12.12.2023

Market Insights – 12/12/2023

Wholesale Prices, Week Ending December 9th

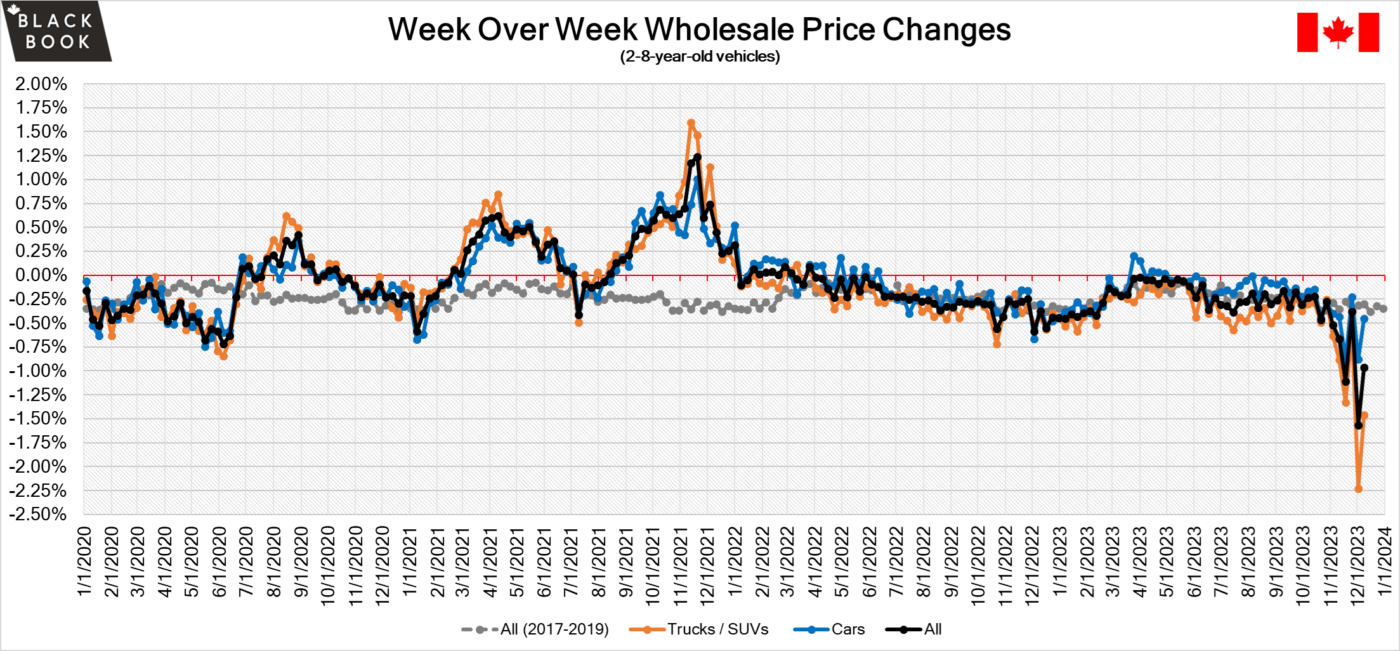

The Canadian used wholesale market saw a decline in prices for the week at –0.96%. The Car segment fell by -0.46% and the Truck/SUVs segment prices declined –1.46%. 2 out of 22 segments’ values have increased for the week. The Full-Size Crossover/SUV segment increased 0.81% followed by the Full-Size Car segment at +0.02%. The segments with the largest declines were Full-Size Luxury Crossover/SUV at –2.95% followed by Compact Crossover/SUV at –2.56%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.46% | -0.88% | -0.35% |

| Truck & SUV segments | -1.46% | -2.23% | -0.26% |

| Market | -0.96% | -1.56% | -0.30% |

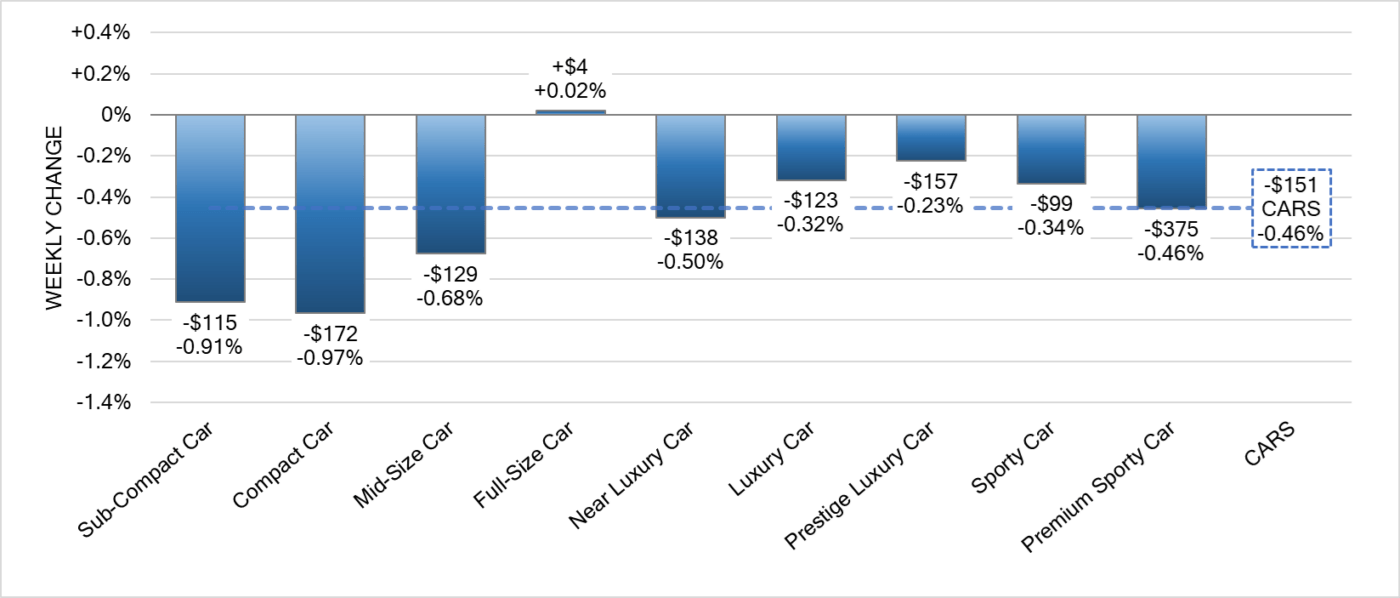

Car Segments

- There was an overall decrease of -0.46% seen in Car segments last week. This decrease was seen across all but one of the nine segments.

- Full-Size car was the only segment to show an increase in pricing with a (+0.02%) change.

- Compact Car showed the most significant decrease with a (-0.97%) drop in pricing, followed by Sub-Compact Car at (-0.91%) and Mid-Size Car at (-0.68%).

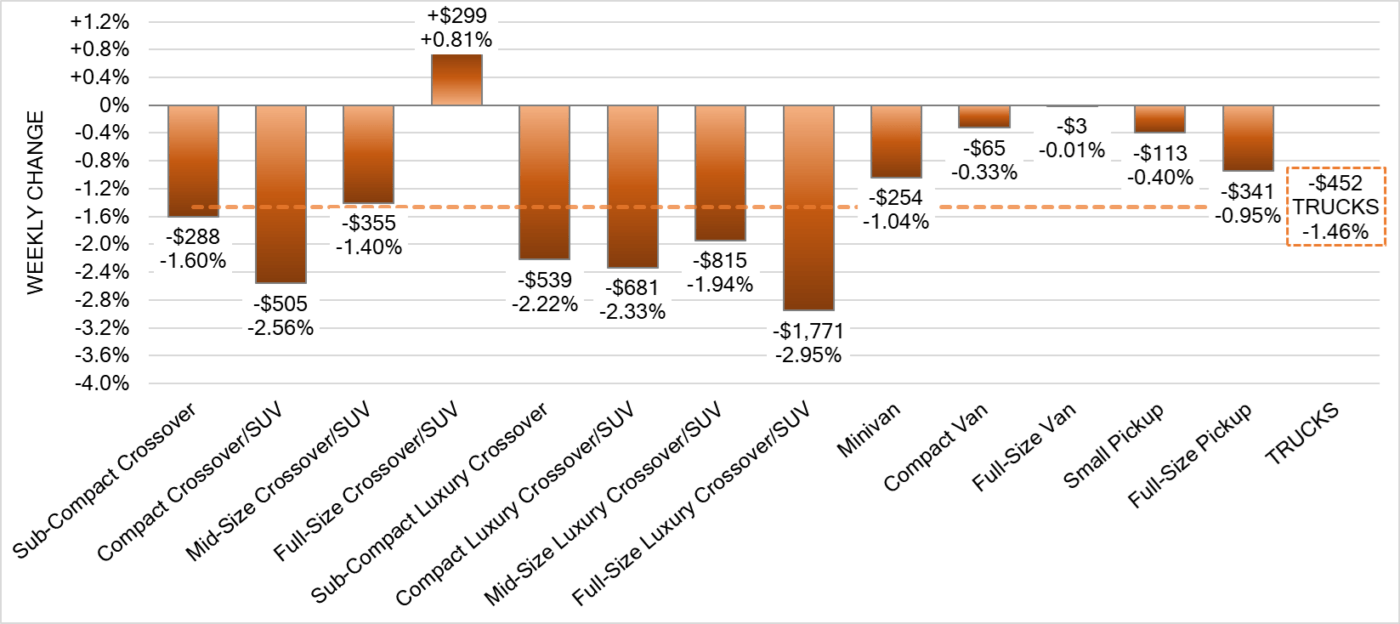

Truck Segments

- Last week there was an overall decrease in truck segments of -1.46%.

- Segments with the largest depreciation were Full-Size Luxury Crossover/SUV (-2.95%), Compact Crossover/SUV (-2.56%) and Compact Luxury Crossover/SUV (-2.33%).

- One segment had an increase. That segment was Full-Size Crossover/SUV (+0.81%).

Used Retail Prices & Listing Volumes

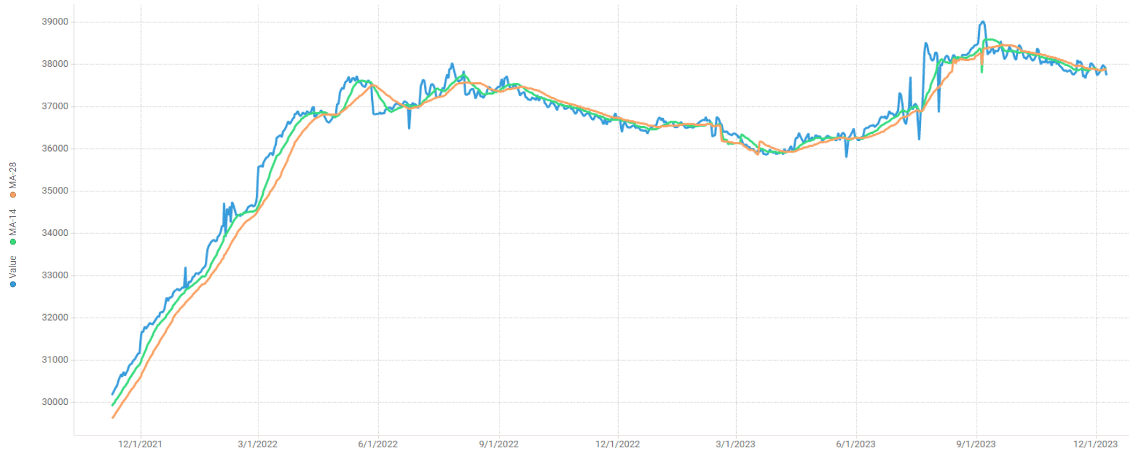

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,875. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease continues the high level of declines more than the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 2% and as high as 48% but most were less than 25%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Bank of Canada held its target for the overnight rate at 5% for a third consecutive meeting in December 2023, in line with market expectations, leaving borrowing costs at a 22-year high.

- The S&P Global Canada Services PMI fell to 44.5 in November 2023, down from 46.6 in the previous month, marking the sixth consecutive month of contraction and at the sharpest rate since June 2020.

- Canada recorded a trade surplus of 2.97 billion dollars in October 2023, from the downwardly revised 1.12 billion dollars in the previous month and surpassing market expectations of 1.6 billion dollars.

- The yield on the Canadian 10-year government bond dips slightly to 3.4%.

- The Canadian dollar is around $0.737 this Monday morning up slightly from $0.733 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.49% last week; the prior week decreased by -1.86%.

Volume-weighted Car segments decreased -1.72%, compared to the prior week’s -2.40% decrease:

- The 0-to-2-year-old Car segments were down -1.36% and 8-to-16-year-old Cars declined -2.15%.

- All nine Car segments decreased last week, with four of those segments reporting declines greater than 2%.

- Sporty (-3.55%) and Full-Size (-3.35%) Car segments had the largest declines last week, compared with -3.32% and -2.83% the week prior, respectively.

- Compact Car had another week of large declines with a drop of -2.28%, but the declines slowed compared to the previous two weeks that were both in excess of -3.5%.

- Premium Sporty Cars, once again, had the lowest depreciation last week, declining -0.37%, a typical single week depreciation for this time of year.

Volume-weighted Truck segments decreased by -1.40%; the previous week decreased -1.64%:

- The 0-to-2-year-old models declined -1.18% on average and the 8-to-16-year-olds decreased by -1.32% on average.

- All thirteen Truck segments declined last week. Two of the thirteen segments had declines greater than 2%, compared with four of the thirteen the week prior.

- The Full-Size Luxury Crossover/SUV (-3.17%) segment reported a third consecutive week with depreciation greater than 3%.

- Compact Vans had the smallest single week depreciation that the segment has experienced in the last six weeks, with a decline of -1.07% last week. The previous six weeks averaged a weekly decline of -3.07%.

Industry News

- Jeep is discontinuing its Renegade sub-compact SUV in North America after 2023MY due to declining sales; the model was introduced in 2015.

- GM CEO Mary Barra said that the next generation Chevrolet Bolt will arrive in 2025 after scheduling an end to production of its current model after this year to retool the production facility for building electric pickups as well as reintroduce the upcoming Bolt to be produced on the Ultium platform.

- New car sales in November came in 20.7% above last year, as this represents the largest gain in year-over-year sales growth and marks the 13th consecutive improvement in sales over last year, as 138,747 vehicles were sold – though still below pre-pandemic numbers.

- Fisker Automotive announced its Country Manager this week, naming Wolfgang Hoffman after leaving his position as President of Jaguar Land Rover Canada.

- Openlane has announced its plans to purchase Manheim Canada, as the organizations’ CEO Peter Kelly says it will retain 100 Manheim Canada staff but discontinue all Canadian wholesale auctions except for its operations in Montreal.

- Ineos Automotive has announced its dealer selection for Canadian sales in 2024, as its received almost 9,000 North American orders for its first model, the Grenadier – Dilawri will open a store in Mississauga, ON and Weissach will open in Vancouver, B.C.