10.16.2024

Market Insights – 10/15/24

Wholesale Prices, Week Ending October 12th, 2024

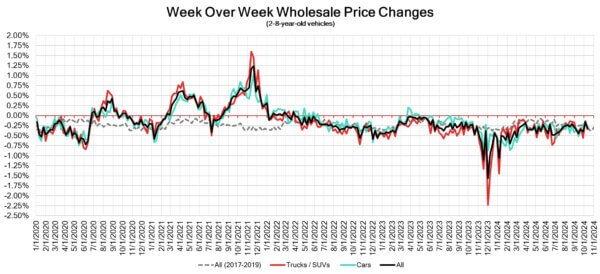

The Canadian used wholesale market experienced a decline of –0.31% in pricing for the week. Car segments prices decreased by –0.28% while the Truck/SUVs segments dropped -0.34%. Full-Size Pickup and Compact Van both had an increase of +0.16% followed by Sub-Compact Car at +0,07%. The largest declines in the car segments were seen in Mid-Size Car with –0.44% followed by Luxury Car at –0.42%. The largest declines in the Truck/SUV segments were Full-Size Luxury Crossover/SUV at -0.77% followed by Compact Luxury Crossover/SUV -0.65%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.28% | -0.17% | -0.28% |

| Truck & SUV segments | -0.34% | -0.14% | -0.28% |

| Market | -0.31% | -0.15% | -0.28% |

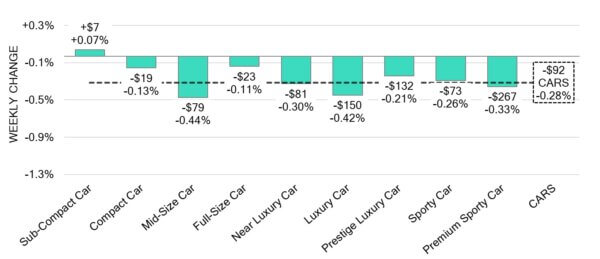

Car Segments

- Last week there was an overall decrease of -0.28% across all Car segments. This decrease was noted across eight out of nine segments.

- The Sub-Compact Car segment saw an increase (+0.07%), while the Full-Size Car (-0.11%) and Compact Car (-0.13%) segments showed the smallest declines.

- The largest decreases were seen from Mid-Size Car (-0.44%), Luxury Car at (-0.42%) and Premium Sporty Car at (-0.33%).

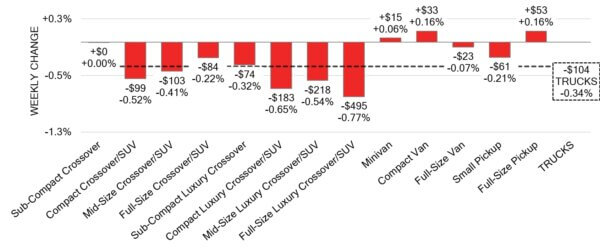

Truck / SUV Segments

- Truck segments reflected an overall depreciation of–0.34% last week. Nine of the thirteen truck segments showed a decline.

- Full-Size Luxury Crossover/SUV (-0.77%), Compact Luxury Crossover/SUV (-0.65%) and Mid-Size Luxury Crossover/SUV (-0.54%) had the largest depreciations.

- Three segments reflected an increase. Those were Compact Van and Full-Size Pickup, both at (+0.16%) and Minivan (+0.06%).

Wholesale

The Canadian markets continue a downward trend, with a decline more pronounced than its previous week. Just over 27% of market segments experienced an

average value change of more than ±$100, indicating a higher rate than the previous week. Among these, the decline in truck segments was 20% greater than last

week. Monitored auction sale rates ranged from17 to 60% averaging at 36.4% The fluctuations in sale rates across various lanes can be attributed several factors

including the ongoing decline in floor prices. An increase in supply entering the wholesale market has been noted, despite upstream channels continuing to gain early

access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

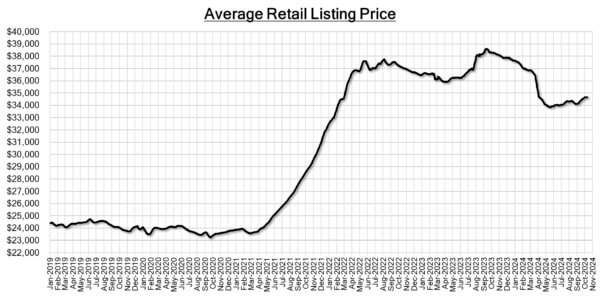

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,650. This analysis is

based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The unemployment rate in Canada eased to 6.5% in September of 2024 from the

34-month high of 6.6% recorded in the previous month, defying market

expectations of an increase to 6.7%. - Canada posted a trade deficit of $1.10 billion in August 2024, widening from a

revised $0.29 billion gap in the previous month and exceeding market

expectations of a $0.5 billion deficit. - The annual inflation rate in Canada fell to 1.6% in September of 2024 from 2% in

the previous month, the lowest since February of 2021, and well below the market

consensus of 1.9%. - The yield on the Canadian 10-year government bond slightly decreased to 3.21%.

- The Canadian dollar is around $0.725 this Monday morning, representing a slight

decrease from $0.735 a week prior.

U.S. Market

- Last week, auction activity slowed down in several locations across the Southeast, as the region focused on recovery efforts from Hurricane Helene, while Florida prepared for Hurricane Milton’s impact. Effects on the automotive industry remain unclear; however, the estimated number of affected vehicles continues to climb.

Industry News

- General Motors projects that in 2025, its lineup of electric vehicles will take on lower losses, listing scalability and federal emission credits as key contributors, while many of its gasoline vehicles have undergone refreshes, streamlining their assembly and making them simpler to build, benefiting the bottom line on each model.

- Prestone Products Corp. has developed a new electric vehicle coolant that are aimed at reducing fires from thermal runaway events and preventing corrosion of high-voltage parts improving efficiency within plug-in hybrid, fully electric, and hydrogen fuel cell vehicles.

- Empowering Auto, an industry conference focused on the representation and opportunities for women in auto took place this week in Toronto, attracting over 500 attendees.

- Stellantis CEO, Carlos Tavares, announces his retirement in 2026 along with his proposal to the Board of Directors to make significant changes to its leadership team with multiple transitions of C-suite executives.

- Nissan announced it will join EV charging alliance, Chargescape, as an equal partner of the creation from Ford Motor Company, American Honda, and BMW, with a 25% investment.

- Honda has released its future electric vehicle plans with the Honda 0 series of vehicles in an all-day briefing in Japan. The Japanese carmaker will release at least one 0 series model per year from 2026-2030 with 5 of 7 future models being crossovers.