12.19.2023

Market Insights – 12/19/2023

Wholesale Prices, Week Ending December 16th

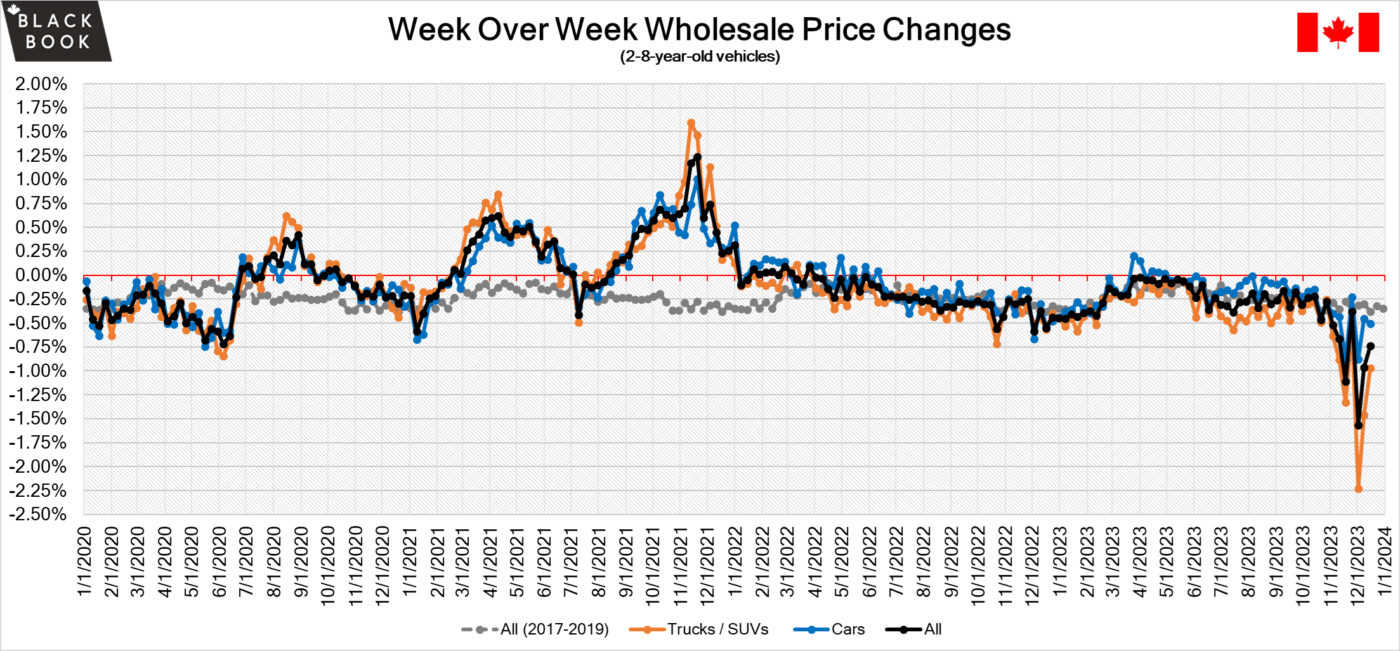

The Canadian used wholesale market saw a decline in prices for the week at –0.74%. The Car segment fell by -0.51% and the Truck/SUVs segment prices declined –0.97%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Compact Crossover/SUV at –1.59% followed by Sub-Compact Luxury Crossover/SUV at –1.40%.

| This Week | Last Week | |

| Car segments | -0.51% | -0.46% |

| Truck & SUV segments | -0.97% | -1.46% |

| Market | -0.74% | -0.96% |

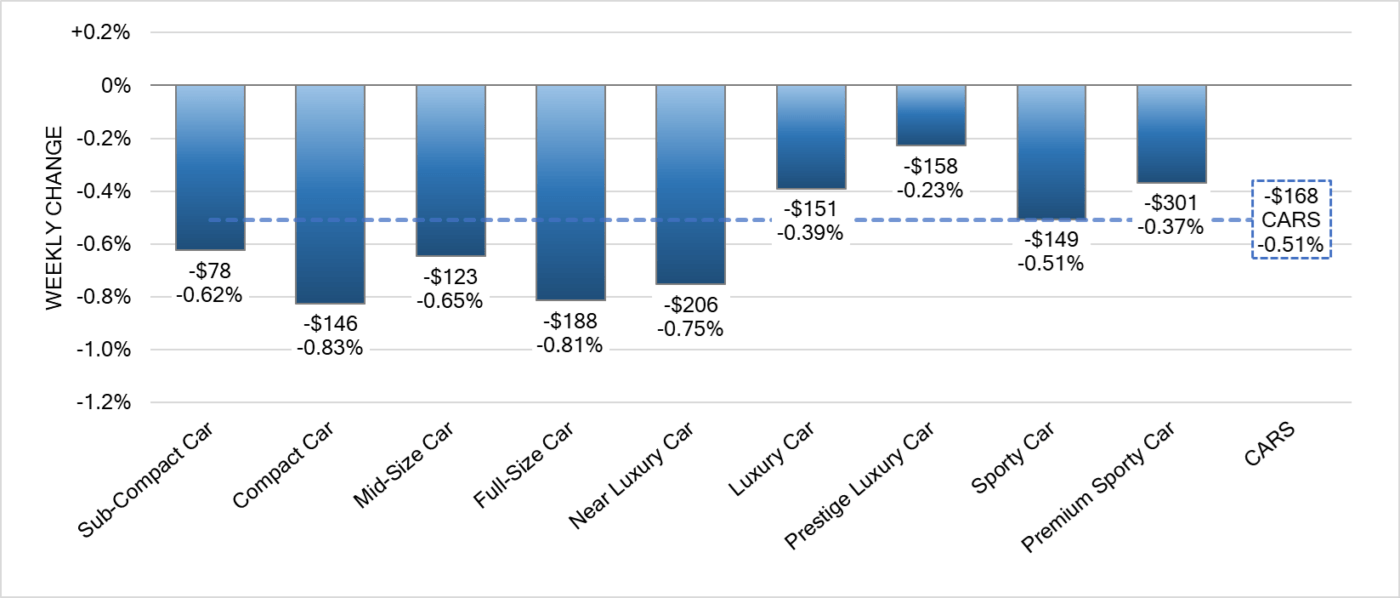

Car Segments

- Last week there was an overall decrease of -0.51% seen in Car segments. This decrease was seen across all nine segments.

- Compact Car showed the most significant decrease with a (-0.83%) drop in pricing, followed closely by Full-Size Car at (-0.81%) and Near Luxury Car at (-0.75%).

- The Segments with the least decreases were Prestige Luxury Car at (-0.23%) and Premium Sporty Car with (-0.37%).

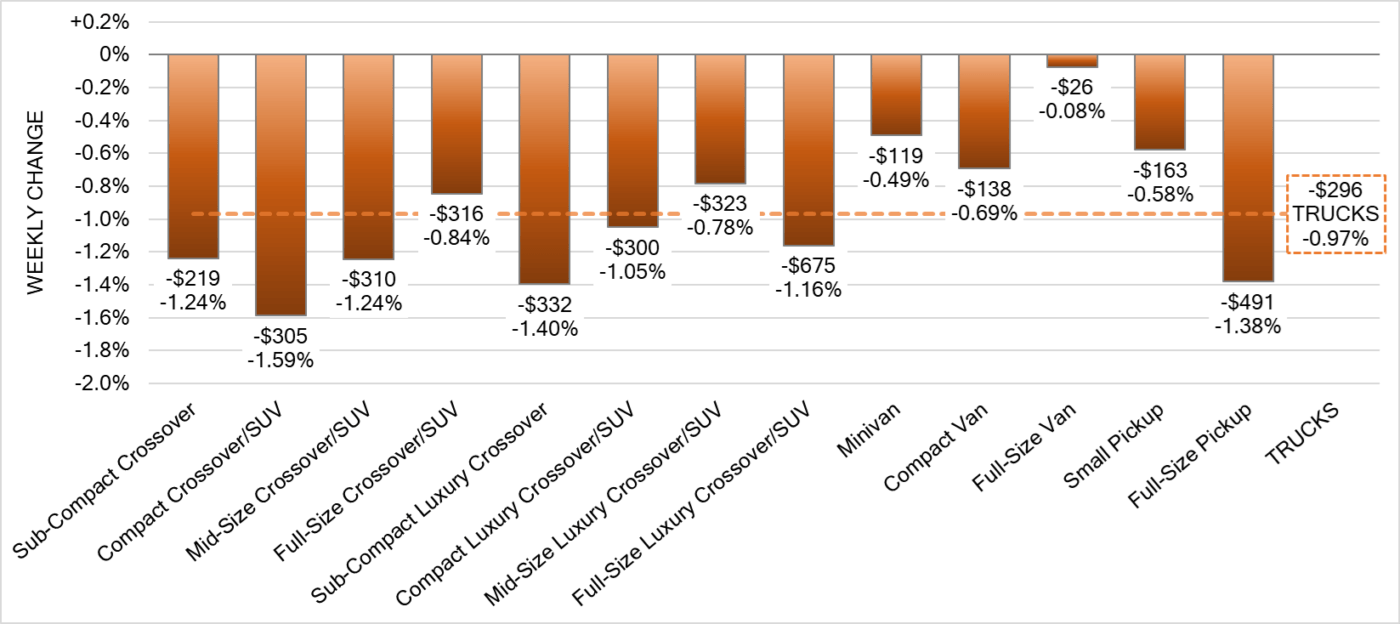

Truck Segments

- There was an overall decrease of -0.97% in truck segments last week.

- All sectors of trucks had a depreciation. Those with the largest were Compact Crossover/SUV (-1.59%), Sub-Compact Luxury Crossover (-1.40%) and Full-Size Pickup (-1.38%).

- Two segments had the same decline. Those were Sub-Compact Crossover and Mid-Size Crossover/SUV (-1.24%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,750. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease continues the high level of declines more than the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 8.7% and as high as 87% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- New home prices for Canada went down by 0.2% month-over-month in November 2023, following a flat reading in October and slightly surpassing market expectations of a 0.1% downtick.

- Housing starts in Canada slipped by 22% over a month earlier to 212,624 units in November 2023, missing market expectations of 257,100 units, according to the Canada Mortgage and Housing Corporation.

- Canada’s manufacturing sales dropped by 2.8% from a month earlier to $71 billion in October of 2023, following an upwardly revised 0.7% gain in September and compared to preliminary estimates of a 2.7% decline.

- The yield on the Canadian 10-year government bond dips slightly to 3.2%.

- The Canadian dollar is around $0.747 this Monday morning up slightly from $0.737 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.05% last week; the prior week decreased by -1.49%.

Volume-weighted Car segments decreased -1.03%, compared to the prior week’s -1.72% decrease:

- The 0-to-2-year-old Car segments were down -0.77% and 8-to-16-year-old Cars declined -1.58%.

- Premium Sporty Car continues to decline at a rate that is more in-line with the typical seasonal declines, down -0.54% last week. Over the past six weeks, the segment has averaged a weekly decline of -0.49%. This compares with the Sporty Car segment that has averaged -2.10% over the last six weeks.

- The Compact Car segment has had exceptionally high depreciation in recent weeks, one week even by as much as -4.32%, but last week, the rate of decline slowed to -1.13%.

- The Luxury Car segment also had one of the larger declines of all car segments, down -1.38%.

Volume-weighted Truck segments decreased by -1.06%; the previous week decreased -1.40%:

- The 0-to-2-year-old models declined -0.97% on average and the 8-to-16-year-olds decreased by -0.96% on average.

- Minivan reported the smallest decline last week, dropping -0.72%. With all the large declines across many of the segments in recent weeks, the Minivan segment has had lower depreciation compared with the rest of the market.

- In sharp contrast to the Minivans, the Compact Van segment continues to report large declines, but the rate of decline is slowing, dropping -1.71% last week, compared with the average weekly depreciation over the past eight weeks of -2.65%.

Industry News

- GM Canada President, Marissa West, is leaving her post as she receives a promotion that moves her to the U.S. to lead operations as President of GM North America in a shuffle of executives for the brand that take effect as of January 2nd, 2024.

- Statistics Canada released updated market share numbers showing that in the third quarter of this year Canadian ZEV registrations accounted for 12.1% of all new vehicle sales, up from 8.7% at the same time last year; almost tripling volume for PHEV’s while BEV’s gained more than a third of their volume.

- Suppliers to Ford say the brand is cutting F-150 Lightning production in half due to slower sales growth than initially expected – going from a goal production level of 3,200 vehicles per week down to 1,600.

- As the GM lineup of EV’s looks to continue growing, Cadillac plans to add a three-row crossover that slots between the Lyriq and Escalade IQ, called the Vistiq which should reach the market by 2026 – a model that has not yet been confirmed on its size, but is speculated to have proportions similar to the brands XT6 mid-size SUV.

- More than two years after the initiated defect investigation into Tesla’s AutoPilot feature, the U.S. National Highway Traffic & Safety Administration (NHTSA) is ordering the recall of more than 2 million vehicles across all model lines (193,000 in Canada) dating back from December of this year to 2012, the brands largest recall ever.