10.03.2023

Market Insights – 10/3/2023

Wholesale Prices, Week Ending September 30th

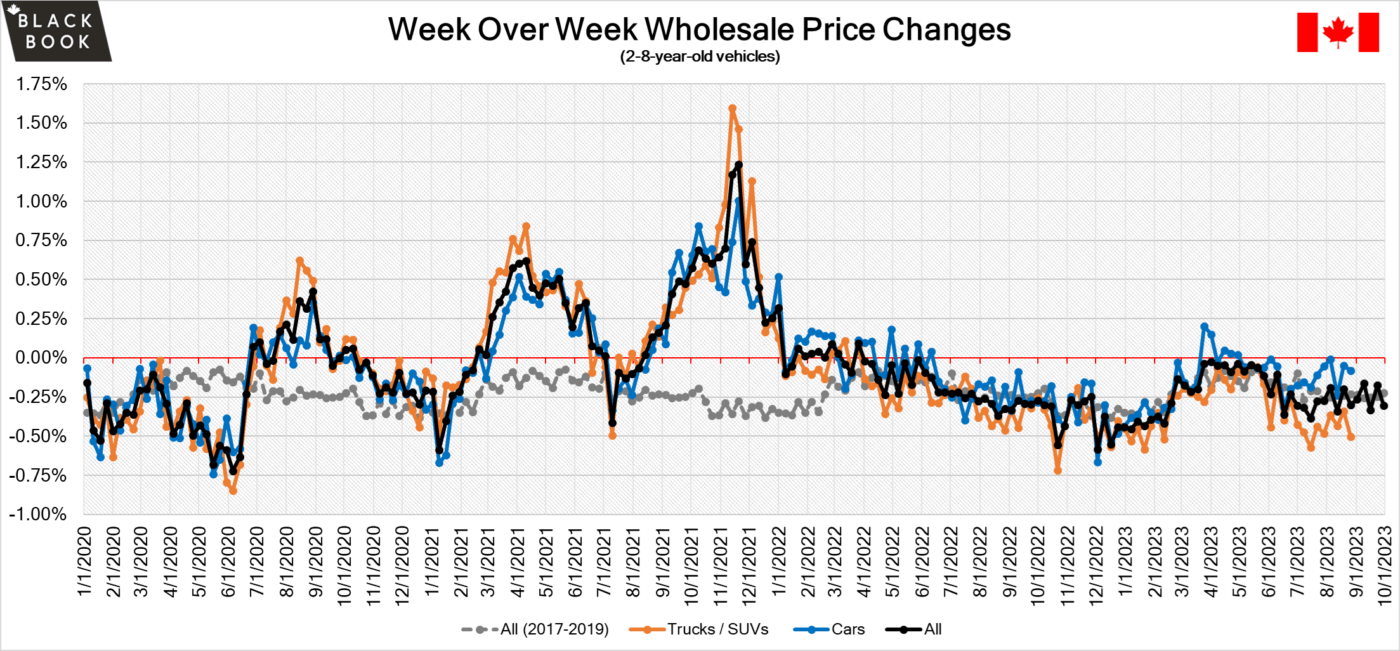

The Canadian used wholesale market saw a decline in prices for the week at -0.30%. The Car segment fell by -0.23% and the Truck/SUVs’ segment prices declined -0.37%. 1 out of 22 segments’ values have increased for the week. The Sub-compact car segment increased 0.24%. The segments with the largest declines were Full-Size Van at –1.45% followed by Compact Van at –0.70%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.13% | -0.25% |

| Truck & SUV segments | -0.37% | -0.21% | -0.19% |

| Market | -0.30% | -0.17% | -0.22% |

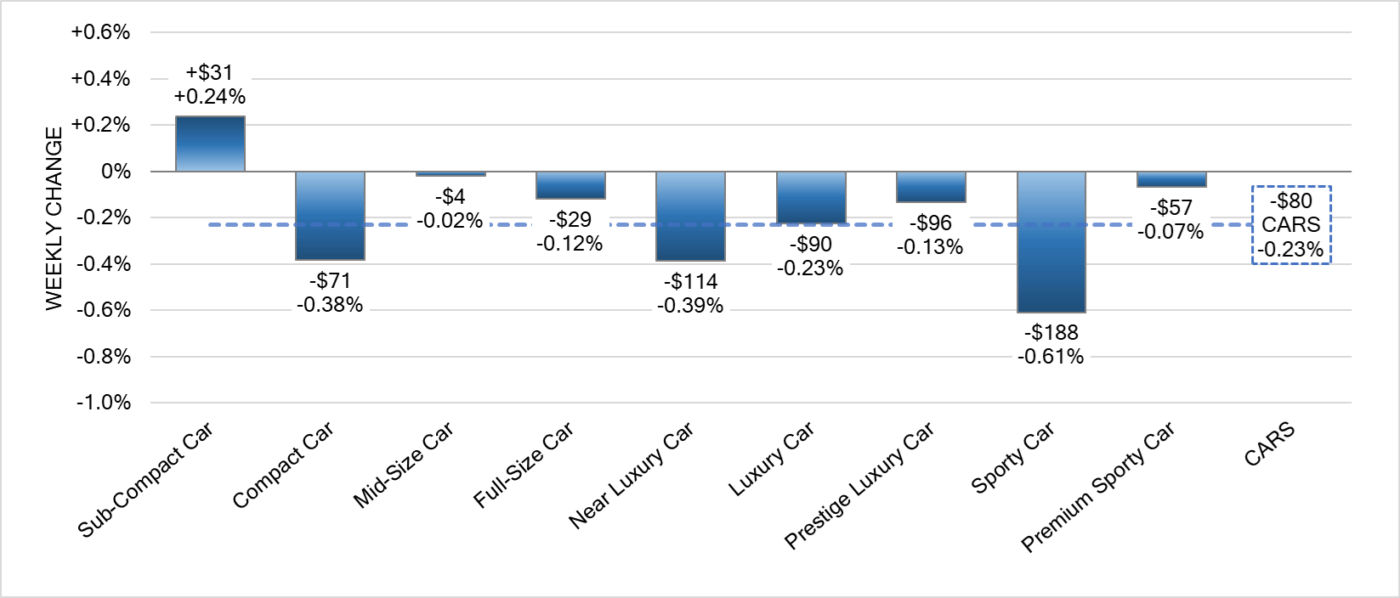

Car Segments

- There was an overall decrease of -0.23% within the Car Segments last week.

- All but one of the nine segments showed a decrease in pricing.

- The most significant decline was seen in Sporty Car at (-0.61%), followed by Near Luxury Car (-0.39%) and Compact Car with (-0.38%).

- The only segment to show an increase was Sub-Compact Car at (+0.24%).

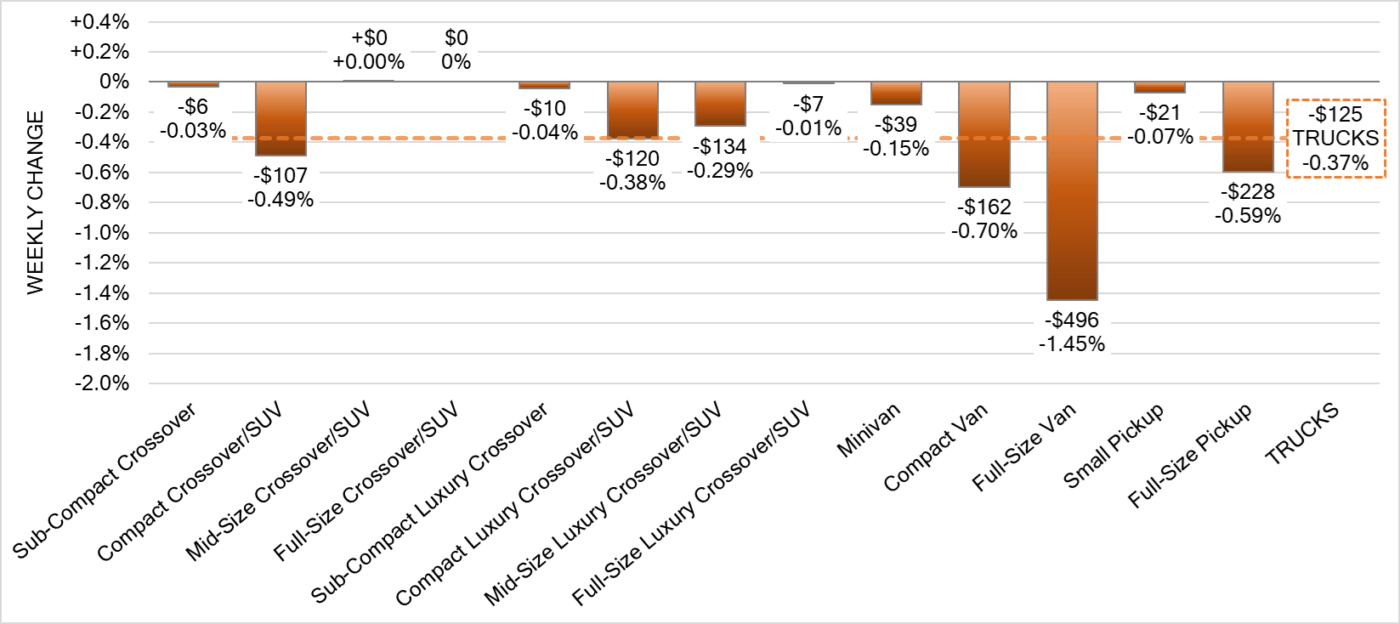

Truck Segments

- Truck segments showed an overall decrease of -0.37% last week.

- Eleven of the thirteen truck segments showed a decline. Full-Size Van had the largest drop (-1.45%), followed by Compact Van (-0.70%) and Full-Size Pickup (-0.59%).

- Other segments with a notable depreciation were Compact Crossover/SUV (-0.49%) and Compact Luxury Crossover/SUV (-0.38%).

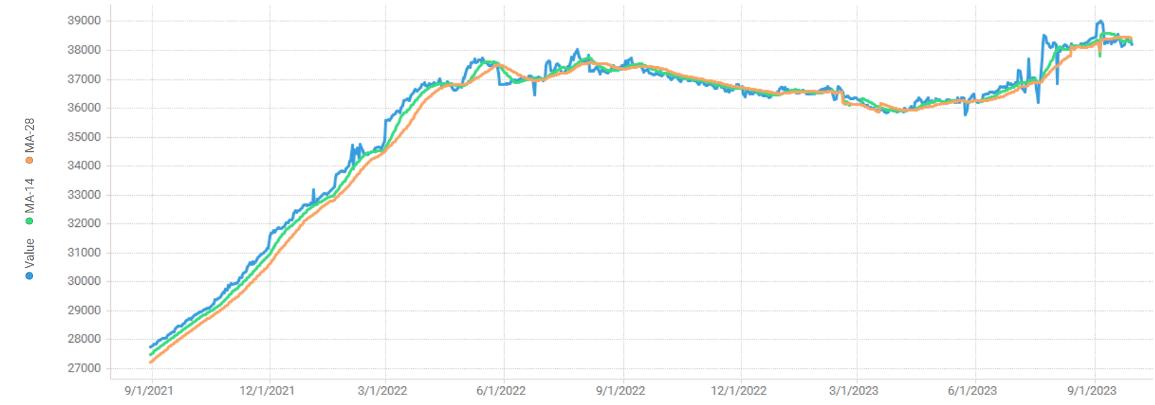

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,350. Analysis is based on approximately 191,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was slightly larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 3% and as high as 60% but most were in the 15-35% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s economy is expected to have grown by 0.1% in August 2023, with increases in the wholesale trade and finance and insurance sectors partially offset by declines in the retail trade and oil and gas extraction sectors..

- Average weekly earnings of non-farm payroll employees in Canada rose 4.3% year-on-year to $1,215 in July 2023, after a 3.6% advance in the prior month.

- Canadian 10-year bond yields decreased to 4.0% in September.

- The Canadian dollar is around $0.731 this Monday morning down from $0.741 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.08% last week; the prior week decreased by -0.22%.

Volume-weighted Car segments decreased -0.15%, compared to the prior week’s -0.29% decrease:

- The 0-to-2-year-old Car segments were down -0.03% and 8-to-16-year-old Cars declined -0.09%.

- Seven of the nine Car segments decreased last week.

- Sub-Compact (+0.04%) and Compact (+0.02%) Car segments increased last week, compared to the prior week’s decline of -0.48% and -0.35%, respectively. Prior to last week’s increase, the Compact Car segment had been declining consistently for the previous eighteen weeks, for an average weekly change of -0.94%.

- Prestige Luxury Car had the largest decline last week, down -0.44%, compared to the prior week’s decline of -0.25%.

Volume-weighted Truck segments decreased by -0.05%; the previous week decreased -0.19%:

- The 0-to-2-year-old models were stable with a 0.00% average change last week, while the 8-to-16-year-olds declined -0.25%.

- Three of the thirteen Truck segments increased last week, with Small Pickup reporting the largest increase at +0.26%, followed by Mid-Size Crossover (+0.19%) and Compact Crossover (+0.09%). The Mid-Size Crossover segment also increased +0.08% the week prior.

- Compact Van had the largest decline, with a drop of -1.28%. The segment has been declining for twenty-five consecutive weeks with an average weekly decline of -0.62%.

Industry News

- EV transition has been a see-saw battle over the past few years, and adding to the mix is the fact that EV’s are more expensive to repair and insure. That’s because of the significant costs of replacing or fixing the EV battery which generates a 20-22% increase in comparable fixes for ICE’s. Due to this insurance companies are more likely to write these cars off for that reason.

- Swedish Battery cell maker Northvolt has committed $7 Billion to build a plant in Quebec which will include cell production, initial cathode active material production, as well as battery recycling on a campus that covers 420 acres, beginning cell production in 2026.

- The iZEV program has been incentivizing consumers to purchase zero-emission vehicles to substantial success, but manufacturers will eventually have to sell these models without rebates, so it’s good to hear that some OEMs are pricing their EVs in a way that wouldn’t see increased MSRP’s once rebates are eliminated from the market, at least that’s what we’ve seen examples of from carmakers like Chevrolet, Kia, Hyundai, and Mercedes-Benz.

- AutoCanada has appointed new positions to a pair of its executive team as Jeff Thorpe will now be the President of North American Operations, and Brian Feldman will be the Canadian Chief Operating Officer. Both members started in April 2022.