02.20.2024

Market Insights – 2/20/2024

Wholesale Prices, Week Ending February 17th

The Canadian used wholesale market saw a decline in prices for the week at –0.55%. The Car segment fell by -0.80% and the Truck/SUVs segment prices declined –0.29%. 1 out of 22 segments’ values have increased for the week. The Compact Van segment rose by 0.48% The segments with the largest declines were Compact Car at –1.69% followed by Prestige Luxury Car at –1.49%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.80% | -0.86% | -0.25% |

| Truck & SUV segments | -0.29% | -0.55% | -0.22% |

| Market | -0.55% | -0.70% | -0.23% |

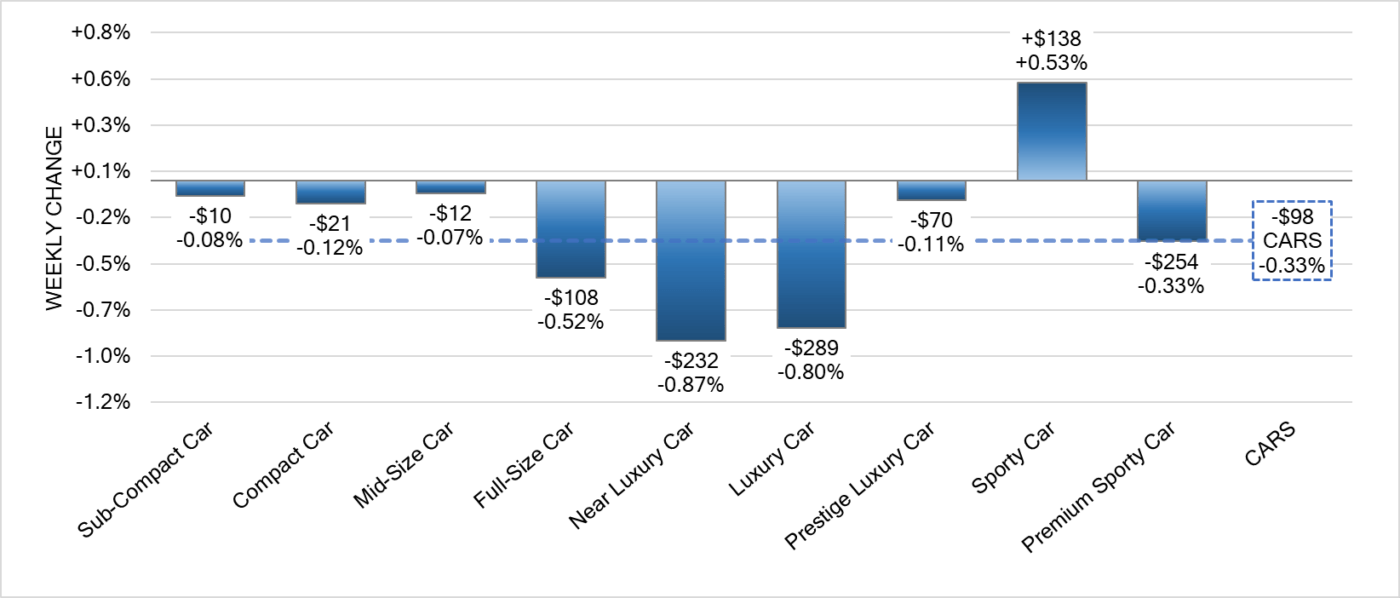

Car Segments

- Last week there was an overall decrease of -0.80% seen in Car segments.

- Compact Car showed the most significant decline at (-1.69%) followed by Prestige Luxury Car at (-1.49%).

- The least of the decreases noted was from Premium Sporty Car at (-0.09%). Full-Size Car dropped by (-0.46%), trailed by Sporty Car at (-0.61%).

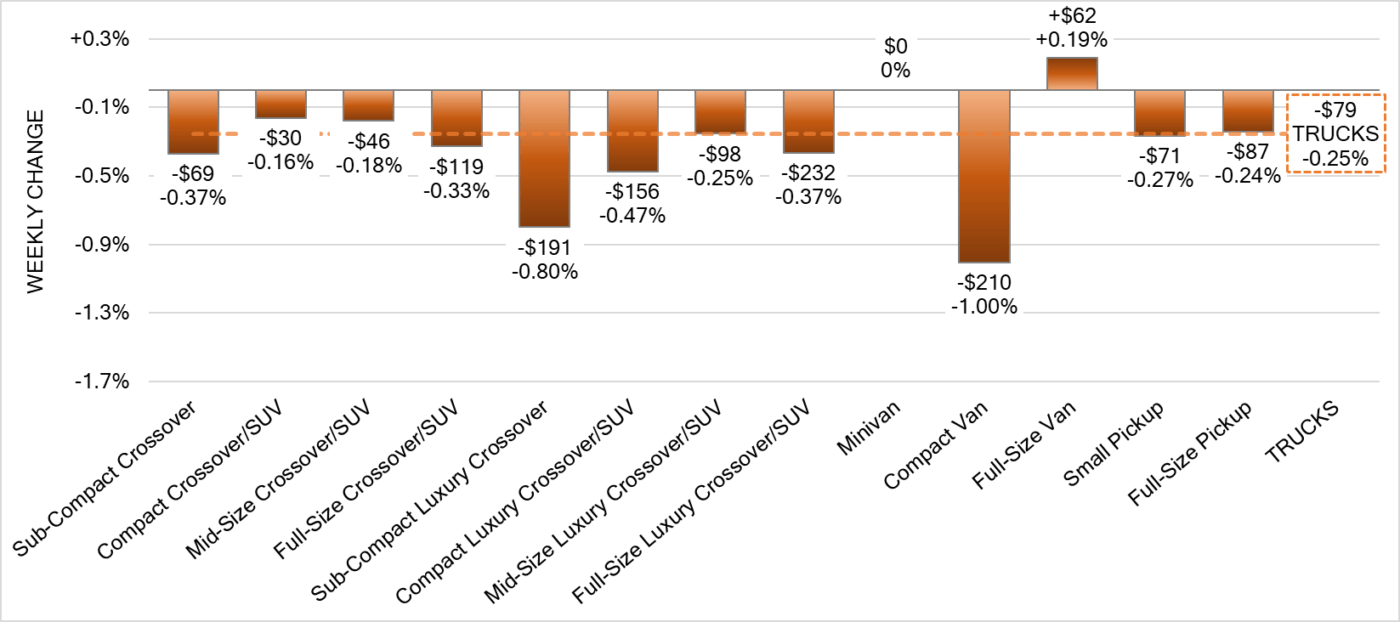

Truck Segments

- Truck segments had an overall decrease of -0.29% last week.

- Sectors with the largest declines were Full-Size Van (-0.76%), Small Pickup (-0.72%) and Sub-Compact Luxury Crossover (-0.65%).

- Two segments showed an increase. One being Compact Van (+0.48%). Full-Size Luxury Crossover/SUV had a negligible amount (+0.00%).

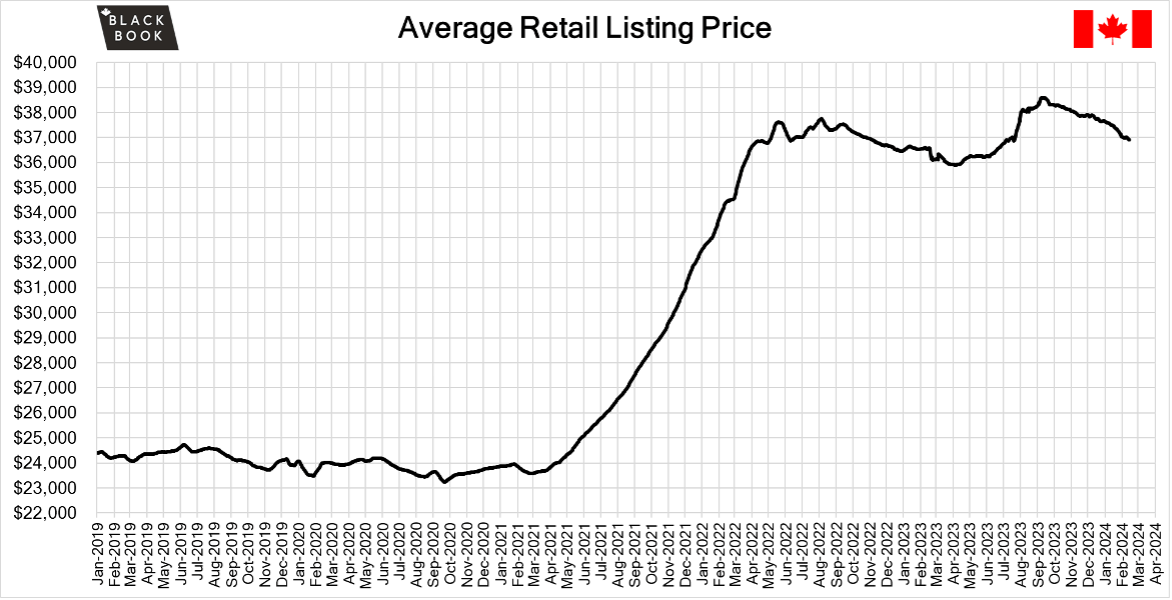

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,900. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

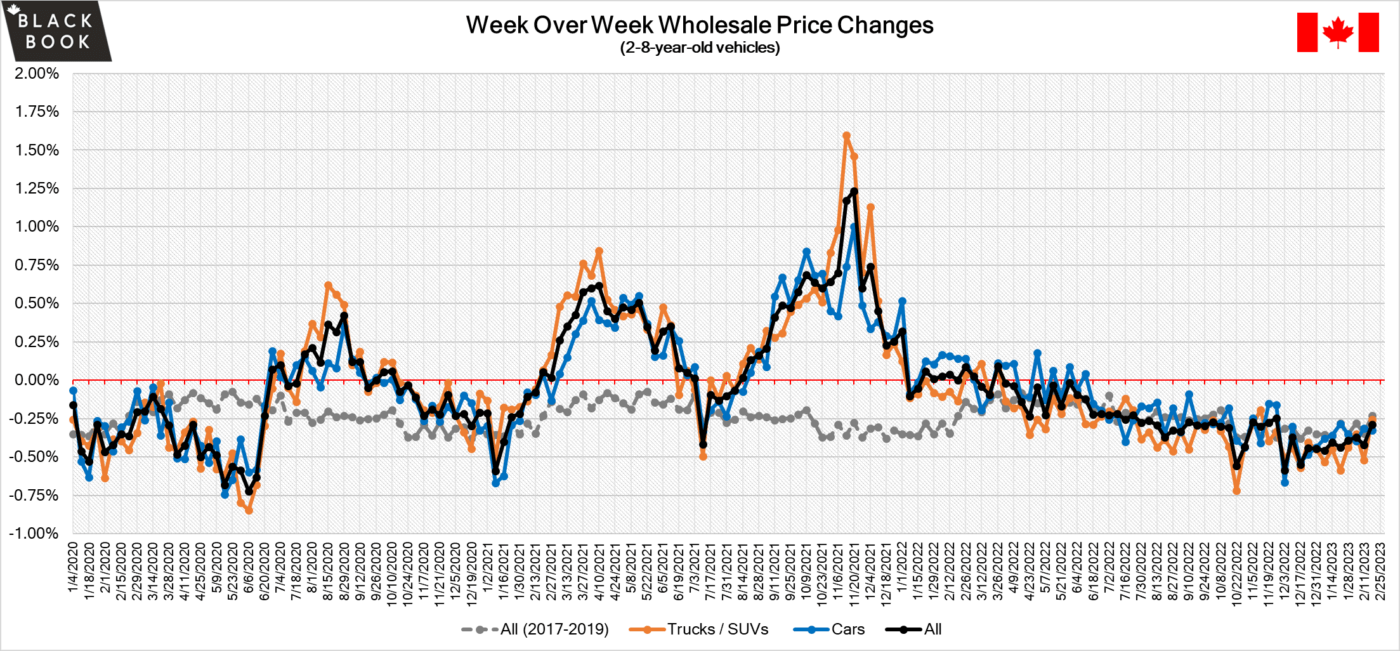

Wholesale

The Canadian market continued to decrease, with declines easing slightly from the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 22% and as high as 51% but most were between 25-35%. Last week we saw more sellers dropping floors, which has been contributing to less lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The annual inflation rate in Canada fell to 2.9% in January of 2024, the lowest since June, from 3.4% in the previous month, and well below market expectations of 3.3%.

- Industrial producer prices in Canada fell by 0.1% from the previous month in January of 2024, aligned with market estimates and expanding on the upwardly revised 1.6% decline in the previous month.

- Canadian mortgage debt continues to rise, but barely. Outstanding mortgage credit climbed 0.3% to $2.16 trillion in December.

- The yield on the Canadian 10-year government bond fell slightly to 3.50%.

- The Canadian dollar is around $0.742 this Monday morning similar to $0.744 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.23% last week; the prior week decreased by -0.26%.

Volume-weighted Car segments decreased -0.17%, compared to the prior week’s -0.18% decrease:

- The 0-to-2-year-old Car segments were down -0.17% and 8-to-16-year-old Cars declined -0.16%.

- Eight of the nine Car segments decreased last week.

- The Compact Car segment maintained its upward trajectory last week with a +0.08% rise, representing the sixth week in a row of appreciation for vehicles aged between 2 to 8 years old. On average, over the past six weeks, this segment has seen a weekly increase of 0.13%.

- Standing in stark difference to the Compact segment, the smaller Sub-Compact category is depreciating faster than the broader Car segment. Nonetheless, last week saw a deceleration in its decline to -0.38%, versus its six-week average depreciation rate of -1.01%.

Volume-weighted Truck segments decreased by -0.26%; the previous week decreased -0.29%:

- The 0-to-2-year-old models declined -0.15% on average and the 8-to-16-year-olds decreased by -0.28% on average.

- Only one of the thirteen Truck segments increased last week.

- Last week, the Full-Size Luxury Crossover/SUV segment experienced the steepest drop, depreciating by -0.74%. This represents a sharp increase in the rate of depreciation when compared to the past four weeks’ average weekly rate of -0.05%.

- For the third consecutive week, the mainstream Full-Size Crossover/SUV category saw an increase, this time by +0.07%. However, this uptick was more modest compared to the previous week’s more substantial gain of +0.38%.

- Small Pickups in the 0-to-2-year-old used vehicle category posted gains for the second week in a row, increasing by +0.17%.

Industry News

- Global ZEV sales have increased steeply year-over-year, as 1.1 million electric and plug-in hybrid vehicles were sold in January, up from 660,000 just 1 year ago – marking a 69% increase, while a 41% increase was realized in North America.

- Used EV’s are quickly becoming the next frontier for electric vehicles, but many concerns regarding EV valuations offer little history to rely upon. Recurrent CEO, Scott Case has seen over the last 4 years that current EV batteries are beating expectations, but a few problems have soured dealers’ rates of acquisition of used EV’s as they dealt with degraded performance and bad battery system design. Expect all this to improve as better batteries are made and user education improves.

- Stellantis replaces head of Canadian operations, Jason Stoicevich as he heads off to the U.S. to become Vice President of Retail Sales. In his place, Jeff Hines, Vice President of U.S. Fleet Sales and Operations will become President of Canadian operations. These moves are effective March 1st.

- The Chevrolet Equinox EV is set to start taking orders this week, but the new starting price of $51,498 is a far cry from expectations set when the vehicle was announced earlier at roughly $35,000 in Canada.