02.11.2025

Market Insights – 2/11/25

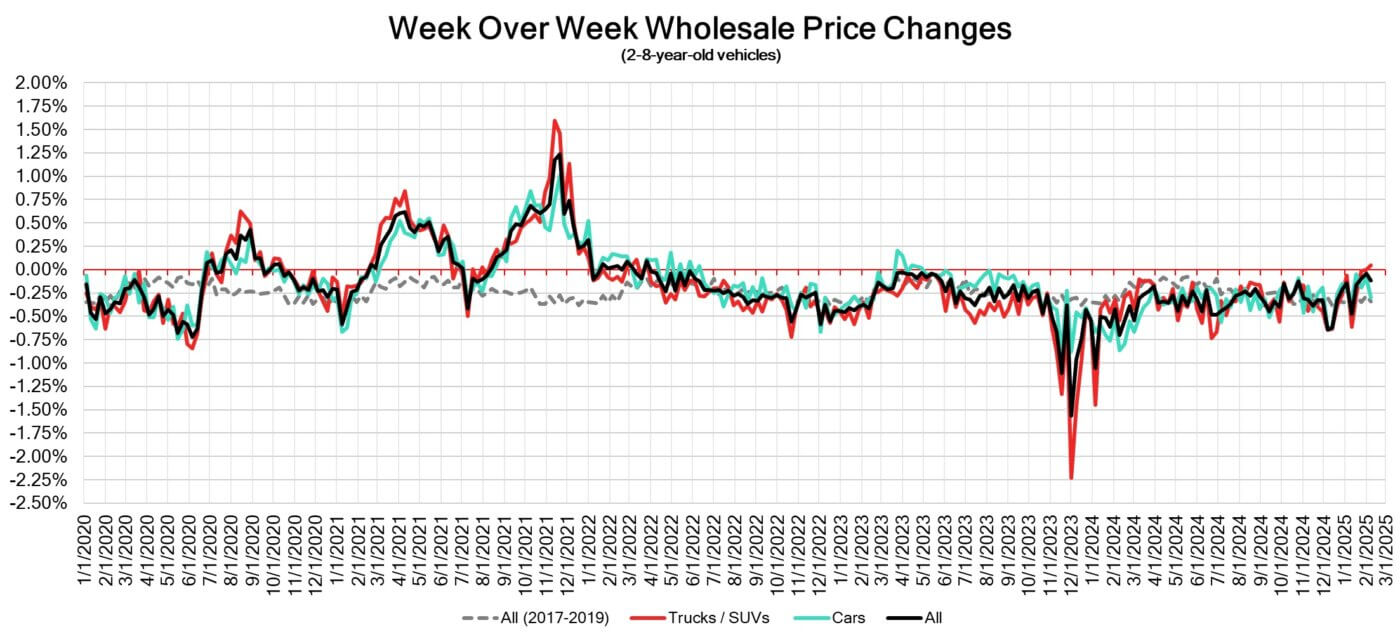

Wholesale Prices, Week Ending February 8th, 2025

The Canadian used wholesale market experienced a decline of –0.12% in pricing for the week. Car segments prices decreased by –0.30% while the Truck/SUVs segments increased by +0.04%. The largest increases were seen in Compact Van at +0.55% and Mid-Size Crossover/SUV at +0.36%. The largest declines in the car segments were seen in Mid-Size Car at -1.03% and Full-Size Car with -0.58%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -0.72% followed by Small Pickup with -0.57%.

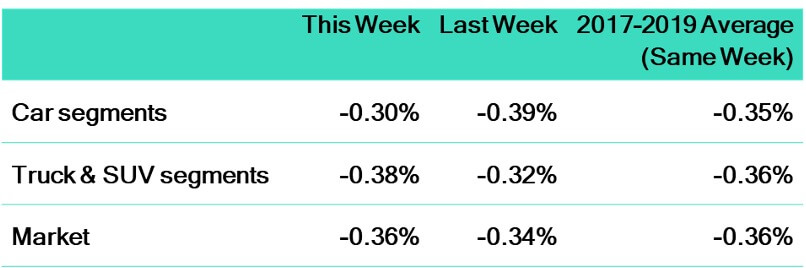

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.30% | -0.09% | -0.39% |

| Truck & SUV segments | 0.04% | -0.00% | -0.30% |

| Market | -0.12% | -0.05% | -0.34% |

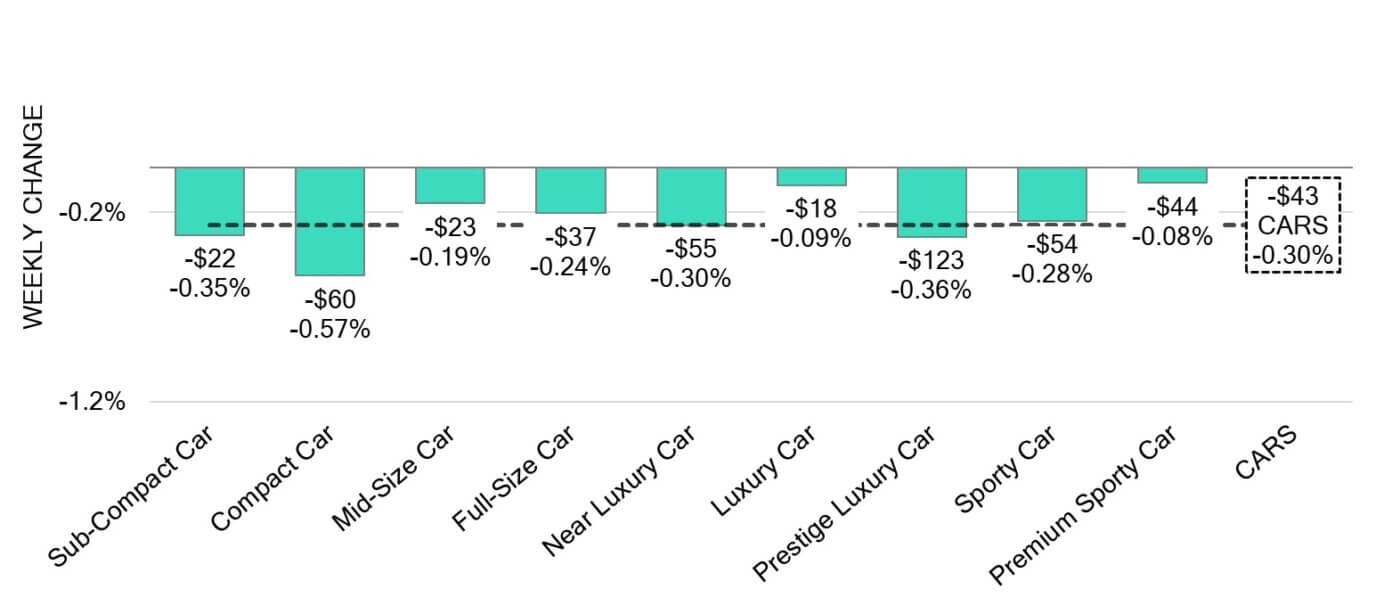

Car Segments

- All nine car segments reflected a decline last week. The overall average depreciation was -0.30%.

- Segments with the smallest declines were Luxury Car (-0.20%), Near Luxury Car (-0.21%), and Prestige Luxury Car (-0.24%).

- The largest decreases were seen from Mid-Size Car (-1.03%), Full-Size Car (-0.58%), and Sub-Compact Car (-0.48%).

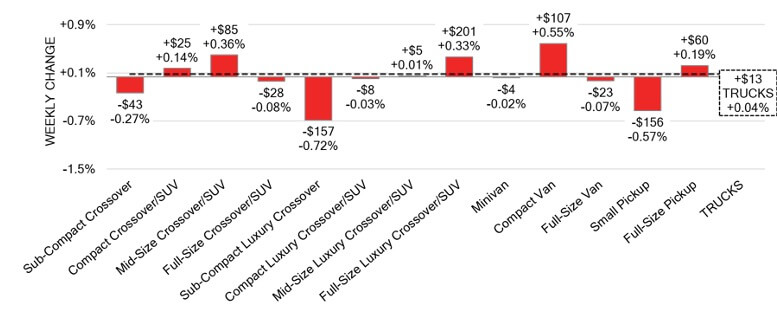

Truck / SUV Segments

- Truck segments showed an overall increase of +0.04% last week.

- Six segments reflected an uptick in values. Those with the largest increases were Compact Van (+0.55%), Mid-Size Crossover/SUV (+0.36%) and Full-Size Luxury Crossover/SUV (-0.33%).

- Seven segments saw values depreciate. The largest was seen in Sub-Compact Luxury Crossover (-0.72%), Small Pickup (-0.57%) and Sub-Compact Crossover (-0.27%).

Wholesale

The Canadian market remains on a downward trend, with notable differences compared to its previous week. Just over 36% of the market segments experienced an average value change of more than ±$100. The change in truck segments rose to +0.04%, while the decline of the car segments increased by 0.21%, bringing its change to –0.30%. Monitored auction sale rates ranged from 31.6 to 72.6% averaging at 51.7%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent adjustments to interest rates. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. As the new year continues, so does the high demand on both sides of the border for an increase in inventory and vehicles at auctions.

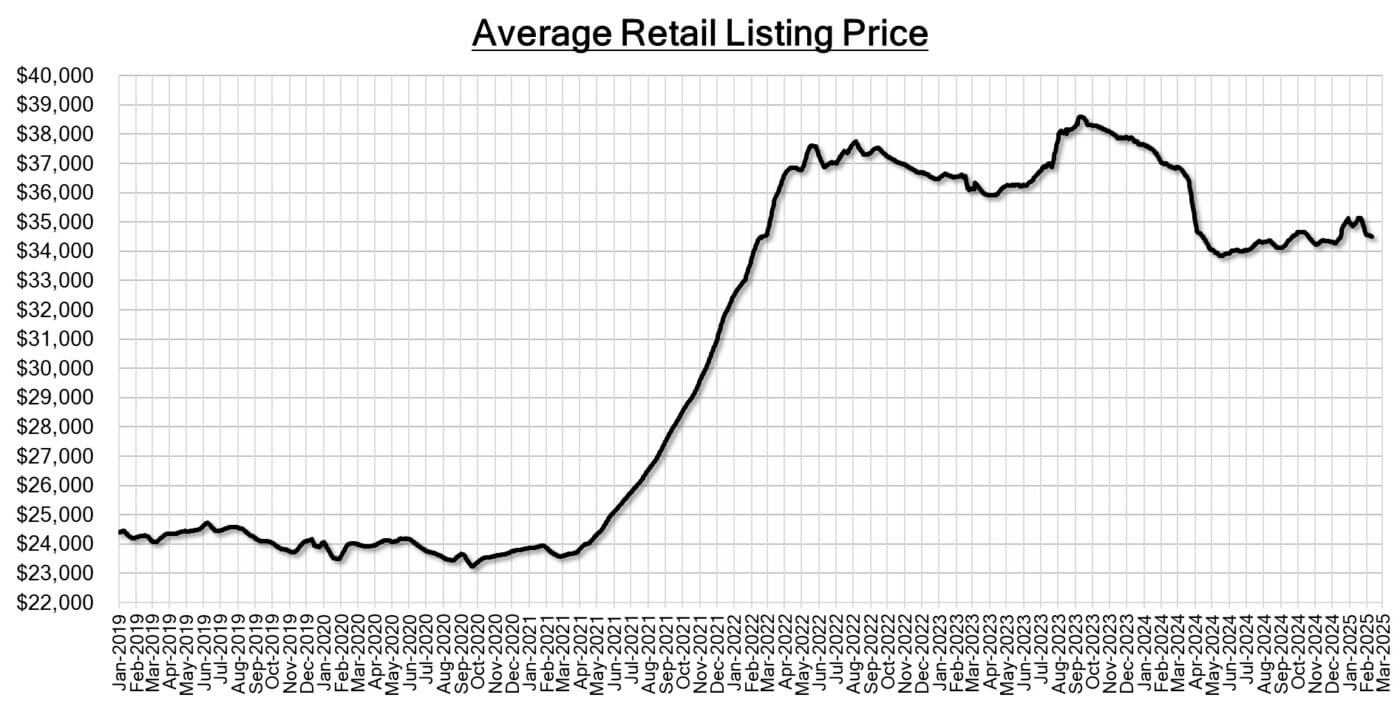

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,490. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The unemployment rate in Canada decreased to 6.6% in January 2025, down from 6.7% in December 2024. This is the lowest it has been in three months, defying market predictions that it would increase to 6.8%.

- The S&P Global Canada Manufacturing PMI dropped to 51.6 in January 2025, a decrease from 52.2 in December, indicating a slower rate of expansion.

- Canada reported a trade surplus of $0.7 billion in December 2024, shifting from a revised deficit of $1 billion the previous month, roughly meeting market expectations of a $0.75 billion surplus.

- The yield on the Canadian 10-year government bond decreased to 3.04%.

- The Canadian dollar is around $0.698 this Monday morning, representing a slight decrease from $0.685 a week prior.

U.S. Market

- Despite the uncertainty introduced into the market last week due to the President’s negotiations with Canada and Mexico regarding a 25% tariff on imports, the wholesale market remained resilient, showing strong sales nationwide and values that continued to align with seasonal depreciation trends.

Industry News

- January new vehicle sales results have tied a record from 2018, as dealers sold ~118,000 vehicles last month, a 3.1% increase over last year. It is difficult to assume that this could be a trend for the year, as there is significant pressure on the new car market from the threat of U.S. tariffs on vehicles that could be implemented as of March 1st.

- Subaru is launching a Hybrid version of its Forester crossover for 2025MY that will start arriving in the Spring. Using a Toyota-derived system coupled with a mechanical driveshaft to keep Subaru’s symmetrical all-wheel-drive system intact, the “e-boxer” (as it will be named in Canada) will fetch up to 40% improvement in fuel economy compared to the outgoing model and will be priced around $48,000.

- After the abrupt discontinuation of the Federal iZEV rebate on January 13th, some dealers and automakers reinstated the program with their own $5,000 incentive to support consumers. It has now been communicated that those businesses are likely not be reimbursed for their contributions to prolong the program.

- The possible Nissan-Honda merger has been all but cancelled as Nissan apparently refused to agree to Honda’s terms of the deal. As Nissan continues to seek a qualified partner to merge with, Foxconn is reportedly interested in partnering with the brand.

- Tesla could stand to significantly benefit from the possible enforcement of U.S. tariffs, as the brand’s models are all made from factories in California and Texas, whereas many legacy automakers produce vehicles in Mexico.