10.29.2025

Market Insights – 10/28/25

Wholesale Prices, Week Ending October 25th, 2025

The Canadian used wholesale market saw a decline of -0.26% in pricing for the week. Car segments prices decreased by –0.21% while the Truck/SUV segments decreased by -0.30%. There was no positive segment this week. The largest declines in the Car segments were seen in Full-Size Car at -0.91% and Sub-Compact Car with -0.28%. The largest declines in the Truck/SUV segments were Full-Size Crossover/SUV with -0.69% followed by Mid-Size Crossover/SUV at -0.50%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.23% | -0.44% |

| Truck & SUV segments | -0.30% | -0.26% | -0.30% |

| Market | -0.26% | -0.25% | -0.37% |

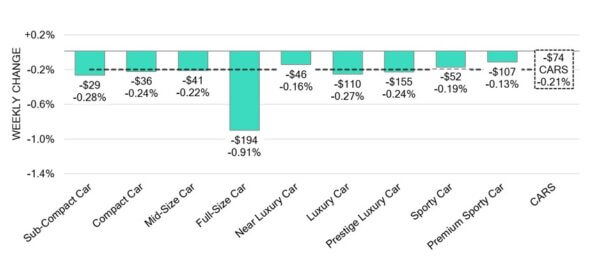

Car Segments

- Last week there was an overall depreciation of -0.21% recorded in car values. All nine segments followed this direction.

- Segments with the largest drops was seen in Full-Size Car (-0.91%), Sub-Compact Car (-0.28%), and Luxury Car (-0.27%).

- Those with the least notable declines were Premium Sporty Car (-0.13%) and Near Luxury Car (-0.16%).

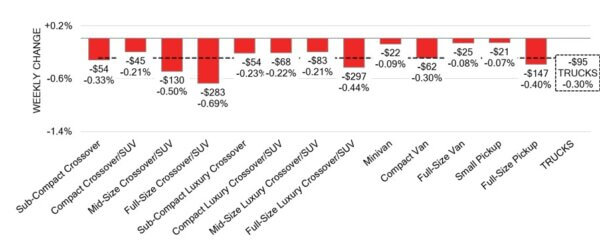

Truck / SUV Segments

- Last week truck segments witnessed an overall decline of -0.30%. All thirteen segments followed this movement.

- Those with the largest reductions were Full-Size Crossover/SUV (-0.69%) followed by Mid-Size Crossover/SUV (-0.50%) and Full-Size Crossover/SUV (-0.44%).

- Segments with the least notable softening were Small Pickup (-0.07%) and Full-Size Van (-0.08%).

Wholesale

The Canadian market’s downward trend continues, showing a decline in line with last week’s trend. Truck segment values shifted by 0.04%, extending the total decline to –0.30%. Car segments values recorded a slight change of 0.02%, dropping its total decline to –0.21%. Just over 36% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 10% to 72.8%, averaging at 29%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Supply has stabilized and returned to regular levels; however, upstream channels continue to hold priority sale access to inventory. Buyer demand for high-quality vehicles at auctions on both sides of the border persists.

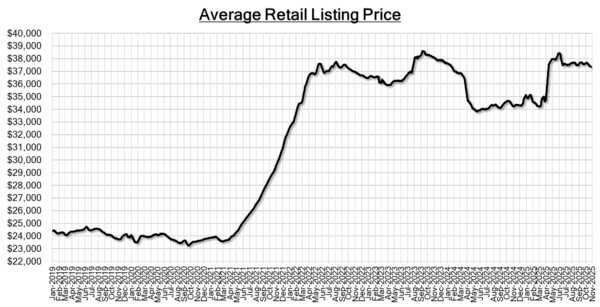

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,360. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- New housing prices in Canada declined by 0.2% month-over-month in September

2025, following a 0.3% decrease in August and falling short of market

expectations for a 0.2% increase. - Canada’s employment increased by 60,400 (+0.3%) in September 2025,

rebounding from a loss of 65,500 jobs in the previous month and significantly

surpassing market expectations of a 5,000 gain. - Retail sales in Canada are projected to have fallen by 0.7% month-over-month in

September 2025, based on a preliminary estimate. - The yield on the Canadian 10-year government bond decreased to 3.08%.

- The Canadian dollar is around $0.717 this Monday morning, up slightly from

$0.712 a week prior.

U.S. Market

- Depreciation accelerated last week, with several segments posting single week declines reminiscent of 2022 and 2023 levels. The overall market for 2-to-8-year-old vehicles fell -0.84%, marking the steepest weekly drop since December 2023. Newer used units (0–2 years old) also experienced a sharp decline of -0.85%, while older 8–16-year-old vehicles softened by -0.58%.

Industry News

- President Donald Trump has said he will end all trade negotiations with Canada over a television advertisement he viewed from the Government of Ontario. As he claims that it misstated facts about tariffs and portrayed them negatively, also threatening to increase current tariffs on Canadian goods another 10%.

- Stellantis and GM recently stated alternate plans for vehicle assembly originally slated for Canadian plants, moving them into the U.S. Now those automakers could be losing millions of dollars as Canada’s department of finance looks to ‘significantly reduce’ the limit they extended to those brands to import vehicles tariff-free into Canada.

- Trevor Longley, who recently resigned from his position leading Nissan Canada has been announced as the new President of Stellantis Canada, as previous President, Jeff Hines moves into a newly created Fleet Strategy role for the brand in the U.S.

- Kia Canada is planning to bring its PV5electric van to the market as a commercial fleet only model, aimed at being an urban business compact emissions-free work van. Other markets will be receiving a passenger version of the model, currently not slated for the North American market.

- Foreign Affairs Minister, Anita Anand has said that Canada now views China as a strategic partner, entering a partnership with the country as tariffs on their EVs is carefully being looked at.

- Nissan has begun importing the Infiniti QX60 into Canada again on a limited volume basis, while still impacted by tariffs. The brand continues to keep other models (Pathfinder, Murano, and Frontier) on pause as the premium brand takes on a different approach.

- A redesign of the Kia Telluride will be first seen at the LA Auto Show as a 2027MY, while the brand skips the 2026MY and anticipates a hybrid powertrain to be available.