10.17.2023

Market Insights – 10/17/2023

Wholesale Prices, Week Ending October 14th

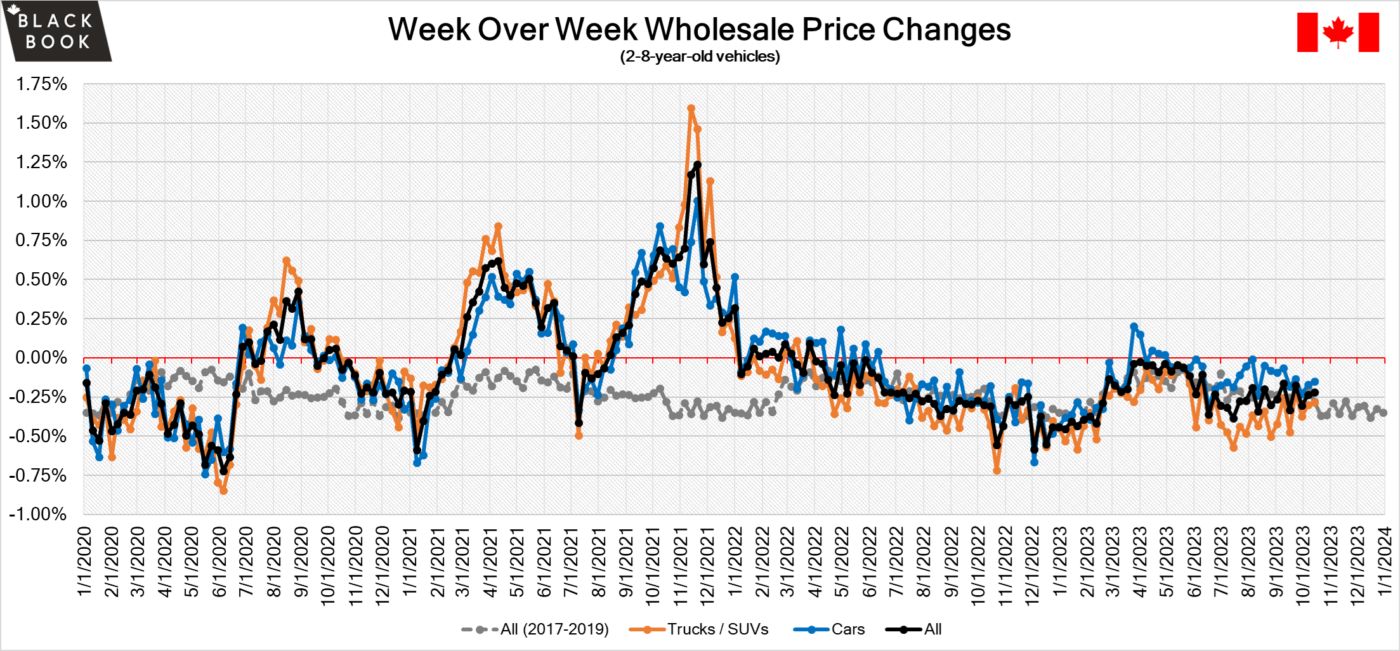

The Canadian used wholesale market saw a decline in prices for the week at -0.22%. The Car segment fell by -0.15% and the Truck/SUVs segment prices declined -0.28%. 3 out of 22 segments’ values have increased for the week. The Small Pickup segment increased 0.07% and the Premium Sporty Car segment increased 0.06%. The segments with the largest declines were Compact Van at –0.81% followed by Full-Size Car at –0.51%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.17% | -0.28% |

| Truck & SUV segments | -0.28% | -0.30% | -0.28% |

| Market | -0.22% | -0.24% | -0.28% |

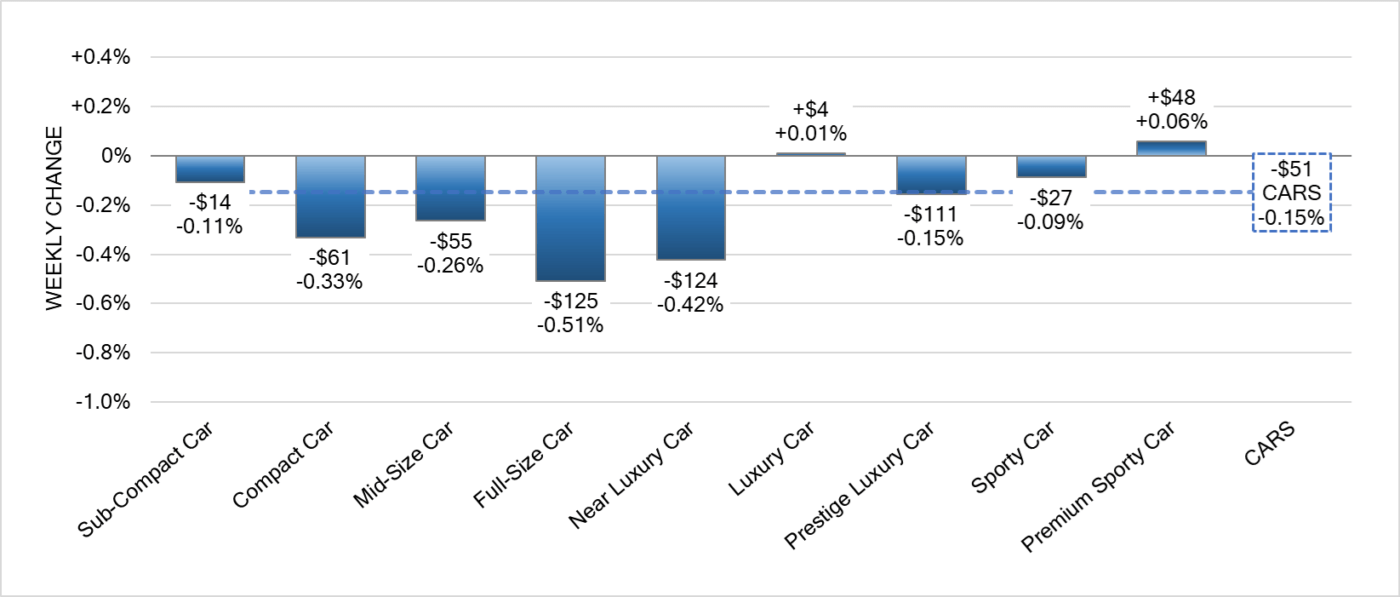

Car Segments

- There was an overall decrease of -0.15% within the Car Segments last week.

- Two of the nine segments showed an increase in pricing. Leading with Premium Sporty Car at (+0.06%) followed by Luxury Car (+0.01%).

- The most significant decline was seen in Full-Size Car at (-0.51%), followed by Near Luxury Car at (-0.42%) & Compact Car (-0.33%)

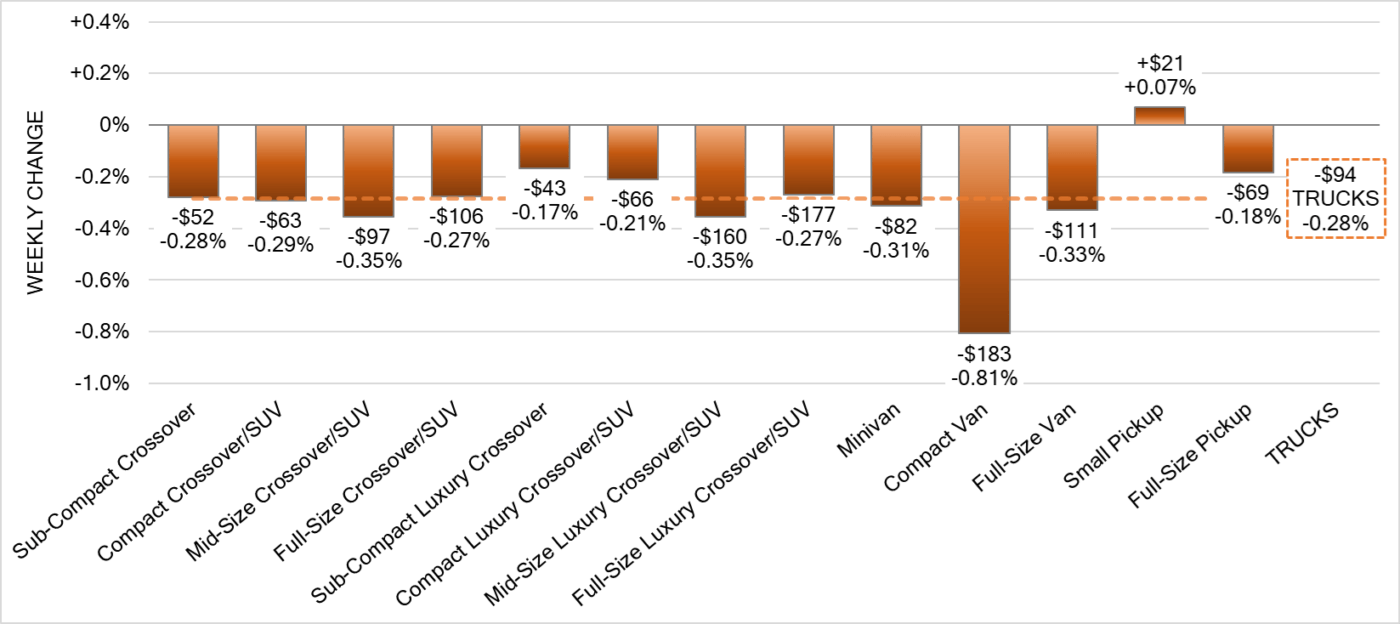

Truck Segments

- Truck segments showed an overall decrease of -0.28% last week.

- Twelve of the thirteen truck segments showed a decline. As in the previous week, Compact Van had the largest drop (-0.81%). Mid-Size Crossover/SUV and Mide-Size Luxury Crossover/SUV had the next largest depreciation (-0.35%).

- Small Pickup was the only segment with an increase (+0.07%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,300. Analysis is based on approximately 195,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was slightly less than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 7% and as high as 58% but most were in the 20-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canadian consumer confidence in October fell to its lowest level since 2020 according to an IPSOS poll.

- Manufacturing sales increased 0.7% month over month in August 2023, below the preliminary estimate of a 1% gain and less than a 1.6% rise in the previous month.

- The total value of building permits in Canada rose by 3.4% from a month earlier to $11.9 billion in August 2023, rebounding from an upwardly revised 3.8% drop in the prior month and surpassing market expectations of a 0.5% rise.

- The Canadian dollar is around $0.733 this Monday morning up from $0.733 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.36% last week; the prior week decreased by -0.32%.

Volume-weighted Car segments decreased -0.47%, compared to the prior week’s -0.34% decrease:

- The 0-to-2-year-old Car segments were down -0.28% and 8-to-16-year-old Cars declined -0.33%.

- All nine Car segments decreased last week.

- Mid-Size Car had the largest decline last week, down -0.65%. This marked the twentieth consecutive week of declines for the segment with an average weekly decrease of -0.79%.

- Compact Car decreased last week (-0.53%) after two weeks of increases.

- The 0-to-2-year-old Premium Sporty Car segment increased for a fourth consecutive week, up +0.70%.

Volume-weighted Truck segments decreased by -0.32%; the previous week decreased -0.28%:

- The 0-to-2-year-old models declined -0.21% on average last week, while the 8-to-16-year-olds declined -0.38%.

- Only one (Sub-Compact Crossover) of the thirteen Truck segments increased last week and it was a minimal increase of +0.004%.

- After two weeks of increases, the Small Pickup segment decreased -0.05%. However, the 0-to-2-year-olds increased by +0.02% during the same time.

- The Compact Van segment had the largest decline last week, down -1.38%. The segment has been declining for twenty-seven weeks, with an average weekly drop of -0.65%.

Industry News

- Canadian auto thefts have been on the rise, and with advancements in automotive tech have come gateways for easier access for criminals – namely keyless entry and push-button start. With the increases in vehicle pricing the market has become even more lucrative.

- Magna International has introduced a new seating material that is 100% recyclable in either overall material content or at end of life. The new seat is anticipated to hit the market by 2026.

- Toyota Motor Corporation is approaching further breakthroughs in solid-state batteries through a new partnership that will develop mass production methods with Japanese petrochemical giant Idemitsu Kosan that should begin by 2027-2028.

- BMW brings the X2 crossover into its second-generation with a larger and higher performing model that increases power for both 4- and 6-cylinder engines as well as increases overall length by 7.6 inches.

- The latest UAW strike at Ford’s Kentucky Truck plant could potentially affect output of an Ontario-based factory out of Windsor, which supplies the 7.3 and 6.8-litre engines used in select heavy-duty pickups.