12.05.2023

Market Insights – 12/5/23

Wholesale Prices, Week Ending December 2nd

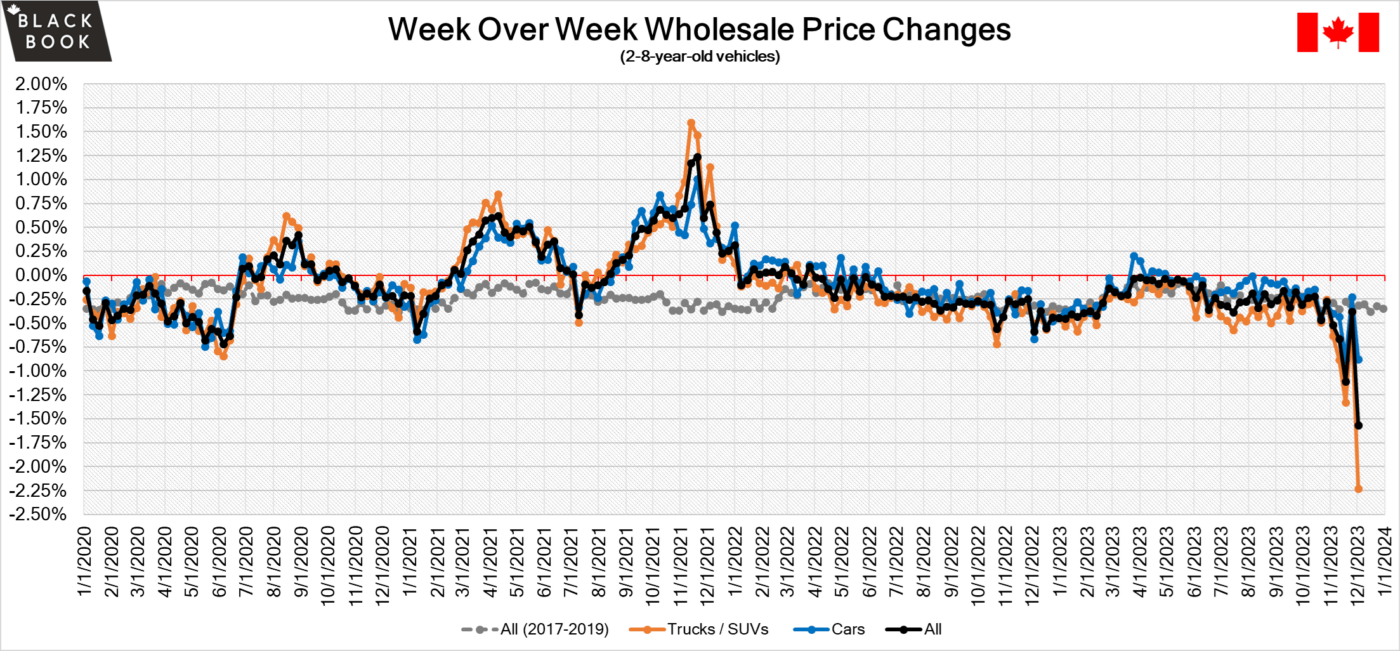

The Canadian used wholesale market saw a decline in prices for the week at –1.56%. The Car segment fell by -0.88% and the Truck/SUVs segment prices declined –2.23%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Luxury Compact Crossover/SUV at –3.57% followed by Compact Crossover/SUV at –3.56%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.88% | -0.23% | -0.28% |

| Truck & SUV segments | -2.23% | -0.53% | -0.35% |

| Market | -1.56% | -0.38% | -0.31% |

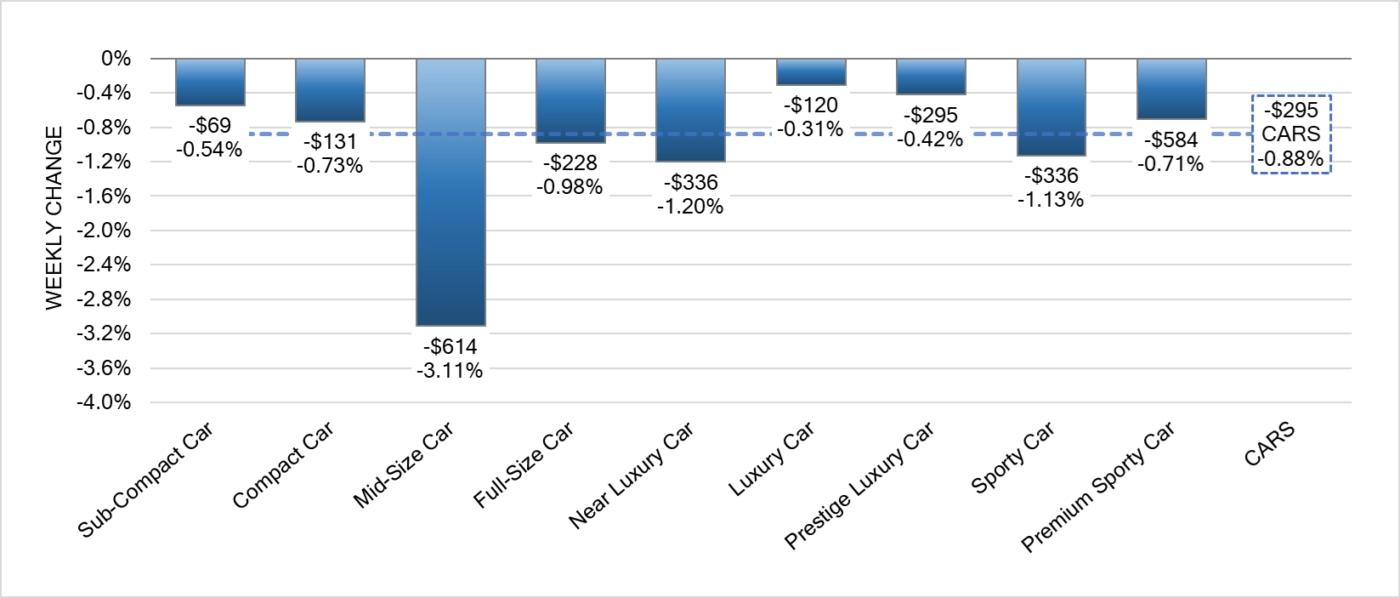

Car Segments

- There was an overall decrease of -0.88% seen in Car segments last week. This decrease was seen across all nine segments.

- Mid-Size Car showed the most significant decrease with a (-3.11%) drop in pricing, followed by Near Luxury Car at (-1.20%) and Sporty Car at (-1.13%).

- Luxury Car made the least impact with a decrease of (-0.31%) followed by Sub-Compact Car at a decrease of (-0.54%)

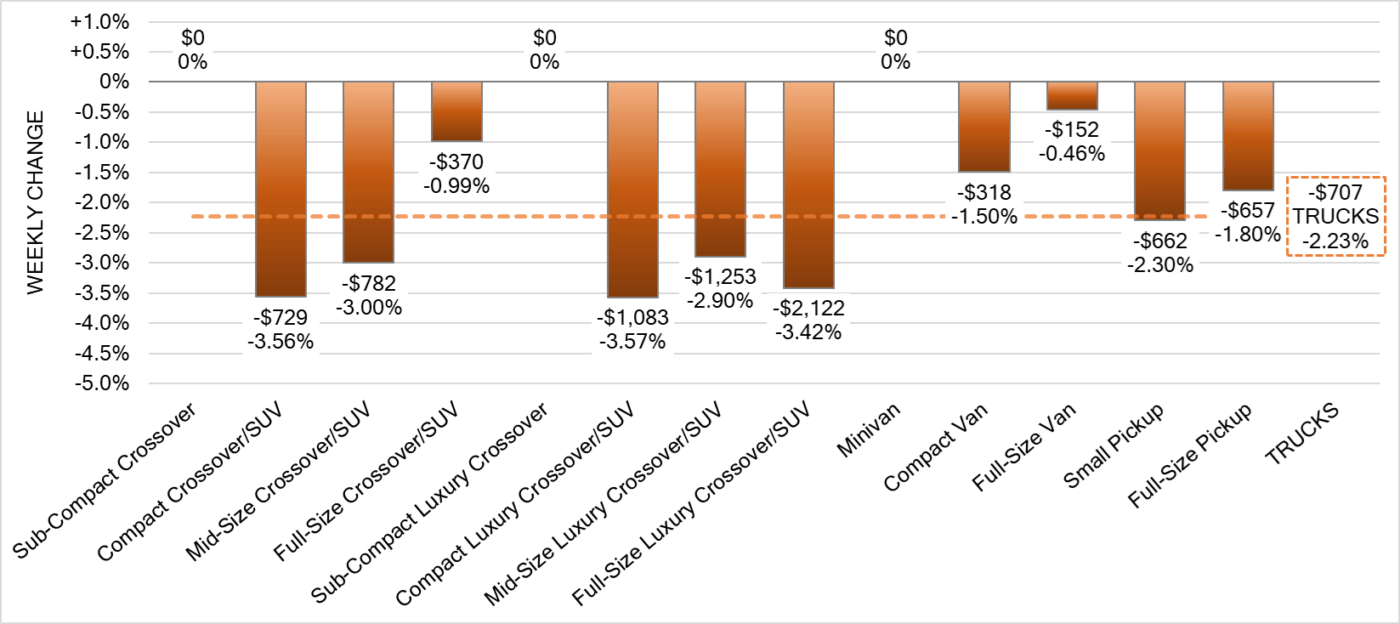

Truck Segments

- Last week there was an overall decrease in truck segments of -2.23%.

- Four segments had a 3% or greater depreciation. Those segments were Compact Luxury Crossover/SUV (-3.57%), Compact Crossover/SUV (-3.56%), Full-Size Luxury Crossover/SUV (-3.42%) and Mid-Size Crossover/SUV (-3.00%).

- Other segments with notable declines were Mid-Size Luxury Crossover/SUV (-2.90%) and Small Pickup (-2.30%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at roughly $37,870. Analysis is based on approximately 209,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was the largest seen this year and more than six times the historical average. Supply remains low with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. We see that smaller vehicles have been outperforming their larger alternatives as possibly both Canadian consumers budgets tighten and arbitrage risk to exporters continues to rise. Conversion rates were quite low this past week. Some observed sell rates were as low as 9% and as high as 49% but most were less than 30%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s GDP contracted by 0.3% in the third quarter of 2023, marking its first decline since the second quarter of 2021 and compared to a revised 0.3% expansion in the previous period.

- The unemployment rate in Canada rose to 5.8% in November 2023, up from 5.7% in the previous month, in line with market expectations.

- Consumer confidence increased in November to 47.26 from 45.56 a month prior according to an IPSOS survey.

- The yield on the Canadian 10-year government bond dips slightly to 3.5%.

- The Canadian dollar is around $0.733 this Monday morning up slightly from $0.729 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.86% last week; the prior week decreased by -1.49%.

Volume-weighted Car segments decreased -2.40%, compared to the prior week’s -1.82% decrease:

- The 0-to-2-year-old Car segments were down -1.82% and 8-to-16-year-old Cars declined -2.44%.

- All nine Car segments decreased last week, with four of those segments reporting declines greater than 2%.

- Compact Car had the largest decline, with a record-breaking single week depreciation of -4.32%. This is on the heels of the previous week’s, also incredibly large depreciation of -3.84%.

- The Sporty Car segment is also accelerating the rate of depreciation, declining -3.32% last week, compared with the prior week’s decline of -2.05%.

Volume-weighted Truck segments decreased by -1.64%; the previous week decreased -1.35%:

- The 0-to-2-year-old models declined -1.48% on average and the 8-to-16-year-olds decreased by -1.51% on average.

- All thirteen Truck segments declined last week. Four of the thirteen segments had declines greater than 2%.

- Full-Size Luxury had another week with depreciation exceeding 3% with a decline of -3.81%, compared with the -3.20% drop the previous week.

- The Compact Van segment had two consecutive weeks of declines exceeding 4%, but last week, it slowed down to -2.67%, still a large single week decline. The segment has now averaged -3.66% depreciation per week over the last four weeks.

Industry News

- The Volkswagen Group shakes up its top executive spots after sending Pierre Boutin off to Europe for a new placement. In his place, Vito Palladino will assume the role of CEO for Volkswagen Group in Canada while retaining his spot as President of Audi Canada. Edgar Estrada comes from Mexico as the head of the Volkswagen brand there to lead Volkswagen Canada.

- With the smoke clearing from the UAW strike, Ford released the costly financial aftermath of the ratified contract and what the strike did to the organization. Cutting profits by $1.7 Billion USD was one sizeable implication to the strike, but outside of that the new contract will cost Ford $8.8 Billion USD or $900 per vehicle in 2028. With efforts to offset vehicle prices from rising any further, the brand will be hard-pressed to compete profitably.

- GM says its EV’s that lose money today will not continue to lose money by 2024 and should bring in profit only one year later. The global carmaker says that this will be due to heavily increasing production volume, more favorable vehicle mix, as well as falling battery costs – providing variable profit in the second half of 2024.

- Consumer Reports says EVs are less reliable than ICEs, as reliability survey scores show 79% more problems for EVs over ICEs, while Hybrids become the most reliable vehicles available, with 26% fewer problems than ICEs.