02.27.2024

Market Insights – 2/27/2024

Wholesale Prices, Week Ending February 24th

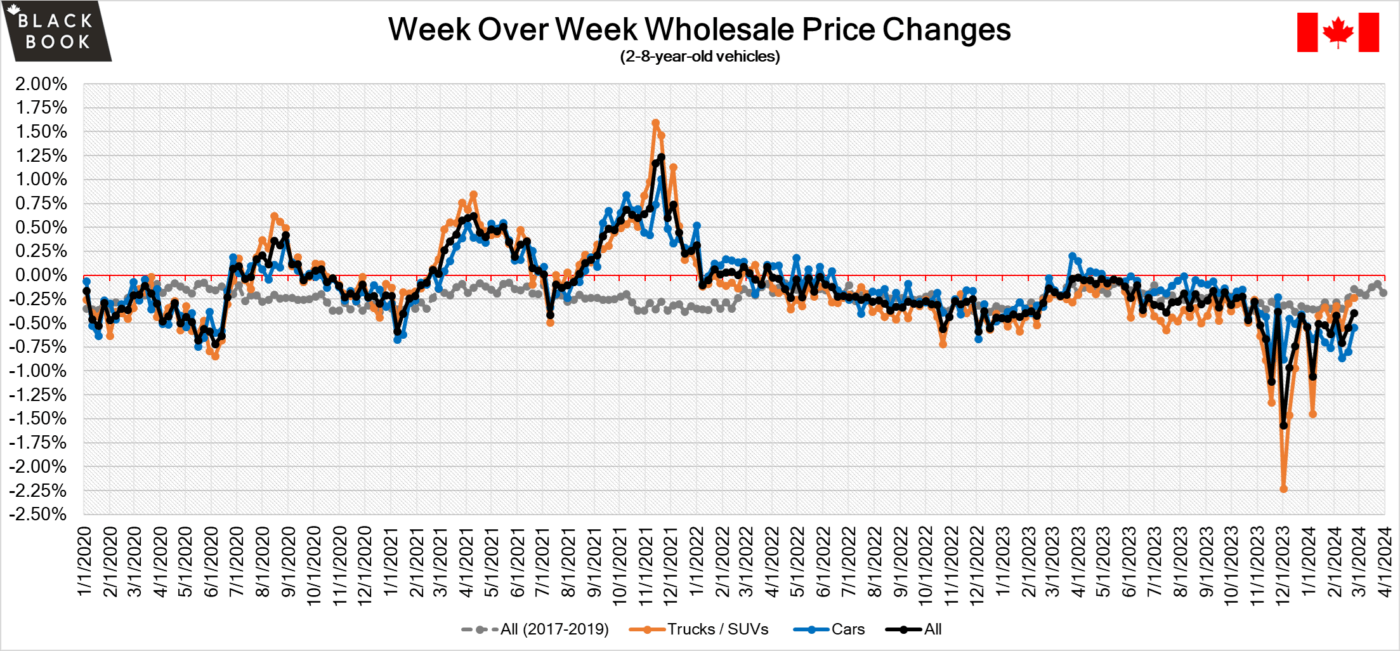

The Canadian used wholesale market saw a decline in prices for the week at –0.39%. The Car segment fell by -0.55% and the Truck/SUVs segment prices declined –0.24%. 2 out of 22 segments’ values have increased for the week. The Minivan segment rose by 0.50% followed by the Small Pickup segment which increased by 0.01%. The segments with the largest declines were Full-Size Pickup at –1.03% followed by Near Luxury Car at –0.88%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.55% | -0.80% | -0.12% |

| Truck & SUV segments | -0.24% | -0.29% | -0.16% |

| Market | -0.39% | -0.55% | -0.14% |

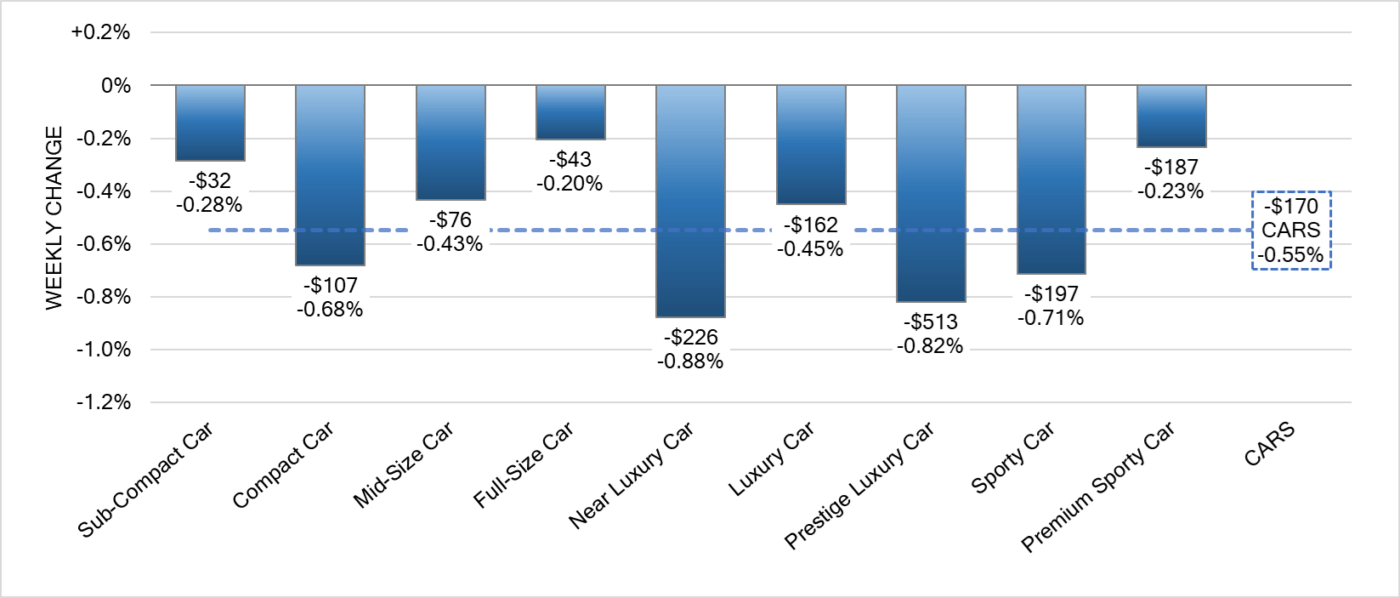

Car Segments

- Last week there was an overall decrease of -0.55% seen in Car segments.

- Near Luxury Car showed the most significant decline at (-0.88%) followed closely by Prestige Luxury Car at (-0.82%).

- The least of the decreases noted were from Full-Size Car at (-0.20%) tailed by Premium Sporty Car with (-0.23%) and Sub-Compact Car at (-0.28%).

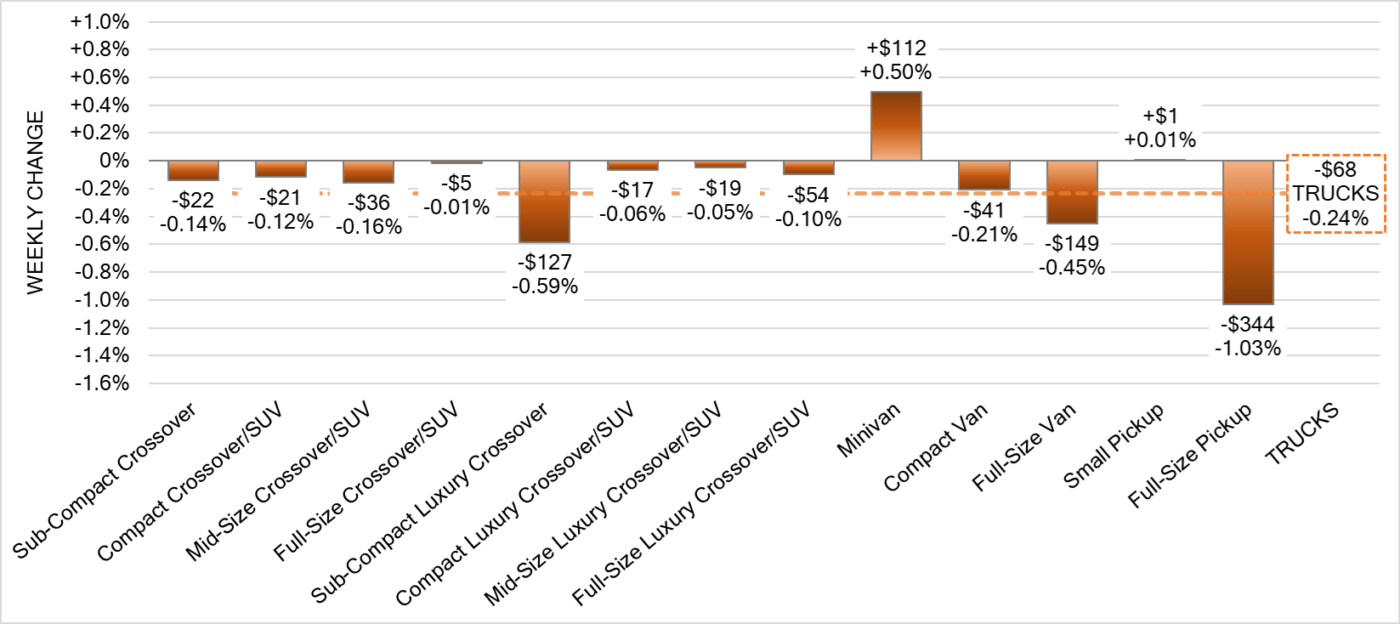

Truck Segments

- Truck segments had an overall decline of -0.24% last week.

- Full-Size Pickups had the largest decrease (-1.03%) Followed by Sub-Compact Luxury Crossover (-0.59%) and Full-Size Van (-0.45%).

- Two segments showed an increase. Minivan (+0.50%) and a negligible amount for Small Pickup (+0.01%).

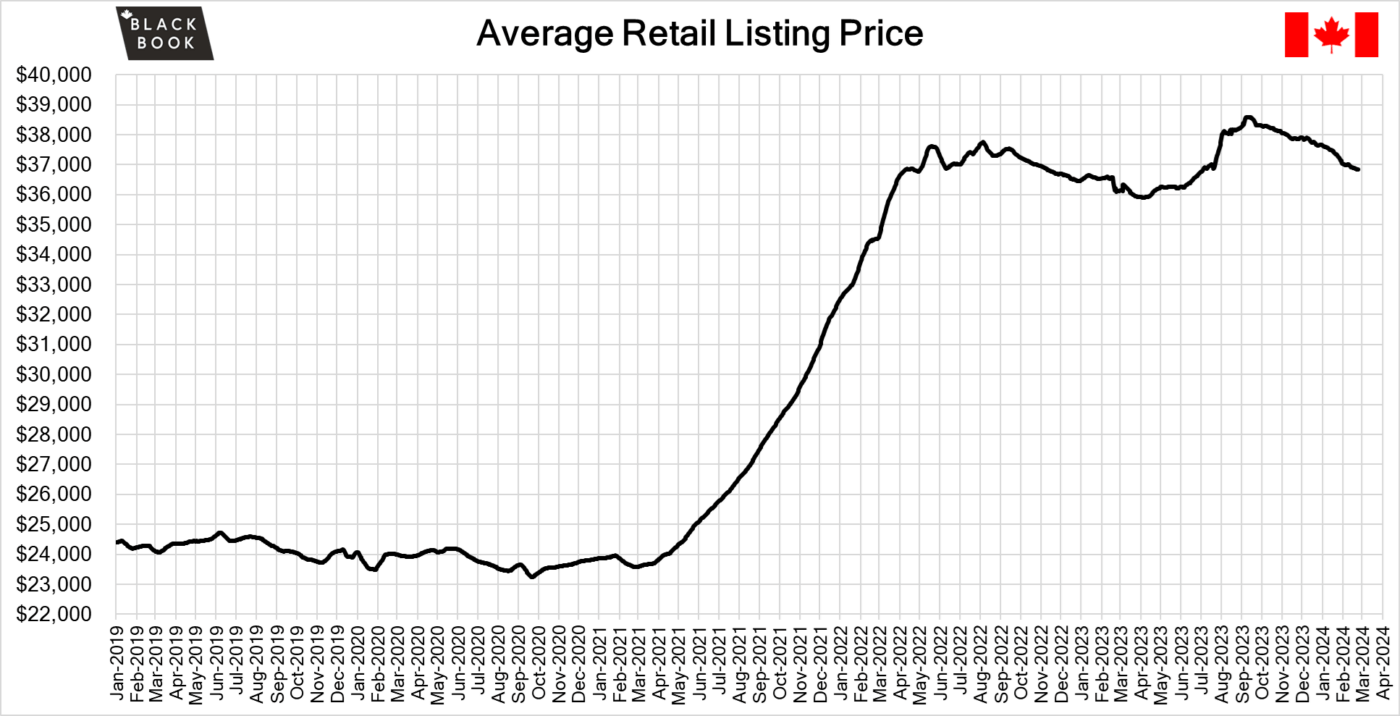

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,800. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines easing slightly from the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 8% and as high as 61% but most were between 25-35%. Last week we saw more sellers dropping floors, which has been contributing to less lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- New home prices in Canada edged down by 0.1% month-on-month in January 2024, following a flat reading in December and missing the market estimates of a 0.1% rise.

- Retail sales in Canada likely fell 0.4% month-over-month in January 2024, preliminary estimates showed. Considering December, retail sales increased 0.9%, revised from the preliminary estimate of 0.7% and after showing no growth in November.

- Desjardins Group expects the Bank of Canada to cut interest rates in half by the end of 2025.

- The yield on the Canadian 10-year government bond maintained at 3.50%.

- The Canadian dollar is around $0.740 this Monday morning similar to $0.742 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.19% last week; the prior week decreased by -0.23%.

Volume-weighted Car segments decreased -0.25%, compared to the prior week’s -0.17% decrease:

- The Compact Car segment saw its value rise for the seventh consecutive week, with a modest gain of +0.04% last week. This uptick marks a deceleration in growth compared to the previous four weeks, which averaged a more robust +0.18% weekly increase.

- The Near Luxury Car segment experienced the most substantial decrease, with a decline of -0.86%. This represents the biggest one-week drop for the segment since December 2023.

- While the Sub-Compact Car segment for vehicles aged 2 to 8 years continues to experience a decline, models in the older 8 to 16 years range have seen an upward trend over the past three weeks. Last week, this segment saw an increase of +0.26%.

Volume-weighted Truck segments decreased by -0.16%; the previous week decreased -0.26%:

- The Full-Size Crossover/SUV segment recorded the greatest gain last week, rising by +0.21%. This advance marks the fourth week in a row of gains for this segment.

- Last week, the Sub-Compact Luxury Crossover/SUV segment experienced the most significant drop, with a decline of -0.46%, which was a steeper rate of depreciation compared to the mainstream Sub-Compact Crossovers (-0.31%).

- The Minivan segment saw a slight increase of +0.01% last week, the first rise for the segment since early June 2023.

- The Small Pickup category experienced growth last week, registering a gain of +0.16%. For this segment, the most sizable increases have been observed in the 0- to 2-year-old models, which have been consistently rising for the past three weeks, with last week’s uptick being +0.15%.

Industry News

- The 2024 Canadian International Auto Show is now over and attendance during the 10-day event hit a new record of 371,559 people, 13,184 higher than the previous record and included 4 single day records in only its 2nd year back after the pandemic forced closure back in 2021.

- The 2024 Honda Prologue is schedule to arrive this Spring but will only be sold in 3 provinces for at least the first 2 model years – British Columbia, Quebec, and Ontario which will reach 160 of its dealers nationally. With anticipated low supply to start, and weak demand outside of these 3 markets, the Honda brand decided it best to prioritize the Prologue inventory and then grow outward.

- A software update is needed for 28,000 Toyota vehicles as a recalled has been stated for 2023-24 model year Toyota Tundra, Sequoia and Lexus LX 600 vehicles as the transmission may not immediately disengage when shifted in neutral causing the vehicle to creep forward.

- Congratulations to Canadian Black Book’s own Yolanda Biswah and Dwain Samuels who were announced as winners of the inaugural Black Automotive Professional Awards which recognize “outstanding individuals within the industry” and “their exceptional contributions as Black professionals,” stated by Accelerate Auto.

- The direct-sales model many EV start-ups operated by has not been working for all, as multiple carmakers such as Vinfast, Fisker, and Lucid have either opened dealerships or are planning to so that they can continue to move forward in their effort to gain sales volume and market share.

- January 2024 was the first month since February 2020 to surpass pre-pandemic monthly volume; but comparing current sales to those in 2019 proves that sales volume doesn’t portray the real message, as average transaction prices were $49,000 last month as opposed to $35,000 in 2019, according to figures from J.D. Power Canada. Consumers are shying away from Pick-up trucks to get away from higher transaction prices and seeking out smaller Crossovers.