11.21.2023

Market Insights – 11/21/2023

Wholesale Prices, Week Ending November 18th

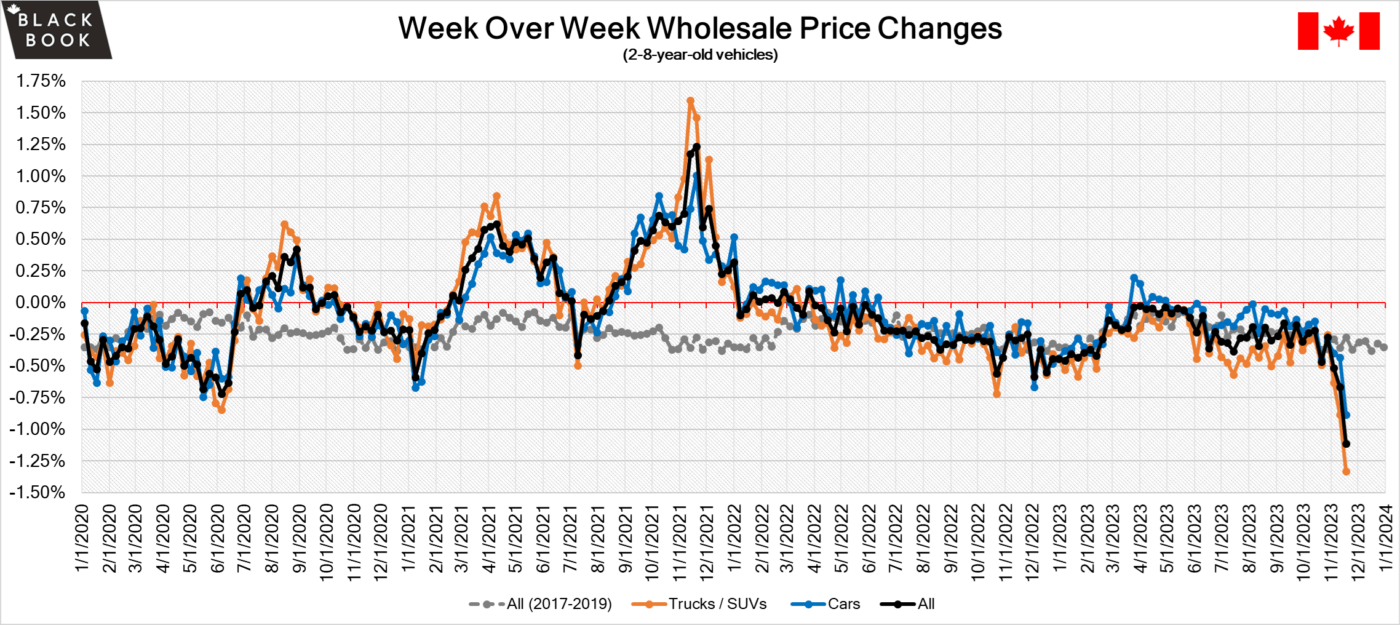

The Canadian used wholesale market saw a decline in prices for the week at –1.11%. The Car segment fell by -0.89% and the Truck/SUVs segment prices declined –1.33%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Full-Size Luxury Crossover/SUV at –3.17% followed by Mid-Size Luxury Crossover/SUV at –1.91%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.89% | -0.43% | -0.38% |

| Truck & SUV segments | -1.33% | -0.89% | -0.17% |

| Market | -1.11% | -0.66% | -0.27% |

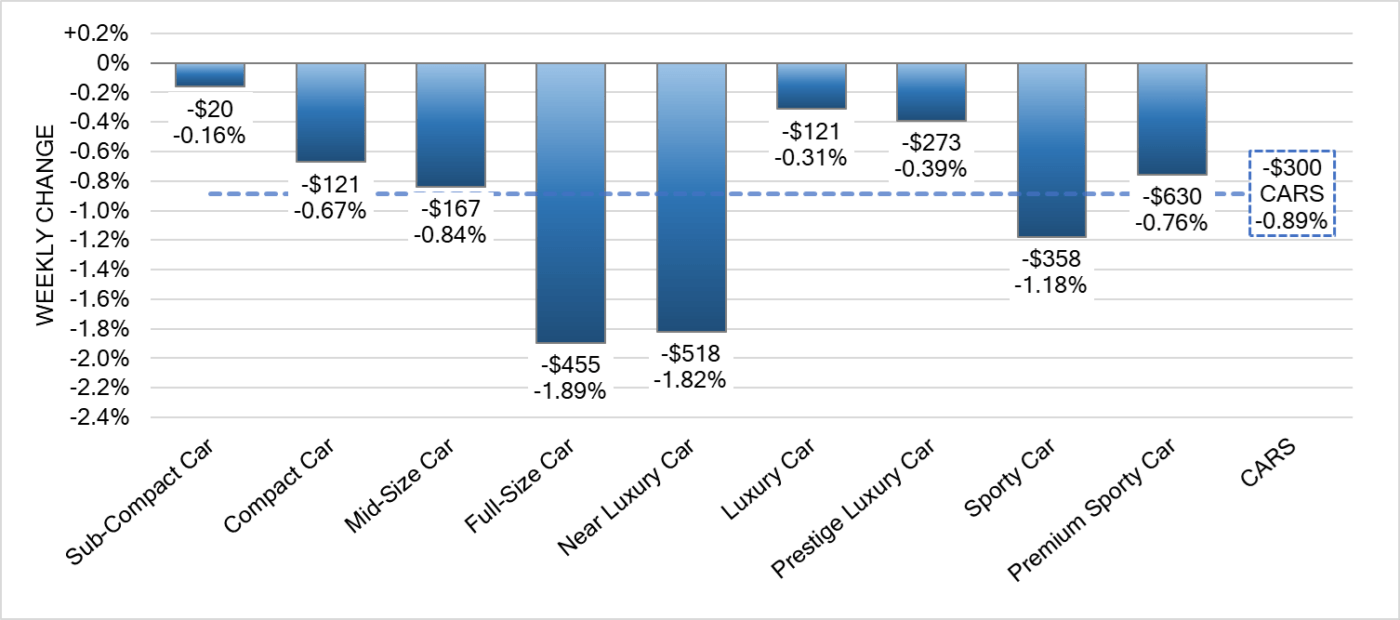

Car Segments

- The Car segments showed an overall decrease of -0.89% last week. This decrease was seen across all nine segments.

- The least of the declines were seen with Sub-Compact Car at (-0.16%), Luxury Car at (-0.31%) and Prestige Luxury Car at (-0.39%).

- Full-Size Car showed the most significant decrease with (-1.89%) followed closely by Near Luxury Car at (-1.82%) and Sporty Car with (-1.18%).

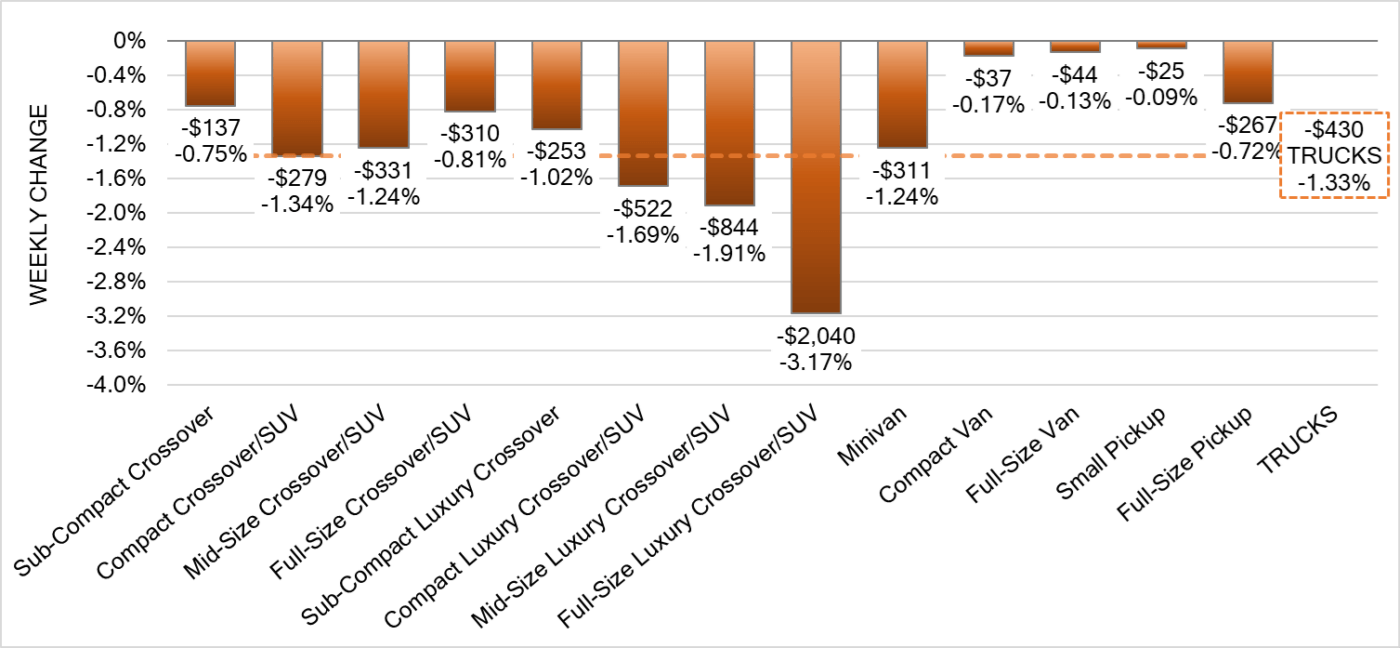

Truck Segments

- Overall truck segments reflected a decrease of -1.33%.

- All segments showed a decline. The segment with the highest decrease was Full-Size Luxury Crossover/SUV (-3.17%), next was Mid-Size Luxury Crossover/SUV (-1.91%) followed by Compact Luxury Crossover/SUV (-1.69%).

- Compact Crossover/SUV also had a notable drop (-1.34%). Mid-Size Crossover/SUV and Minivan had the same decrease (-1.24%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,950. Analysis is based on approximately 206,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was much larger than the historical average. Supply remains low with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 4% and as high as 43% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Foreign investors reduced their exposure to Canadian securities by a net 15.09 billion in September 2023 compared to an upwardly revised net divestment of 8.77 billion in August.

- Canada’s manufacturing sales rose by 0.4% from a month earlier to 72.8 billion in September of 2023, following an upwardly revised 1% gain in August and compared to preliminary estimates of a 0.1% decline.

- Housing starts in Canada edged up by 1% over a month earlier to 274,700 units in October 2023, above market expectations of 252,900 units, according to the Canada Mortgage and Housing Corporation.

- The yield on the Canadian 10-year government bond declined towards the 3.66% the lowest in 9 weeks.

- The Canadian dollar is around $0.729 this Monday morning up slightly from $0.725 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.55% last week; the prior week decreased by -1.48%.

Volume-weighted Car segments decreased -1.35%, compared to the prior week’s -1.13% decrease:

- The 0-to-2-year-old Car segments were down -0.96% and 8-to-16-year-old Cars declined -1.05%.

- All nine Car segments decreased last week with seven of those segments reporting declines greater than 1%.

- Full-Size Car (-2.33%) and Sub-Compact Car (-2.12%) had the largest declines last week. This continues the trend that was started the week prior with these same two segments leading the Car segment declines.

- Premium Sporty Car continues to be the only segment that is on pace with typical seasonality, declining -0.25% last week. The segment has averaged a weekly decline of -0.20% over the past six weeks.

Volume-weighted Truck segments decreased by -1.53%; the previous week decreased -1.73%:

- The 0-to-2-year-old models declined -1.36% on average and the 8-to-16-year-olds decreased by -1.77% on average.

- All thirteen Truck segments declined last week. Twelve of the thirteen segments had declines greater than 1%.

- Compact Van led the declines last week with a record setting decline of -5.48%, compared with the prior week’s also large decline of -2.24%. This now makes the six-week average rate of decline for the segment -2.18%.

- Full-Size Crossovers also had a large decline at -2.09%, an increase in depreciation over the prior week’s decline of -1.73%.

Industry News

- There has been perceived change in EV sentiment lately as particular electric models’ slowdown their pace of sales, but with new EV insights provided by Electric Autonomy, who reported S & P Global numbers for 3rd quarter ZEV registrations in Canada at a record 13.3%. Stating that every 1 in 8 vehicle sold was a ZEV.

- The redesigned 2025 Subaru Forester has just been released, and the model will finally bring a hybrid powertrain to its lineup sourced from Toyota, which will go on sale later as the internal combustion models launch first, around this Springtime.

- Toyota has just released the next generation Camry for 2025, and the model will now only offer the company’s hybrid powertrain for the first time ever – still available will be all-wheel-drive trims and the vehicle is set to begin selling in the Spring next year.

- In an effort to bring solid-state battery technology quicker to market, some battery companies are testing semisolid-state batteries that could provide the same benefit as fully solid-state, but arrive to market that much earlier as the industry looks to make adoption of electric vehicles easier for consumers.

- The second model for the new Crown line of Toyotas, the Signia, was released as a 2-row all-wheel-drive crossover hybrid that will ultimately replace the Toyota Venza that was only just recently revived.