03.11.2025

Market Insights – 3/11/25

Wholesale Prices, Week Ending March 8th, 2025

The Canadian used wholesale market experienced a decline of –0.12% in pricing for the week. Car segments prices decreased by –0.16% while the Truck/SUVs segments decreased by -0.08%. The largest increases were seen in Full Size Crossover/SUV at +0.81% and Sub-Compact Luxury Crossover/SUV at +0.47%. The largest declines in the car segments were seen in Full-Size Car at -0.59% and Sub-Compact Car with -0.39%. The largest declines in the Truck/SUV segments were Compact Van at -0.78% followed by Mid-Size Luxury Crossover/SUV with -0.67%.

| Car segments | -0.16% | -0.20% | -0.21% |

| Truck & SUV segments | -0.08% | -0.18% | -0.20% |

| Market | -0.12% | -0.19% | -0.21% |

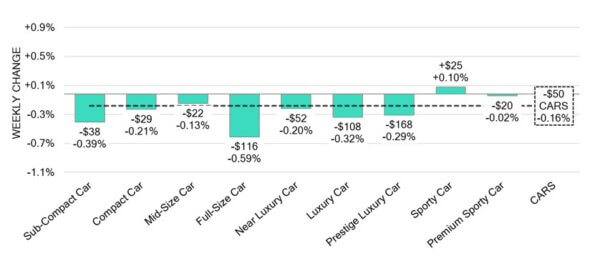

Car Segments

- There was an overall depreciation of –0.16% seen in car segments last week. This softening was reflected across eight of the nine car segments.

- Segments with the largest reductions were Full-Size Car (-0.59%), Sub-Compact Car (-0.39%) and Luxury Car (-0.32%).

- One segment showed an increase. That segment was Sporty Car (+0.10%).

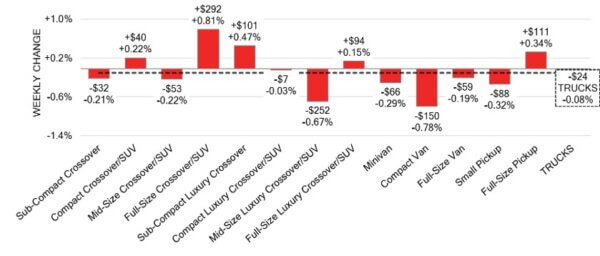

Truck / SUV Segments

- Truck segments showed an overall decrease of –0.08% last week. Eight of the thirteen segments reflected this change.

- Segments with the largest declines were Compact Van (-0.78%), Mid-Size Luxury Crossover/SUV (-0.67%) and Small Pickup (-0.32%).

- Five of the thirteen segments reflected an increase in values. Those with the largest were Full-Size Crossover/SUV (+0.81%), Sub-Compact Luxury Crossover (+0.47%) and Full-Size Pickup (+0.34).

Wholesale

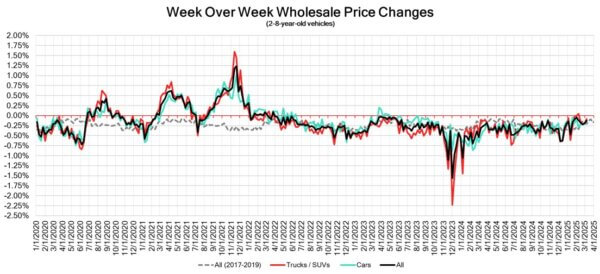

The Canadian market remains on a downward trend, with a decline far less pronounced compared to its previous week. Just over 36% of the market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell to –0.08%, while the decline of the car segments also experienced a decrease, bringing its change to –0.16%. Monitored auction sale rates ranged from 36.7 to 95.5% averaging at 56.8%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent political variances. The increase in supply entering the wholesale market continues to slow down, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Canadian GDP increased by 0.6% in the quarter ending December 2024,

after a revised increase of 0.3% in the previous quarter. - The S&P Global Canada Manufacturing PMI dropped to 47.8 in February 2025,

down from 51.6 the previous month. This was a significant decline compared to

the market expectations of 51.9. - Canada’s current account deficit increased to $5.0 billion in the fourth quarter of

2024, up from a revised $3.6 billion in the third quarter and significantly higher

than the anticipated $3.2 billion deficit. - The yield on the Canadian 10-year government bond increased to 2.96%.

- The Canadian dollar is around $0.696 this Monday morning, representing a slight

increase from $0.694 a week prior.

U.S. Market

- Last week was eventful, with daily updates on tariffs creating uncertainty. Auctions saw strong bidding activity nationwide, marked by high sales rates and growing demand, especially for late-model units, as many speculated tariffs would raise new vehicle prices, boosting used car demand. The industry gained another month’s reprieve from tariffs. Meanwhile, consumer refund checks are hitting bank accounts, adding another factor to monitor for its impact on used car values.

Industry News

- President Trump has issued a one-month exemption from tariffs on the auto industries in Canada and Mexico, as auto sector tariffs were to be imposed on March 4th, they are now scheduled to be activated on April 2nd as long as the goods are USMCA-compliant.

- New car sales for February were an estimated 122,000 units according to Desrosiers, resulting in an 8.2% decline over last year’s historically strong result. A portion of the decline was provided by a massive slide in EV sales predicted to be some 85% down against last year as February registered the first sales month without an active Federal iZEV rebate.

- Steve Flamand has been named Hyundai Canada’s next CEO, effective March 10th. He will succeed Don Romano, who will lead Hyundai Australia and act as an advisor for the business in the Asia-Pacific region.

- Toyota has halted the production of Japanese-produced Rav4’s and the Harrier crossover, as an explosion was reported at a Japan-based parts supplier in Toyota City, killing one worker and backing up the domestic supply chain. The production stoppage could affect models destined for North American supply.

- Data from Natural Resources Canada has shown that from March 2024 to March 2025, public charging ports increased by at least 6,586 at 1,559 stations across the country. This accounts for a 24.2% increase year-over-year, with charging ports totaling 33,767, with 18.7% (6,309 ports) being DC fast chargers.

- Equifax Canada released 2024 data results on fraud, highlighting an increase of 25% last year. This equates to a fraud rate 0.25% or 1 in every 400 applicants, with higher frequency of fraud in buyers new to Canada.