01.07.2025

Market Insights – 1/7/25

Wholesale Prices, Week Ending January 4th, 2025

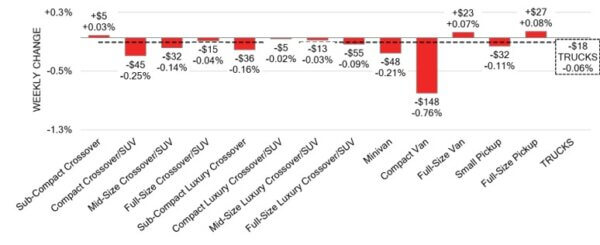

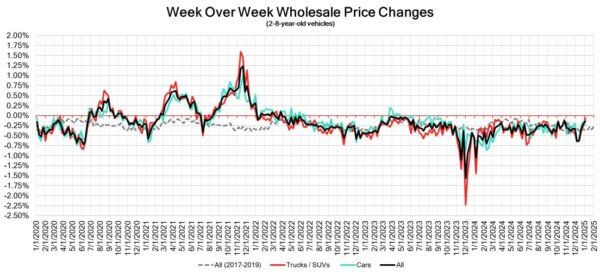

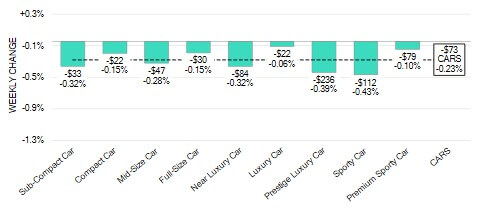

The Canadian used wholesale market experienced a decline of –0.14% in pricing for the week. Car segments prices decreased by –0.23% while the Truck/SUVs segments dropped -0.06%. Top two Segments with increases this week were Full-Size Pickup +0.08% and Full-Size Van +0.07%. The largest declines in the car segments were seen in Sporty Car at -0.43% and Prestige Luxury Car with -0.39%. The largest declines in the Truck/SUV segments were Compact Van at -0.76% followed by Compact Crossover/SUV with -0.25%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.15% | -0.34% |

| Truck & SUV segments | -0.06% | -0.26% | -0.37% |

| Market | -0.14% | -0.21% | -0.35% |

Car Segments

- All nine car segments declined in the first week of 2025, with an average drop of -0.23%.

- The Luxury Car Segment (-0.06%), Premium Sporty Car (-0.10%), Compact Car (-0.15%), and Full-Size Car (-0.15%) segments dropped the least.

- The largest decreases were seen from Sporty Car (-0.43%), Prestige Luxury Car (-0.39%), Near Luxury Car (-0.32%), and Sub-Compact Car (-0.32%)

Truck / SUV Segments

- An overall depreciation of –0.06% was seen in truck segments last week. Ten of thirteen segments reflected a negative movement.

- Those with the largest declines were Compact Van (-0.76%), Compact Crossover/SUV (-0.25%) and Minivan (-0.21%).

- Three segments showed an increase. Full-Size Pickup (+0.08%), Full-Size Van (+0.07%) and Sub-Compact Crossover (+0.03%).

Wholesale

The Canadian market continues its downward trend, with the decline less pronounced than in the week before. Under 14% of market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell by 20%, while that of the car segments rose by 8%. There has been continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the recent adjustments to interest rates and the ongoing gradual decline in floor prices. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. As the new year starts up, the high demand on both sides of the border for an increase in inventory and vehicles at auctions continues on.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,950. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Justin Trudeau has announced his resignation as leader of Canada’s governing

party after nearly a decade as prime minister. - Canada recorded a trade deficit of $0.32 billion in November 2024, an

improvement from the upwardly revised $0.54 billion deficit in the previous month

and smaller than the market forecast of a $0.9 billion deficit. - The Ivey Purchasing Managers Index in Canada increased to 54.7 in December

2024, rising from 52.3 in November, but it fell short of market expectations of

55.4. - The yield on the Canadian 10-year government bond slightly decreased to 3.29%.

- The Canadian dollar is around $0.696 this Monday morning, representing a slight

increase from $0.694 a week prior.

U.S. Market

- As we look back at the final week of 2024, depreciation remained stable amidst rising auction inventories and improved conversion rates compared to the Christmas week. Last week’s depreciation trends reflected a balance, with vehicles maintaining their values more steadily as auction activity picked up post-holiday.

Industry News

- With November’s iZEV rebate claims in, the best-selling EVs in the country tell a big story as the Chevrolet Equinox EV has topped the charts for the second consecutive month, eclipsing the reign of Tesla vehicles taking that spot in each month prior.

- As Cadillac transitions its lineup away from gas-only models and towards luxury EV’s it has seen its midsize Lyriq crossover volume grow almost 3x from last year, selling 2,382 units through Q3 and become the 2nd highest volume model in its lineup next to the XT4 which will be replaced for an EV in 2025.

- For the first time global deliveries for Tesla vehicles has fallen slightly,down 1.1%, even with a push for volume via incentives from the brand. A sign that perhaps more competitive models are now arriving to market, and with higher inventory levels to support consumer demand… and then some.

- In wake of the news around Nissan’s financial trouble and the possibility of a merger with Honda, Nissan Canada President, Trevor Longley stated that the brand “is in a strong position from a liquidity perspective” and that its 249 Canadian dealerships are “doing quite well and fully expect to continue to.”

- Buick and GMC are using momentum built up in 2024 to make 2025 a successful year under new global brand leadership in Jaclyn McQuaid, who took over in September as Vice President of Global Buick and GMC. Now with new designs and approach to model lineups, including an entry-level Envista crossover from Buick.

- Canadian Prime Minister, Justin Trudeau has announced his resignation to take effect after a Liberal Party leadership contest confirms a new party leader. Trudeau became Prime Minister in 2015.