11.12.2024

Market Insights – 11/12/24

Wholesale Prices, Week Ending November 9th, 2024

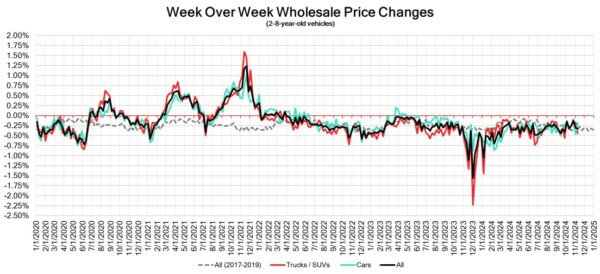

The Canadian used wholesale market experienced a decline of –0.32% in pricing for the week. Car segments prices decreased by –0.18% while the Truck/SUVs segments dropped -0.44%. Small Pickup was the only segment to see an increase of +0.05%. The largest declines in the car segments were seen in Sub-Compact Car at -0.58% and Sporty Car with –0.51%. The largest declines in the Truck/SUV segments were Full-Size Crossover/SUV at -0.67% followed by Mid-Size Crossover/SUV and Full-Size Van both with -0.65%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.18% | -0.46% | -0.44% |

| Truck & SUV segments | -0.44% | -0.17% | -0.27% |

| Market | -0.32% | -0.31% | -0.36% |

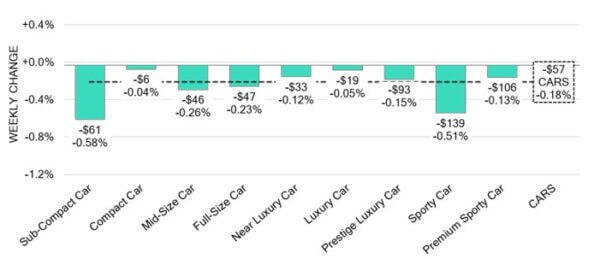

Car Segments

- Car segments saw an overall decline of -0.18% last week with all nine segments trending downwards.

- The Compact Car (-0.04%) segment decreased the least with Luxury Car (-0.05%) and Premium Sporty Car (-0.13%) coming in close behind.

- The largest decreases were seen from Sub-Compact Car (-0.58%), Sporty Car (-0.51%), and Mid-Size Car (-0.26%).

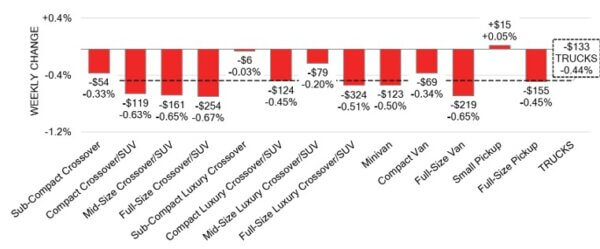

Truck / SUV Segments

- Truck segments reflected downturn of–0.44% last week. Twelve of the thirteen truck segments reflected this movement.

- Segments with the largest declines were Full-Size Crossover/SUV (-0.67%), Mid-Size Crossover/SUV (-0.65%), Full-Size Van (-0.65%) and Compact Crossover/SUV (-0.63%).

- One segment had a small increase. That segment Was small Pickup (+0.05%).

Wholesale

The Canadian market continues a downward trend, with a decline less pronounced than in its previous week. Just over 45% of market segments experienced an

average value change of more than ±$100, virtually mirroring last week’s change. Among these, the decline in truck segments increased by 27% compared to the

week prior. Monitored auction sale rates ranged from16.1 to 69.1% averaging at 35.2% The fluctuations in sale rates across various lanes can be attributed several

factors including the ongoing gradual decline in floor prices. An increase in supply entering the wholesale market has been noted once again, despite upstream

channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,250. This analysis is

based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In October 2024, Canada’s unemployment rate stood at 6.5%. This figure was

unchanged from the previous month and was slightly lower than market

expectations, which anticipated a rise to around 6.6%, the near three-year high

recorded in August. - In September 2024, Canada experienced a trade deficit of $1.26 billion. This

figure is a slight improvement from the $1.5 billion deficit recorded in August, but

it’s still larger than what analysts had anticipated, which was a deficit of $0.8

billion. - The yield on the Canadian 10-year government bond slightly decrease to 3.18%.

- The Canadian dollar is around $0.718 this Monday morning, representing a slight

decrease from $0.719 a week prior.

U.S. Market

- Over the past three weeks, the overall conversion rate has remained stable, though transaction prices are beginning to soften, causing an increase in the market’s overall depreciation rate. The Car segments saw a deceleration in depreciation, significantly influenced by the reduced rate of decline in the budget-friendly Compact Car category. Following the election, there is considerable discussion in the industry regarding how the change in administration might affect the sector, particularly concerning the future of electric vehicles.

Industry News

- Early last week the Port of Vancouver shut out unionized workers after the union’s strike notice. This comes as another supply chain disruption in a host of union issues that end up bottlenecking new car distribution of overseas vehicles – affecting the likes of European, Japanese, and Korean manufacturers.

- Scout Motors approaches a selling timeline on bringing its vehicles to Canada with a corporate store approach in its 3initial selling markets, Ontario, B.C., and Quebec, where it will release its electric-only Traveller SUV and Terra Pickup.

- With the news of President-elect Donald Trump taking office in 2025, auto manufacturers are preparing for difficult times ahead – especially those from overseas. U.S. automakers are closely aligned with Canadian auto suppliers and should help steer any threat from Donald Trump away from the Country as that would hurt U.S. auto companies as well.

- Mercedes-Benz is planning to produce its first dedicated AMG SUV model, an electric crossover that would be a standalone product from the tuning arm of the German automaker, joining the AMG sedan that was announced in March to enter the market in 2026 as a successor to the AMG GT 4-Door.

- Q3 financial results for Rivian and Lucid show a worrying trend, necessitating cost-cutting for both brands if they intend to turn a profit. As they both see losses of roughly $1B, the EV automakers currently only sell higher-end luxury vehicles in a time when affordability is such that its shying would-be consumers away from luxury and electric vehicles.

- Toyota/Lexus is preparing its dealers for the roughly 100,000 engines it needs to replace in its Tundra and LX models, with an estimated 13–21-hour completion timeline for each work order.