump’s 25% Tariff on vehicle imports, stating that Canada exports roughly 1.5M vehicles to the U.S. per year and in order for them to replace that capacity, around 10%, 6 new production facilities would need to be built. Many of the highest volume sold models in the U.S. are massively supported by production plants in Canada (Toyota Rav4, Honda CR-V and Chrysler Pacifica).

- A University of Toronto study has found that usage of electric vehicles and the impact of a cleaner grid system would yield over $100 billion in benefits to human health, by improving the level ambient air chemicals we breathe.