10.01.2024

Market Insights -10/1/24

Wholesale Prices, Week Ending September 28th, 2024

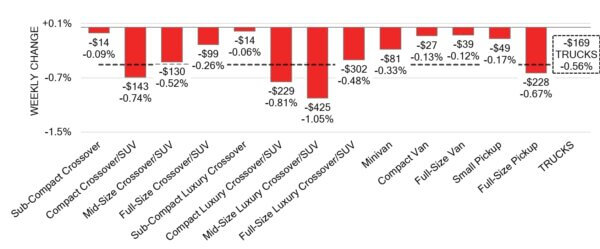

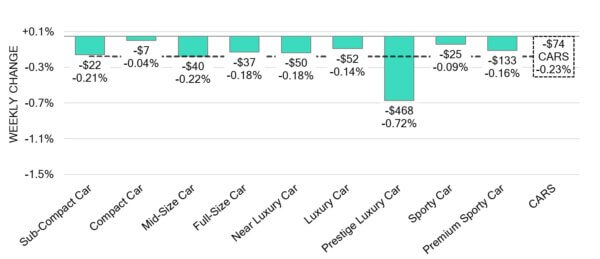

The Canadian used wholesale market experienced a decline of –0.40% in pricing for the week. Car segments prices decreased by –0.23% while the Truck/SUVs segments dropped -0.56%. The largest declines in the car segments were seen in Prestige Luxury Car with –0.72% followed by Mid-Size Car at –0.22%. The largest declines in the Truck/SUV segments were Mid-Size Luxury Crossover/SUV at -1.05% followed by Compact Luxury Crossover/SUV -0.81%.

Car Segments

- Last week there was an overall decrease of -0.23% across Car segments.

This decrease was noted across all nine segments. - The Compact Car (-0.04%), Sporty Car (-0.09%) and Luxury Car (-0.14%)

segments showed the smallest declines. - The largest decreases were seen from Prestige Luxury Car (-0.72%), Mid-

Size Car at (-0.22%) and Prestige Sub-Compact Car at (-0.21%).

Truck / SUV Segments

- Truck segments reflected an overall depreciation of –0.56% last

week. All thirteen segments noted a decline. - Mid-Size Luxury Crossover/SUV (-1.05%), Compact

Luxury Crossover/SUV (-0.81%), Compact Crossover/SUV (-0.74%)

and Full-Size Pickup (-0.67%) all had the largest depreciations. - Segments with the smallest decrease were Sub-Compact

Luxury Crossover (-0.06%) and Sub-Compact Crossover (-0.09%).

Wholesale

The Canadian market continues a downward trend, with a decline similar to its previous week. Just over 36% of market segments experienced an average value change of more than ±$100, indicating a lower rate than the previous week. Among these, Truck segments experienced a decline 25% greater compared to the previous week. Monitored auction sale rates ranged from 33 to 90% averaging at 51.1% The fluctuations in sale rates across various lanes can be attributed several factors including the ongoing decline in floor prices. An increase in supply entering the wholesale market has been noted, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP is projected to hold steady in August 2024. This stability is attributed to gains in oil and gas extraction, along with growth in the public sector, which counterbalance declines in manufacturing and the transportation and warehousing sectors.

- Canada’s government budget deficit decreased to $4.4 billion in July 2024, compared to $4.86 billion in July 2023.

- In August 2024, wholesale sales in Canada decreased by 1.1% compared to the previous month, following a 0.4% rise in July, according to preliminary estimates. This drop was seen in five out of seven subsectors.

- The yield on the Canadian 10-year government bond increases slightly to 2.95%.

- The Canadian dollar is around $0.739 this Monday morning, representing a slight decrease from $0.741 a week prior.

U.S. Market

- Last week, the overall market continued its decline, dropping by -0.19%, though this is a slower decline than what is typical for this time of year. Looking ahead, regional differences may arise due to the devastation caused by Hurricane Helene throughout the southeast last week.

Industry News

- Equifax Canada reports a 54% increase in auto fraud year-over-year, as fake credit applications and identity theft roam largest among recorded instances. Key reasons for this upward trend are vehicle pricing of the last few years, labelling the auto sector as a specific target with over 60% of fraud coming from consumers committing “first-party” fraud by misrepresenting their finances.

- Stellantis chairman John Elkann has started looking for a new CEO, as Carlos Tavares’ contract is up in 2026. Though still almost 18 months away, this is apparently common. But the findings do appear distinctly more sensitive due to related concerns over the company’s recent financial performance.

- Porsche has announced Trevor Arthur as its new Canadian CEO, succeeding John Cappella who had transitioned to lead U.S. operations on July 2nd. Arthur had initially joined the brand back in 2008 as a Regional Manager in Canada, now returning home since leaving in 2016. He is also a graduate of Georgian College’s Automotive program in Barrie, ON.

- National Security risks have been identified through Chinese-made software and hardware that is intended to provide connected vehicle technologies to models sold in North America. These risks have led to an industry request on banning these products, effectively removing any opportunity for Chinese-made vehicles to be sold in the continent.