11.07.2023

Market Insights – 11/7/2023

Wholesale Prices, Week Ending November 4th

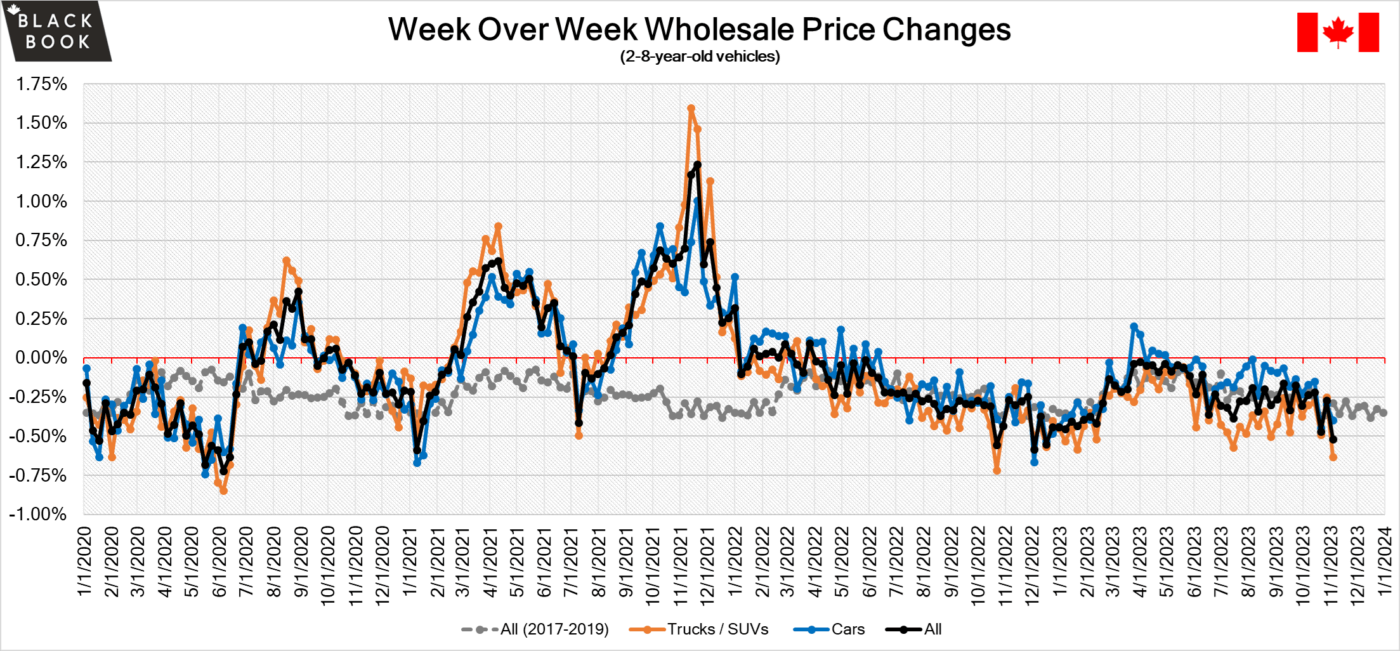

The Canadian used wholesale market saw a decline in prices for the week at -0.52%. The Car segment fell by -0.40% and the Truck/SUVs segment prices declined -0.63%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Minivan at –2.10% followed by Full-Size Luxury Crossover/SUV at –1.85%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.40% | -0.30% | -0.28% |

| Truck & SUV segments | -0.63% | -0.25% | -0.30% |

| Market | -0.52% | -0.27% | -0.29% |

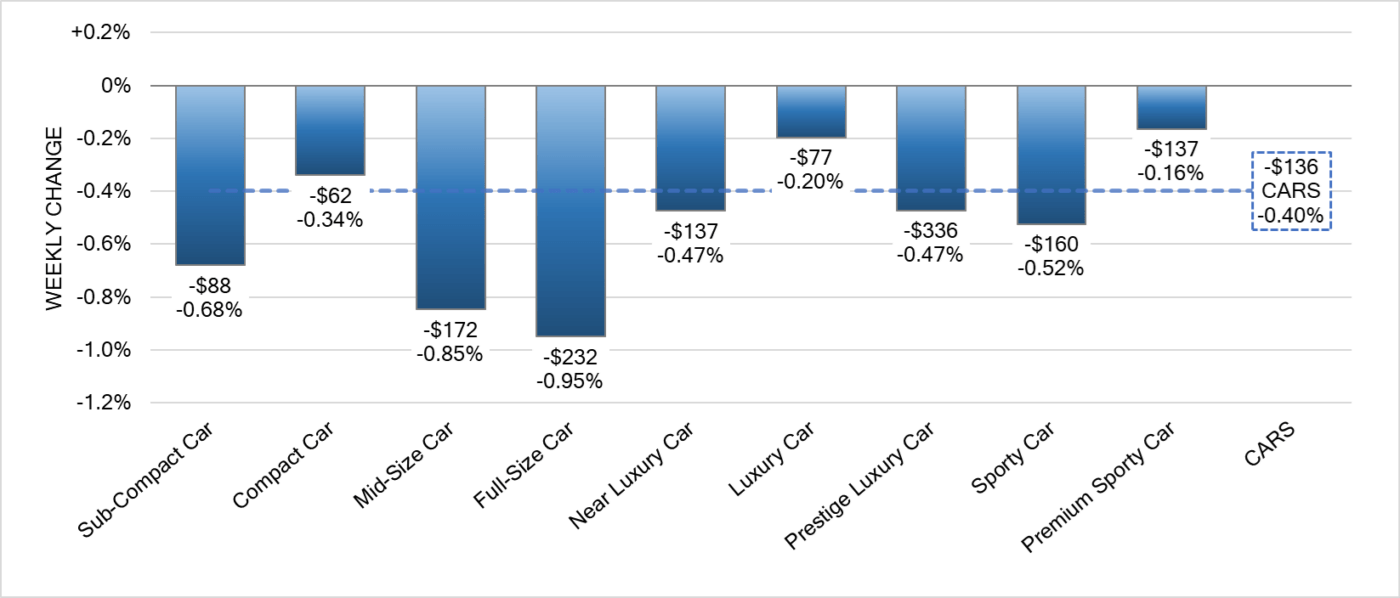

Car Segments

- There was an overall decrease of -0.34% seen across the Car Segments last week. This decrease was seen across all nine of the segments.

- The least of the declines were seen in Premium Sporty Car (-0.16%) and Luxury Car sitting at (-0.20%)

- The most significant decrease was seen in Full-Size Car at (-0.95%), followed by Mid-Size Car at (-0.85%). Both Prestige Luxury Car and Near Luxury Car fell to (-0.47%).

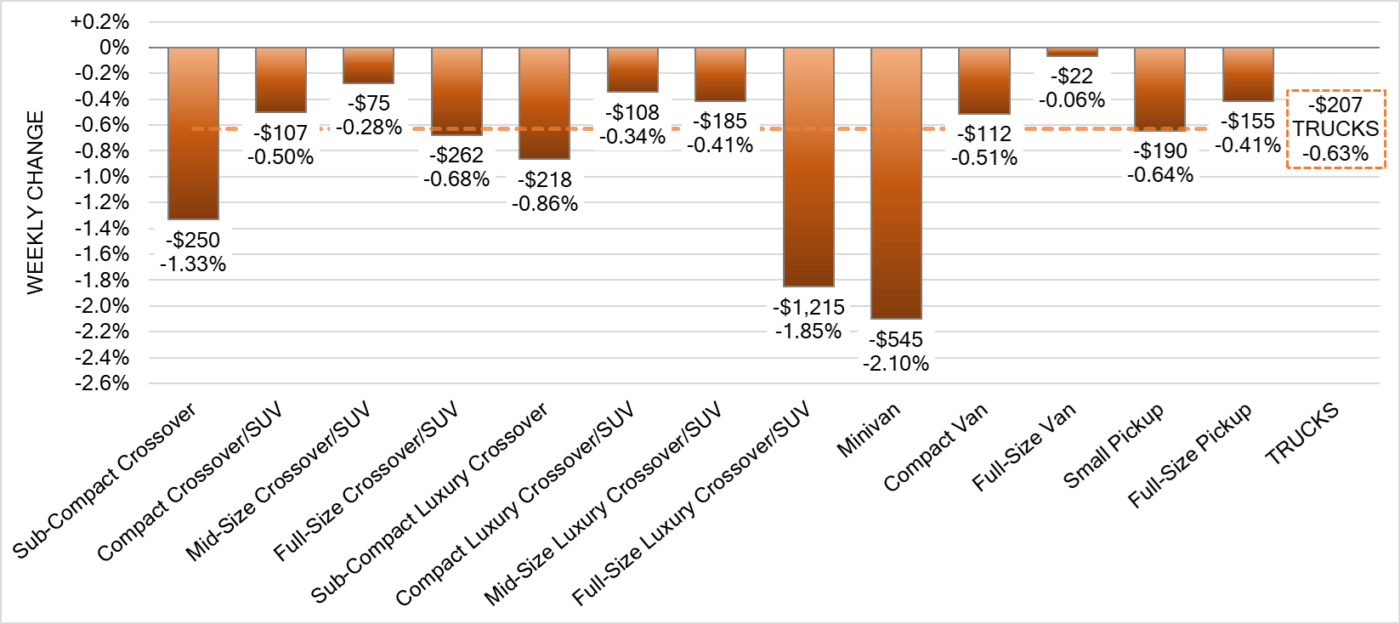

Truck Segments

- Last week truck segments reflected an overall decrease of -0.63%.

- All segments showed a downturn. The segment with the most significant decline was Minivan (-2.10%), followed by Full-Size Luxury Crossover/SUV (-1.85%) and Sub-Compact Crossover (-1.33%).

- Other segments with a notable softening were Sub-Compact Luxury Crossover (-0.86%) and Full-Size Crossover/SUV (-0.68%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,000. Analysis is based on approximately 206,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week. Some observed sell rates were as low as 6.6% and as high as 58% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The unemployment rate in Canada rose to 5.7% in October of 2023 from 5.5% in the previous month, the highest since January of 2022 and above market expectations of 5.6%.

- The Canadian economy added 17.5K jobs in October 2023, below market expectations of 22.5K, but marking the third consecutive month of expansion in the workforce.

- The yield on the Canadian 10-year government bond sank toward the 3.7% level, the lowest in seven weeks, aligned with the sharp declines in US Treasury yields as a series of soft jobs data in North America backed the Bank of Canada and the Federal Reserve signals that they may refrain from raising interest rates further.

- The Canadian dollar is around $0.732 this Monday morning up from $0.722 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.95% last week; the prior week decreased by -0.60%.

Volume-weighted Car segments decreased -0.57%, compared to the prior week’s -0.53% decrease:

- The 0-to-2-year-old Car segments were down -0.49% and 8-to-16-year-old Cars declined -0.53%.

- All nine Car segments decreased last week.

- Mid-Size Cars had the largest Car segment decline last week, depreciating -0.99%, compared with -0.60% the week prior.

- Sub-Compact Car also had a large depreciation last week, dropping -0.92%. Over the last four weeks, the segment has averaged a weekly decline of -0.85%.

- Premium Sporty Cars continue to report minimal depreciation, dropping -0.13% compared with the prior week’s -0.15%.

Volume-weighted Truck segments decreased by -1.12%; the previous week decreased -0.63%:

- The 0-to-2-year-old models declined -0.86% on average and the 8-to-16-year-olds decreased by -1.18%.

- All thirteen Truck segments declined last week.

- Compact and Full-Size Vans were hot commodities during the pandemic and after record setting increases, the segments are now experiencing consistent large declines. The Compact Vans declined -2.01% last week versus 1.80% the week prior.

- The Compact Crossover segment also had a large decline last week, dropping -1.74%. This compares with the prior week’s decline of -1.13%.

Industry News

- Pent-up demand and improvements in new vehicle inventory have supported the 12th consecutive month of sales gains with October improving 20% over a very weak month last year – Toyota and Kia reported the largest year-over-year gains of more than 35% each.

- Telus Corp. is partnering with the Flo network of EV chargers to improve reliability of its stations, providing real-time visibility through receiving performance-based data that will help conduct timely diagnostics remotely, providing support when something isn’t working as it should which can reduce down time.

- Rivian has very slowly entered the Canadian market with its R1T and R1S electric models but is now increasing its staff volume for service centers in Alberta, Ontario, as well as Quebec, as it prepares to deliver vehicles in early 2024.

- With current waning interest in electric vehicles, Toyota Motor Corp. has reduced its sales planning on battery-electric models as the brand realizes record profits through its lineup of Hybrid and Plug-ins. It has reduced its volume expectations 39% for its fiscal year ending March 31st.