12.23.2024

Market Insights – 12/23/24

Wholesale Prices, Week Ending December 21st, 2024

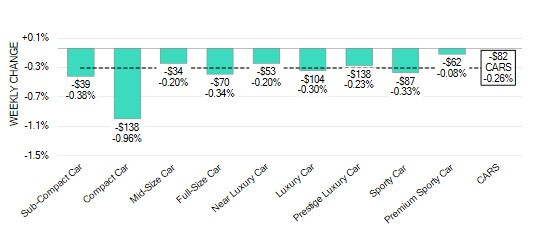

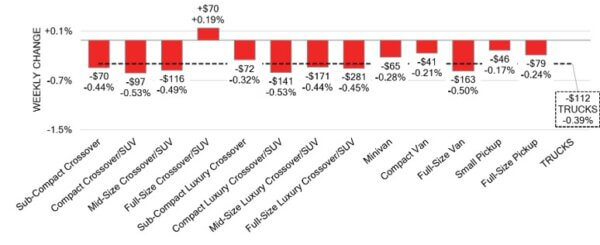

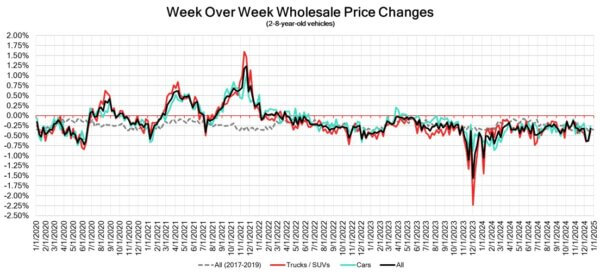

The Canadian used wholesale market experienced a decline of –0.33% in pricing for the week. Car segments prices decreased by –0.26% while the Truck/SUVs segments dropped -0.39%. The largest declines in the car segments were seen in Compact Car at -0.96% and Sub-Compact Car with -0.38%. The largest declines in the Truck/SUV segments were Compact and Luxury/Compact Crossover/SUVs both at -0.53% followed by Full-Size Van with -0.50%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.26% | -0.62% | -0.36% |

| Truck & SUV segments | -0.39% | -0.63% | -0.28% |

| Market | -0.33% | -0.63% | -0.32% |

Car Segments

- Car segments continue to decline, with all nine segments trending downwards at an average of -0.26%.

- The three segments that decreased the least were Premium Sporty Car (-0.08%), Mid-Size Car (-0.20%), and Near Luxury Car (-0.20%)

- The largest decreases were seen from Compact Car (-0.96%), Sub-Compact Car (-0.39%, and) Full-Size Car (-0.34%)

Truck / SUV Segments

- An overall depreciation of –0.39% was seen in truck segments last week. Twelve of the thirteen segments showed this negative movement.

- Segments with the largest declines were Compact Crossover/SUV and Compact Luxury Crossover/SUV (-0.53%), Full-Size Van (-0.50%) and Mid-Size Crossover/SUV (-0.49%).

- One segment reflected an increase. That segment was Full-Size Crossover/SUV (+0.19%).

Wholesale

The Canadian market remains on a downward trajectory, with a decline far less pronounced that in its previous week. Just over 36% of market segments experienced an average value change of more than ±$100. The decrease in the car segments fell by 36%, while that of the truck segments dropped by 24%. Monitored auction sale rates ranged from 7 to 70% averaging at 32.6%. The continuous fluctuation in sale rates across various lanes can be attributed several factors including the recent adjustments to interest rates and the ongoing gradual decline in floor prices. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continuing to gain early access. As the year nears to an end there continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,400. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s annual inflation rate stood at 1.9% in November 2024, slightly down

from 2% in the previous month and falling short of market expectations of 2%.

This outcome aligns with the Bank of Canada’s baseline projection that CPI

inflation will remain near the 2% mark in the foreseeable future. - New home prices in Canada rose by 0.1% over a month in November 2024,

following a 0.4% decrease in October and matching market forecasts. - Canada’s government budget deficit narrowed to $1.5 billion in October 2024,

down from $7 billion in the same month of the previous year. - The yield on the Canadian 10-year government bond slightly increase to 3.28%.

- The Canadian dollar is around $0.693 this Monday morning, representing a slight

decrease from $0.703 a week prior.

U.S. Market

- Last week, the auctions recorded the highest total inventory of the year, accompanied by a 2% decrease in the auction conversion rate. Although depreciation slowed for the second week in a row, buyers are showing increased caution. The market’s -0.46% decline aligns with typical seasonal depreciation patterns, slightly better than the pre-pandemic average during the same week of -0.50%.

Industry News

- A partnership between Japanese auto brands Honda and Nissan could be decided as the two organizations discuss the possibility of joining together. The move would make them a global automotive juggernaut only behind Toyota and VW Group, providing both company’s larger scalability to bring costs down on developing new technologies.

- Subaru is developing an electrified transaxle that will hybridize a portion of the brands lineup outfitting this new technology known as “e-boxer “for 2026in the North American market for Crosstrek and Forester models.

- The Government of Canada’s Finance Minister, Chrystia Freeland resigned from the Cabinet early last week after Prime Minister Trudeau offered her another role which would remove her from power. Freeland was a strong proponent of the Canadian Auto Industry, starting her appointment as Finance Minister in 2015.

- As vehicle affordability is front and center in today’s automotive retail market, Stellantis has disregarded those concerns and slowly but surely removed affordable vehicles like the Dodge Grand Caravan, a $24,999 family hauler in 2020, by reimagining it as a Chrysler at double the price, $49,995 in 2024.Also discontinuing the Ram Classic, Jeep Renegade and Jeep Cherokee, the incentivized Jeep Compass has become the only sub-$40,000option for the budget-minded or first-time buyers considering a Stellantis vehicle.

- Due to a rush of buyers in anticipation of the rebate reduction in Quebec come 2025, the province has stopped its Roulez vert funding on ZEVs for 60 days, starting in February 2025.

- StatsCan has reported retail sales for the most recent data as of October which increased by 0.6%, with the largest part of that increase coming from automotive retail at 2.5%.