10.24.2023

Market Insights – 10/24/2023

Wholesale Prices, Week Ending October 21st

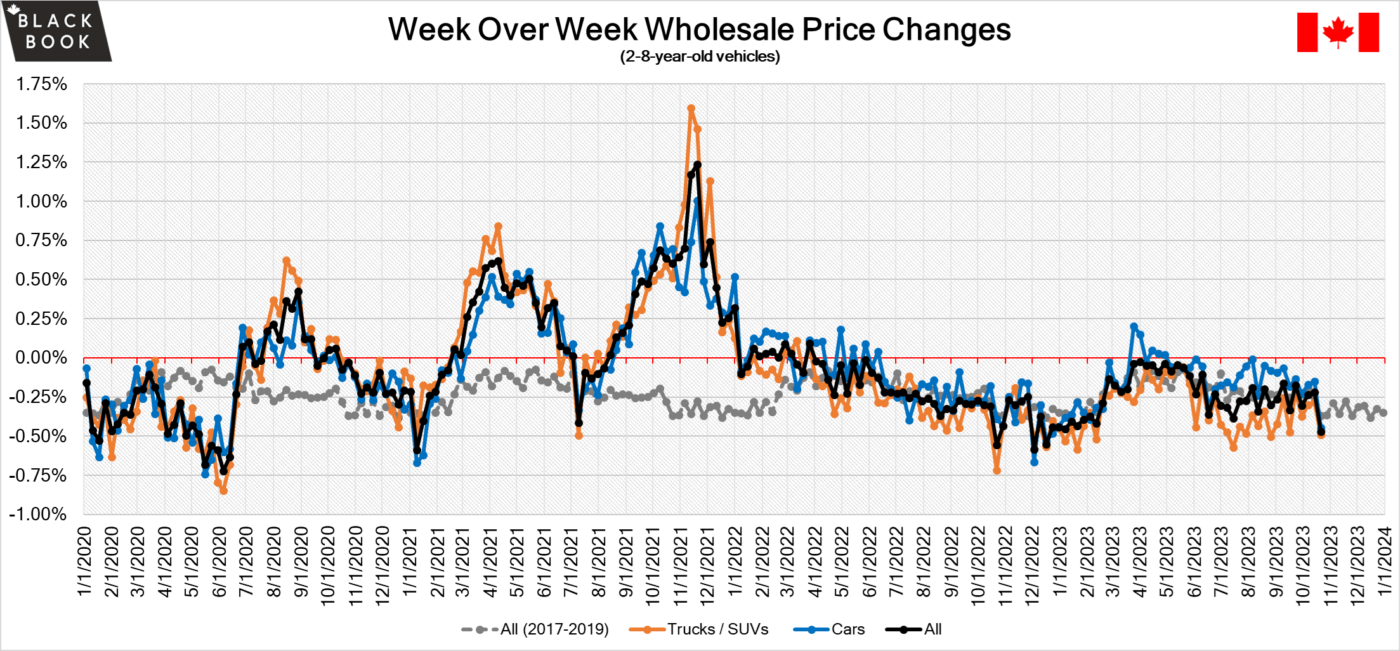

The Canadian used wholesale market saw a decline in prices for the week at -0.47%. The Car segment fell by -0.45% and the Truck/SUVs segment prices declined -0.49%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Compact Van at –1.21% followed by Full-Size Pickup at –0.90%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.45% | -0.15% | -0.44% |

| Truck & SUV segments | -0.49% | -0.28% | -0.30% |

| Market | -0.47% | -0.22% | -0.37% |

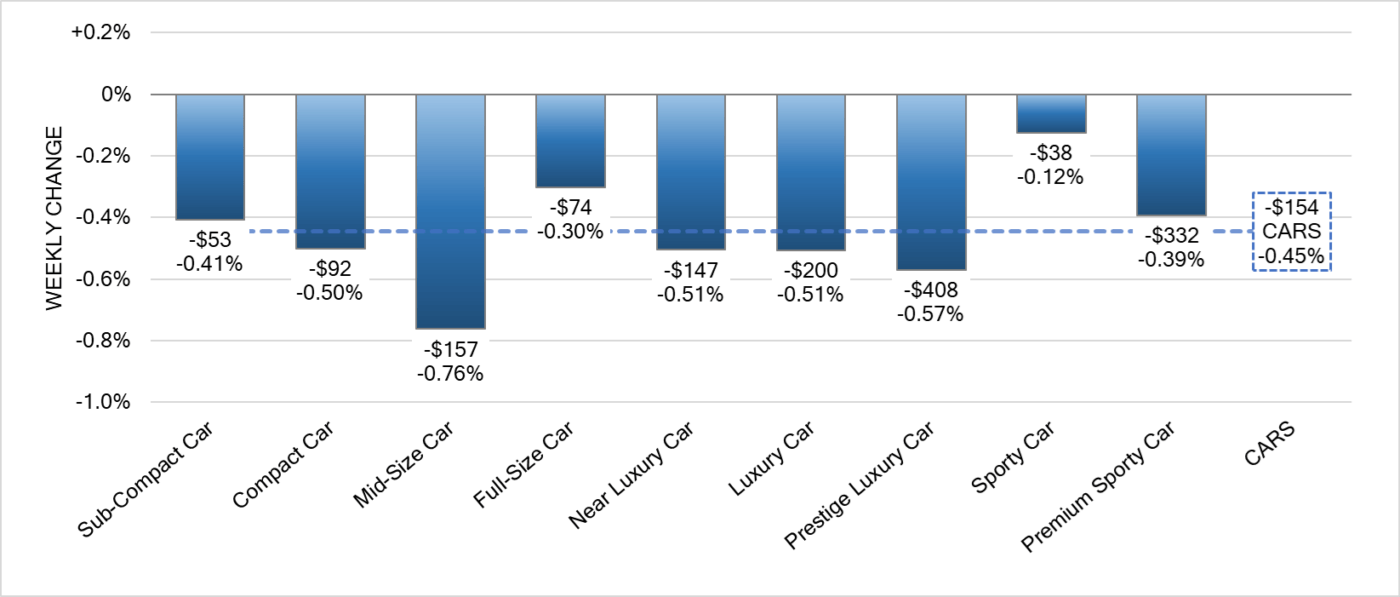

Car Segments

- Car Segments showed an overall decrease of -0.45% last week. All nine segments showed a notable drop in pricing.

- The most significant decline was seen in Mid-Size Car at (-0.76%), followed by Prestige Luxury Car at (-0.57%).

- Both Luxury Car and Near Luxury car sit at (-0.51%).

- The segment with the least decline was Sporty Car sitting at (-0.12%)

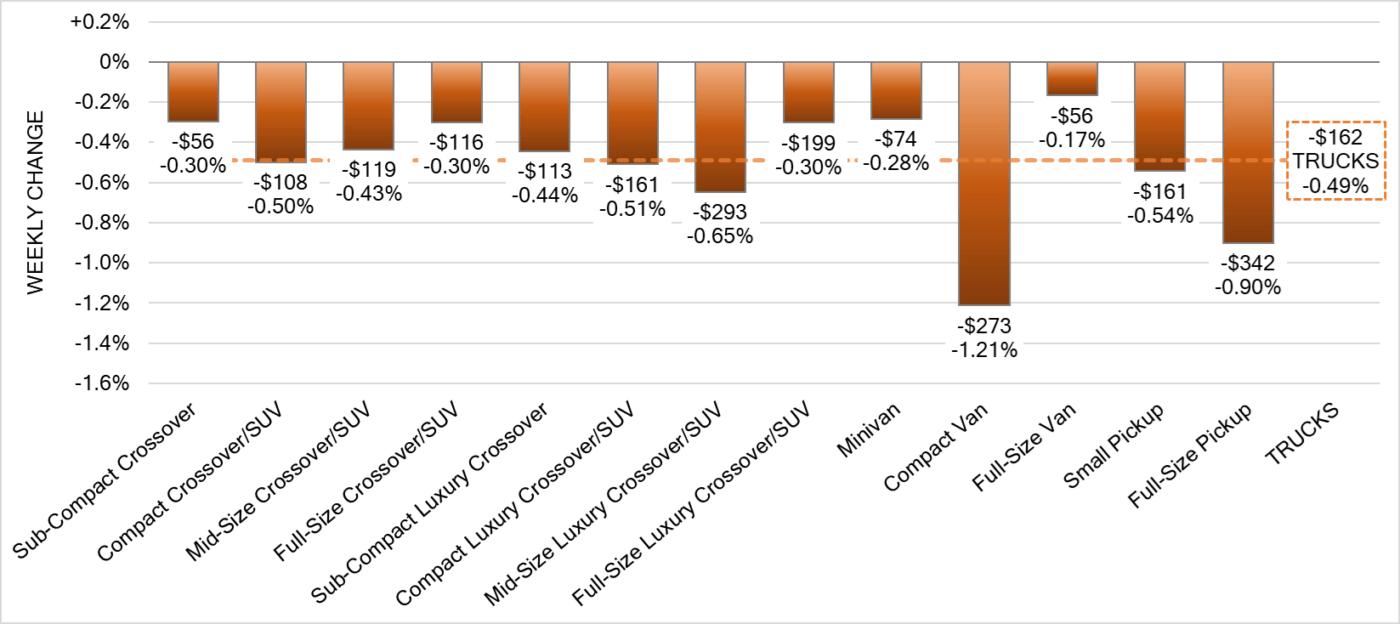

Truck Segments

- Last week truck segments reflected an overall decrease of -0.49%.

- All thirteen truck segments declined. Compact Van had the largest drop (-1.21%). Full-Size Pickup had the next largest depreciation (-0.90%), followed by Mid-Size Luxury Crossover/SUV (-0.65%).

- Other segments with a notable drop were Small Pickup (-0.54%) and Compact Luxury Crossover/SUV (-0.51%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,200. Analysis is based on approximately 200,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was more than double the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 3.8% and as high as 69% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

• The annual inflation rate in Canada declined to 3.8% in September of 2023 from 4% in the previous month, below market expectations of 4%.

• Retail sales in Canada are expected to have stagnated in September of 2023, according to preliminary estimates. Considering August, retail sales fell by 0.1% from the previous month, revised from earlier estimates of a 0.3% decline and trimming the upwardly revised 0.4% increase from July.

• Foreign investors reduced their exposure to Canadian securities by a net 8.47 billion in August 2023 compared to an upwardly revised net acquisition of 13.93 billion in July and at odds with the market expectations of 11.78 billion acquisition.

• The Canadian dollar is around $0.728 this Monday morning down from $0.733 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.28% last week; the prior week decreased by -0.36%.

Volume-weighted Car segments decreased -0.46%, compared to the prior week’s -0.47% decrease:

- The 0-to-2-year-old Car segments were down -0.45% and 8-to-16-year-old Cars declined -0.40%.

- All nine Car segments decreased last week.

- The Sub-Compact Car segment had the largest decline at -1.04%, compared with the prior week’s decline of -0.61%.

- Premium Sporty Car continues to report small declines, last week dropping -0.21% compared with the prior week’s decline of -0.20%.

- After two weeks of increases, the Compact Car segment is back on the decline for two weeks now. However, the rate of decline last week was smaller than the week prior, -0.25% vs -0.53%.

Volume-weighted Truck segments decreased by -0.20%; the previous week decreased -0.32%:

- The 0-to-2-year-old models declined -0.26% on average last week, while the 8-to-16-year-oldsactually increased by +0.14%.

- Only one of the thirteen Truck segments, Mid-Size Crossover, increased last week, up +0.09%. This is the third time in the past five weeks the segment has reported an increase.

- The Full-Size Crossover/SUV segment reported its largest depreciation last week, since the start of the UAW strike, down -0.38%, compared with the week prior’s decline of -0.10%. For five weeks before the start of the strike, the segment was reporting declines exceeding 1% each week.

Industry News

- 2023 has been cited as recovery in vehicle production, and with North American production at near “record pace” according to AutoForecast Solutions, there’s little doubt in that statement. But this will shake-up the selling structure in dealer showrooms, and demand has already peaked in some areas, with dealers already “remembering the glory years” they will have to get back to emphasizing their skillset in selling to a customer rather than allocating a sold order.

- Among the many OEM’s already set to utilize Tesla’s EV charging standard, “NACS”, Toyota will now be added to that list with plans to adopt this charge connector in 2025.

- With the interest in making a standard EV charging connection in North America, not only are car makers changing their compatibility, but EV charging companies like Chargepoint are making the change as well – with select Chargepoint stations turning over to the NACS connector this month the company looks to support Tesla vehicles charging at locations other than Tesla Superchargers.

- After years since its last Civic Hybrid was sold in showrooms, Honda will once again bring the most efficient Civic back for 2025MY, and starting in the Spring of 2024 will be producing the compact sedan in its Alliston, ON facility.