01.03.2024

Market Insights – 1/3/2024

Wholesale Prices, Week Ending December 30th

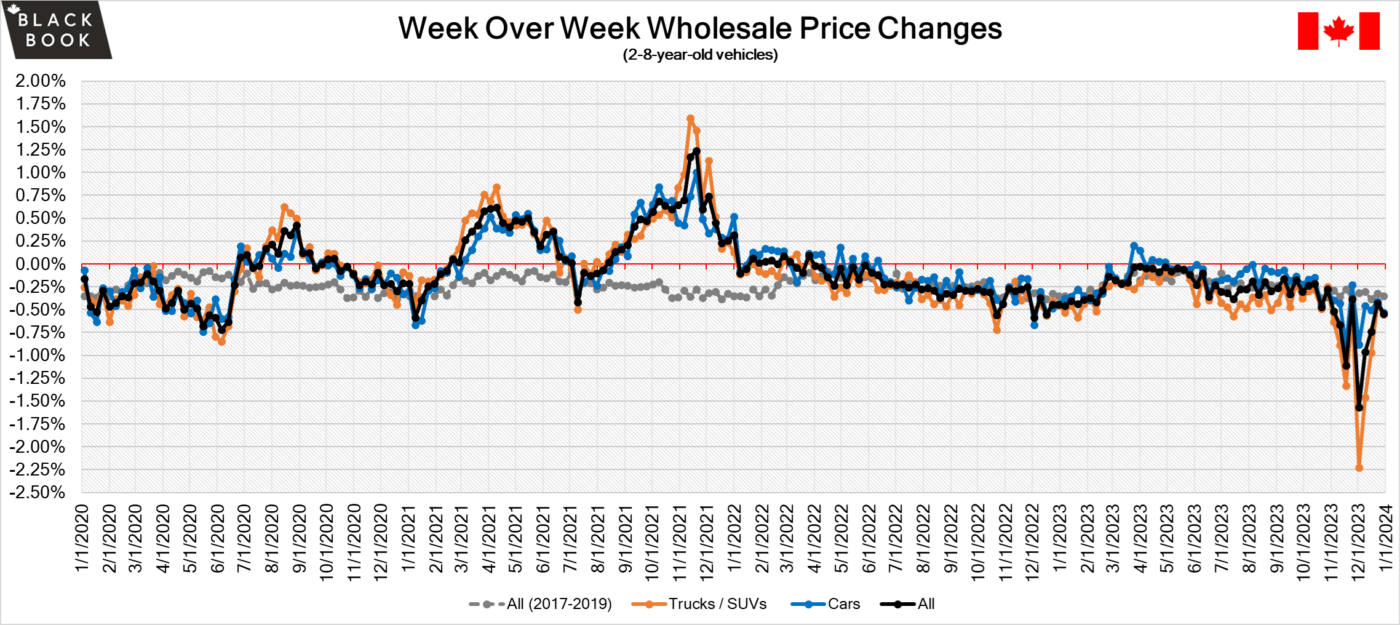

The Canadian used wholesale market saw a decline in prices for the week at –0.54%. The Car segment fell by -0.53% and the Truck/SUVs segment prices declined –0.55%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Minivan at –1.59% followed by Full-Size Crossover/SUV at –1.36%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.53% | -0.41% | -0.32% |

| Truck & SUV segments | -0.55% | -0.45% | -0.39% |

| Market | -0.54% | -0.43% | -0.35% |

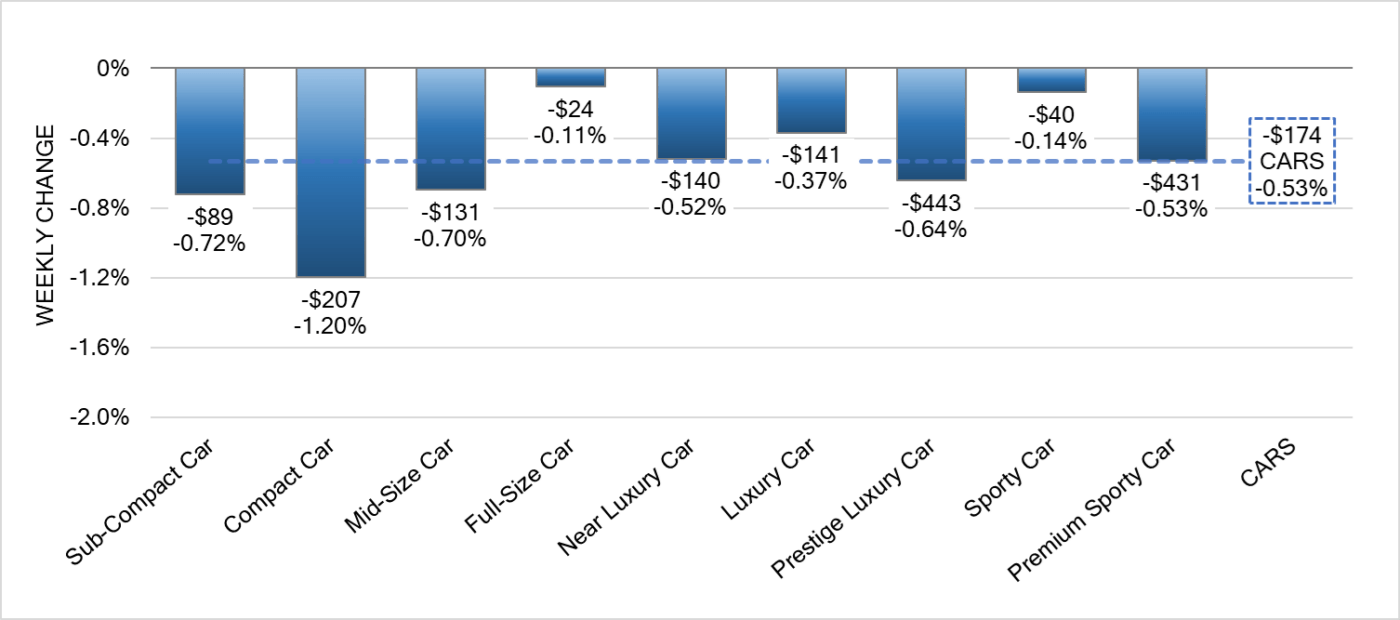

Car Segments

- There was an overall decrease of -0.53% seen in Car segments last week. This decrease was seen across all of the nine segments.

- The most significant decrease was seen in Compact Car at (-1.20%), followed by Sub-Compact Car at (-0.72%) and Mid-Size Car at (-0.70%).

- The Segments with the least decreases were Full-Size Car at (-0.11%) and Sporty Car with (-0.14%).

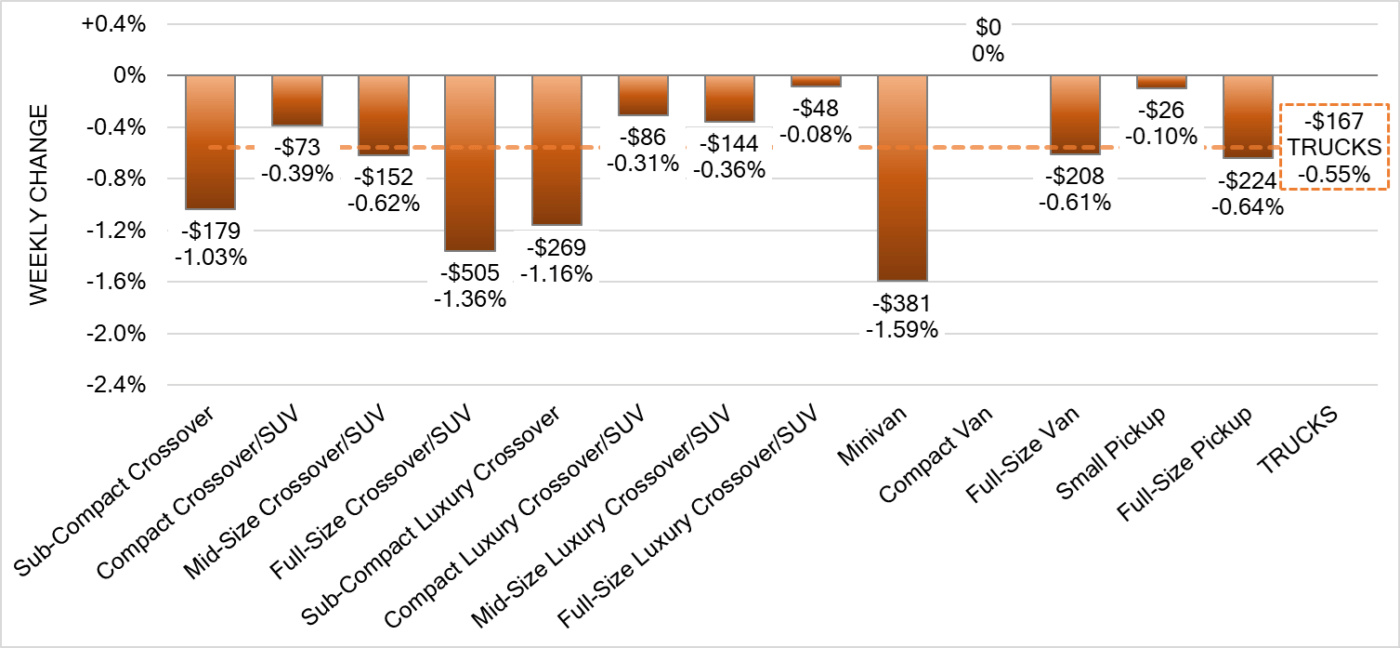

Truck Segments

- Last week there was an overall decrease of -0.55% in truck segments.

- Segments with the largest drops were Minivan (-1.59%), Full-Size Crossover/SUV (-1.36%), Sub-Compact Luxury Crossover/SUV (-1.16%) and Sub-Compact Crossover (-1.03%).

- Full-Size Pickup (-0.64%), Mid-Size Crossover/SUV (-0.62%) and Full-Size Van (-0.61%) also had notable depreciations.

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,700. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease slowed during the holidays with declines closer to the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 4% and as high as 56% but most were less than 35%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The S&P/TSX Composite index ended 0.1% higher at the 20,958 level on the last trading session of the year, as gains in oil producers were restrained by losses in mining companies, primarily influenced by lower bullion prices.

- The S&P Global Canada Manufacturing PMI fell to 45.4 in December of 2023 from 47.7 in the previous month, pointing to the eighth consecutive contraction in the Canadian manufacturing sector, at the sharpest pace since the pandemic-induced crash in the second quarter of 2020.

- The yield on the Canadian 10-year government bond decreased slightly to 3.07%.

- The Canadian dollar is around $0.755 this Monday morning up from $0.732 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.68% last week; the prior week decreased by -0.70%.

Volume-weighted Car segments decreased -0.51%, compared to the prior week’s -0.51% decrease:

- The 0-to-2-year-old Car segments were down -0.42% and 8-to-16-year-old Cars declined -0.51%.

- Near Luxury Car had the largest decline last week, down -0.88%, compared with -0.76% the week prior.

- The Compact Car (-0.07%) segment had the smallest decline last week, the lowest single week depreciation for the segment since the first week of October.

- Sporty Car depreciation also dramatically slowed down last week, dropping -0.10%, compared with the average weekly depreciation over the previous six weeks of -2.02% per week.

Volume-weighted Truck segments decreased by -0.80%; the previous week decreased -0.78%:

- The 0-to-2-year-old models declined -0.73% on average and the 8-to-16-year-olds decreased by -0.74% on average.

- All thirteen Truck segments declined last week, with only four of the thirteen reporting declines exceeding 1%.

- Small Pickup had the largest decline last week with a drop of -1.91%. This was the largest single week decline for the segment since May 2020.

- After large declines for six weeks, averaging -2.23% each week, the Full-Size Luxury Crossover/SUV segment depreciation slowed down last week with a minimal -0.37%.

Industry News

- Toyota has labelled as a laggard of EV adoption, but the brand has a very different approach, and one that is proving successful in both sales volume and overall emissions. Toyota Vice President Stephen Beatty says, “they’re running at about a 42% rate of electrified product sales” which includes both hybrids and plug-ins as they bring any new model to market with a hybrid option, if not solely hybrid powered.

- EVs have been identified as the cause for a greater share of overall vehicle delays in 2023 as they are linked to 34% of them. While they were only 5% back in 2018 according to consulting firm PwC – keeping in mind the number of available models today over that 2018 timeframe for electric alternatives, highlighting continued demand for these vehicles in Canada.

- Honda is recalling almost 300,000 2017-20MY Honda/Acura models in Canada over defective fuel pumps that could cause engines stall while driving.

- As we draw closer to the 2024 Canadian International Auto Show hosted in Toronto, there are 7 brands returning which skipped the show last year. A very positive sign as the market continues to recover and the widespread success of the show in 2023 resonates with automakers over their participation. The 7 brands are Ford, Lincoln, Volvo, Polestar, Porsche, Infiniti, and Genesis.

- Flavio Volpe, head of the Canadian Automotive Parts Manufacturers’ Association (APMA), has been named to the Order of Canada for his working in leading Project Arrow – the all-electric and all-Canadian developed and supplied crossover utility vehicle platform.