10.14.2025

Market Insights – 10/14/25

Wholesale Prices, Week Ending October 11th, 2025

The Canadian used wholesale market saw a decline of -0.30% in pricing for the week. Car segments prices decreased by –0.21% while the Truck/SUV segments decreased by -0.37%. This Weeks positive segment was Full Size Luxury Crossover/SUV at +0.42%. The largest declines in the Car segments were seen in Prestige Luxury Car at -0.30% and Premium Sporty Car with -0.25%. The largest declines in the Truck/SUV segments were Compact Van with -1.64% followed by Full Size Crossover/SUV at -0.70%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.18% | -0.19% |

| Truck & SUV segments | -0.37% | -0.12% | -0.20% |

| Market | -0.30% | -0.15% | -0.19% |

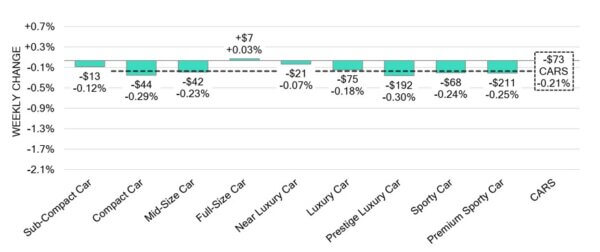

Car Segments

- There was an overall depreciation of -0.21% noted in car segments last week. Eight of the nine categories reflected this movement.

- The largest downturn was observed in Prestige Luxury Car (-0.30%), Compact Car (-0.29%), and Premium Sporty Car (-0.25%).

- One segment represented a small increase. That segment was Full-Size Car (+0.03%).

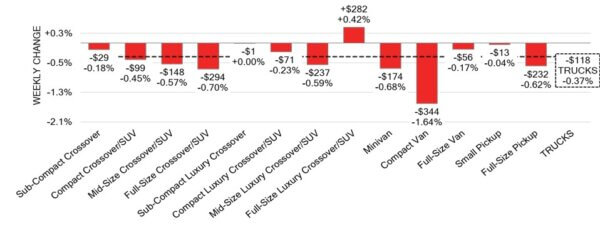

Truck / SUV Segments

- Last week, truck segments experienced an overall depreciation of -0.37%. Twelve of the thirteen segments showed this.

- Groups with the largest declines were Compact Van (-1.64%) followed by Full-Size Crossover/SUV (-0.70%) and Full-Size Pickup (-0.62%).

- One segment had an increase. That was Full-Size Luxury Crossover/SUV (+0.42%).

Wholesale

The Canadian market maintained its downward trend, showing a slightly sharper pace of decline than in its prior week. Truck segment values recorded a 0.25% change resulting in a total decline of –0.37%. Car segments values recorded a smaller change of 0.03%, leading to a total decline of –0.21%. Just under 41% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 9.2% to 78.8%, averaging at 29.5%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Nonetheless, supply levels have increased; however, upstream channels still have priority sale access to inventory. Demand for inventory and high-quality vehicles at auctions on both sides of the border persists.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,590. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s trade deficit widened to $6.3 billion in August 2025, up from a

downwardly revised $3.8 billion in July and well above market expectations of

$5.6 billion, marking the second-largest trade shortfall on record. - Canada’s employment increased by 60,400 (+0.3%) in September 2025,

rebounding from a loss of 65,500 jobs in the previous month and significantly

surpassing market expectations of a 5,000 gain. - Building permits in Canada declined by 1.2% to $11.6 billion in August 2025,

driven by a drop in residential construction intentions. - The yield on the Canadian 10-year government bond decreased to 3.12%.

- The Canadian dollar is around $0.713 this Monday morning, down slightly from

$0.717 a week prior.

U.S. Market

- Historically, the fourth quarter represents the period of greatest market depreciation, and current trends suggest a return to this seasonal norm. Depreciation levels last week were consistent with the prior week and aligned with pre-pandemic patterns for this time of year. Additionally, sales rates showed modest improvement; however, purchasing activity remains measured, with buyers exhibiting continued selectivity.

Industry News

- Chevrolet is bringing its affordable Bolt EV electric car back to the market after a short hiatus. The model improves range slightly, to 410km of range while retaining an inexpensive price point for consumers to shop in the EV space. With pricing confirmed under $30,000 in the U.S., availability should come early in 2026.

- China’s tariffs on Canadian agriculture have been said to be removed should Canada remove tariffs on Chinese electric vehicles. Canada currently has a 100% tariff on Chinese EVs as it follows the U.S. lead.

- The Jeep brand is aligning its Grand Wagoneer model as the sole Wagoneer nameplate, as it will be discontinuing the lower-priced Wagoneer model from its lineup after 2025MY.

- Tesla is bringing more affordable trims as options to its Model 3 and Model Y lineups, called the Standard trim. The cost-cutting measures that allowed for this unconfirmed price point were focused on battery capacity and electric motor power, along with wheel size, cheaper materials, and even a cover over the panoramic glass roof (with glass still in place!)

- An aluminum plant fire at a supplier facility has idled production of certain vehicles, one included is the Ford F-150 Lightning, and could result in as much as a $1 billion impact to the brand.

- The all-new VW Tiguan undergoes its next addition to the lineup, as a hotly anticipated higher output motor arrives with a larger turbo, upgrading power from 201hp and 207lb.ft of torque to 268 & 258, respectively

- Ferrari is entering the EV space, as it has released figures for its power unit of 1,000hp for its electric model that is anticipated to either be a shooting brake, wagon, or most likely, a small family crossover.