10.21.2025

Market Insights – 10/21/25

Wholesale Prices, Week Ending October 18th, 2025

The Canadian used wholesale market saw a decline of -0.25% in pricing for the week. Car segments prices decreased by –0.23% while the Truck/SUV segments decreased by -0.26%. This Weeks positive segment was Small Pickup at +0.12%. The largest declines in the Car segments were seen in Sporty Car at -0.41% and Sub-Compact Car with -0.37%. The largest declines in the Truck/SUV segments were Full-Size Pickup with -0.65% followed by Sub-Compact Crossover/SUV at -0.45%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.21% | -0.28% |

| Truck & SUV segments | -0.26% | -0.37% | -0.28% |

| Market | -0.25% | -0.30% | -0.28% |

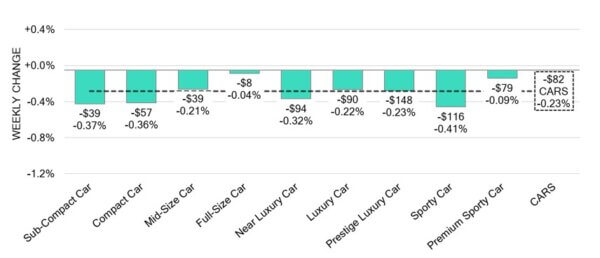

Car Segments

- There was an overall reduction in values of -0.23% noted in cars last week. All nine segments followed this direction.

- Those with the largest drops was noted in Sporty Car (-0.41%), Sub-Compact Car (-0.37%), and Compact Car (-0.36%).

- The least notable declines were in Full-Size Car (-0.04%) and Premium Sporty Car (-0.09%).

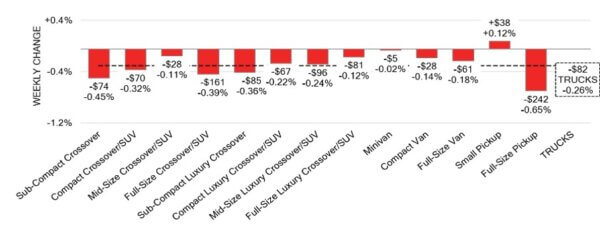

Truck / SUV Segments

- Last week, truck segments experienced an overall depreciation of -0.26%. Twelve of the thirteen categories followed this movement.

- Those with the largest downturn were Full-Size Pickup (-0.65%) followed by Sub-Compact Crossover (-0.45%) and Full-Size Crossover/SUV (-0.39%).

- One segment reflected an increase. That was Small Pickup (+0.12%).

Wholesale

The Canadian market maintained its downward trend, showing a slightly smaller decline than in its previous week Truck segment values recorded an 0.11% change resulting in a total decline of –0.26%. Car segments values recorded a slight change of 0.02%, leading to a total decline of –0.23%. Just over 18% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 7.2% to 64.4%, averaging at 22.1%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Nonetheless, supply levels have increased; however, upstream channels still have priority sale access to inventory. Demand for inventory and high-quality vehicles at auctions on both sides of the border persists.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,420. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s Raw Materials Price Index (RMPI) increased by 1.7% month-over month

in September 2025, recovering from a 0.8% decline in August. - Canada’s employment increased by 60,400 (+0.3%) in September 2025,

rebounding from a loss of 65,500 jobs in the previous month and significantly

surpassing market expectations of a 5,000 gain. - Canada’s manufacturing sales declined by 1.0% to $69.4 billion in August 2025,

following a 2.5% increase in July, but fared slightly better than market

expectations of a 1.5% drop. - Canada’s industrial producer prices rose by 0.8% month-over-month in

September, marking the fourth straight monthly increase, following a downwardly

revised 0.2% gain in August. - The yield on the Canadian 10-year government bond decreased to 3.01%.

- The Canadian dollar is around $0.712 this Monday morning, down slightly from

$0.713 a week prior.

U.S. Market

- Wholesale prices declined -0.59% last week, reflecting a steeper pace of seasonal depreciation as fall market softness deepened. Conversion rates held unevenly across the lanes, with strong results for clean, late-model units offset by selective bidding and lower returns on aging and higher-mileage inventory. Demand for traditional gas vehicles remained steady, while EV pricing and 2025-model values continued to face downward pressure amid heightened buyer caution.

Industry News

- Nissan Canada has swiftly named its new President, as Trevor Longley resigned from the position over a week ago. Steve Rhind will take the helm, who had previously replaced Longley when he moved into the head position last August. Rhind will report into Christian Meunier, Chairman of Nissan Americas.

- Stellantis has changed its plans for its Brampton, ON assembly plant. As the automaker looks to line its support of U.S. assembly over tariff impacts, its promise to Canadian auto workers becomes fuzzy, sparking Canada’s Industry Minister to write Stellantis CEO, Anthony Filosa, and urge legal action from Ottawa as a repercussion of the decision.

- VW Canada President, Edgar Estrada has said the brand is entertaining the idea of offering a more diverse lineup by including its other group brands to enter the Canadian market if the Federal Government allows for safety standards to include vehicles designed for Europe and Asia.

- Canada’s ZEV share of sales continues to tick up since the first quarter of sales in 2025. At 8.8% in August, ZEV share hit its highest level since ending the Federal iZEV rebate in January.

- Cadillac has announced it will be discontinuing itsCT4 entry-level luxury sedan this year, while it has another generation planned for its larger CT5 sedan. Backed by sales, the CT5 sedan continues to improve while the smaller CT4 continues its sales decline.

- An analysis by Anderson Economic Group has calculated that automakers will be paying$10.6 billion in tariffs on vehicles and parts from Canada and Mexico imported into the U.S. after only the first 10 months of the year. Impacts to the consumer have been minimal so far, as these companies have chosen to absorb the costs rather than pass them along, but this trend is likely to decrease as costs mount.