02.13.2024

Market Insights – 2/13/2024

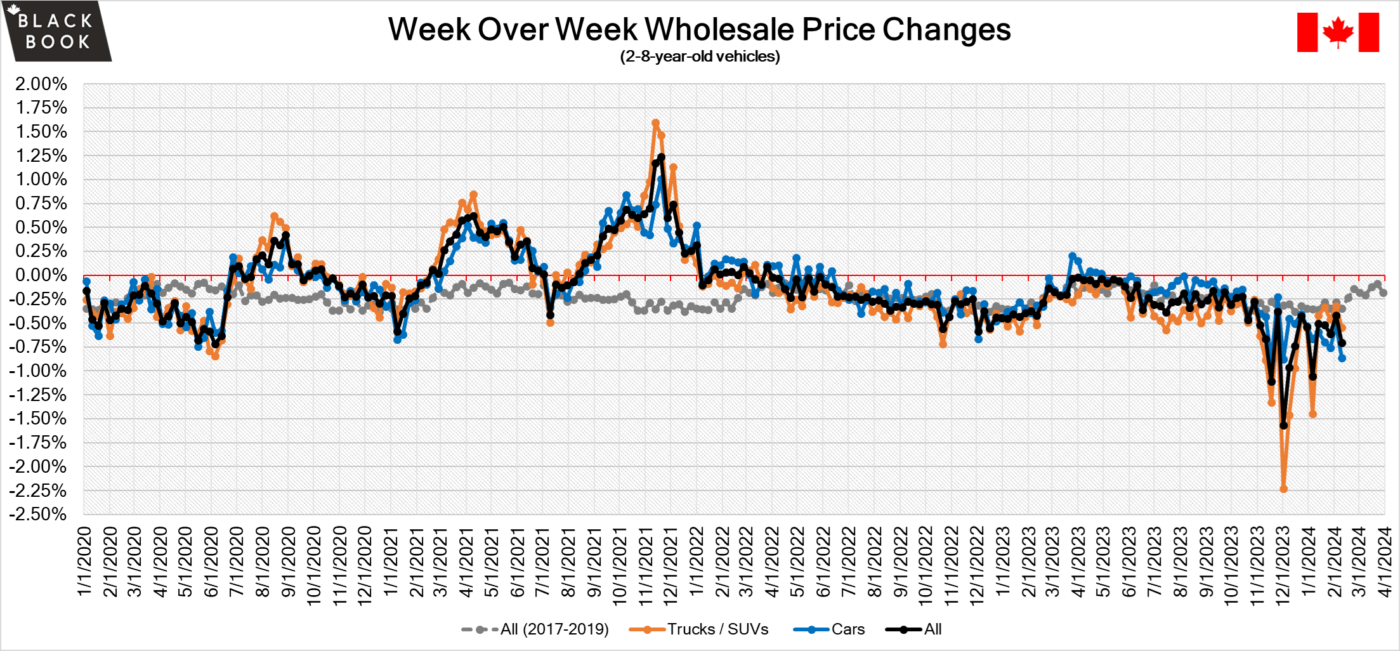

Wholesale Prices, Week Ending February 10th

The Canadian used wholesale market saw a decline in prices for the week at –0.70%. The Car segment fell by -0.86% and the Truck/SUVs segment prices declined –0.55%. 0 out of 22 segments’ values have increased for the week. The segments with the largest declines were Full-Size Car at –1.77% followed by Prestige Luxury Car at –1.57%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.86% | -0.52% | -0.39% |

| Truck & SUV segments | -0.55% | -0.32% | -0.30% |

| Market | -0.70% | -0.42% | -0.34% |

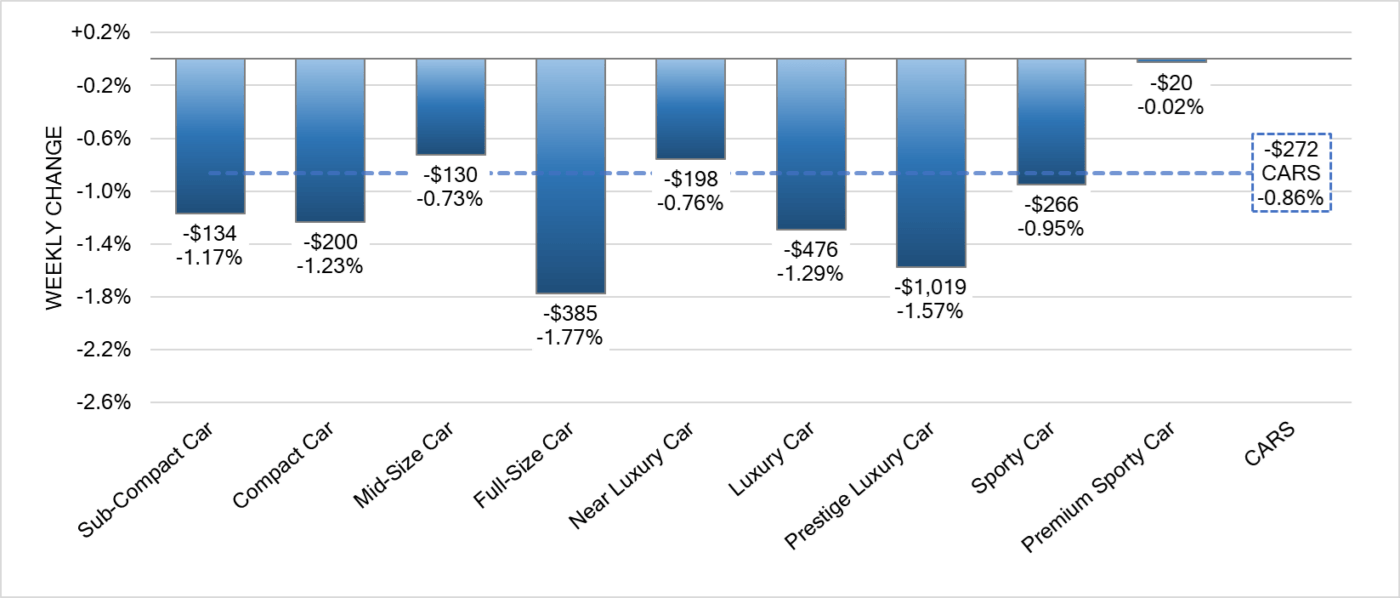

Car Segments

- There was an overall decrease of -0.86% seen in Car segments last week. The decline was noted across all nine segments.

- The least of the decreases noted was from Premium Sporty Car at (-0.02%). Mid-Size Car dropped by (-0.73%), trailed by Near Luxury Car at (-0.76%).

- The most significant decline observed was Full-Size Car at (-1.77%) followed by Prestige Luxury Car at (-1.57%).

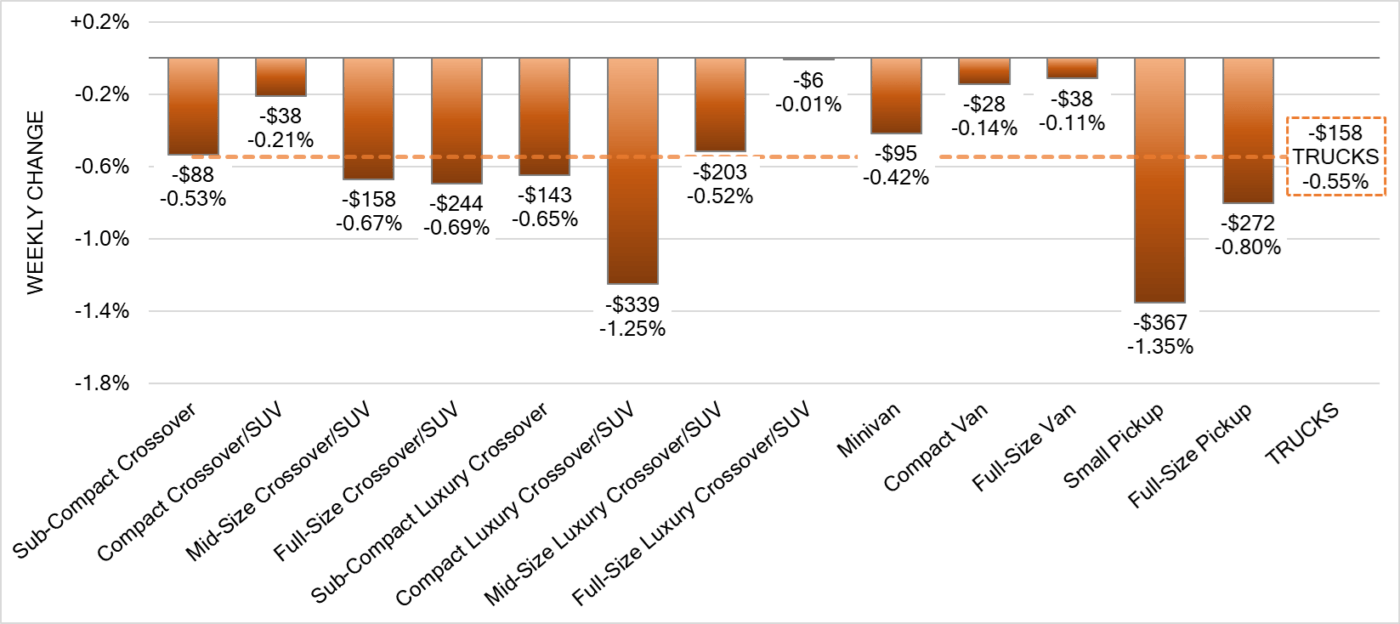

Truck Segments

- Truck segments experienced an overall decrease of -0.55% last week.

- All segments reflected a decline. Those with the largest were Small Pickup (-1.35%) and Compact Luxury Crossover/SUV (-1.25%).

- Other segments with a notable drop were Full-Size Pickups (-0.80%) and Full-Size Crossover/SUV (-0.69%).

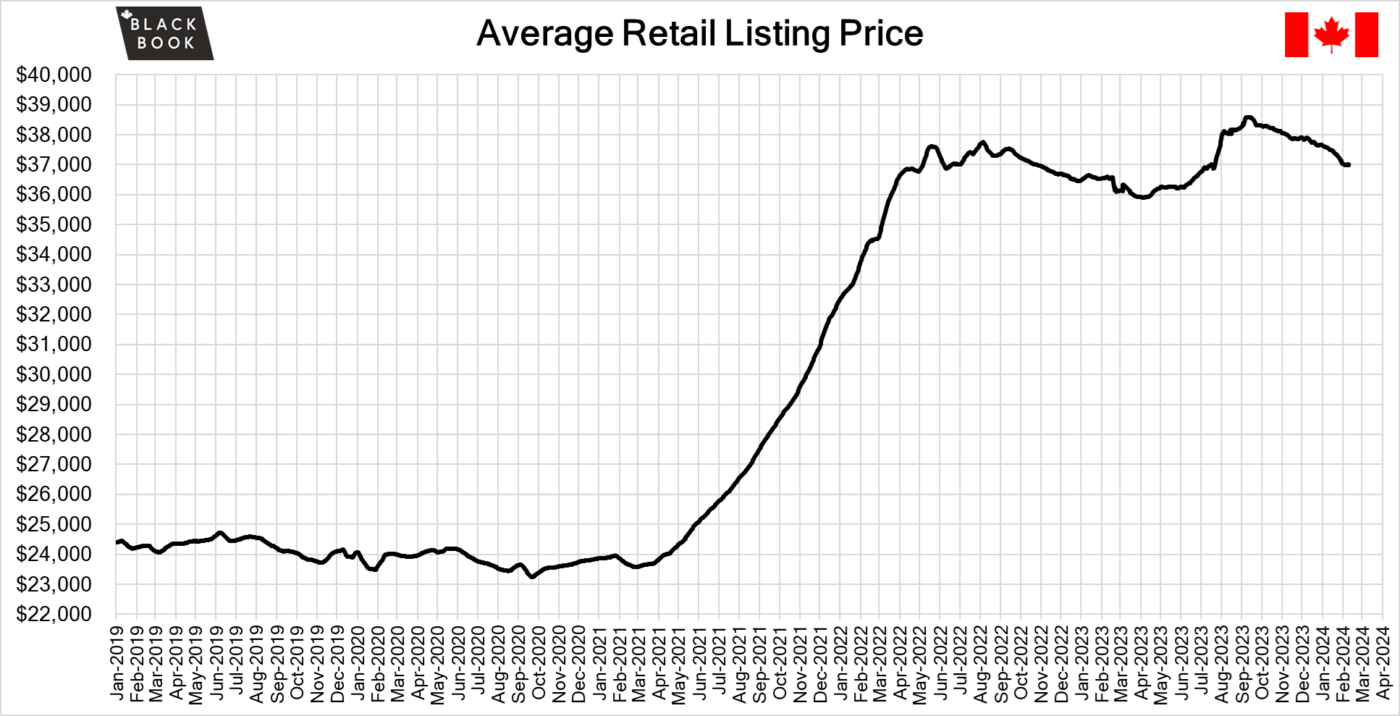

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $37,000. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines increasing slightly. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were decreasing this past week with some observed sell rates were as low as 10% and as high as 42% but most were between 20-35%. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The unemployment rate in Canada eased to 5.7% in January of 2024 from the 22-month high of 5.8% recorded in the previous month, defying market expectations of an increase to 5.9%, and marking the first monthly decrease in the unemployment rate in over one year.

- Canada reported a trade deficit of 0.3 billion in December of 2023, contrasting with a downwardly revised surplus of 1.1 billion in November and against market forecasts of a 1.1 billion surplus.

- Canadian consumer confidence rebounded in January to 49.46 according to a Ipsos survey.

- The yield on the Canadian 10-year government bond increased slightly to 3.56%.

- The Canadian dollar is around $0.744 this Monday morning similar to $0.741 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.26% last week; the prior week decreased by -0.33%.

Volume-weighted Car segments decreased -0.18%, compared to the prior week’s -0.22% decrease:

- The 0-to-2-year-old Car segments were down -0.02% and 8-to-16-year-old Cars declined -0.11%.

- Two of the nine Car segments increased last week.

- Compact Car continues to increase across all age groupings: 0-to-2-year-olds increased for a fourth consecutive week with a gain of +0.31%, 2-to-8-year-olds increased for a fifth consecutive week, up +0.08%, and 8-to-16-year-olds increased for a sixth straight week, +0.10%.

- The smaller sibling of Compact Car, the Sub-Compact segment, continues to report large declines, but the rate of decline is slowing, averaging -0.57% over the last two weeks, compared with an average of -1.37% the previous three weeks.

- Near Luxury Car reported the largest decline last week, down -0.65%.

Volume-weighted Truck segments decreased by -0.29%; the previous week decreased -0.38%:

- The 0-to-2-year-old models declined -0.25% on average and the 8-to-16-year-olds decreased by -0.05% on average.

- Three of the thirteen Truck segments increased last week.

- The Full-Size Crossover/SUV segment increased the rate of gain last week, up +0.38%, compared with +0.03% the week prior.

- Small Pickup also moved into positive territory last week, for the first time since the first week of October 2023, with an increase of +0.26%.

- Full-Size Truck depreciation continues to slow down, with a minimal -0.12% decline last week, compared to -0.20% the previous week.

- The Sub-Compact and Compact Crossover segments had the largest drops last week, down -0.71% and -0.70%, respectively.

Industry News

- Bloomberg NEF’s Global Lithium-Ion Battery Supply Chain Rankings place Canada in the #1 spot for the first time, marking a historical achievement for the country as part of the annual ranking that “rates 30 countries on their potential to build a secure, reliable, and sustainable lithium-ion battery supply chain.” This year’s ranking also marks the first time in which China has not placed in the top spot.

- Dalhousie University is planning a new battery R&D center and Master’s program in battery technology to support the growing need for EV battery experts. The Canadian Battery Innovation Centre (CBIC) began in 2023 and has acquired support from companies like Tesla, Novonix, Salient Energy, and Li Metal among others as the University looks to develop $13.5 million to fund the facility while the Master’s program is set to start in 2025.

- The joint venture between 7 legacy OEM’s to run an EV charging network has now revealed its organizational name, Ionna which will service both the U.S. and Canada with plans to install 30,000 beginning in the U.S. starting this year.

- Ford has recently announced that it will be adjusting its EV strategy as news of a $4.7 Billion (USD) loss last year on its EV unit is recorded. The global carmaker looks to possibly postpone EV launches and return to sourcing batteries externally, rather than continue to develop in-house production.

- Porsche refreshes its current sole EV, the Taycan with touch-ups to front and rear fascias and more importantly with higher performance regarding power, range, and charging capability… and of course a higher price. The 2025 Taycan will now start at $135,600 in Canada.