02.06.2024

Market Insights – 2/6/2024

Wholesale Prices, Week Ending February 3rd

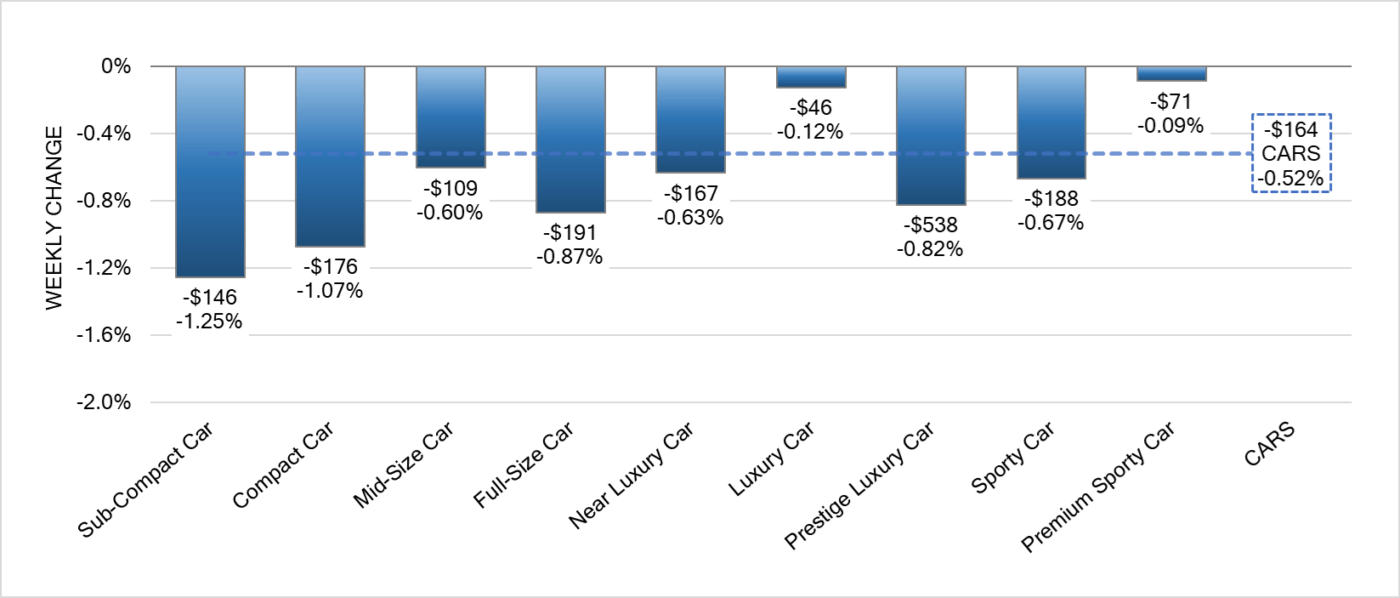

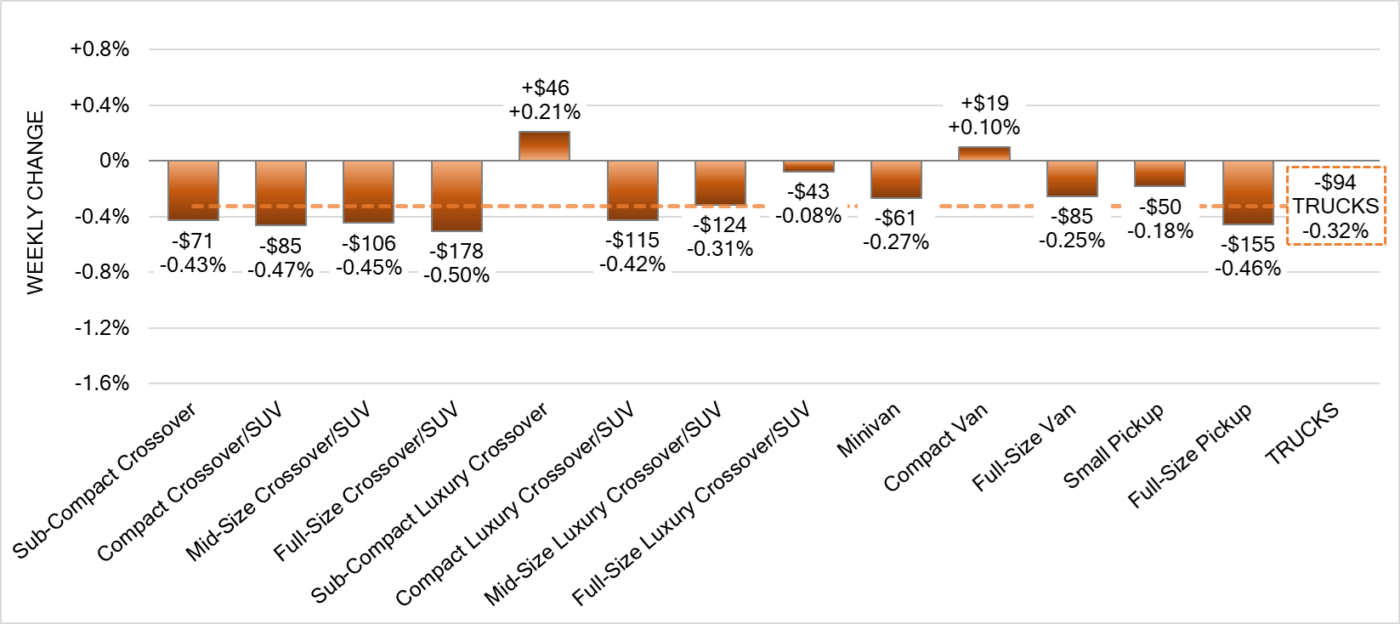

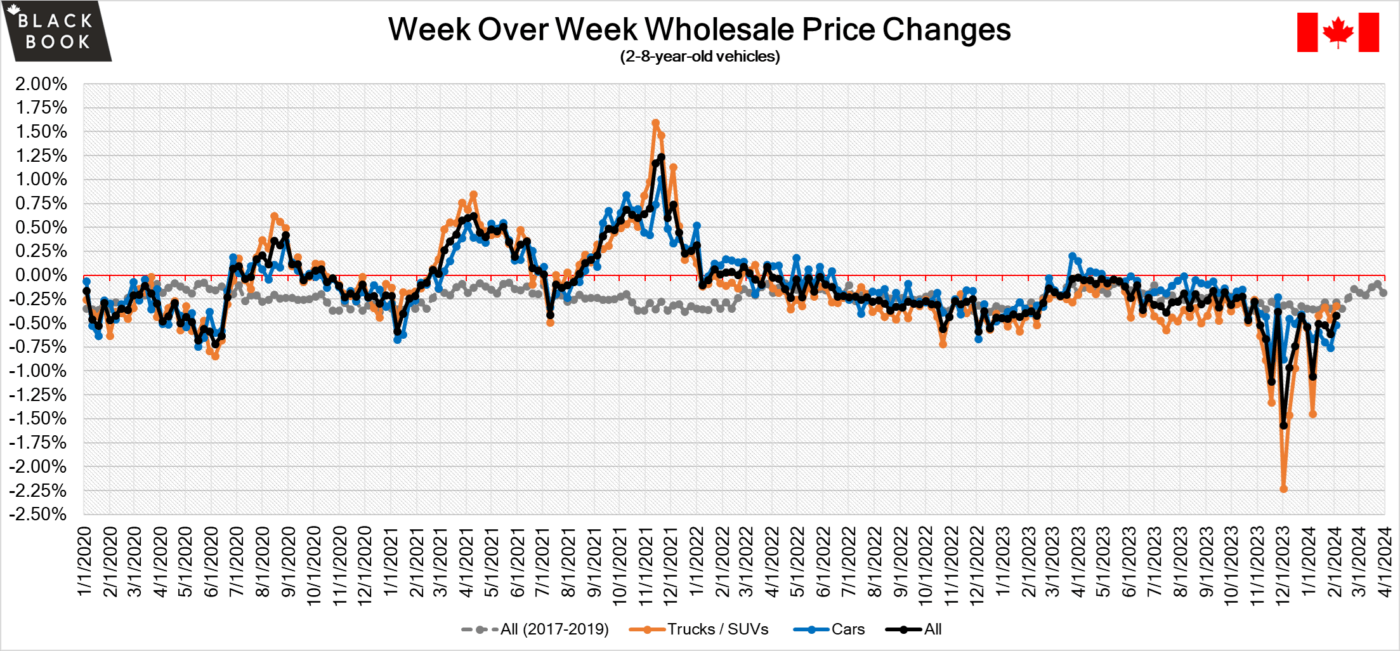

The Canadian used wholesale market saw a decline in prices for the week at –0.42%. The Car segment fell by -0.52% and the Truck/SUVs segment prices declined –0.32%. 2 out of 22 segments’ values have increased for the week. The Sub-Compact Luxury Crossover segment increased 0.21% followed by the Compact Van segment which was up 0.10%. The segments with the largest declines were Sub-Compact Car at –1.25% followed by Compact Car at –1.07%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.52% | -0.76% | -0.22% |

| Truck & SUV segments | -0.32% | -0.46% | -0.33% |

| Market | -0.42% | -0.61% | -0.28% |

Car Segments

- There was an overall decrease of -0.52% seen in Car segments last week. The decline was noted across all nine segments.

- The least of the decreases noted were from Premium Sporty Car at (-0.09%) and Luxury Car with (-0.12%).

- The most significant decline observed was Sub-Compact Car at (-1.25%) followed by Compact Car at (-1.07%).

Truck Segments

- Truck segments experienced an overall decrease of -0.32% last week.

- Full-Size Crossover/SUV (-0.50%), Compact Crossover/SUV (-0.47%) and Full-Size Pickup (-0.46%) had the largest declines.

- Two segments had increases. Those were Sub-Compact Luxury Crossover (+0.21%) and Compact Van (+0.10%).

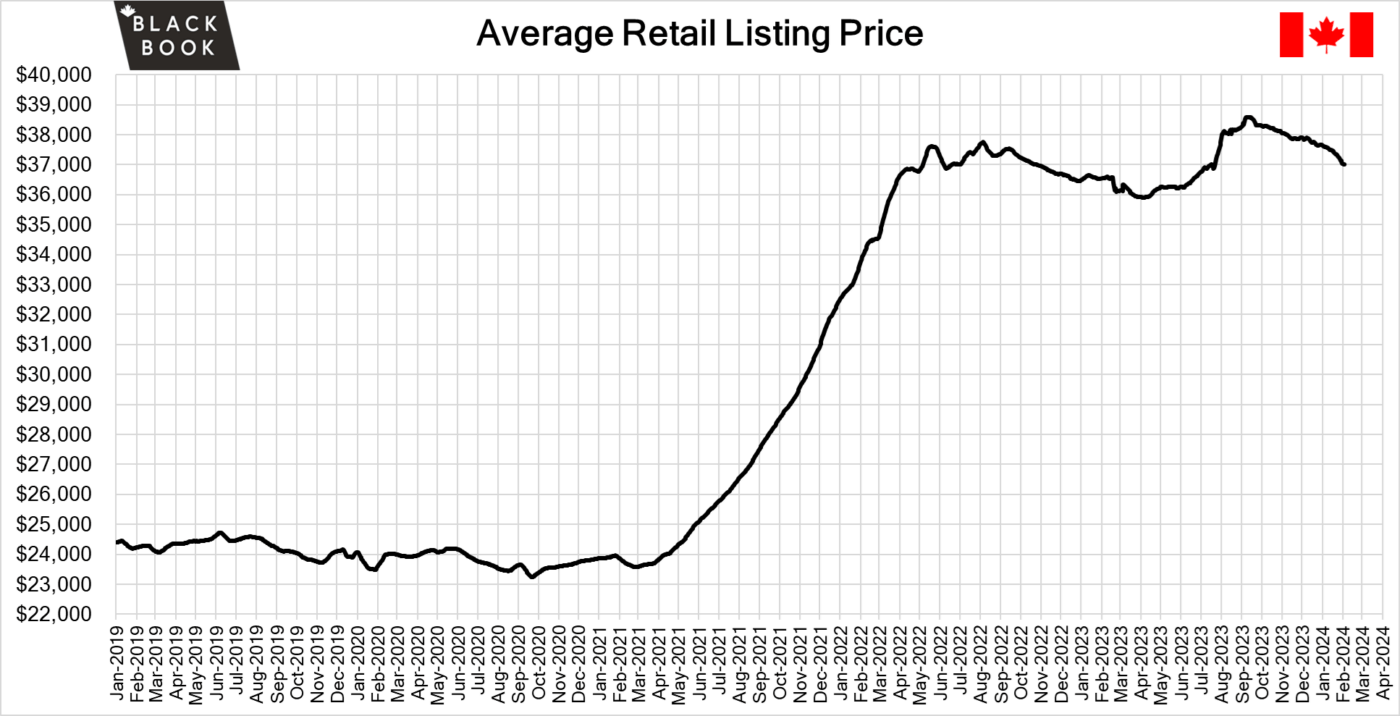

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $37,000. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines closer to the historical average than the last few weeks. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were improving this past week with some observed sell rates were as low as 29% and as high as 66% but most were between 35-50%. Last week we saw more sellers dropping floors, which has been contributing to lanes with higher sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s economy is expected to have grown by 0.3% in December 2023, with increases in the manufacturing, real estate & rental & leasing, and mining, quarrying & oil & gas extraction being partially offset by declines in transportation & warehousing, construction, and educational services.

- The S&P Global Canada Manufacturing PMI improved to 48.3 in January from 45.4 in the previous month, marking the largest improvement since October.

- Canadian mortgage credit continues to advance despite elevated mortgage rates. The balance of outstanding residential mortgage credit climbed 0.2% to $2.2 trillion in November.

- The yield on the Canadian 10-year government bond increased slightly to 3.48%.

- The Canadian dollar is around $0.741 this Monday morning similar to $0.743 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.33% last week; the prior week decreased by -0.33%.

Volume-weighted Car segments decreased -0.22%, compared to the prior week’s -0.26% decrease:

- The 0-to-2-year-old Car segments were down -0.26% and 8-to-16-year-old Cars declined -0.10%.

- Two of the nine Car segments increased last week.

- The Compact Car segment increased for a fourth consecutive week, gaining +0.26% last week. The 8-to-16-year-old Compact Cars reported a fifth straight increase. The newer 0-to-2-year-olds had a large gain of +0.58%, largest for the segment since mid-March 2023.

- Despite the gains being reported in Compact Car, the smaller Sub-Compact segment has continued to depreciate. However, after three weeks of depreciation exceeding 1%, the rate of decline slowed last week to -0.58%.

- Compact Car was not the only segment to reported appreciation last week, Sporty Car had a small positive gain, up +0.07%. Additionally, the older model years (aged 8-16 years old) also increased (+0.18%).

Volume-weighted Truck segments decreased by -0.38%; the previous week decreased -0.36%:

- The 0-to-2-year-old models declined -0.36% on average and the 8-to-16-year-olds decreased by -0.30% on average.

- Twelve of the thirteen Truck segments declined last week.

- The Full-Size Crossover/SUV segment was the only Truck segment to report an increase last week with a small +0.03% increase. The 0-to-2-year-old Full-Size Crossover/SUV segment reported a third consecutive week of increases, with an increase of +0.05% last week.

- Full-Size Trucks continue to decline, but the rate of decline is slowing with the depreciation last week of -0.20%, compared to -0.30% the prior week.

- The Compact Car segment is reporting gains, but the same cannot be said for the Compact Crossover/SUV segment, with another drop (-0.43%). The segment marked an eighteenth week of declines with an average weekly decline of -0.87%.

Industry News

- 2024 Canadian auto sales are off to a hot start as January numbers show a huge improvement over 2023 as well as increases versus pre-pandemic numbers. Total sales in January are estimated at 112,862, which is 14.9% over 2023 and more than January of 2019 where 111,225 units were sold.

- Mazda released its new 2-row Mid-size Crossover, the CX-70 as it fills out its SUV lineup for 2025MY to cover the range of higher volume SUV segments and leverage the success of its larger CX-90 model released last year, as the CX-70 utilizes the same platform and powertrains as its brand sibling.

- Ford updated the Explorer Mid-size Crossover for 2025MY, updating front and rear fascia’s and bringing the interior to the next level of technology, comfort, and passenger engagement. The model looks to reduce lineup complexity as it now offers 4 trims starting with its new Activ trim, starting at $50,535 in Canada.

- As Jeep nears closer to launching its first all-electric crossover, the brand has released details and images of the Wagoneer S EV which will ride on Stellantis’ STLA-Large platform that will support multiple other brands in the portfolio as well. The Wagoneer S EV targets 640km of range and should accelerate to 96km/h in 3.5 seconds.

- With consumer’s undecided interest in EV adoption, GM returns to the planning of PHEV’s that would provide a much greater number of electrified alternatives to buyers and allow the scheduled target share of ZEV’s to be reached in 2026, 2030, and 2035.

- Federal rebates for the iZEV program reached $712.6 million in 2023, nearly tripling the amount in 2022 as Tesla, Hyundai, Toyota, Chevrolet, and Kia round out the top 5 manufacturers by volume as the industry sold 146,000 ZEVs last year.