11.14.2023

Market Insights – 11/14/2023

Wholesale Prices, Week Ending November 11th

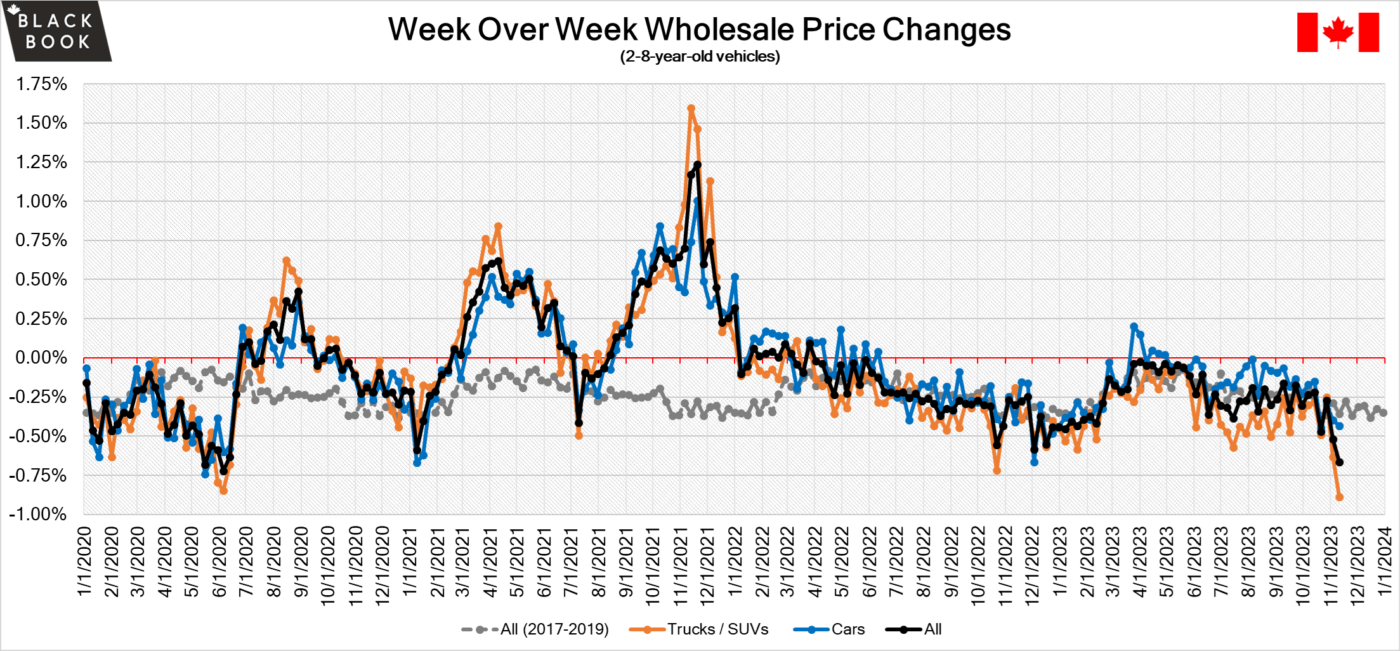

The Canadian used wholesale market saw a decline in prices for the week at -0.66%. The Car segment fell by -0.43% and the Truck/SUVs segment prices declined -0.89%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Compact Van at –1.97% followed by Mid-Size Crossover/SUV at –1.73%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.43% | -0.40% | -0.44% |

| Truck & SUV segments | -0.89% | -0.63% | -0.27% |

| Market | -0.66% | -0.52% | -0.36% |

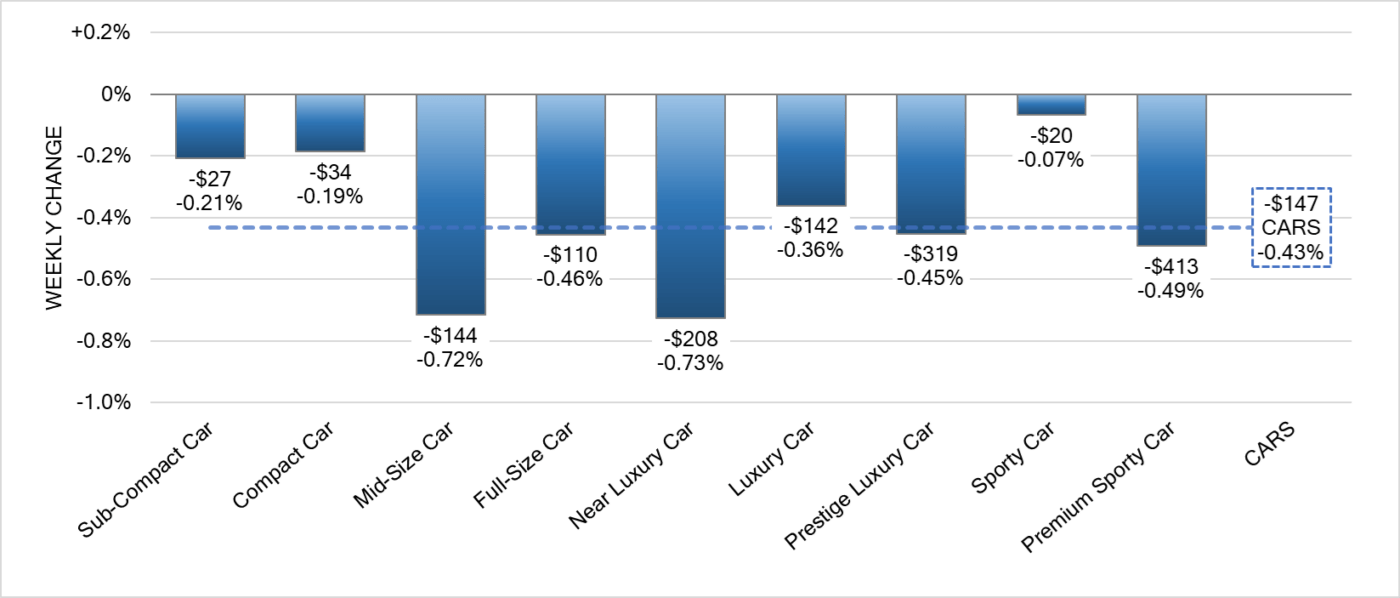

Car Segments

- There was an overall decrease of -0.43% seen across the Car Segments last week. This decrease was seen across all nine segments.

- Sporty car showed the least of the declines with (-0.07%) followed by Compact Car at (-0.19%) and Sub-Compact Car at (-0.21%).

- The most significant decrease was seen in Near Luxury Car at (-0.73%) followed closely by Mid-Size Car at (-0.72%).

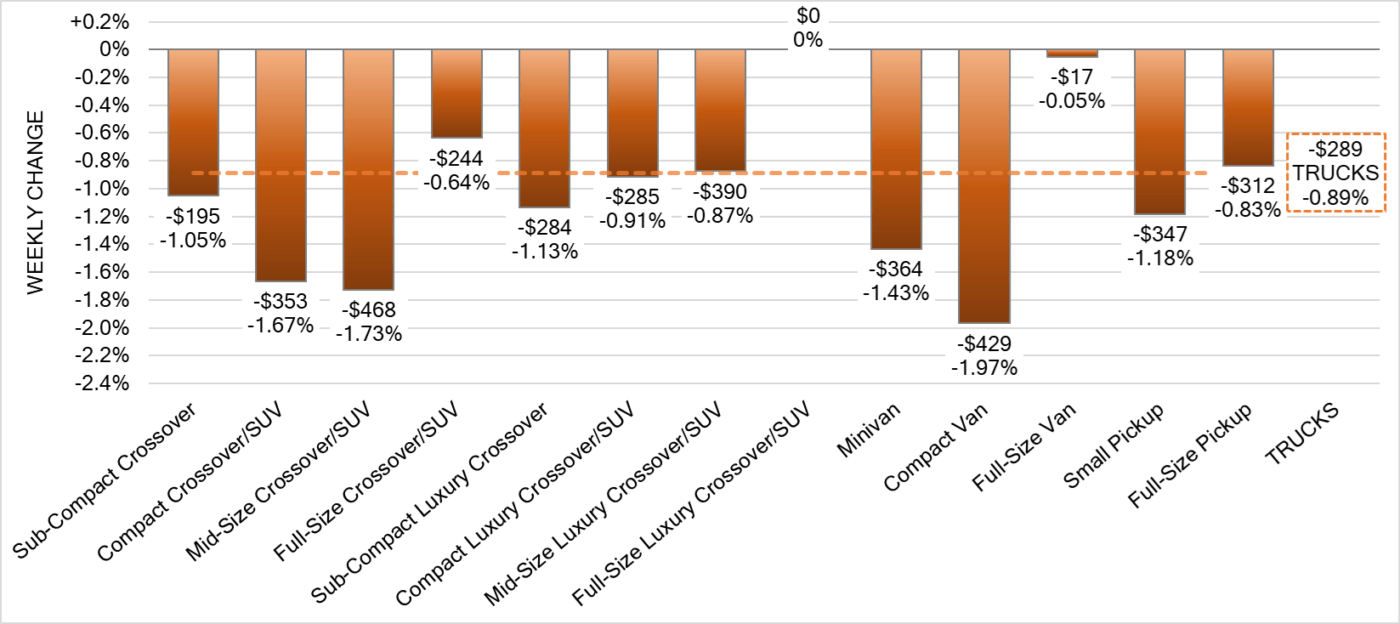

Truck Segments

- Last week truck segments reflected an overall decrease of -0.89%.

- As in the prior week, all segments showed a downturn. The segment with the most significant decline was Compact Van (-1.97%), next was Mid-Size Crossover/SUV (-1.73%) followed by Compact Crossover/SUV (-1.67%).

- Other segments with a notable drop were Minivan (-1.43%), Small Pickup (-1.18%) and Sub-Compact Luxury Crossover (-1.13%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,900. Analysis is based on approximately 206,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was larger than the historical average. Supply remains low with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 6.6% and as high as 42% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The S&P Global Canada Composite PMI dropped to 46.7, down from 47.4 in the previous month, indicating an accelerated contraction in private sector activity that was the fastest since August 2022.

- Exports from Canada rose 2.7% to $67.03 billion in September, the highest since June 2022 and the third consecutive monthly increase.

- Imports to Canada increased 1.0% to $64.99 billion in September, the highest since January. Purchases rose for motor vehicles and parts (5.8%) mainly due to passenger cars and light trucks (+9.4%).

- The yield on the Canadian 10-year government bond declined towards the 3.8% level, nearing the lowest point in seven weeks observed on November 8th and tracking US Treasury yields as investors assessed recent data and outcomes of bond auctions.

- The Canadian dollar is around $0.725 this Monday morning down from $0.732 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.55% last week; the prior week decreased by -0.95%.

Volume-weighted Car segments decreased -1.13%, compared to the prior week’s -0.57% decrease:

- The 0-to-2-year-old Car segments were down -0.96% and 8-to-16-year-old Cars declined -0.93%.

- All nine Car segments decreased last week with five of those segments reporting declines greater than 1%.

- The Full-Size Car segment had the largest decline last week, dropping -1.82%. Last month, the average weekly decline for this segment was only -0.41%.

- Sub-Compact Cars continue to have large depreciation with the segment declining -1.51% last week, compared with -0.92% the week prior.

Volume-weighted Truck segments decreased by -1.73%; the previous week decreased -1.12%:

- The 0-to-2-year-old models declined -1.34% on average and the 8-to-16-year-olds decreased by -2.23% on average.

- All thirteen Truck segments declined last week. Eleven of the thirteen segments had declines greater than 1% and four exceeded 2%.

- The Van segments had some of the larger declines last week, with Full-Size Van declining a massive -3.64% (compared with the prior week’s decline of -1.53%) and Compact Vans dropping -2.24% (versus the previous week’s large depreciation of -2.01%).

- Full-Size Pickups also had a large decline last week, down -2.79%, the largest single week decline on record for the segment with Ford F150 and Ram 1500 reporting the largest drops.

Industry News

- TalkAuto 2023 took place this past week; the annual industry conference put on by Canadian Black Book that hosts over 300 industry professionals from businesses reaching OEM’s, Banks, Lenders, and automotive tech providers.

- Volvo has released its least expensive electric model, the EX30 which is a compact SUV set to arrive in showrooms during the first quarter of 2024 with a Canadian base MSRP of $53,700 before EV rebates as the brands quickest and smallest vehicle in its lineup.

- Volkswagen Canada’s CEO, Pierre Boutin will be leaving his post to join the brand in Europe as he sets out for a new placement without any details of who will occupy the empty seat going forward.

- To combat the complex battle of EV towing, Stellantis just released the Ramcharger pickup truck that will have an onboard 3.6-litre V6 to remove any threat of range anxiety, especially under towing. The gasoline motor acts as a generator that operates as an energy supply to the EV powertrain and allows up to 1,110km of range when both electric battery and gasoline tank are full.