11.19.2024

Market Insights – 11/19/24

Wholesale Prices, Week Ending November 16th, 2024

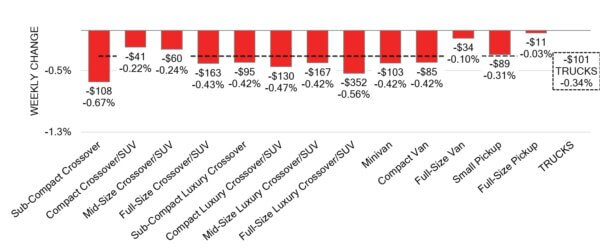

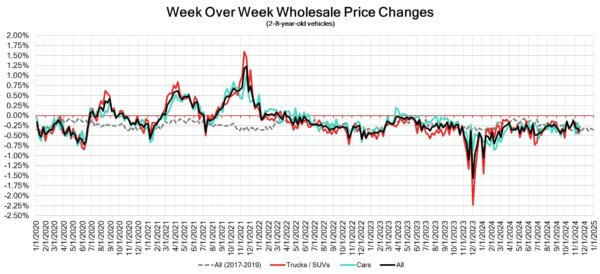

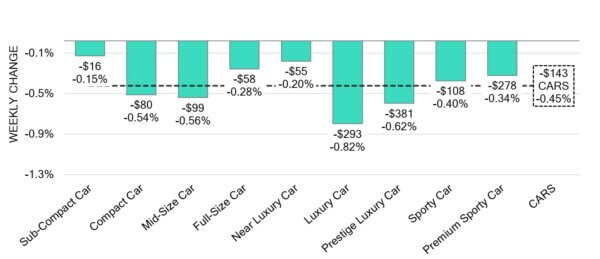

The Canadian used wholesale market experienced a decline of –0.39% in pricing for the week. Car segments prices decreased by –0.45% while the Truck/SUVs segments dropped -0.34%. The largest declines in the car segments were seen in Luxury Car at -0.82% and Prestige-Luxury Car with –0.62%. The largest declines in the Truck/SUV segments were Sub-Compact Crossover at -0.67% followed by Full-Size Luxury Crossover/SUV with -0.56%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.45% | -0.18% | -0.38% |

| Truck & SUV segments | -0.34% | -0.44% | -0.17% |

| Market | -0.39% | -0.32% | -0.27% |

Car Segments

- Car segments saw an overall decline of -0.18% last week with all nine segments trending downwards.

- The Compact Car (-0.04%) segment decreased the least with Luxury Car (-0.05%) and Premium Sporty Car (-0.13%) coming in close behind.

- The largest decreases were seen from Sub-Compact Car (-0.58%), Sporty Car (-0.51%), and Mid-Size Car (-0.26%).

Truck / SUV Segments

- Truck segments reflected an overall depreciation of–0.34% last week. All thirteen truck segments reflected this movement.

- Segments with the largest declines were Sub-Compact Crossover (-0.67%) and Full-Size Luxury Crossover/SUV (-0.56%). Four segments had the same depreciation. Sub-Compact Luxury Crossover, Mid-Size Luxury Crossover/SUV, Minivan and Compact Van (-0.42%).

- The smallest declines were seen in Full-Size Pickup (-0.03%) and Full-Size Van (-0.10%).

Wholesale

The Canadian market continues a downward trend, with a decline slightly more pronounced than in its previous week. Just over 45% of market segments experienced an average value change of more than ±$100, once again mirroring last week’s change. Among these, the decline in car segments increased by 27% compared to the week prior. Monitored auction sale rates ranged from 25.9 to 73% averaging at 41.9%. The continuous fluctuation in sale rates across various lanes can be attributed several factors including the ongoing gradual decline in floor prices. An increase in supply entering the wholesale market has been noted once again, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In October 2024, Canada experienced a month-over-month increase in housing

starts of 7.8%, reaching a total of 240,761 units. This marks the highest level in

the past three months. However, this figure remains below market expectations,

which anticipated 242,500 units, as reported by the Canada Mortgage and

Housing Corporation. - In September 2024, manufacturing sales in Canada saw a decrease of 0.5% from

the previous month. This decline was smaller than the earlier estimates of a 0.8%

drop and came after a 1.3% decrease in August. - The yield on the Canadian 10-year government bond slightly increased to 3.36%.

- The Canadian dollar is around $0.712 this Monday morning, representing a slight

decrease from $0.718 a week prior.

U.S. Market

- The market continues to follow typical seasonal depreciation patterns, with an overall decline of -0.51%, aligning closely with the pre-pandemic average depreciation rate of -0.53%. Last week, while auction inventory increased, conversion rates decreased to an average of 57%, compared to the consistent 58% seen in recent weeks.

Industry News

- The Federal Labour Minister has ordered the B.C. and Quebec ports back to work, stopping the latest strike action that has been in motion at the Port of Vancouver since November 4th.

- Honda and Acura have announced new-generation and all-new vehicles to their lineup with the redesigned 2026 Honda Passport, that becomes the “most capable off-road Honda SUV ever”, and the 2025 Acura ADX, that takes Acura into the sub-compact crossover market as its entry to the luxury crossover market and is based on the Honda HR-V platform.

- Hyundai Motor Company has announced its new Global CEO, effective January 1st. Jose Munoz, who currently holds the position as COO of Hyundai Motor Co. and CEO of Hyundai and Genesis Motor North America will lead the Korean car maker in 2025.

- Jaguar has been quiet about bringing out new vehicles as it transitions to an electric lineup, but a first look has come out on its next-gen models (albeit with heavy camouflage) as the brand moves forward on bringing vehicles to market in 2026. Using its new “Jaguar Electric Architecture”, the brand is showing a new 4-door ultra-luxury sedan with a traditional long-hood and low stance, sure to be a high-performance cruiser.

- Toyota Motor Corp. has pulled up its socks and made a concerted effort to move into the electric vehicle market in a much larger format than they presently have. Announcing its “Area 35” plan that will focus on decreasing its production footprint while maintaining current production volume, reduce component variety, increase product update rates, and prepare itself to produce 3.5 million EVs annually by 2030.