11.28.2023

Market Insights – 11/28/2023

Wholesale Prices, Week Ending November 25th

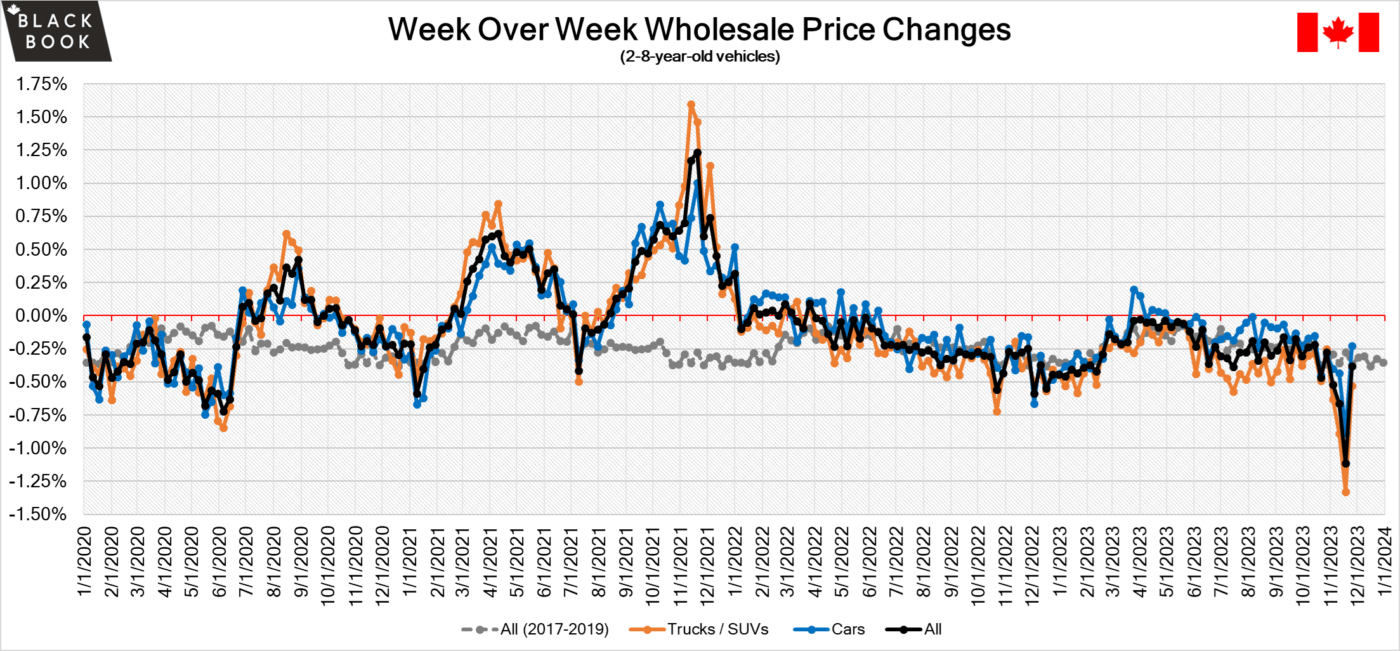

The Canadian used wholesale market saw a decline in prices for the week at –0.38%. The Car segment fell by -0.23% and the Truck/SUVs segment prices declined –0.53%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Full-Size Car at –1.03% followed by Sub-Compact Crossover and Sub-Compact Luxury Crossover at –1.00%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.89% | -0.43% |

| Truck & SUV segments | -0.53% | -1.33% | -0.31% |

| Market | -0.38% | -1.11% | -0.37% |

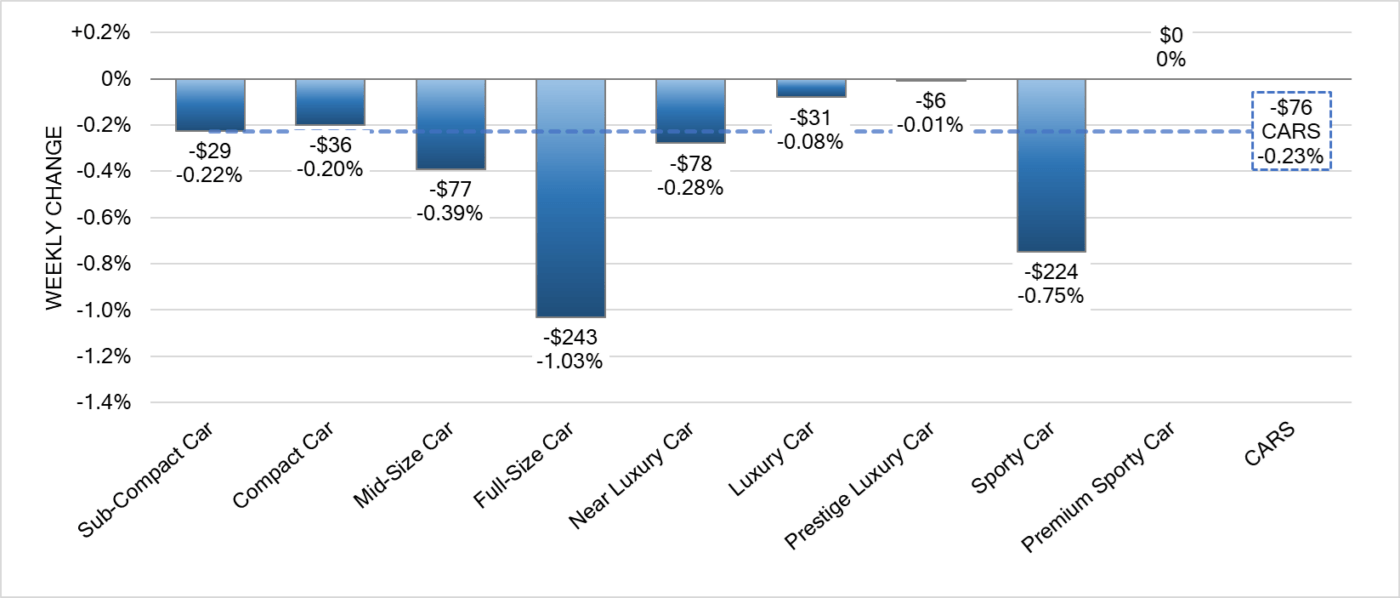

Car Segments

· There was an overall decrease of -0.23% seen in Car segments last week. This decrease was seen across all but one of the nine segments, as there was no change (0%) in Premium Sporty Car prices.

· The least of the declines were seen with Prestige Luxury car at (-0.01%) and Luxury Car at (-0.08%).

· Full-Size Car showed the most significant decrease with (-1.03%), followed by Sporty Car at (-0.75%).

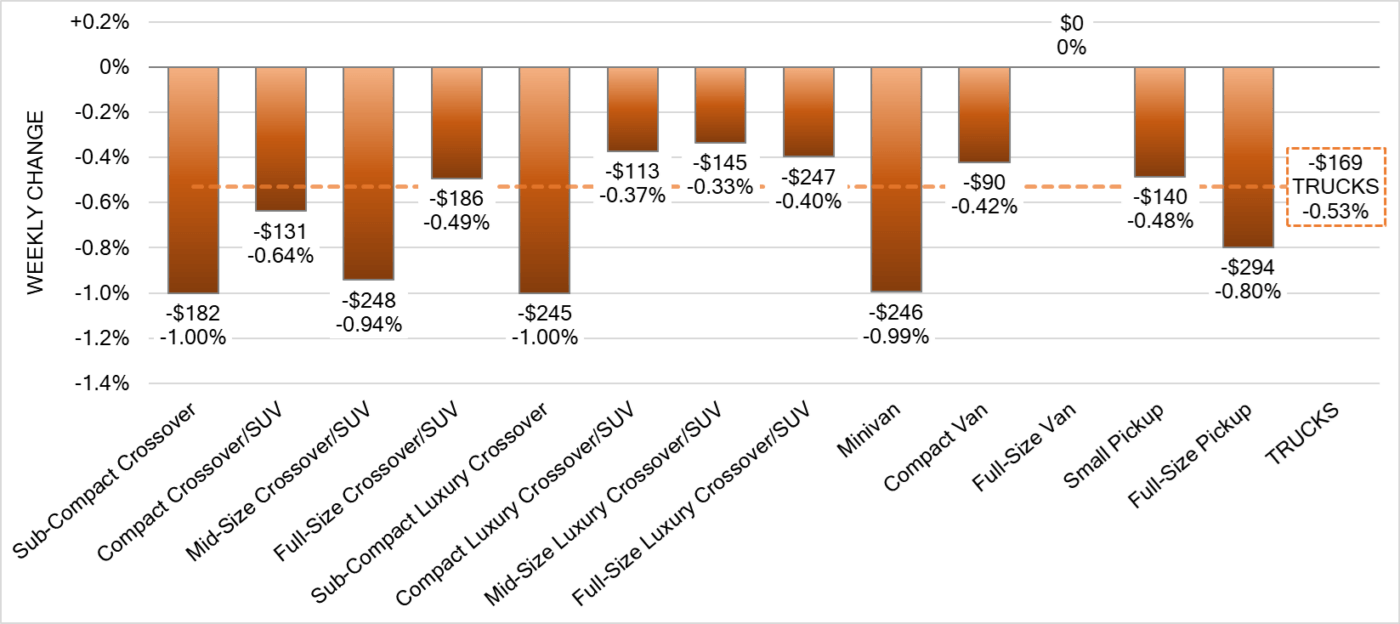

Truck Segments

· Overall truck segments reflected a decrease of -0.53%.

· Two segments had the highest decrease. Those were Sub-Compact Crossover and Sub-Compact Luxury Crossover (-1.00%). Decreasing nearly as much was Minivan (-0.99%).

· Next largest drop was Mid-Size Crossover/SUV (-0.94%), followed by Full-Size Pickup (-0.80%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,900. Analysis is based on approximately 206,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 6% and as high as 49% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The annual inflation rate in Canada fell to 3.1% in October of 2023 from 3.8% in the previous month, slightly below market expectations of 3.2%.

- New home prices in Canada remained unchanged month-on-month in October 2023, following a 0.2% drop in September and in line with market forecasts.

- Canadian federal government budget deficit widened to 3.88 billion in September of 2023 from 2.16 billion in the same month of the previous year.

- The yield on the Canadian 10-year government bond increased slightly towards the 3.7%.

- The Canadian dollar is around $0.733 this Monday morning up slightly from $0.729 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.49% last week; the prior week decreased by -1.48%.

Volume-weighted Car segments decreased -1.82%, compared to the prior week’s -1.35% decrease:

- The 0-to-2-year-old Car segments were down -1.52% and 8-to-16-year-old Cars declined -2.10%.

- All nine Car segments decreased last week, with six of those segments reporting declines greater than 1%.

- Compact Car had the largest decline last week, with a record setting decline for the segment of -3.84%, compared with -1.43% the week prior.

- Sub-Compact Car also had a third week of large declines, depreciating -1.80% last week, compared with -2.12% the previous week.

- The Luxury Car segments were the only segments to have depreciation closer to typical seasonal trends. Near Luxury Car was the only “Luxury” segment to exceed 1%.

Volume-weighted Truck segments decreased by -1.35%; the previous week decreased -1.53%:

- The 0-to-2-year-old models declined -1.01% on average and the 8-to-16-year-olds decreased by -1.37% on average.

- All thirteen Truck segments declined last week. Nine of the thirteen segments had declines greater than 1%.

- Compact (-4.25%) and Full-Size (-3.19%) Vans had incredible strength throughout most of the pandemic but are now in a state of correction. Compact Van has averaged a weekly decline of -3.49% over the past four weeks.

- The Full-Size Crossover segments also had large declines last week, with the mainstream segment declining -1.75% and the Luxury variants declining -3.20%.

- The Compact Crossover (-1.40%) segment reported a fifth consecutive week of a decline exceeding 1%.

Industry News

- The 2024MY Porsche Panamera has been released as it receives a minor model change this year and gains 23 horsepower as well as styling upgrades versus the outgoing model – the new model arrives in the Spring.

- The Jeep Wrangler 4xe plug-in hybrid has been recalled after 8 vehicle fires have been investigated, affecting 45,000 vehicles globally from 2021-24MY.

- With the next-generation electric vehicles looking to arrive in the market with solid-state batteries equipped, Toyota has shared that the expectation of their models coming to the market will only support roughly 10,000 vehicles globally, starting in 2030.

- Magna International is the supplier expected to assemble the Volkswagen Group’s new electric brand, Scout, out of their Magna Steyr division from an order worth $492 million USD.

- The global semiconductor shortage is improving over last year as the numbers show an expected global cut of 2.466 million vehicles this year, which is significantly down compared to last year’s final number of 4.388 million. With only 20,000 more vehicles to be cut from production for the remainder of the year, the scenario has improved continuously throughout 2023.