11.26.2024

Market Insights – 11/26/24

Wholesale Prices, Week Ending November 23rd, 2024

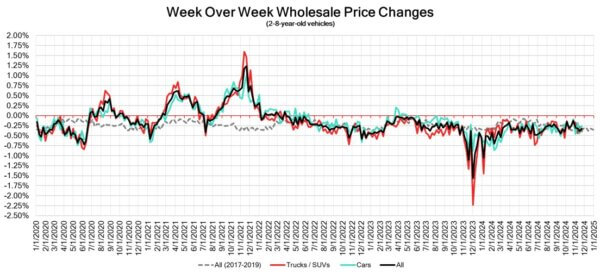

The Canadian used wholesale market experienced a decline of –0.33% in pricing for the week. Car segments prices decreased by –0.26% while the Truck/SUVs segments dropped -0.39%. Full-Size Luxury Crossover/SUV was the only positive segment with +0.19%. The largest declines in the car segments were seen in Midsize Car at -0.43% and Sporty Car with -0.39%. The largest declines in the Truck/SUV segments were Compact Van at -0.91% followed by Full-Size Crossover/SUV with -0.79%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.26% | -0.45% | -0.43% |

| Truck & SUV segments | -0.39% | -0.34% | -0.31% |

| Market | -0.33% | -0.39% | -0.37% |

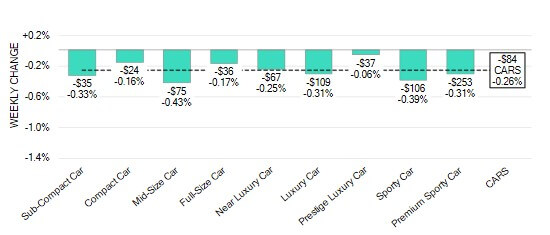

Car Segments

- Car segments saw an overall decline of -0.26% last week with all nine segments trending downwards.

- The Prestige Luxury Car (-0.06%) segment decreased the least with Compact Car (-0.16%) and Full-Size Car (-0.17%) coming in close behind.

- The largest decreases were seen from Mid-Size Car (-0.43%), Sporty Car (-0.39%), and Sub-Compact Car (-0.33%).

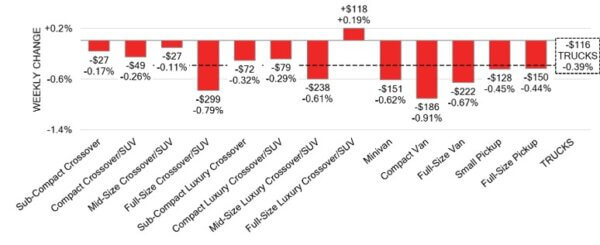

Truck / SUV Segments

- Truck segments saw an overall depreciation of–0.39% last week. Twelve of thirteen truck segments trended downward.

- Segments with the largest declines were Compact Van (-0.91%), Full-Size Crossover/SUV (-0.79%), Full-Size Van (-0.67%), Minivan (-0.62%) and Mid-Size Luxury Crossover/SUV (-0.61%).

- One segment showed an increase. That segment was Full-Size Luxury Crossover/SUV (+0.19%).

Wholesale

The Canadian market remains on a downward trajectory, with a decline less pronounced than in its previous week. 50% of market segments experienced an average value change of more than ±$100. Among these, the decline in car segments decreased by 19% compared to the week prior. Monitored auction sale rates ranged from 32.9 to 78.2% averaging at 42.9%. The continuous fluctuation in sale rates across various lanes can be attributed several factors including the ongoing gradual decline in floor prices and the recent adjustments to interest rates. An increase in supply entering the wholesale market has been noted once again, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

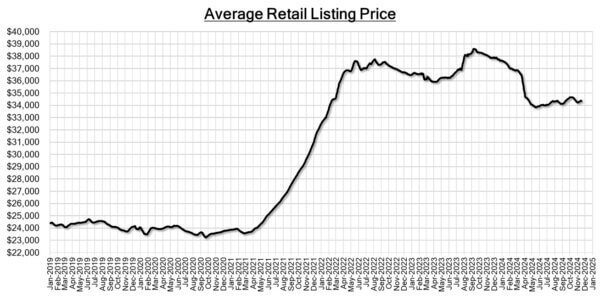

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,330. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s annual inflation rate increased to 2% in October 2024, up from 1.6% in

September, which had been the lowest rate in over three years. This rise

exceeded market predictions of 1.9%. - Retail sales in Canada are projected to have increased by 0.7% in October 2024

compared to the previous month, based on a preliminary estimate. - Manufacturing sales in Canada are expected to have increased by 1.3% month over-

month in October 2024, recovering from a 0.5% decrease in September,

contrary to forecasts of a 0.8% decline, based on preliminary estimates. - The yield on the Canadian 10-year government bond slightly decrease to 3.33%.

- The Canadian dollar is around $0.716 this Monday morning, representing a slight

increase from $0.712 a week prior.

U.S. Market

- Last week, the market maintained a stable trend for this time of year, with steady declines averaging about -0.50% per week. This is less than the same period before the pandemic, when declines were nearer to -0.75% per week.

Industry News

- The Toyota Highlander was the most stolen vehicle in Canada in 2023, surpassing the Honda CR-V which ran at the top for the last 2 years. A list no one wants to be on sees an estimated total of 90,000vehicles are stolen annually in Canada. Ram 1500, Lexus RX and Toyota Rav4also take high positions.

- Hyundai and Kia have ordered a recall affecting 208,000 of their EV’s in North America from 2022-2024 model years for an issue causing a “loss of drive power, increasing the risk of a crash”. 34,529 Canadian-market Hyundai vehicles are affected with no disclosed number on the Canadian share of the 63,000Kia models affected.

- Stellantis brands have been working through making their vehicles lower priced and more highly demanded with price cuts applied to their 2025 Ram 1500’s and now the Jeep brand planning to add hybrid SUV’s next year with a Cherokee replacement.

- Ford is stepping back from its $1.2B battery materials plant in Quebec as it feels the global EV slowdown. The plant itself will continue with lead partner, EcoPro from South Korea.

- Q3 2024 ZEV market share has been totaled at a record high of 16.5%, but with most of that growth coming from Quebec, this pace is not sustainable as incentives slow in the province and adoption has stalled in most other markets – gas powered vehicles continue to decline with 70.1% market share: a new low.

- Jaguar released its new brand direction and marketing theme to much criticism, as the UK-based carmaker looks to redefine itself and transition into selling only electric vehicles.