10.10.2023

Market Insights – 10/10/2023

Wholesale Prices, Week Ending October 7th

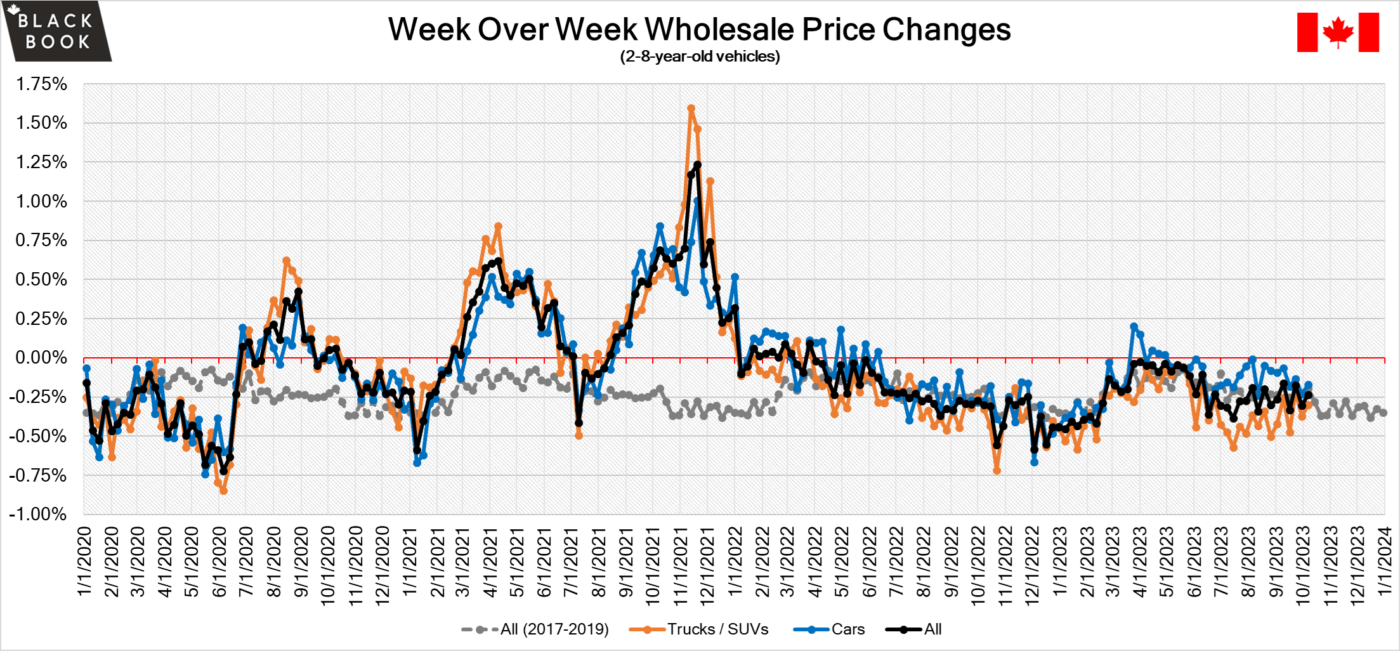

The Canadian used wholesale market saw a decline in prices for the week at -0.24%. The Car segment fell by -0.17% and the Truck/SUVs segment prices declined -0.30%. 2 out of 22 segments’ values have increased for the week. The Sporty Car and Premium Sporty Car segments increased 0.01%. The segments with the largest declines were Compact Van at –1.93% followed by Compact Car at –0.62%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.17% | -0.23% | -0.19% |

| Truck & SUV segments | -0.30% | -0.37% | -0.20% |

| Market | -0.24% | -0.30% | -0.19% |

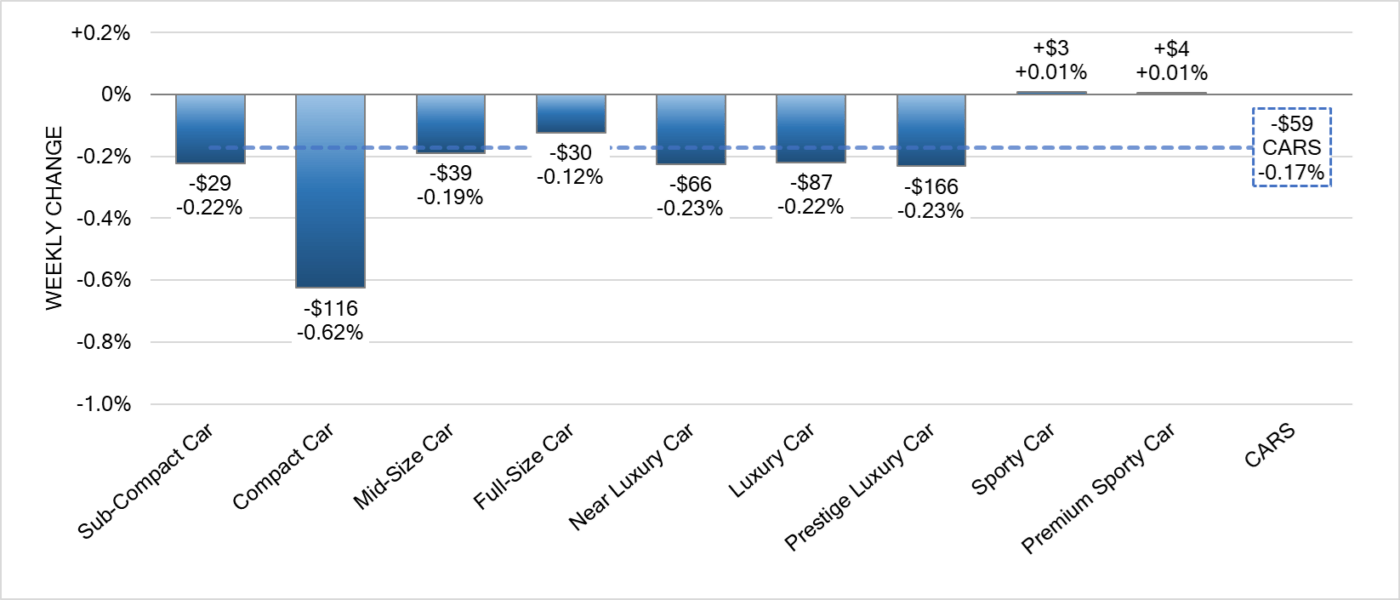

Car Segments

- There was an overall decrease of -0.17% within the Car Segments last week.

- Seven of nine segments showed a decrease in pricing.

- The most significant decline was seen in Compact Car at (-0.62%), followed by both Near Luxury Car & Prestige Luxury Car at (-0.23%)

- The two segments to show an increase were both Premium Sporty Car & Sporty Car at (+0.01%).

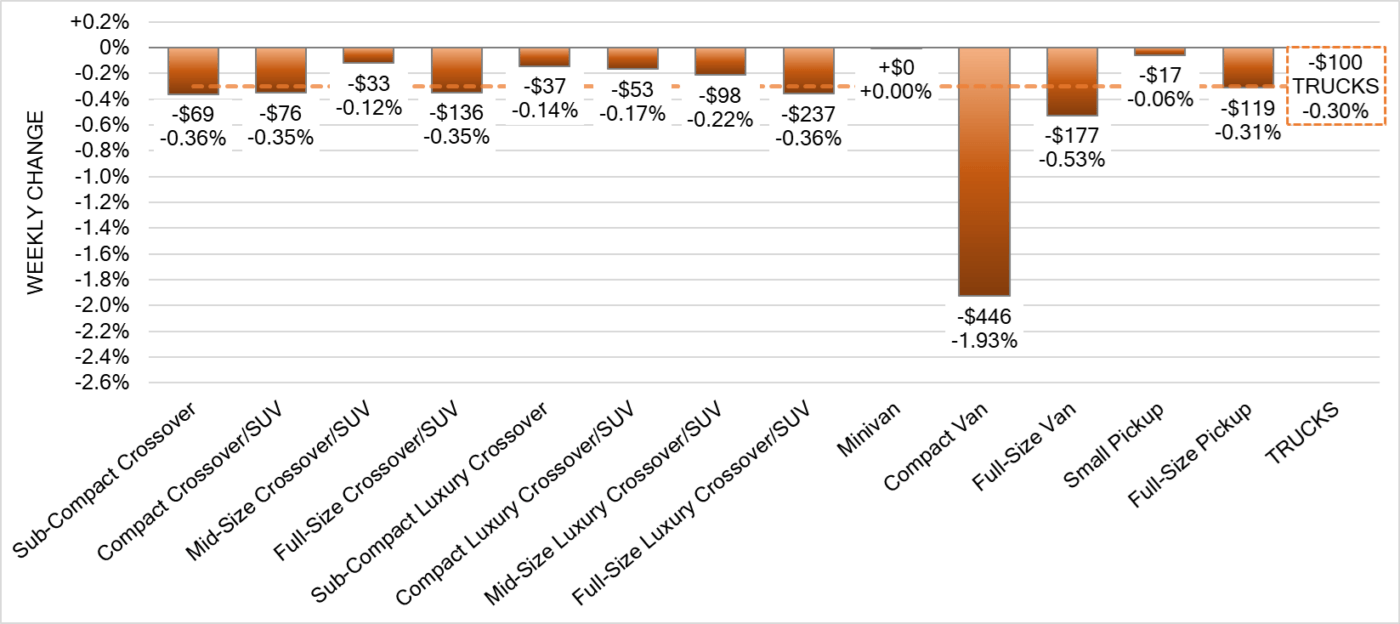

Truck Segments

- Truck segments showed an overall decrease of -0.30% last week.

- Twelve of the thirteen truck segments showed a decline. Compact Van had the largest drop (-1.93%), followed by Full-Size Van (-0.53%).

- Other segments with a notable depreciation were Full-Size Luxury Crossover/SUV & Sub-Compact Crossover both sitting at (-0.36%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,300. Analysis is based on approximately 195,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was slightly larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 18% and as high as 69% but most were in the 20-45% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Canadian economy created 63.8K jobs in September of 2023, the highest in eight months and well above market expectations of a 20K increase.

- Canada posted a trade surplus of 720 million in August of 2023, the first trade surplus since April, from a downwardly revised deficit of 440 million in July and compared to market estimates of a 1.5 billion gap.

- The S&P Global Canada Manufacturing PMI fell to 47.5 in September of 2023 from 48 in the previous month, pointing to the fifth consecutive contraction in Canadian factory activity, and at the sharpest pace since the pandemic-driven crash in the second quarter of 2020.

- The Canadian dollar is around $0.733 this Monday morning up from $0.731 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.32% last week; the prior week decreased by -0.08%.

Volume-weighted Car segments decreased -0.34%, compared to the prior week’s -0.15% decrease:

- The 0-to-2-year-old Car segments were down -0.32% and 8-to-16-year-old Cars declined -0.23%.

- Seven of the nine Car segments decreased last week.

- Compact Car increased for a second consecutive week, up +0.19%, compared with the prior week’s increase of +0.02%. Premium Sporty Car also increased, but only by +0.003%.

- Sub-Compact (-0.87%) and Mid-Size Cars (-0.81%) had the largest declines last week. Sub-Compact Car had a small increase the week prior of +0.04%, but that was the first increase since late April. As for Mid-Size Car, the segment has been on the decline for nineteen weeks with an average weekly depreciation of -0.79%.

Volume-weighted Truck segments decreased by -0.31%; the previous week decreased -0.05%:

- The 0-to-2-year-old models declined -0.28% on average last week, while the 8-to-16-year-olds declined -0.23%.

- Three of the thirteen Truck segments increased last week.

- Small Pickup (+0.33%), Full-Size Luxury (+0.17%) and Full-Size Crossover/SUV (+0.07%) were the segments to show increases. The Full-Size Crossover/SUV segment has increased two of the past three weeks for an average weekly change of +0.10%.

- Minivan had the largest decline last week, dropping -1.58%. The segment has now been on the decline for seventeen consecutive weeks with an average weekly change of -0.81%.

Industry News

- The risk of connected vehicles being hijacked virtually has been an increasing concern over the last decade, but a study conducted by global automotive cybersecurity company, Upstream, shows remote attacks which rely on connected services have consistently been the majority for private transportation, accounting for 85% between 2010-2021 – which has grown to 97% in 2022.

- In the 3rd quarter of 2023, two big automotive manufacturers posted double-digit sales gains in the electrified segment. Toyota Canada posted record sales for ZEVs in September, seeing 47% of all sales for Toyota and Lexus brands electrified – totalling 5,644 ZEV in Q3 2023. General Motors Canada also saw strength in its electrified portfolio, as 4,086 fully electric Bolt and Bolt EUVs were sold in Q3 “due to strong customer demand”.

- Honda is amplifying its focus on Civic production, as last year it lost its status as #1 passenger car in Canada to Corolla, after almost 25 years of bragging rights. Honda cites the inability to build those vehicles as the cause, and with issues still resuming over production, the model will continue to be challenged. With increased pricing and high interest rates, consumers look to more affordable options, in most cases that’s Cars over SUVs/Trucks.

- Kia and Hyundai announce their decision to adopt the North American Charging Standard (NACS) as many automakers align to provide more unity to the industry on EV charging. In Canada, Kia EV’s will be equipped by the end of 2024 with Hyundai EV’s to follow in the first half of 2025.