12.30.2024

Market Insights – 12/30/24

Wholesale Prices, Week Ending December 28th, 2024

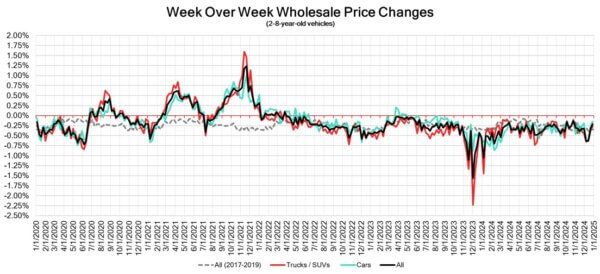

The Canadian used wholesale market experienced a decline of –0.21% in pricing for the week. Car segments prices decreased by –0.15% while the Truck/SUVs segments dropped -0.26%. Two Segments saw increases this week, Luxury Car +0.06% and Minivan +0.21%. The largest declines in the car segments were seen in Mid-Size Car at -0.42% and Near Luxury Car with -0.24%. The largest declines in the Truck/SUV segments were Full-Size Pickup at -1.30% followed by Sub-Compact Luxury Crossover/SUV with -0.53%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.26% | -0.32% |

| Truck & SUV segments | -0.26% | -0.39% | -0.39% |

| Market | -0.21% | -0.33% | -0.35% |

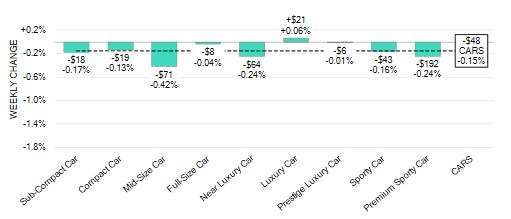

Car Segments

- Eight out of nine car segments declined this week with an average drop of -0.15%.

- The Luxury Car Segment (+0.06%) saw an increase, while Prestige Luxury Car (-0.01%) and Full-Size Car (-0.04%) decreased the least.

- The largest decreases were seen from Mid-Size Car (-0.42%), Near Luxury Car (-0.24%, and) Premium Sporty Car (-0.24%).

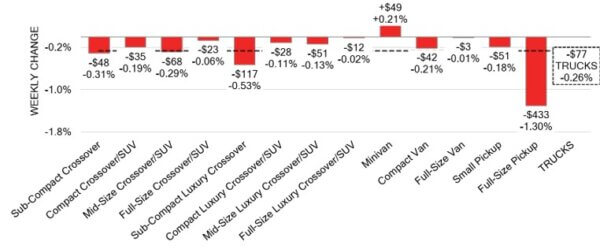

Truck / SUV Segments

- An overall depreciation of –0.26% was seen in truck segments last week. Twelve of the thirteen segments reflected this negative movement.

- Segments with the largest declines were Full-Size Pickup (-1.30%), Sub-Compact Luxury Crossover (-0.53%), Sub-Compact Crossover (-0.31%) and Mid-Size Crossover/SUV (-0.29%).

- One segment reflected an increase. That segment was Minivans (+0.21%).

Wholesale

The Canadian market remains on a downward trajectory, with a decline once again far less pronounced that in its previous week. Just over 13% of market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell by 13%, while that of the car segments dropped by 11%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the recent adjustments to interest rates and the ongoing gradual decline in floor prices. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. As the year nears to an end there continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

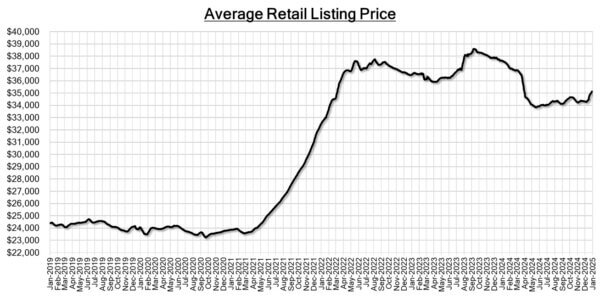

Used Retail Prices & Listing Volume

The average listing price for used vehicles is increasing slightly, as the 14-day moving average was at $35,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP decreased by 0.1% in November 2024 compared to the previous

month, marking the first decline in 11 months. This drop was attributed to reduced

output in extractive industries, transportation and warehousing, and financial

services, which outweighed gains in accommodation and food services as well as

real estate and rental and leasing, according to a preliminary estimate. - The Raw Materials Price Index in Canada decreased by 0.5% in November 2024

compared to the previous month, reversing a 4.0% rise in October and falling

short of the anticipated 0.6% increase. - The yield on the Canadian 10-year government bond slightly increase to 3.31%.

- The Canadian dollar is around $0.694 this Monday morning, representing a slight

decrease from $0.703 a week prior.

U.S. Market

- Due to the Christmas holiday last week, auction activity decreased significantly, with some auctions either rescheduling their sale dates or canceling altogether. This reduction in activity led to a sharp drop in the nation’s overall conversion rate, which fell to 44% from 56% the previous week. Additionally, depreciation slowed down, with the overall market declining by -0.38%, compared to a -0.46% decline the week before.

Industry News

- Federal iZEV rebate claims were recorded at 23,713 in November, very close to the record month set in October. The program has made almost 70,000 claims in the last 3 months and is under renewal come March 2025, providing rebates for more than 500,000 BEV and PHEV’s total since its inception in 2019.

- Accusations of human trafficking have been made in Brazil as 163 workers placed by the BYD contracted Jinjiang Group said they had been brought in by “slavery-like” conditions to the BYD factory construction site in the northeastern state of Bahia.

- The direct-to-consumer sales method for Volkswagen Group’s Scout Motors is under pressure from its California Dealer Association to stop taking refundable deposits on its vehicles, claiming that they are violating state laws against direct sales to consumers.

- Vehicles to be discontinued for 2025: Audi A5 2D Coupe, Chevrolet Malibu, Ford Edge, Infiniti Q50, Jaguar’s XF, F-type, I-Pace, and E-Pace, Lamborghini Huracan, Maserati Levante, Mini Clubman, Mitsubishi Mirage, Nissan GT-R, Ram Classic, Volvo S60