12.27.2023

Market Insights – 12/27/2023

Wholesale Prices, Week Ending December 23rd

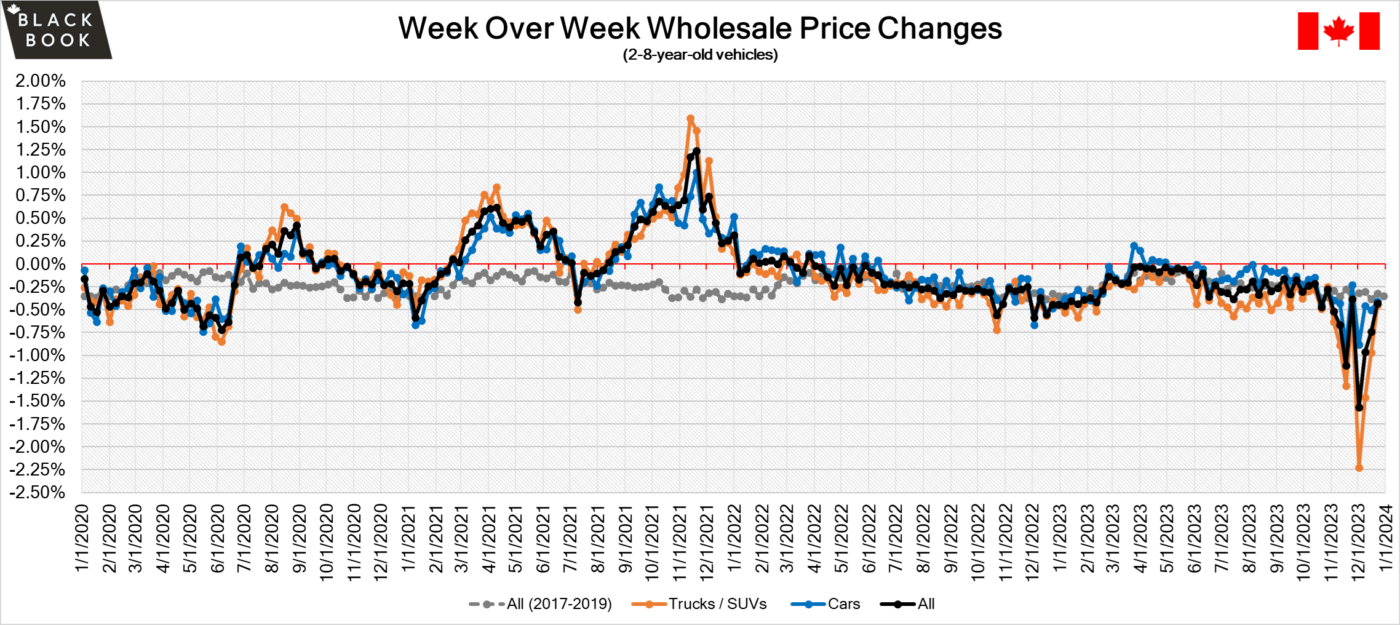

The Canadian used wholesale market saw a decline in prices for the week at –0.43%. The Car segment fell by -0.41% and the Truck/SUVs segment prices declined –0.45%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Sub-Compact Luxury Crossover at –1.20% followed by Sub-Compact Crossover at –1.08%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.41% | -0.51% | -0.36% |

| Truck & SUV segments | -0.45% | -0.97% | -0.28% |

| Market | -0.43% | -0.74% | -0.32% |

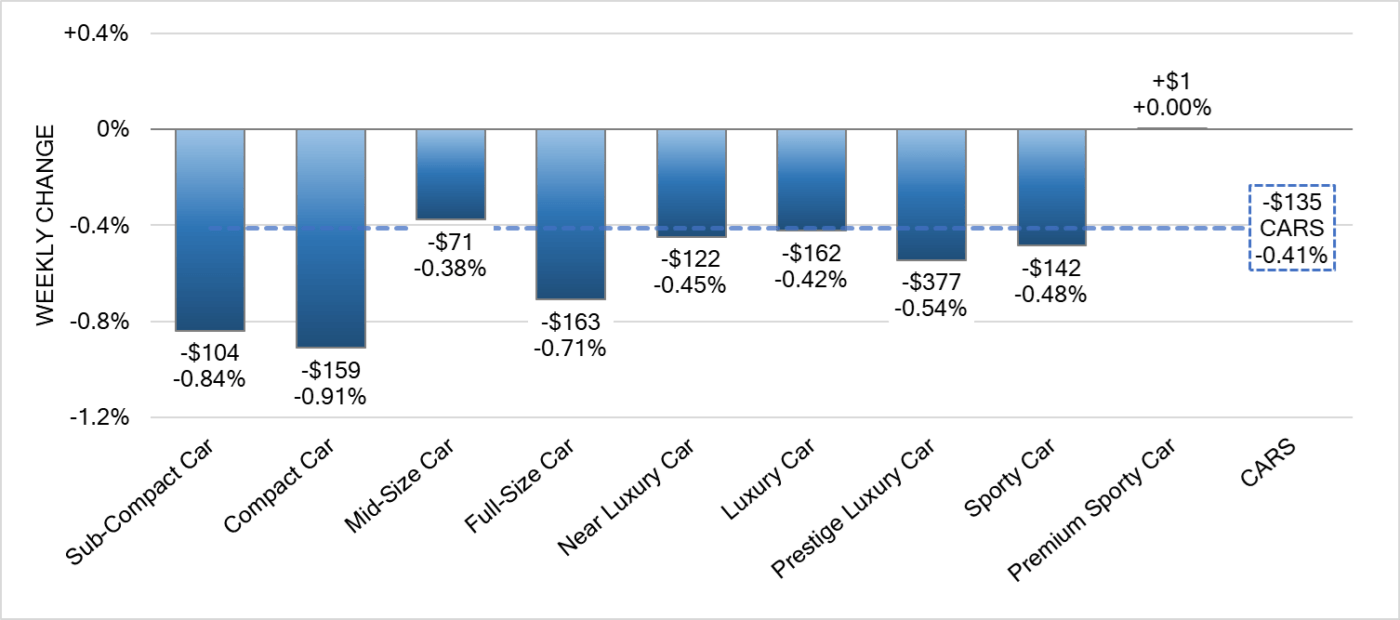

Car Segments

- Last week there was an overall decrease of -0.41% seen in Car segments. This decrease was seen across all but one of the nine segments.

- Premium Sporty Car showed no change in pricing.

- The most significant decrease was seen in Compact Car at (-0.91%), followed by Sub-Compact Car at (-0.84%) and Full-Size Car at (-0.71%).

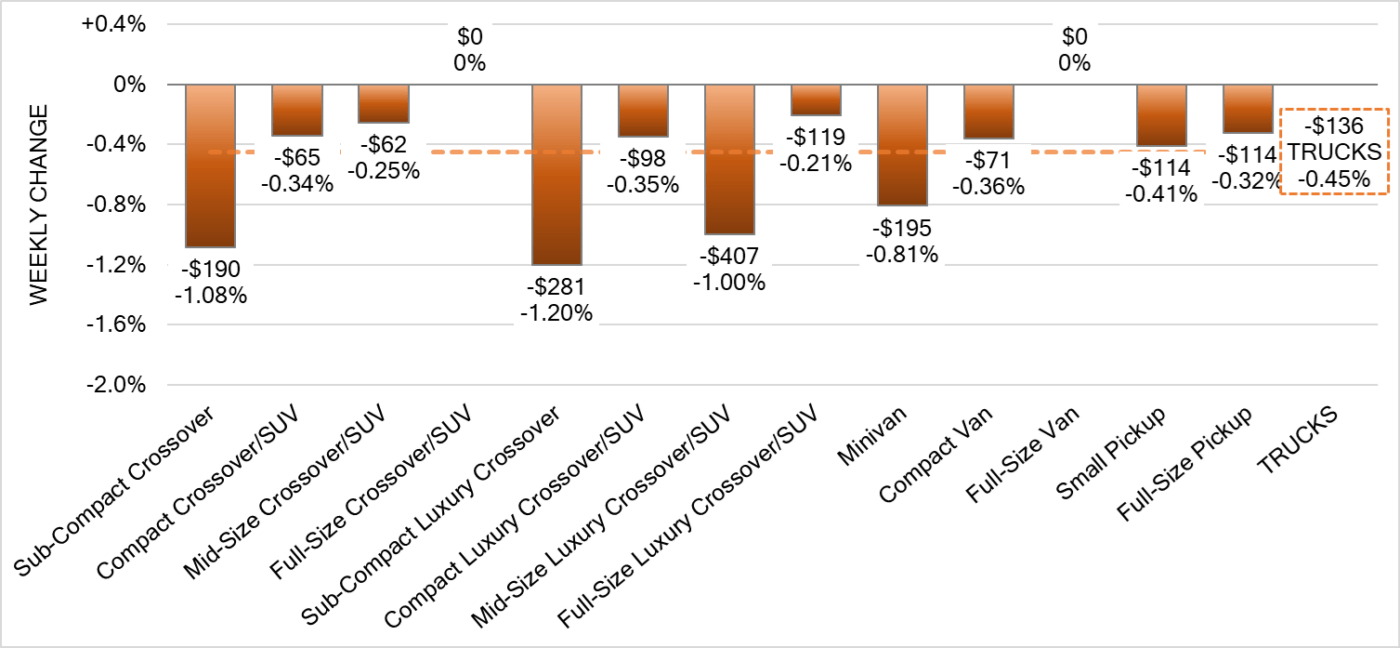

Truck Segments

- There was an overall decrease of -0.45% in truck segments last week.

- Segments with the largest drops were Sub-Compact Luxury Crossover (-1.20%), Sub-Compact Crossover (-1.08%) and Mid-Size Luxury Crossover/SUV (-1.00%).

- The only other segment with a notable depreciation was Minivan (-0.81%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,650. Analysis is based on approximately 210,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease slowed approaching the holidays with declines closer to the historical average. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite low this past week with some observed sell rates were as low as 16.5% and as high as 71% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The annual inflation rate in Canada was at 3.1% in November of 2023, remaining unchanged from the previous month and firmly above market expectations of 2.9%.

- Retail sales in Canada are expected to have stagnated in November of 2023, according to preliminary estimates. Considering October, retail sales rose by 0.7% month-over-month, revised lower from the preliminary estimates of a 0.8% rise and accelerating slightly from the downwardly revised 0.5% gain in September.

- Canada’s manufacturing sales likely rose 1.2% from a month earlier in November 2023, rebounding from a 2.8% decline in the previous month, preliminary estimates showed.

- The yield on the Canadian 10-year government bond increases slightly to 3.21%.

- The Canadian dollar is around $0.732 this Monday morning down slightly from $0.747 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.70% last week; the prior week decreased by -1.05%.

Volume-weighted Car segments decreased -0.51%, compared to the prior week’s -1.03% decrease:

- The 0-to-2-year-old Car segments were down -0.52% and 8-to-16-year-old Cars declined -0.91%.

- All nine Car segments decreased last week. For the first time in six weeks, none of the segments had depreciation exceeding 1%.

- The Sub-Compact Car segment had the largest depreciation last week, declining -0.93%. This compares with the average weekly decline over the last six weeks of -1.29%.

- The Compact Car segment had a dramatic decrease in depreciation, 0.30% last week compared with the prior week’s decline of -1.13%. This was the lowest single week depreciation for the segment since late October.

Volume-weighted Truck segments decreased by -0.78%; the previous week decreased -1.06%:

- The 0-to-2-year-old models declined -0.73% on average and the 8-to-16-year-olds decreased by -0.85% on average.

- All thirteen Truck segments declined last week, with only four of the thirteen reporting declines exceeding 1%.

- The Compact Crossover/SUV segment had the smallest depreciation last week, declining -0.48%, compared with -0.96% the previous week.

- The Sub-Compact Luxury Crossover/SUV segment had the largest decline last week, dropping -1.28%. The segment has averaged a decline of -1.33% per week over the most recent eight weeks.

Industry News

- The Federal government has released its final details of the zero-emission vehicle sales mandate, and the targets remain unchanged as they are written into legislation. What has changed is the breakdown for achieving sales targets, as there are credits associated not only with vehicle sales, but investing in the charging infrastructure as well, and these credits can be traded between OEM’s like currency to achieve the mandated levels of EV share.

- Kia Canada is in hot water as details of a strategy to withhold vehicle deliveries to waiting customers has been released on a video call between a Regional Manager and many of the car makers dealer representatives. This strategy was used to enable Kia Canada to retain marketing dollars provided annually from Korean Headquarters, as the risk of it being removed loomed due to the brands great success in this region.

- Volkswagen, Audi, Porsche, and new EV brand Scout are the latest brands to join some other notable car makers in switching over their electric vehicles to the Tesla pioneered North American Charging Standard (NACS), as they announced the plan to adopt this system starting in 2025.

- Toyota is recalling 99,965 vehicles (between model years 2020-2022) in Canada for a malfunctioning sensor that could prevent airbags from deploying in a crash – the recalls affects 1.1 million vehicles globally.