02.18.2025

Market Insights – 2/18/25

Wholesale Prices, Week Ending February 15th, 2025

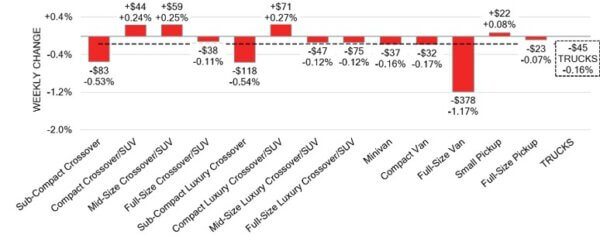

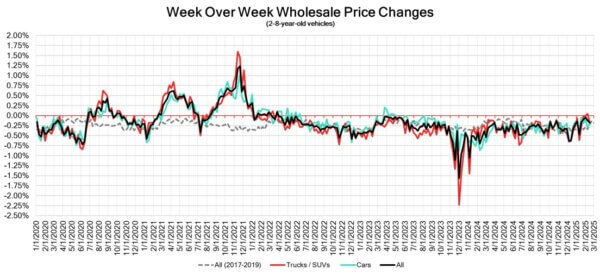

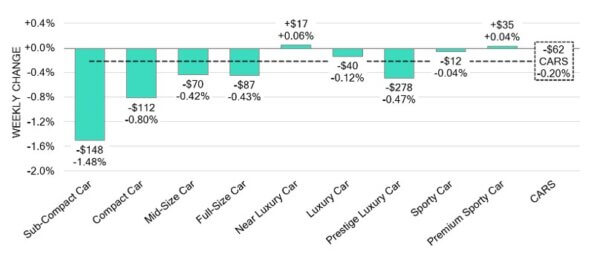

The Canadian used wholesale market experienced a decline of –0.18% in pricing for the week. Car segments prices decreased by –0.20% while the Truck/SUVs segments decreased by -0.16%. The largest increases were seen in Compact Luxury Crossover/SUV at +0.27% and Mid-Size Crossover/SUV at +0.25%. The largest declines in the car segments were seen in Sub-Compact Car at -1.48% and Compact Car with -0.80%. The largest declines in the Truck/SUV segments were Full Size Van at -1.17% followed by Sub-Compact Luxury Crossover/SUV with -0.54%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.20% | -0.30% | -0.25% |

| Truck & SUV segments | -0.16% | 0.04% | -0.22% |

| Market | -0.18% | -0.12% | -0.23% |

Car Segments

- All but two of the nine car segments reflected a decline last week. The overall average depreciation was -0.20%.

- Segments with the smallest declines were Sporty Car (-0.04%) & Luxury Car (-0.12%).

- The largest decreases were seen from Sub-Compact Car (-1.48%), Compact Car (-0.80%), and Prestige Luxury Car (-0.47%).

- The two segments to show a positive change were Near Luxury Car (+0.06%) & Premium Sporty Car (+0.04%).

Truck / SUV Segments

- Truck segments showed an overall decrease of –0.16% last week.

- Four of the thirteen segments reflected an uptick in values. Those with the largest increases were Compact Luxury Crossover (+0.27%), Mid-Size Crossover/SUV (+0.25%) and Compact Crossover/SUV (-0.24%).

- Nine segments saw values depreciate. The largest was seen in Full-Size Van (-1.17%), Sub-Compact Luxury Crossover (-0.54%) and Sub-Compact Crossover (-0.53%).

- The segment with the smallest decline was Full-Size Pickup (-0.07%)

Wholesale

The Canadian market remains on a downward trend, with notable differences compared to its previous week. Just under 23% of the market segments experienced an average value change of more than ±$100. The change in truck segments decreased to –0.16%, while the decline of the car segments dropped by 0.10%, bringing its change to –0.20%. Monitored auction sale rates ranged from 19.1 to 64.3% averaging at 44.9%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent adjustments to interest rates. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

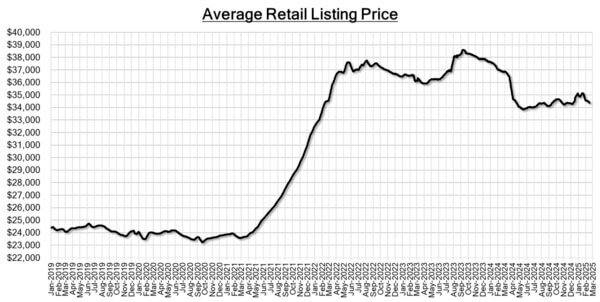

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,400. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Manufacturing sales in Canada increased by 0.3% month-over-month in

December 2024. This growth was slower than the initially estimated 0.6% and

followed a revised increase of 0.7% in the previous month. - Wholesale sales in Canada decreased by 0.2% month-over-month in December

2024, which was below the initial estimates that predicted a 0.1% increase. This

followed a revised flat performance in November. - The total value of building permits increased by 11.0% month-over-month to

$13.1 billion in December 2024, significantly surpassing the market expectations

of a 1.7% increase, after a 5.6% decline in the previous month.. - The yield on the Canadian 10-year government bond increased to 3.17%.

- The Canadian dollar is around $0.705 this Monday morning, representing a slight

increase from $0.698 a week prior.

U.S. Market

- The market is currently characterized by “stability” and “normalcy,” even amid various headline-grabbing external factors. Despite these influences, the wholesale market consistently reports typical seasonal depreciation, accompanied by robust conversion rates week after week.

Industry News

- Canadian Black Book released its 2025 Best Residual Value Awards last week at the Canadian International Auto Show which can be found here: https://www.canadianblackbook.com/cbb-best-residual-value-awards-redefine-industry-benchmarks/

- The Canadian Automobile Association (CAA) conducted a Winter EV driving test between Ottawa and Mt. Tremblant, QC, with results from 13 different fully electric models providing a range variance of between 14-39% compared to the factory stated range. The Chevrolet Silverado EV and Polestar 2 tested best while the Volvo XC40 Recharge was worst.

- 2025 Car of the Year results were announced for Canada on February 13th, as selected by the Automotive Journalists Association of Canada (AJAC). Hyundai walked away withawards for the Santa Fe, winning Utility of the Year and Ioniq 5 Nfor Electric Utility of the Year. The Honda Civic and BMW i4 were named Car of the Year and Electric Car of the Year, respectively.

- President Donald Trump has set a date for new tariffs on automobiles for April 2nd, as the U.S. Trade Representative and Commerce Secretary set out in a process to evaluate possible levies on a country-by-country basis that should be completed by April 1st.

- Nissan and Honda look to plan out alternatives for price efficiencies on production, offsetting possible tariffs applied to Mexican and Canadian made vehicles. Nissan is looking to import 50% of its next-gen Rogue production from Japan where it has a 20% cost advantage. While Honda works on production countermeasures as it stockpiles inventory before any tariffs are enforced.