02.04.2025

Market Insights – 2/4/25

Wholesale Prices, Week Ending February 1st, 2025

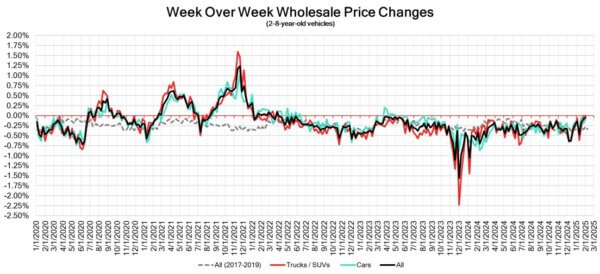

The Canadian used wholesale market experienced a decline of –0.05% in pricing for the week. Car segments prices decreased by –0.09% while the Truck/SUVs segments were flat at -0.00%. The largest increases were seen in Mid-Size Crossover/SUV at +0.34% and Compact Crossover/SUV at +0.18%. The largest declines in the car segments were seen in Luxury Car at -0.29% and Sub-Compact Car with -0.21%. The largest declines in the Truck/SUV segments were Minivan at -0.30% followed by Full-Size Pickup with -0.24%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.09% | -0.19% | -0.22% |

| Truck & SUV segments | -0.00% | -0.01% | -0.33% |

| Market | -0.05% | -0.10% | -0.28% |

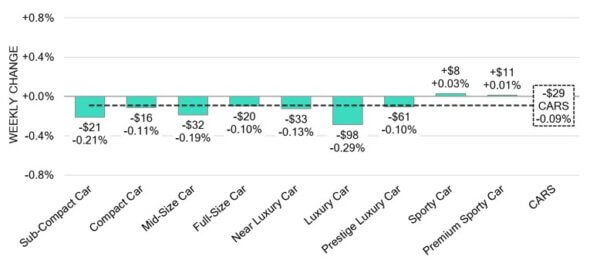

Car Segments

- Seven out of nine car segments declined last week, with an average drop of -0.09%.

- The segments with the slightest increase were Sporty Car (+0.03%), and Premium Sporty Car (+0.01%)

- The largest decreases were seen from Luxury Car (-0.29%), Sub-Compact Car (-0.21%), and Mid-Size Car (-0.19%)

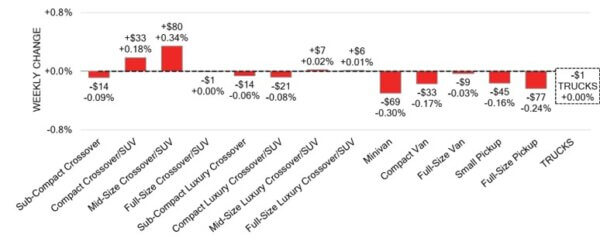

Truck / SUV Segments

- Due to truck segments showing both increases and decreases the overall change last week was 0.00%.

- Eight segments reflected a drop in values. Those with the largest declines were Minivan (-0.30%), Full-Size Pickup (-0.24%) and Compact Van (-0.17%).

- Five segments saw values spike. The largest was seen in Mid-Size Crossover/SUV (+0.34%) and Compact Crossover/SUV (+0.18%).

Wholesale

The Canadian market remains on a downward trend, with a decline far less pronounced than in its previous week. None of the market segments experienced an average value change of more than ±$100. The change in truck segments fell by 1%, bringing the overall change at steady 0%. While the decline of the car segments decreased by 10%, bringing its change to –0.09%. Monitored auction sale rates ranged from 8.1 to 84.6% averaging at 43.3%. There has been continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent adjustments to interest rates. The increase in supply entering the wholesale market has slowed down in comparison to previous weeks, however upstream channels continue to gain early access. As the new year continues, so does the high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada reduced its key interest rate by 25 basis points to 3% in its

January 2025 decision, aligning with market expectations, marking a total of 200

basis points in rate cuts since the beginning of the cycle in June 2024. - In December 2024, Canada’s GDP increased by 0.2% from the previous month.

This growth was driven by robust performance in retail trade, manufacturing, and

construction, which helped counteract declines in transportation and

warehousing, real estate and rental activities, and wholesale trade, based on

preliminary estimates. - Trump tariffs hit markets on Monday in early reaction to Canada-U.S. trade war.

- The yield on the Canadian 10-year government bond decreased to 2.93%.

- The Canadian dollar is around $0.685 this Monday morning, representing a slight

decrease from $0.695 a week prior.

U.S. Market

- The market continued to be very stable last week with depreciation following a normal seasonal pattern. However, the main focus is now on the effects of tariffs on the automotive industry. We will be closely monitoring the impact this week on the used car market.

Industry News

- U.S. President Donald Trump enacted an executive order to apply 25% tariffs on Canadian and Mexican goods starting February 4th. A move that will surely impact the global automotive supply chain also comes with retaliatory clauses if any country were to retaliate against the tariffs.

- Honda Canada has named its next CEO as current appointed leader, Jean-Marc Leclerc, announced his retirement to take effect as of April 1st. Current COO, Dave Jamieson will take his place after Leclerc, who has worked for Honda Canada since 1995 led the business as CEO since May of 2020. Jamieson will be the organizations fourth consecutive Canadian named to the top position.

- Toyota Motor Corp. is once again the global sales volume leader for the auto industry, with worldwide sales of 10.82 million vehicles in 2024. Sales of its hybrid and plug-in hybrid models amounted to 43% of its overall volume, up from 34% in 2023.

- Volkswagen has officially cancelled its electric ID.7 sedan for the U.S. and Canada, citing “the ongoing challenging EV climate”, as the reason for its decision. The vehicle was supposed to go on sale in the fourth quarter of 2024.

- The 2026 Toyota Rav4 has been spotted under camouflage on public roads in Michigan. The all-new sixth generation of Toyota’s top selling nameplate is to be released late this year or early in 2026.

- Porsche’s first electric hardtop sportscar, the Cayman has broken cover in Germany under little camouflage as its road tests before release early next year.

- Kia’s upcoming compact electric EV5 crossover will be coming to Canada in 2026 but will currently pass on being sold in the U.S. market.