12.17.2024

Market Insights – 12/17/24

Wholesale Prices, Week Ending December 14th, 2024

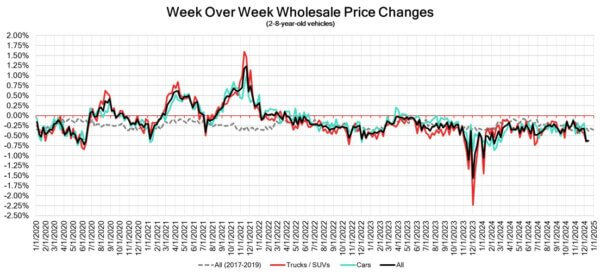

The Canadian used wholesale market experienced a decline of –0.63% in pricing for the week. Car segments prices decreased by –0.62% while the Truck/SUVs segments dropped -0.63%.The largest declines in the car segments were seen in Sub-Compact Car at -1.35% and Compact Car with -1.11%. The largest declines in the Truck/SUV segments were Minivan at -1.98% followed by Mid-Size Crossover/SUV with -1.07%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.62% | -0.62% | -0.45% |

| Truck & SUV segments | -0.63% | -0.65% | -0.31% |

| Market | -0.63% | -0.64% | -0.38% |

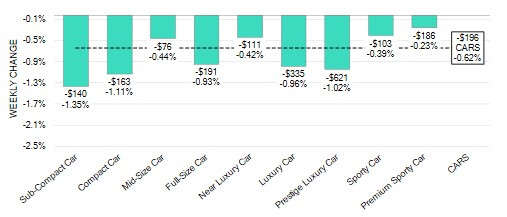

Car Segments

- Car segments once again saw an overall decline of -0.62%, with all nine segments trending downwards.

- The three segments that decreased the least were Premium Sporty Car (-0.23%), Sporty Car (0.39%), and Near Luxury Car (-0.42%)

- The largest decreases were seen from Sub-Compact Car (-1.35%), Compact Car (-1.11%), and Prestige Luxury Car (-1.02%).

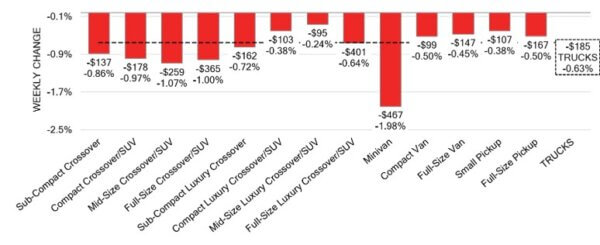

Truck / SUV Segments

- There was an overall depreciation of –0.63% in truck segments last week. All thirteen segments showed a negative movement.

- Those with the largest declines were Minivan (-1.98%), Mid-Size Crossover/SUV (-1.07%) and Full-Size Crossover/SUV (1.00%).

- Segments with the smallest declines were Mid-Size Luxury Crossover/SUV (-0.24%), Compact Luxury Crossover/SUV and Small Pickup (-0.38%).

Wholesale

The Canadian market remains on a downward trajectory, almost mirroring its previous week’s decline. Just over 86% of market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell by 2%. Monitored auction sale rates ranged from 15.4 to 70.1% averaging at 43.5%. The continuous fluctuation in sale rates across various lanes can be attributed several factors including the recent adjustments to interest rates and the ongoing gradual decline in floor prices. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continuing to gain early access. As the year nears to an end there continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,400. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada lowered its key interest rate by 50 basis points during its

December meeting, marking the second consecutive cut. This move, anticipated

by the markets, brings the total reduction to 175 basis points from the cycle’s

peak of 5%. - In the third quarter of 2024, Canadian industries operated at 79.3% of their

production capacity, a slight increase from 79.1% in the second quarter and

surpassing market expectations of 78.9%. - Canada’s annual inflation rate was 1.9% in November 2024, down from 2% in

October and below market expectations of 2%. - The yield on the Canadian 10-year government bond slightly increase to 3.21%.

- The Canadian dollar is around $0.703 this Monday morning, representing a slight

decrease from $0.706 a week prior.

U.S. Market

- The market continued its downward trend last week, with the rate of decline being quite typical for this time of year. In comparison, the standard depreciation for this same week before the pandemic was 0.60%, whereas last week’s overall depreciation rate was 0.53%.

Industry News

- Larry Hutchinson, CEO of Toyota Canada for the last 8 years will be retiring at the end of the month. Capping off an illustrious 40-year career with the brand. Along with him, Stephen Beatty will also be retiring after his 26 years with the company from his latest role as Corporate Secretary.

- Canada’s Federal ZEV Rebate will be up for renewal in March of 2025, and with claims ramping up with the highest market share levels seen to date, the decision whether to renew or not is still up in the air. Over the past 5 years, the program has provided $2.3 billion in rebates as of October says Transport Canada.

- Tim Kuniskis, the previous CEO of Dodge and Ram brands within Stellantis is now back to lead Ram as its CEO amidst the turmoil of global leadership within the organization of which he announced his retirement from just 6 months prior.

- StatsCan has shared its market share numbers on Q3 ZEV adoption, and the numbers are up nearly 20%over Q2, with a total of 75,636 units. 74% of which are full battery electric vehicles, representing 11.6% market share in Canada.

- New vehicles coming for 2025 are significant redesigns as well as all-new nameplates with the next generation VW Tiguan and Hyundai Palisade, along with the Acura ADX sub-compact luxury crossover and Hyundai Ioniq 9 three-row electric crossover that are first-time vehicles to the market.