10.29.2024

Market Insights – 10/29/24

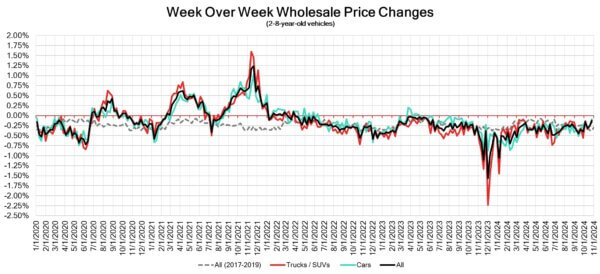

Wholesale Prices, Week Ending October 26th, 2024

The Canadian used wholesale market experienced a decline of –0.13% in pricing for the week. Car segments prices decreased by –0.09% while the Truck/SUVs segments dropped -0.16%. Full-Size Pickup saw an increase of +0.33% followed by Compact Van at +0.19%. The largest declines in the car segments were seen in Sporty Car and Mid-Size Car both with –0.35%. The largest declines in the Truck/SUV segments were Compact Crossover/SUV at -0.48% followed by Mid-Size Luxury Crossover/SUV and Sub Compact Crossover both with -0.47%.

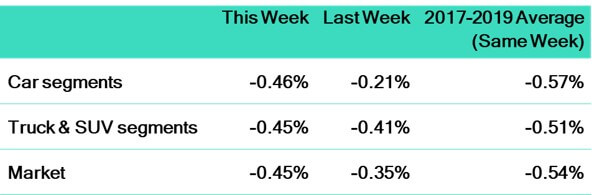

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.09% | -0.27% | -0.42% |

| Truck & SUV segments | -0.16% | -0.25% | -0.31% |

| Market | -0.13% | -0.26% | -0.37% |

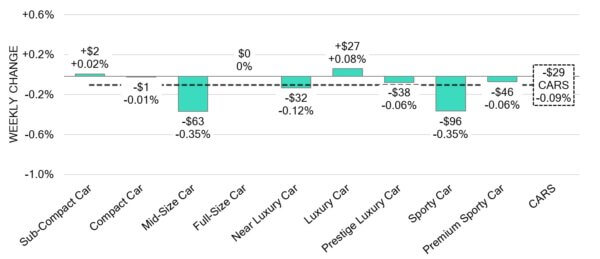

Car Segments

- There was little decline in car segments last week with a total drop of -0.09% seen across just six out of nine segments.

- The Sub-Compact Car (+0.02%) and Luxury Car (+0.08%) segments saw an increase while Full-Size car saw no change.

- The largest decreases were seen from Mid-Size Car (-0.35%), Sporty Car (-0.35%) and Near Luxury Car (-0.12%).

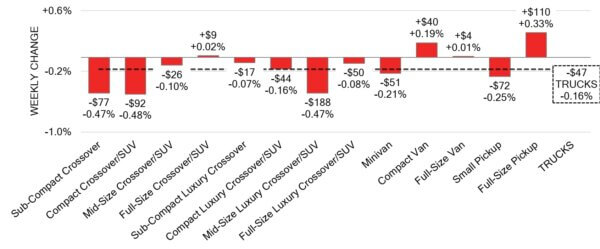

Truck / SUV Segments

- Truck segments reflected an overall depreciation of–0.16% last week. Nine of the thirteen truck segments showed a decline.

- Compact Crossover/SUV had the largest drop (-0.48%). Sub-Compact Crossover and Mid-Size Luxury Crossover/SUV had the next largest (-0.47%).

- Four segments had an increase. Those with the largest were Full-Size Pickup (+0.33%) and Compact Van (+0.19%).

Wholesale

The Canadian market continues a downward trend, with a decline noticeably less pronounced than in its previous week. Just over 9% of market segments

experienced an average value change of more than ±$100. Among these, the decline in car segments was 18% less than last week. Monitored auction sale rates

ranged from15 to 77% averaging at 32.2% The fluctuations in sale rates across various lanes can be attributed several factors including the ongoing gradual decline in

floor prices. An increase in supply entering the wholesale market has been noted once again, despite upstream channels continuing to gain early access. There

continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

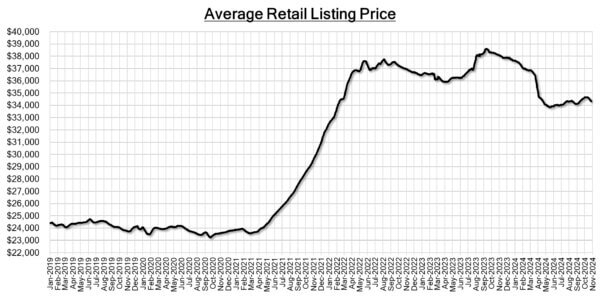

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,350. This analysis is

based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada has reduced its key interest rate by 50 basis points to 3.75%

in its decision for October 2024. This move was anticipated, and the bank

indicated it would keep lowering the rate if the economy evolves as projected. - Housing starts in Canada rose by 5% over a month to 223,808 units in September

2024, below market expectations of 237,500 units, according to the Canada

Mortgage and Housing Corporation. - Manufacturing sales in Canada likely decreased by 0.8% month-over-month in

September 2024, following a 1.3% fall in August. preliminary estimates showed. - The yield on the Canadian 10-year government bond slightly increase to 3.25%.

- The Canadian dollar is around $0.720 this Monday morning, representing a slight

decrease from $0.724 a week prior.

U.S. Market

- The market is showing typical levels of depreciation expected for this time of year. However, a closer look reveals intriguing anomalies. The shortage of budget-friendly newer used vehicles is boosting demand for the 0-to-2-year-old Compact Car and Small Pickup segments.

Industry News

- With an overall drop in auto theft recently, there has been an increase in a process called “re-vinning” whereas a criminal creates a new VIN and applies it to a stolen vehicle. Now, communications have been sent across to all Provinces to prioritize the issue and band together to crack down on this rising issue.

- As provincial rebates get rejigged in certain provinces, it is arguably most impactful to Quebec, which has seen significant growth in the short-term as the provincial rebate is set to reduce from $7,000 to $4,000 by the start of next year, then to $2,000 by 2026 before being eliminated in 2027.

- Sales of smaller compact and sub-compact crossovers is growing in recently quarterly sales figures with sub-compacts up 27.8% while compacts were up 21.8% as these market segments highlight, appropriate vehicle sizing for most families as well as great value and electrified options – though many of these models are still hard to get.

- The Toyota Sienna has been bucking the “minivan” trend and will see a 20% boost in production next year as the Hybrid and AWD Sienna is attracting many buyers looking for an efficient yet spacious family hauler.

- Registrations of ZEV vehicles saw a 37.9% increase in sales from April-June compared to last year, states Statistics Canada. This news comes while the overall market believes consumers are souring on EV’s, but these models just aren’t seeing the exponential sales growth they did over the last few years.

- General Motors has been having a great year when comparing to other Domestic automakers, as the brand raises its earnings guidance for the 3rd time this year, utilizing a strategy that, “grew U.S. retail market share with above-average pricing, well-managed inventories and below-average incentives,” said company CEO Mary Barra.