01.09.2024

Market Insights – 1/9/2024

Wholesale Prices, Week Ending January 6th

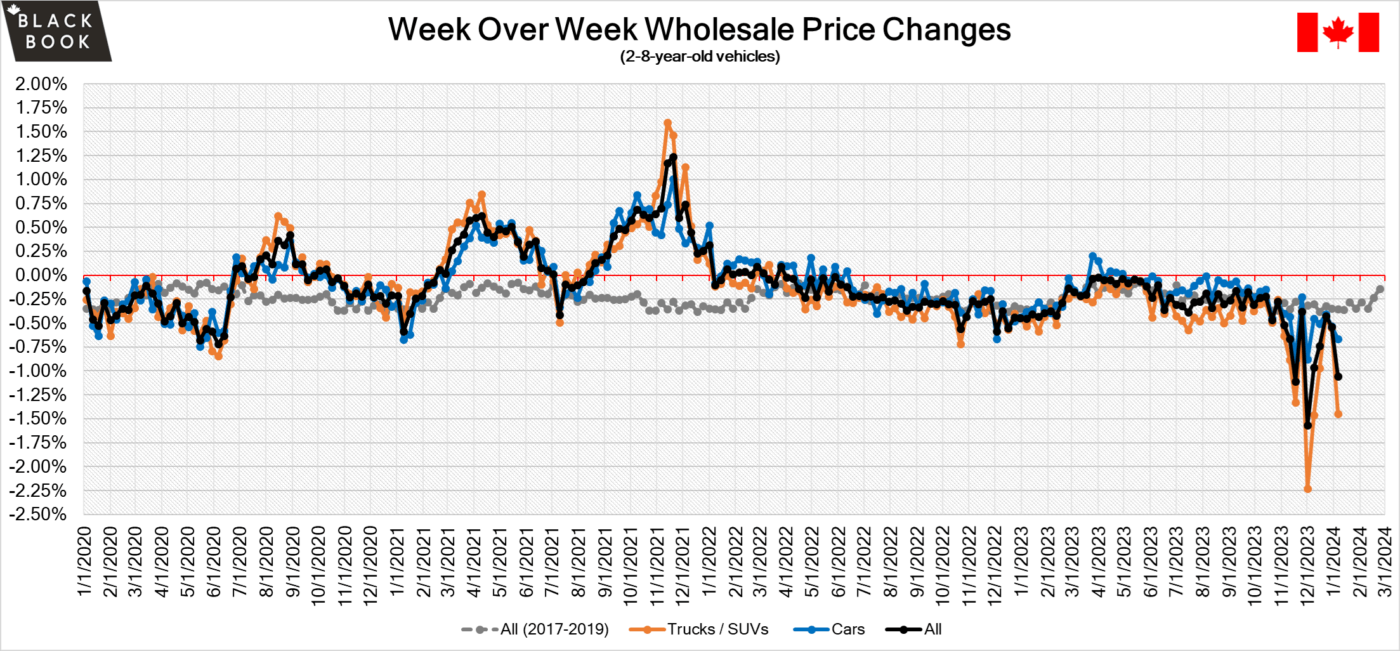

The Canadian used wholesale market saw a decline in prices for the week at –1.06%. The Car segment fell by -0.67% and the Truck/SUVs segment prices declined –1.45%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Full-Size Luxury Crossover/SUV at –2.79% followed by Full-Size Crossover/SUV at –2.35%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.67% | -0.53% | -0.34% |

| Truck & SUV segments | -1.45% | -0.55% | -0.37% |

| Market | -1.06% | -0.54% | -0.35% |

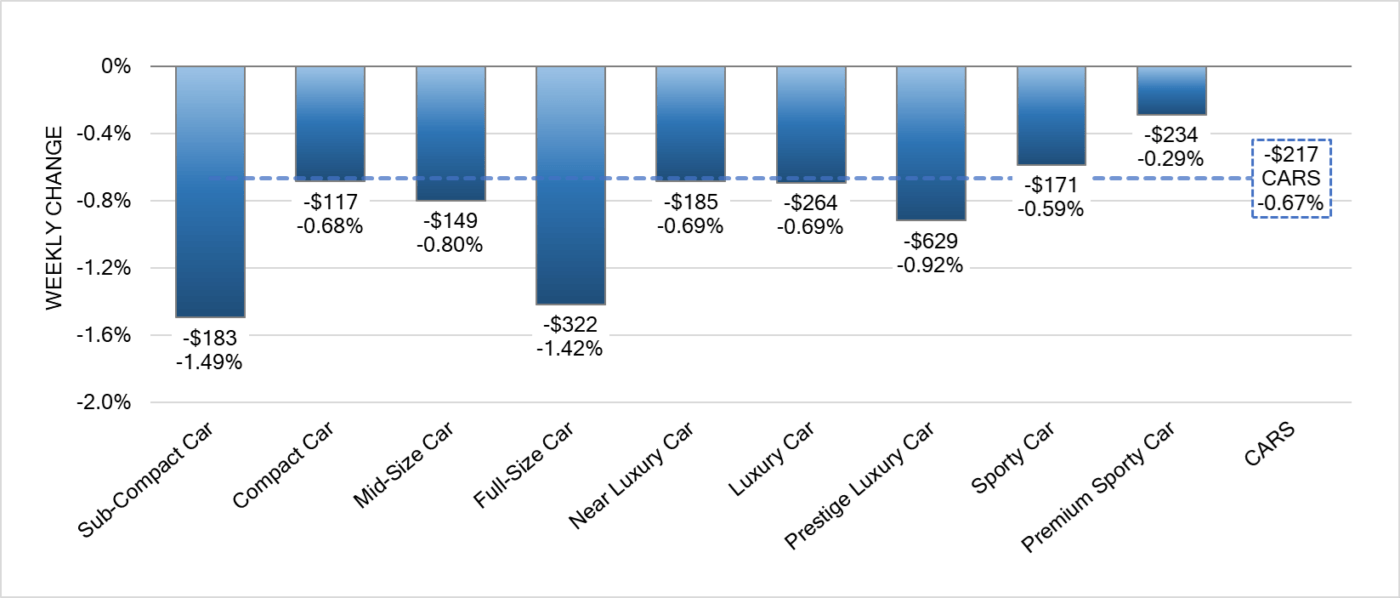

Car Segments

- There was an overall decrease of -0.67% seen in Car segments last week. This decrease was seen across all nine segments.

- The most significant decline was seen in Sub-Compact Car at (-1.49%), followed by Full-Size Car at (-1.42%) and Prestige Luxury Car at (-0.92%).

- Both Luxury Car and Near Luxury Car reflected a decrease of (-0.69%).

- The Segments with the least decreases were Premium Sporty Car at (-0.29%) and Sporty Car with (-0.59%).

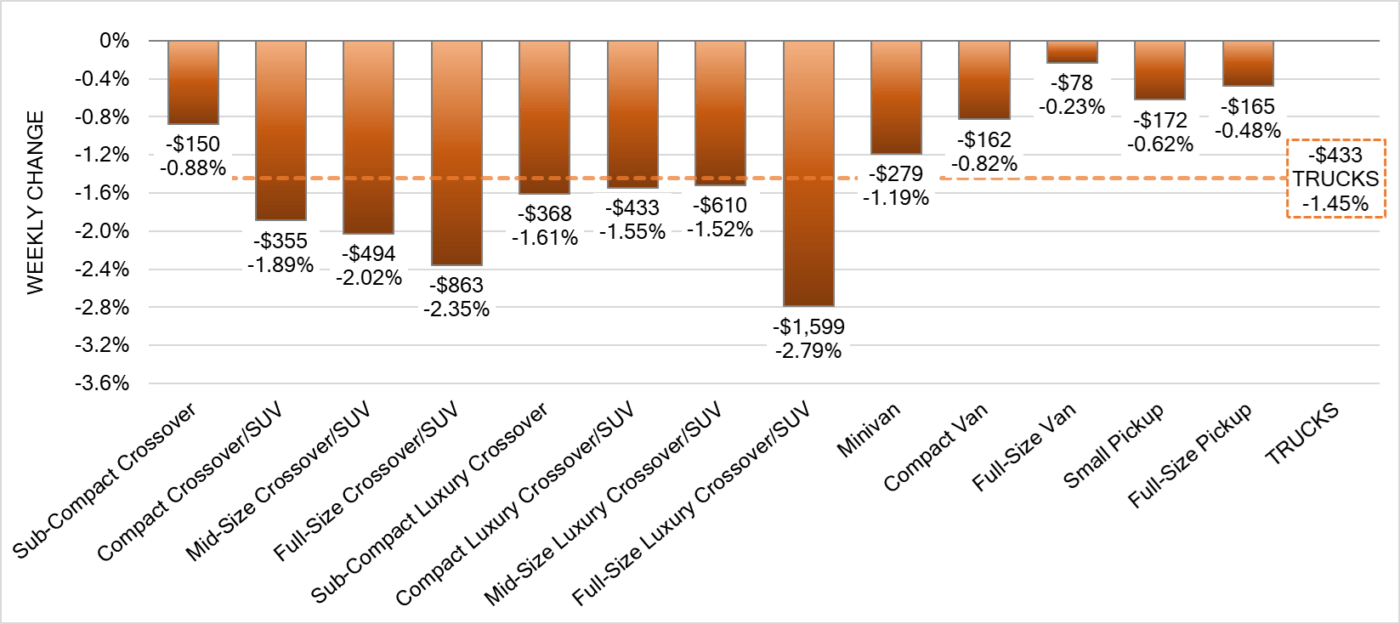

Truck Segments

- There was an overall decrease of -1.45% seen in truck segments last week.

- All segments showed a decline. Those with the largest depreciations were Full-Size Luxury Crossover/SUV (-2.79%), Full-Size Crossover/SUV (-2.35%) and Mid-Size Crossover/SUV (-2.02%).

- Compact Crossover/SUV (-1.89%), Sub-Compact Crossover (-1.61%), Compact Luxury Crossover/SUV (-1.55%) and Mid-Size Luxury Crossover/SUV (-1.52%) also had a noticeable softening.

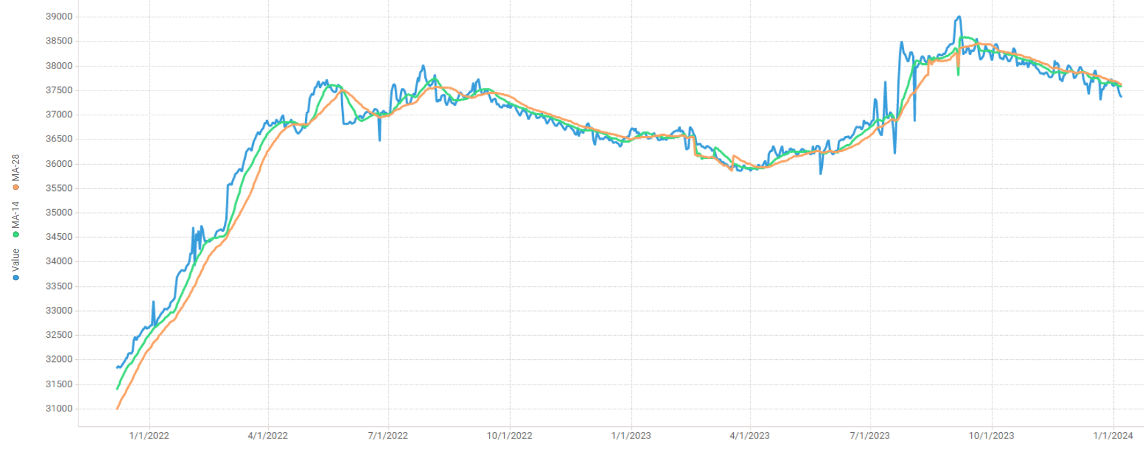

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,600. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease increase after the holidays with declines around three times the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 17% and as high as 65% but most were between 25-40%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The unemployment rate in Canada was at 5.8% in December of 2023, holding unchanged from the 22-month high recorded in the previous month and slightly below expectations of 5.9%.

- Tourism spending in Canada grew 0.5% in the third quarter, following a 1.1% increase in the second quarter. Growth in the third quarter was driven by a 2.3% increase in foreign tourism demand, while domestic tourism demand declined 0.2%.

- The yield on the Canadian 10-year government bond increased slightly to 3.3%.

- The Canadian dollar is around $0.748 this Monday morning down from $0.755 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.68% last week; the prior week decreased by -0.68%.

Volume-weighted Car segments decreased -0.49%, compared to the prior week’s -0.39% decrease:

- The 0-to-2-year-old Car segments were down -0.41% and 8-to-16-year-old Cars declined -0.49%.

- All nine Car segments decreased last week, with only one segment reporting a decline exceeding 1%.

- Prestige Luxury Car had the largest decline last week, dropping -1.90%, an increase in depreciation from the prior week’s decline of -0.81%.

- The Compact Car segment continues to report very light depreciation, -0.06% last week. This is in comparison to the large depreciation in November and early December when the segment had multiple weeks with declines exceeding 2% per week.

Volume-weighted Truck segments decreased by -0.77%; the previous week decreased -0.80%:

- The 0-to-2-year-old models declined -0.66% on average and the 8-to-16-year-olds decreased by -0.81% on average.

- All thirteen Truck segments declined last week, with five of the thirteen reporting declines exceeding 1%.

- The Sub-Compact Luxury Crossover segment had the largest decline last week at -1.66%. This marks the eighth consecutive week the segment has reported a decline greater than 1%.

- The Compact (-0.82%) and Full-Size (-0.37%) Van segments have slowed their rate of depreciation compared to the record setting depreciation in Q4, with some weeks exceeding 3%.

Industry News

- The 2024 North American Awards for Car, Truck, and Utility of the Year are in; Ford’s Super Duty is named Truck of the Year, Kia’s EV9 is Utility of the Year, and Toyota’s Prius/Prius Prime wins Car of the Year honors.

- Stellantis announces they are pulling all corporate-level participation from North American auto shows but will leave dealers with the option to support the brands’ representation at events going forward. This comes after a successful “Camp Jeep” display at the 2023 Canadian International Auto Show.

- Now at the close of 2023, Desrosiers Automotive Consultants has released final sales numbers for new cars in Canada – at 1.66 million vehicles sold last year, the Canadian automotive marketplace sees an 11.8% increase over a constrained 2022.

- After the past 3 years where the auto industry bartered for semiconductors and battled supply chain constraints to bolster dwindling new car inventories, this year shows signs that the chip shortage is finally taking a back seat amongst the major issues to new vehicle production – falling from a global high of more than 10 million units cut from production in 2021 to last year’s estimate of 2.47 million reported by AutoForecast Solutions.