12.03.2024

Market Insights – 12/3/24

Wholesale Prices, Week Ending November 30th, 2024

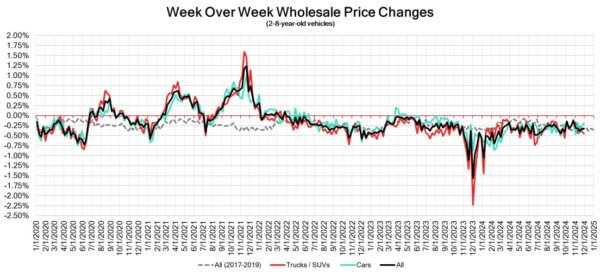

The Canadian used wholesale market experienced a decline of –0.33% in pricing for the week. Car segments prices decreased by –0.19% while the Truck/SUVs segments dropped -0.45%. The largest declines in the car segments were seen in Luxury Car at -0.78% and Compact Car with -0.31%. The largest declines in the Truck/SUV segments were Compact Luxury Crossover/SUV at -0.81% followed by Full-Size Luxury Crossover/SUV with -0.67%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.19% | -0.26% | -0.28% |

| Truck & SUV segments | -0.45% | -0.39% | -0.35% |

| Market | -0.33% | -0.33% | -0.31% |

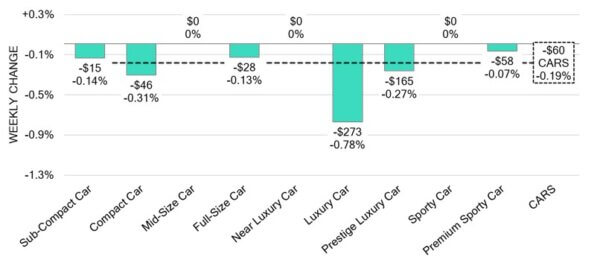

Car Segments

- Car segments saw an overall decline of -0.19% last week with six out of nine segments trending downwards and three segments seeing no change.

- The three segments that saw no change were Mid-Size Car, Near Luxury Car, and Sporty Car

- The largest decreases were seen from Luxury Car (-0.78%), Compact Car (-0.31%), and Prestige Luxury Car (-0.27%).

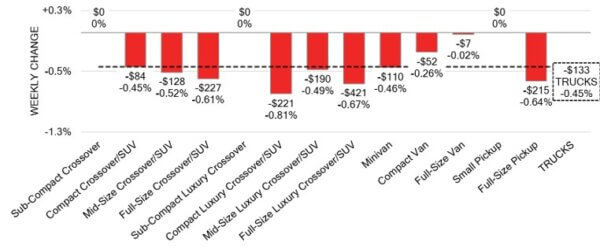

Truck / SUV Segments

- Truck segments saw an overall depreciation of–0.45% last week. Ten of thirteen truck segments trended downward.

- Segments with the largest declines were Compact Luxury Crossover/SUV (-0.81%), Full-Size Luxury Crossover/SUV (-0.67%), Full-Size Pickup (-0.64%) and Full-Size Crossover/SUV (-0.61%).

- The three segments with no change in pricing were Small Pickup, Sub-Compact Crossover and Sub-Compact Luxury Crossover.

Wholesale

The Canadian market remains on a downward trajectory, with a decline similar to its previous week. Just over 40% of market segments experienced an average value change of more than ±$100. Among these, the decline in car segments decreased by 7% compared to the week prior. Monitored auction sale rates ranged from 22.9 to 58.9% averaging at 45.8%. The continuous fluctuation in sale rates across various lanes can be attributed several factors including the ongoing gradual decline in floor prices and the recent adjustments to interest rates. An increase in supply entering the wholesale market has been noted once again, despite upstream channels continuing to gain early access. As the year nears to an end there continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $34,320. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP grew by 0.3% in the three months leading up to September 2024,

marking a slowdown compared to the 0.5% growth recorded in the first two

quarters of the year. This performance aligned with market expectations. - Canada’s current account deficit decreased to $3.2 billion in the third quarter of

2024, improving from a revised $4.7 billion in the second quarter and significantly

beating market estimates of a $9.3 billion deficit. - The S&P Global Canada Manufacturing PMI rose to 52.0 in November 2024,

increasing from 51.1 in October. - The yield on the Canadian 10-year government bond slightly decrease to 3.08%.

- The Canadian dollar is around $0.711 this Monday morning, representing a slight

decrease from $0.716 a week prior.

U.S. Market

- Depreciation slowed last week, with overall auction activity affected by the Thanksgiving holiday. The market saw a slight decline of just over a quarter percent, significantly less than the pre-pandemic average of -0.82% for the same week. This is also a marked improvement compared to the same time last year when the market experienced a substantial decline of -1.86%.

Industry News

- Stellantis CEO Carlos Tavares has stepped down from his position which takes immediate effect as of December 1stwhile leadership will be taken over by the Chairman of the Board, John Elkann.

- In a surprising move, Cadillac plans to discontinue its entry level XT4 Sub-Compact Crossover to the brand. With an internal survey of current XT4 owners, half reporting to be interested or open to an EV as their next vehicle, this will open the door to the all-electric Optiq that arrives at the start of 2025. However, this abandons those uninterested in an EV or looking for a low-priced Crossover entry point into this Luxury brand.

- Citing further “economic hardships has led to more consumers misrepresenting themselves on auto loan applications, as an increase in auto loan fraud is causing lenders and dealers to search high and low for solutions”, says Equifax Canada.

- EY Canada’s Mobility Consumer Index report identifies a slight decrease in Canadians interest in purchasing an EV as their next vehicle. The report highlighted that 48% are car shopping, up 6% from last year, but only 50% of those purchase intenders will consider an EV, down 2% year over year. This trend moves opposite the direction Global adoption.

- Google Canada says that three quarters of buyers who purchase an EV or Plug-in change brands, highlighting the concentration of viable EV’s and Plug-ins within certain early adopter brands selling in Canada.

- Wolfe Research estimates that tariffs imposed by Donald Trump would raise the average cost of a vehicle by $3,000 in the U.S. and could lower demand by 1 million vehicles. Imports from Canada and the U.S. make up to 40% volume for certain brands says Bernstein Research analysts.