10.31.2023

Market Insights – 10/31/2023

Wholesale Prices, Week Ending October 28th

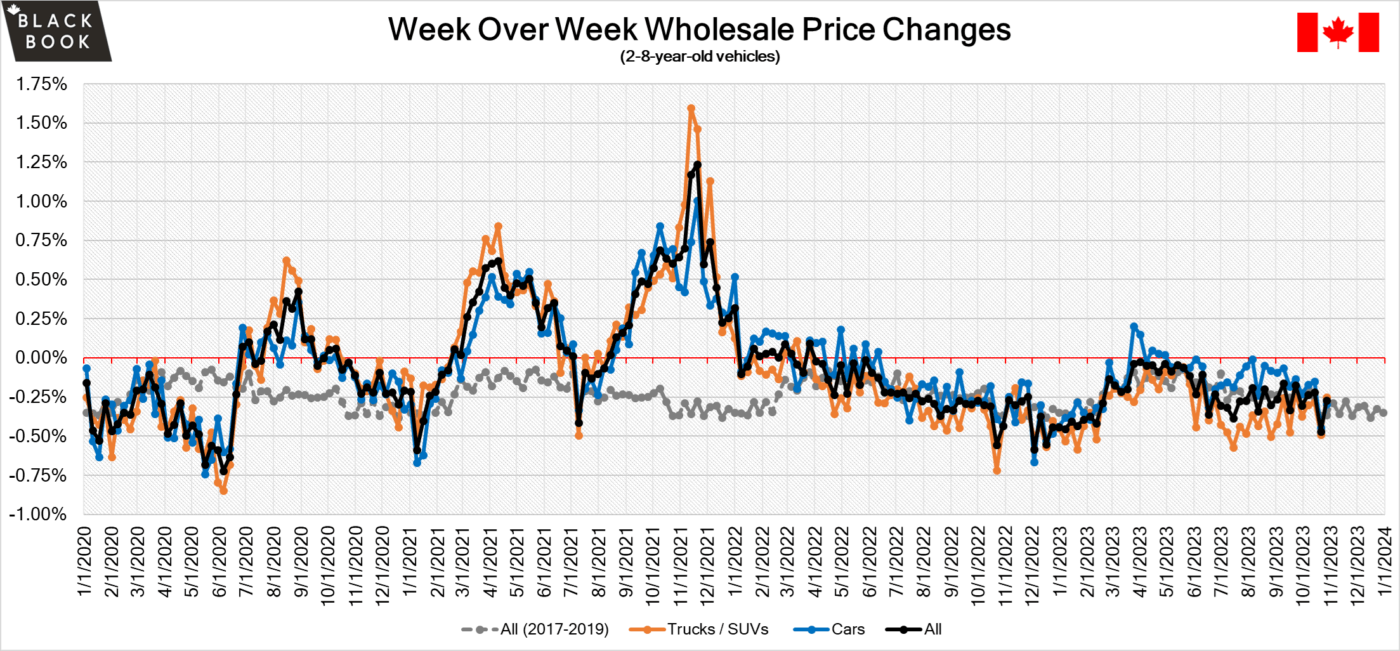

The Canadian used wholesale market saw a decline in prices for the week at -0.27%. The Car segment fell by -0.30% and the Truck/SUVs segment prices declined -0.25%. 1 out of 22 segments’ values have increased for the week. The Small Pickup segment increased by 0.04%. The segments with the largest declines were Compact Van at –1.41% followed by Mid-Size Car at –0.84%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.30% | -0.45% | -0.42% |

| Truck & SUV segments | -0.25% | -0.49% | -0.31% |

| Market | -0.27% | -0.47% | -0.37% |

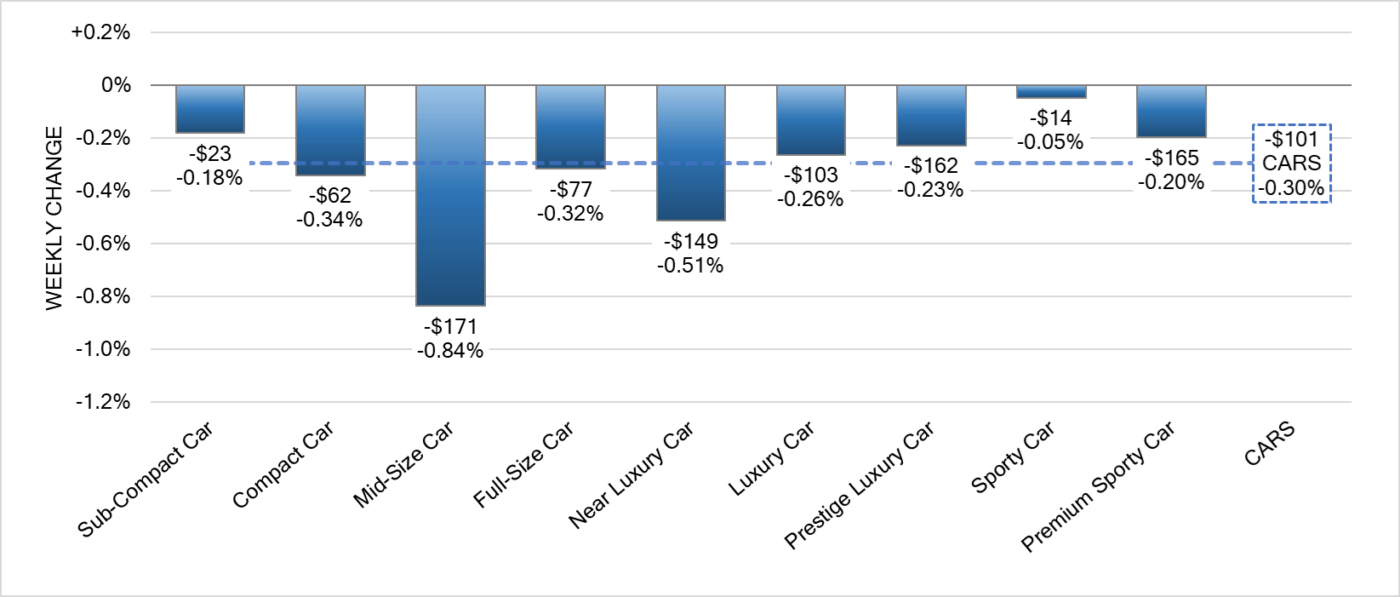

Car Segments

- Car Segments showed an overall decrease of -0.30% last week. This decrease was seen across all nine segments.

- The most significant decline was seen in Mid-Size Car at (-0.84%), followed by Near Luxury Car at (-0.51%).

- The segments with the least decline were Sporty Car (-0.05%) and Sub-Compact Car sitting at (-0.18%).

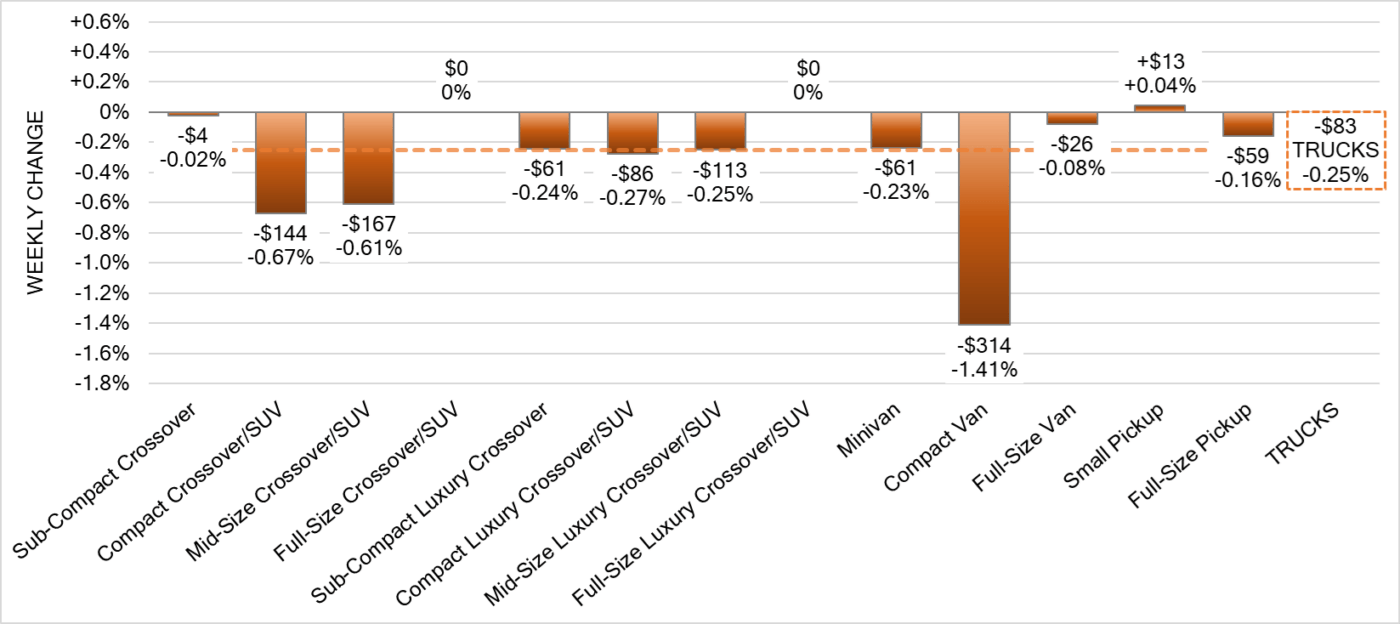

Truck Segments

- Last week truck segments reflected an overall decrease of -0.25%.

- The segment with the most significant decline was Compact Van (-1.41%). Next largest was Compact Crossover/SUV (-0.67%) followed by Mid-Size Crossover/SUV (-0.61%).

- One segment had a small increase. That segment was Small Pickup (+0.04%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,175. Analysis is based on approximately 201,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 8.4% and as high as 69% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Bank of Canada held the target for its overnight rate unchanged at 5% in its October 2023 meeting, leaving borrowing costs at a 22-year high as largely expected by financial markets, and signaled that future rate decisions will be based on the latest economic signals.

- New home prices for Canada went down 0.2% month-over-month in September 2023, following a 0.1% rise in August and against market expectations of a 0.1% uptick.

- Canada’s federal budget deficit widened to 3.05 billion in August of 2023 from 2.16 billion in the corresponding month of the previous year.

- The Canadian dollar is around $0.722 this Monday morning down from $0.728 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.60% last week; the prior week decreased by -0.28%.

Volume-weighted Car segments decreased -0.53%, compared to the prior week’s -0.46% decrease:

- The 0-to-2-year-old Car segments were down -0.31% and 8-to-16-year-old Cars declined -0.56%.

- All nine Car segments decreased last week.

- Sub-Compact Car had the largest decrease last week, falling -0.82%. The segment also had the largest decline the prior week, with a drop of -1.04%.

- The Premium Sporty Car segment continues to report minimal declines, dropping -0.15% last week. Over the last six weeks, the segment has averaged a decline of -0.15% per week.

Volume-weighted Truck segments decreased by -0.63%; the previous week decreased -0.20%:

- The 0-to-2-year-old models declined -0.52% on average and the 8-to-16-year-olds decreased by -0.68%.

- All thirteen Truck segments declined last week.

- The Compact Van segment had the largest decline last week, dropping -1.80%. This is a very small segment that has only a few competitors so small dollar changes have a large percentage impact.

- The Small Pickup segment increased the rate of depreciation last week, dropping -0.63% compared with -0.24% the week prior. After two weeks of increases early in the strike, the segment is now returning to normal depreciation for this time of year.

Industry News

- The BC government is ramping up its 100% transition to zero-emission vehicles from 2040 to 2035, as ZEV light-duty vehicles would now have to be sold or leased abiding with targets of 26% by 2026, 90% by 2030, and the full 100% now coming in 5 years earlier. Energy Minister Josie Osborne says it’s the “first in the world” at putting ZEV sales targets into law.

- The Japan Mobility Show opened last week, and with that showcased many new models, especially EVs. Toyota showed an EV pick-up concept called the EPU, aimed at the small-pickup segment that would target the likes of the Ford Maverick. Also on display were many other vehicles in a diverse set of segments, highlighting sports cars as well as sedans and “people-movers” – all of these concepts with electric powertrains.

- Latest updates in supply chain news show further semiconductor cuts, mostly in China and Europe, amounting to 141,506 vehicles globally over the past 5 weeks – these total projected cuts to 979,368 in North America, and 2,384,881 in total.

- After a short 7-hour strike, Unifor has reached a tentative deal with Stellantis which still requires majority approval from its approximately 8,200 members before the contract is ratified.