01.30.2024

Market Insights – 1/30/2024

Wholesale Prices, Week Ending January 27th

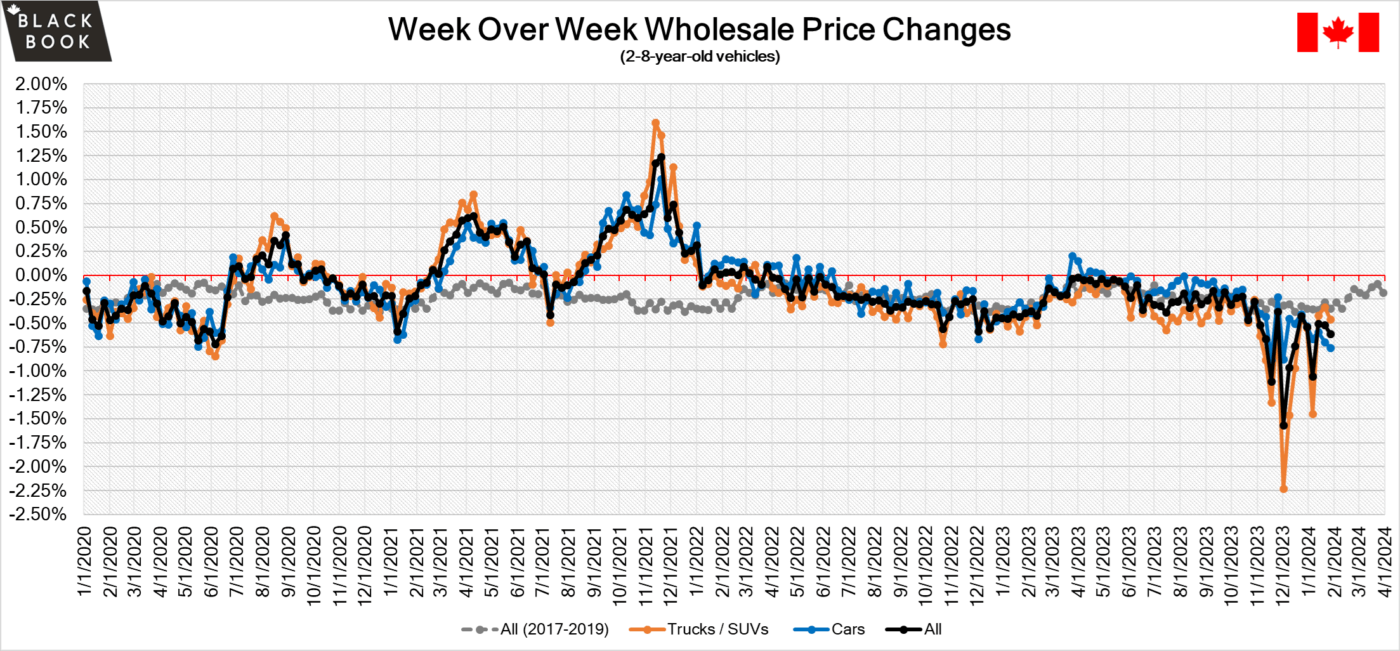

The Canadian used wholesale market saw a decline in prices for the week at –0.61%. The Car segment fell by -0.76% and the Truck/SUVs segment prices declined –0.46%. 2 out of 22 segments’ values have increased for the week. The Compact Van segment increased by 0.64% followed by the Premium Sporty Car segment which was up 0.15%. The segments with the largest declines were Prestige Luxury Car at –2.06% followed by Sub-Compact Car at –1.98%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.76% | -0.70% | -0.28% |

| Truck & SUV segments | -0.46% | -0.34% | -0.42% |

| Market | -0.61% | -0.52% | -0.35% |

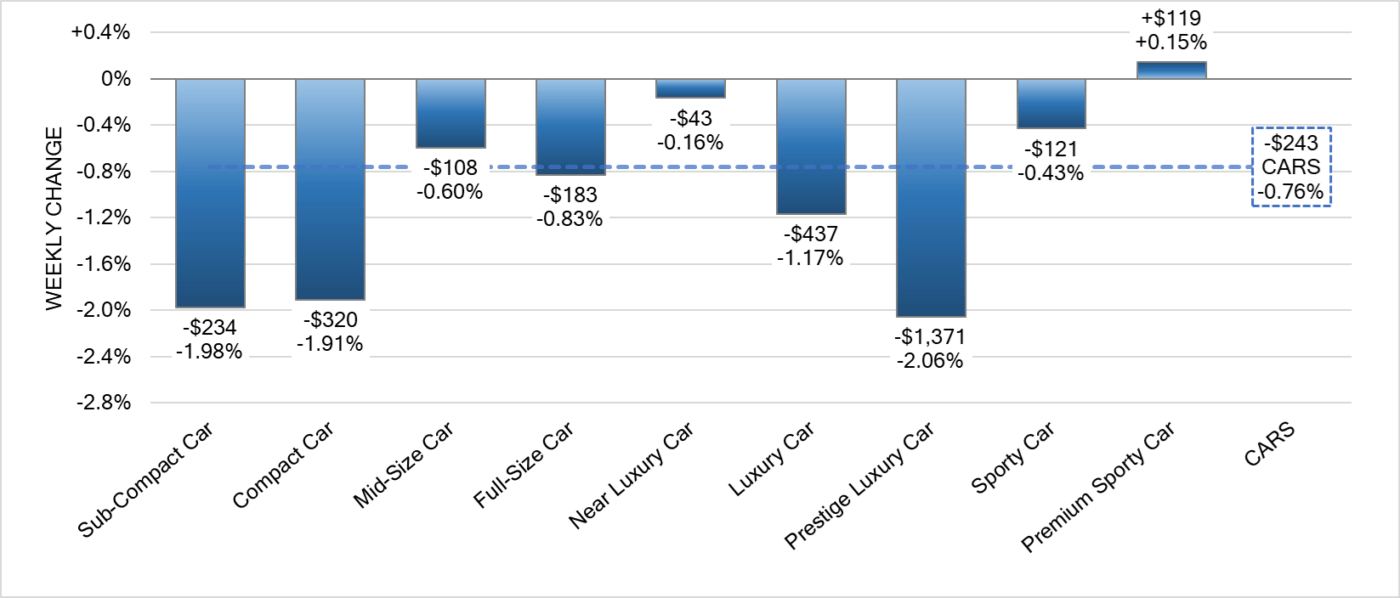

Car Segments

- There was an overall decrease of -0.76% seen in Car segments last week. The decline was noted across all but one of the nine segments.

- The only increase was seen in Premium Sporty Car, with (+0.15%).

- The most significant decline observed was Prestige Luxury Car at (-2.06%), followed by Sub-Compact Car at (-1.98%) and Compact Car at (-1.91%).

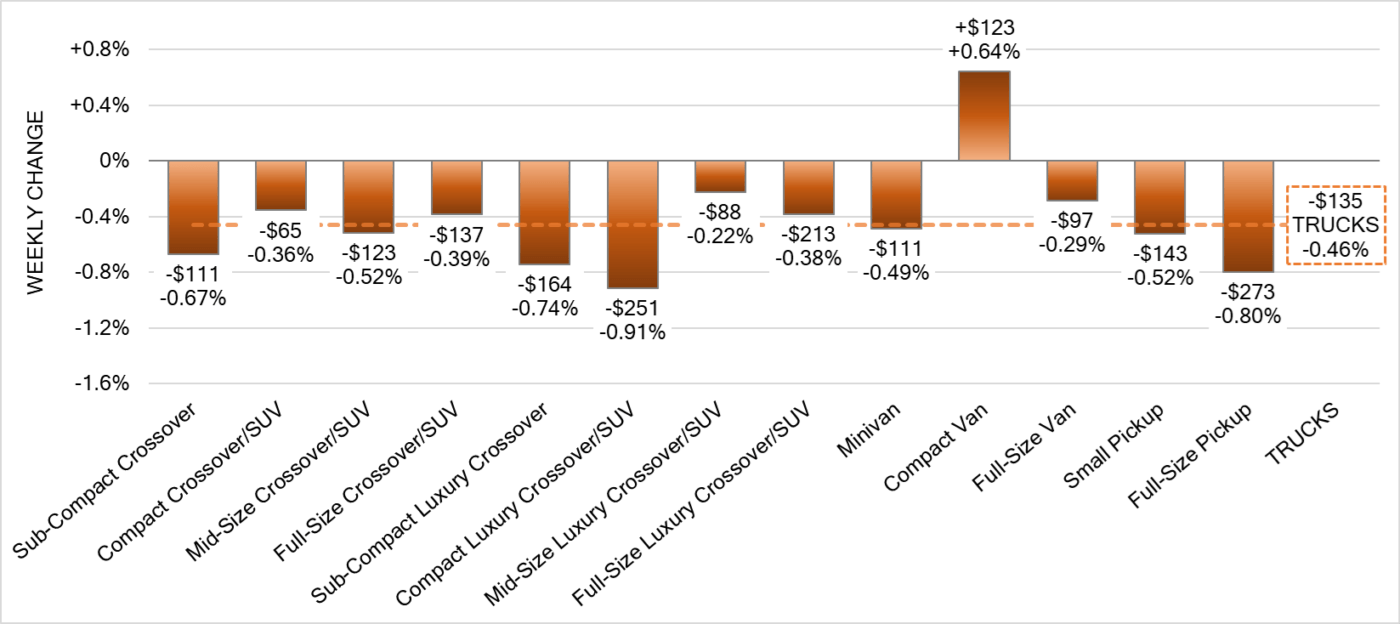

Truck Segments

- Truck segments saw an overall decrease of -0.46% last week.

- Of the segments that depreciated none were over 1.00%. Those with largest were Compact Luxury Crossover/SUV (-0.91%) Full-Size Pickup (-0.80%) and Sub-Compact Luxury Crossover (-0.74%).

- One segment showed an increase. That sector was Compact Van (+0.64%).

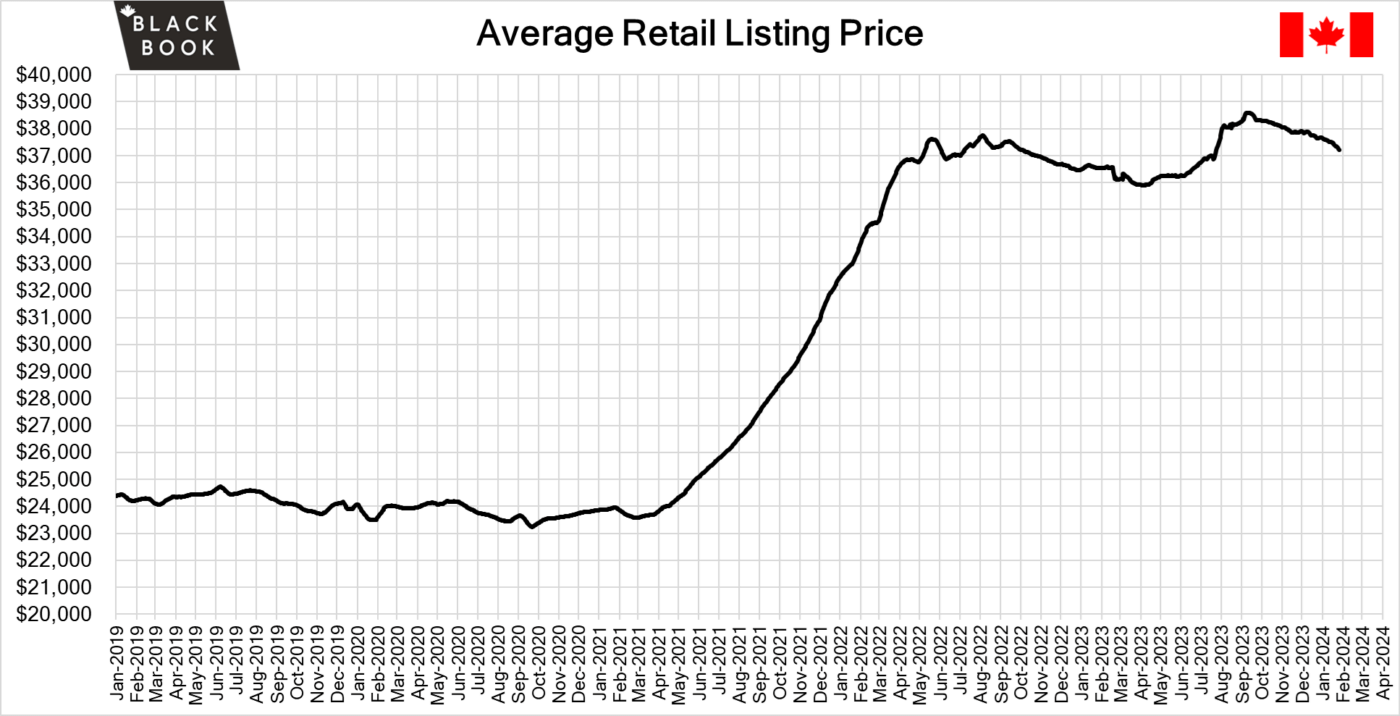

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $37,200. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines around double than the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which we have not seen in many weeks. Conversion rates were quite low this past week with some observed sell rates were as low as 11% and as high as 59% but most were between 25-45%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The annual inflation rate in Canada rose to 3.4% in December of 2023 from 3.1% in the previous month, aligned with market expectations.

- Retail sales in Canada are expected to have surged by 0.8% from the previous month in December of 2023, implying the sharpest increase in 11 months, according to preliminary estimates.

- Consumer Confidence in Canada increased to 49.46 points in January from 46.57 points in December of 2023 according to an Ipsos survey.

- The yield on the Canadian 10-year government bond increased slightly to 3.44%.

- The Canadian dollar is around $0.743 this Monday morning similar to $0.744 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.33% last week; the prior week decreased by -0.49%.

Volume-weighted Car segments decreased -0.26%, compared to the prior week’s -0.37% decrease:

- The 0-to-2-year-old Car segments were down -0.23% and 8-to-16-year-old Cars declined -0.07%.

- One of the nine Car segments increased last week. Compact Car increased for a third consecutive week, up +0.29%, compared with the prior week’s minimal increase of +0.02%.

- For a third straight week, the Sub-Compact Car segment reported the largest decline at -1.30%. This was the only segment to report a decline greater than 1%.

- The Prestige Luxury Car segment also continues to report large declines, declining -0.91% last week. Over the last twelve weeks, the segment has averaged a weekly decline of -0.99%.

Volume-weighted Truck segments decreased by -0.36%; the previous week decreased -0.53%:

- The 0-to-2-year-old models declined -0.25% on average and the 8-to-16-year-olds decreased by -0.50% on average.

- Twelve of the thirteen Truck segments declined last week.

- After a record setting stretch of appreciation during the pandemic, the Full-Size Van segment reported appreciation again for the first time since July 2022. The segment increased +0.09%, this is in sharp contrast to declines that exceeded 2% just two months ago.

- Sub-Compact Crossover reported the largest decline last week, dropping -0.68%. However, this is the smallest single week decline for the segment since mid-October.

- The Small Pickup segment reported a dramatic slowdown in depreciation, -0.07% last week, compared with -0.91% the previous week.

Industry News

- The British auto industry has paused talks with Canada on renewing a free trade agreement that comes due in April which if unresolved could result in tariffs applied to British-made cars sold in Canada – the possibility of this would currently only affect JLR branded vehicles.

- The latest EV in Porsche’s stable breaks cover as the Macan EV looks to go on sale this summer in North America. This would be the 2nd fully electric vehicle added to the German automakers’ lineup and will be sold alongside the Porsche Taycan luxury sedan. Pricing is slated to start at $99,300 for the base Macan 4 and move up to $125,300 for the top trim Turbo.

- Chevrolet has released the next generation Equinox which goes rugged for 2025 model year, adopting styling cues from the recently updated Traverse to fit in with the family of small SUVs like the Trax and TrailBlazer, and will continue to fight in the highly competitive Compact SUV segment.

- Soon Acura will increase its lineup of SUVs by 50% as it looks to add a subcompact luxury crossover to the mix that will fit in below the RDX and be based off the Honda HR-V platform, serving as a gateway into the brand alongside the recently launched Integra hatchback.

- Price parity of ZEVs vs. ICEs continues to be an adoptability issue, and by way of the California Air Resources Board, our Government has reported that these types of vehicles will first break-even with ICE equivalents by 2033, but unwinding that analysis shows this true only for cars, not SUV or Trucks. Those segments will likely reach parity after the 2035 ZEV mandate takes effect.