11.05.2024

Market Insights – 11/5/24

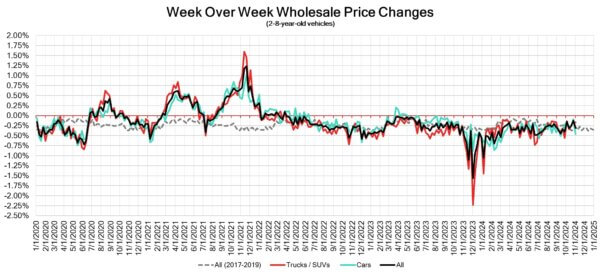

Wholesale Prices, Week Ending November 2nd, 2024

The Canadian used wholesale market experienced a decline of –0.31% in pricing for the week. Car segments prices decreased by –0.46% while the Truck/SUVs segments dropped -0.17%. Full-Size Pickup was the only segment to see an increase of +1.18%. The largest declines in the car segments were seen in Near Luxury Car at -0.63% and Prestige Luxury Car with –0.56%. The largest declines in the Truck/SUV segments were Compact Luxury Crossover/SUV at -0.65% followed by Mid-Size Luxury Crossover/SUV and Minivan both with -0.58%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.46% | -0.09% | -0.28% |

| Truck & SUV segments | -0.17% | -0.16% | -0.30% |

| Market | -0.31% | -0.13% | -0.29% |

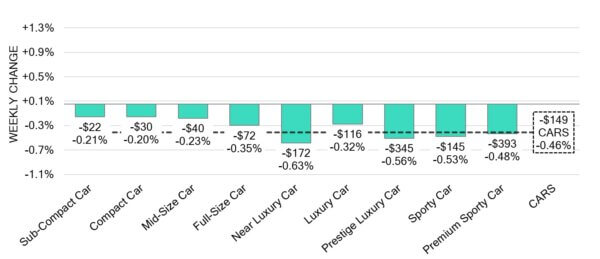

Car Segments

- Car segments saw an overall decline of -0.46% last week with all nine segments trending downwards.

- The Compact Car (-0.20%) segment decreased the least with Sub-Compact Car (-0.21%) and Mid-Size Car (-0.23%) coming in close behind.

- The largest decreases were seen from Near Luxury Car (-0.63%), Prestige Luxury Car (-0.56%), and Sporty Car (-0.53%).

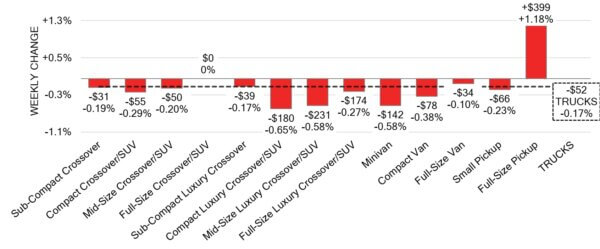

Truck / SUV Segments

- Truck segments had a slight downturn of–0.17% last week. Twelve of the thirteen truck segments reflected this movement.

- Those with the largest declines were Compact Luxury Crossover/SUV (-0.65%). Mid-Size Luxury Crossover/SUV and Minivan had the next largest (-0.58%).

- One segment had an increase. That segment was Full-Size Pickup (+1.18%).

Wholesale

The Canadian market continues a downward trend, with a decline slightly more pronounced than in its previous week. Just over 45% of market segments experienced

an average value change of more than ±$100, a significant increase from last week. Among these, the decline in car segments was 36% more than last

week. Monitored auction sale rates ranged from13.9 to 68.9% averaging at 28% The fluctuations in sale rates across various lanes can be attributed several factors

including the ongoing gradual decline in floor prices. An increase in supply entering the wholesale market has been noted once again, despite upstream channels

continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

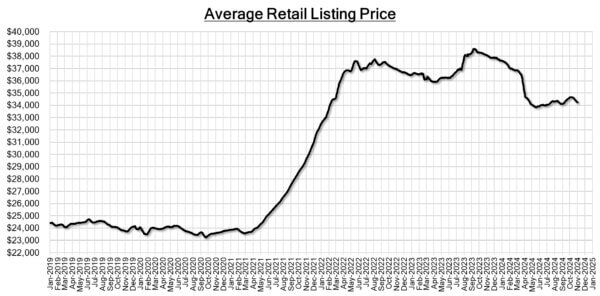

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,250. This analysis is

based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In September 2024, Canada’s economy probably experienced a growth of 0.3%.

This increase was supported by advancements in sectors such as finance,

insurance, construction, and retail trade. However, it was somewhat balanced out

by declines in areas like mining, quarrying, and the extraction of oil and gas. - In October 2024, the S&P Global Canada Manufacturing PMI increased to 51.1,

up from 50.4 in the previous month. This marks the second consecutive month of

growth in Canadian manufacturing activity following 17 months of continuous

decline. - The yield on the Canadian 10-year government bond slightly decrease to 3.24%.

- The Canadian dollar is around $0.719 this Monday morning, representing a slight

decrease from $0.720 a week prior.

U.S. Market

- The fourth quarter usually experiences the highest depreciation compared to other quarters throughout the year. This year’s fourth quarter is following the expected seasonal depreciation for most segments. However, the Small Pickup segment is exhibiting unique behavior, with increasing values observed for units that are 8 years old or newer.

Industry News

- Toyota Canada has appointed Cyril Dimitris CEO as Larry Hutchinson retires at the end of December, concluding an eight-year run as leader of Canadian operations for the brand that he’s worked for nearly 40 years, starting in 1986. Dimitris is currently the VP of Sales and Marketing and will move into the lead position on January 1st.

- October new car sales ended 8.8% over last year, at 162,000 units, which is also very near 2019 sales volume, showing a very strong sales month when comparing to last year’s timing of a quickly strengthening market in late 2023.

- Clean Energy Canada has released a report entitled, “Opening the Door”, which provides a monthly provincial breakdown of savings by switching to decarbonized equipment. The report states that, “EV’s are the largest money-saving option”, including an example where similarly sized family crossovers net owners $3,000 annual savings transitioning from Gas to Electric vehicles.

- Battery electric vehicles now account for 1.3% of all vehicle registrations in 2023, up from 0.9% in 2022 from StatsCan data – totaling 329,402 battery-electric vehicles driving on the road. So far in 2024 Hyundai leads all legacy OEMs in share of sales.

- During Automotive News Canada’s Retail Forum on October 24th, an industry panel including David Carsley, Google Canada’s Head of Automotive said, “most consumers no longer default to particular brands”, and a recent research paper from the organization in 2023 found 34% of buyers were brand loyalists, down from 9% from 2021.