03.12.2024

Market Insights – 3/12/2024

Wholesale Prices, Week Ending March 9th

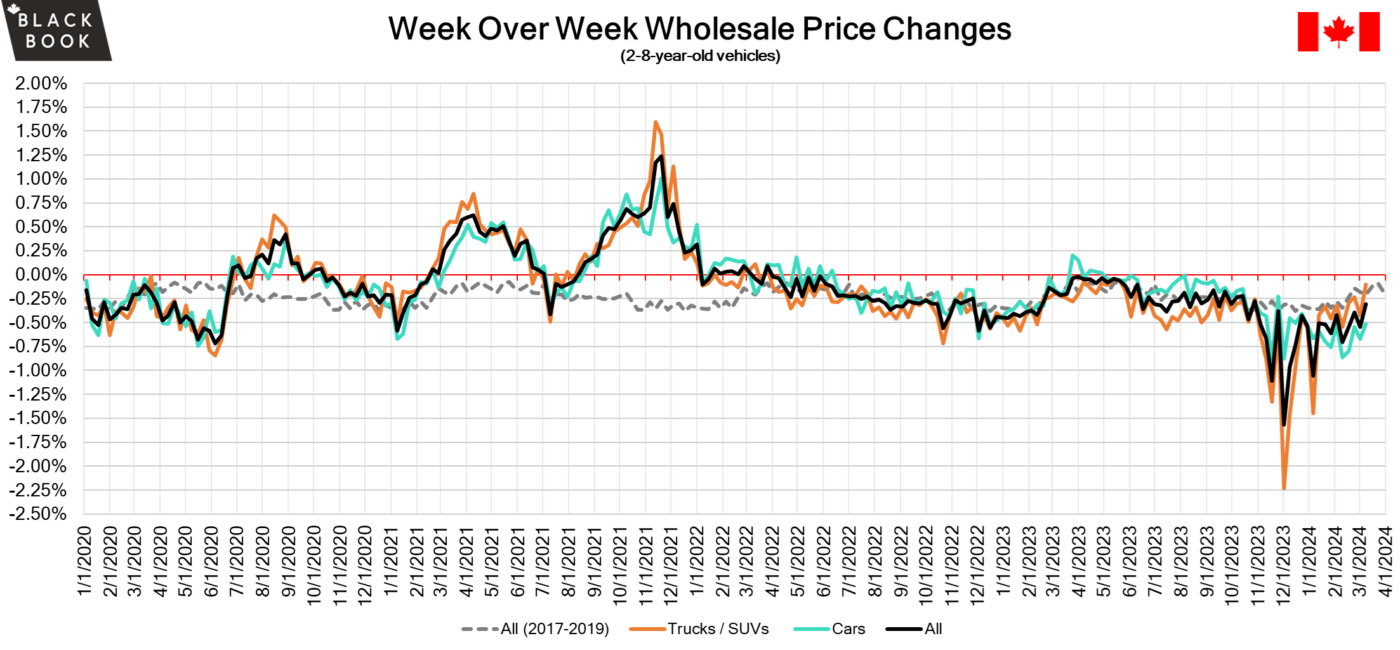

The Canadian used wholesale market saw a decline in prices for the week at –0.31%. The Car segment fell by –0.51% and the Truck/SUVs segment prices declined –0.10%. 4 out of 22 segments’ values have increased for the week. The Compact Luxury Crossover/SUV Luxury Crossover/SUV segment increased by 0.63% followed by the Full-Size Crossover/SUV segment which rose by 0.61%. The segments with the largest declines were Compact Van at -1.77% followed by Full-Size Car at –1.66%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.51% | -0.67% | -0.21% |

| Truck & SUV segments | -0.10% | -0.42% | -0.20% |

| Market | -0.31% | -0.55% | -0.21% |

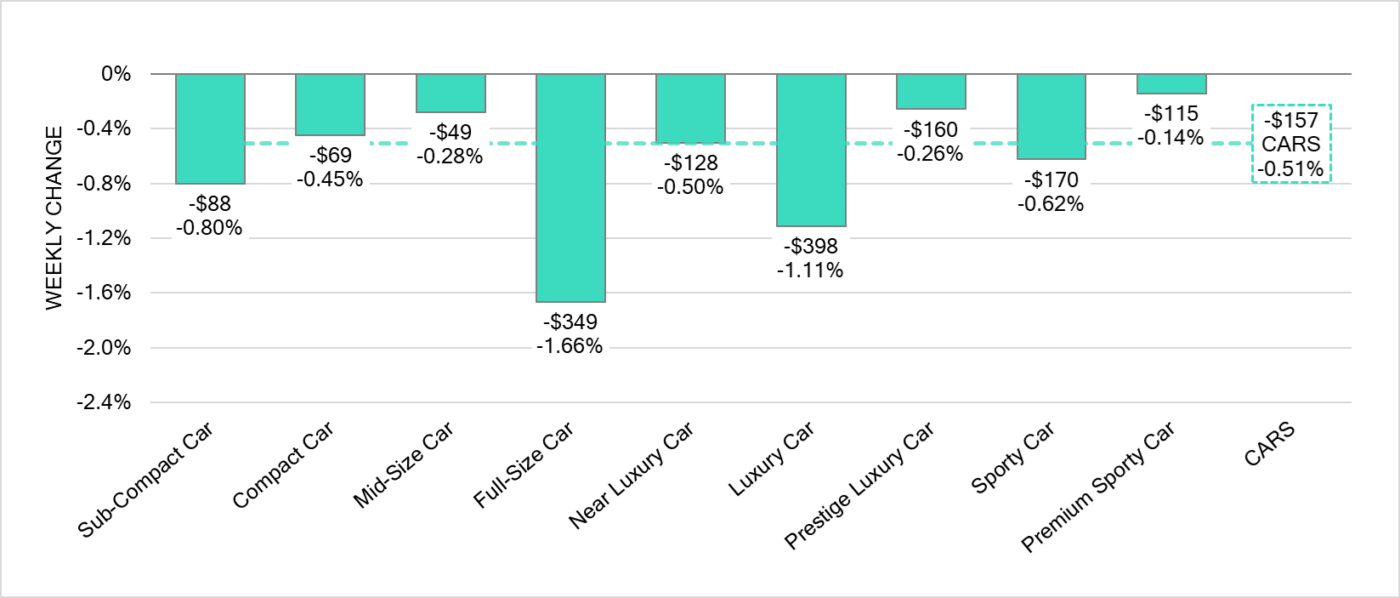

Car Segments

- There was an overall decrease of -0.51% seen in Car segments last week.

- Full-Size Car showed the most significant decline at (-1.66%) followed by Luxury Car at (-1.11%).

- Those with the least amount of a decline were Premium Sporty Car (-0.14%) followed by Prestige Luxury Car (-0.26%) and Mid-Size Car (-0.28%).

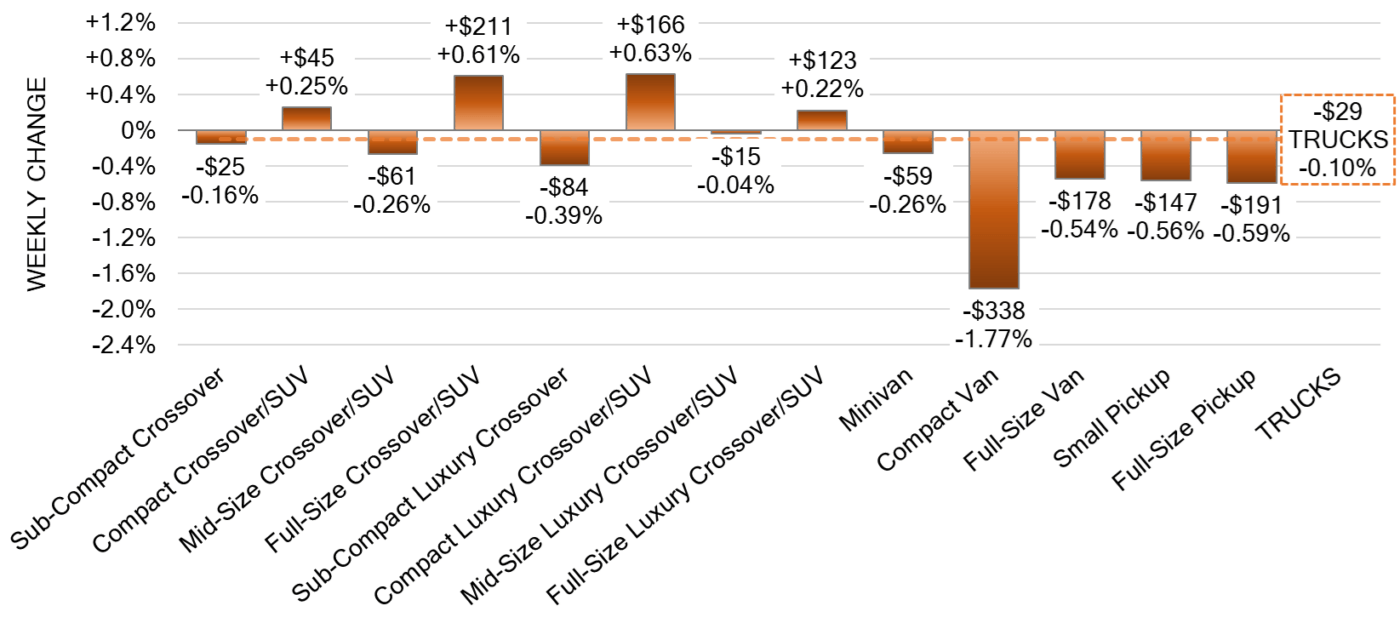

Truck Segments

- Truck segments reflected an overall decline of -0.10% last week.

- Segments with the most notable depreciation were Compact Van (-1.77%), Full-Size Pickup (-0.59%), Small Pickup (-0.56%) and Full-Size Van (-0.54%).

- Four segments had an increase. Those were Compact Luxury Crossover/SUV (+0.63%), Full-Size Crossover/SUV (+0.61%), Compact Crossover/SUV (+0.25) and Full-Size Luxury Crossover/SUV (+0.22%).

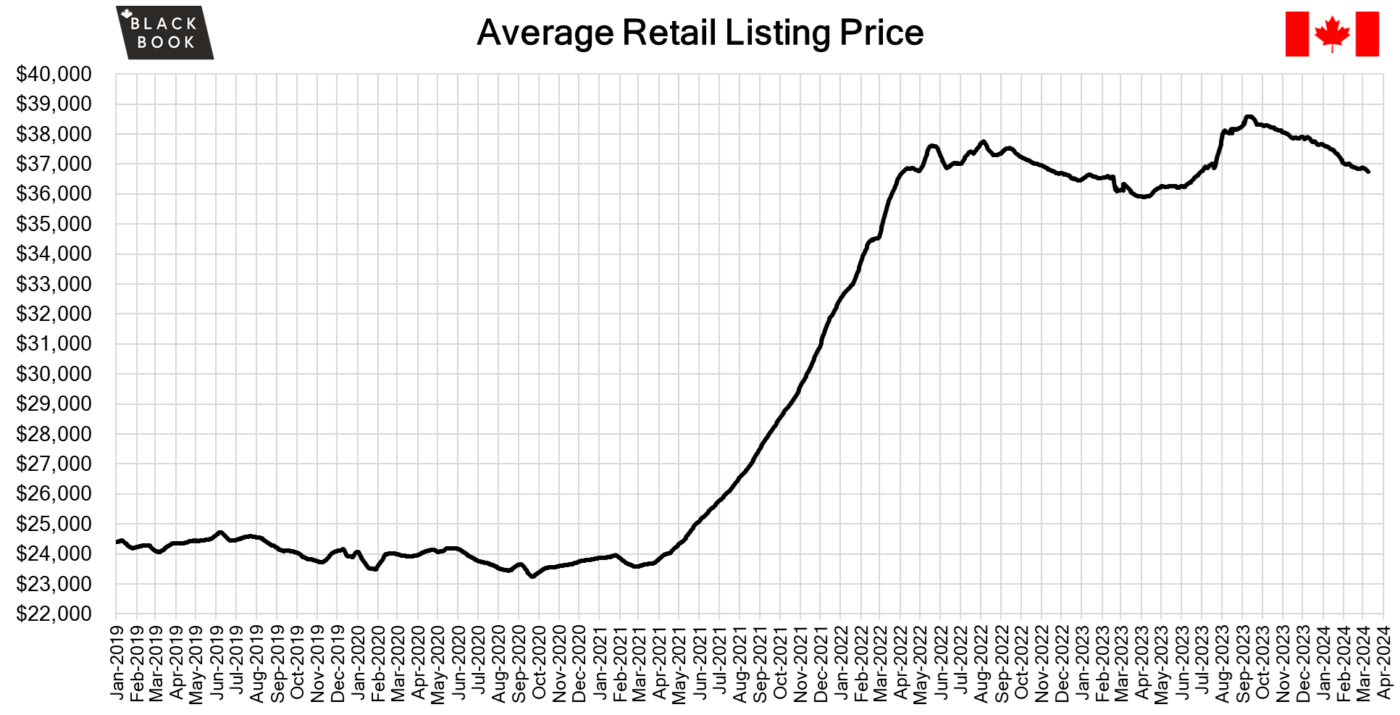

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,700. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines that were less than the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 6% and as high as 53% but most were between 30-40%. Last week we saw less sellers dropping floors, which has been contributing to more lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Bank of Canada held its target for the overnight rate at 5% during its March meeting and pledged to continue normalizing the Bank’s balance sheet, as policymakers remained concerned about risks to the outlook for inflation.

- Canada reported a trade surplus of $500 million in January 2024, contrasting with a revised deficit of $900 million in December and beating market forecasts of a $100 million surplus.

- Employment in Canada rose by 40,700 in February 2024, following a 37,300 reading in January and surpassing forecasts of 20,000.

- The yield on the Canadian 10-year government bond declined to 3.34%.

- The Canadian dollar is around $0.741 this Monday morning down from $0.737 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.05% last week; the prior week decreased by -0.16%.

Volume-weighted Car segments decreased -0.14%, compared to the prior week’s -0.10% decrease:

- The 0-to-2-year-old Car segments were down -0.20% and 8-to-16-year-old Cars declined -0.13%.

- Three of the nine Car segments increased last week.

- Last week saw the Compact Car segment’s value rise by +0.22%, a more modest increase compared to the previous week’s gain of +0.41%, yet still maintaining an upward trend for the ninth consecutive week. Additionally, the Mid-Size and Full-Size Car segments experienced slight gains, with each realizing a marginal increase of +0.01%.

- The Premium Sporty Car segment faced the most significant decrease last week, with a depreciation of -0.77%, marking an acceleration from the prior week’s decline of -0.32%.

Volume-weighted Truck segments decreased by -0.02%; the previous week decreased -0.18%:

- The 0-to-2-year-old models declined -0.14% on average and the 8-to-16-year-olds decreased by -0.02% on average.

- Four of the thirteen Truck segments increased last week.

- Last week, the Small Pickup and Minivan segments both continued to show rising values, with increases of +0.37% and +0.38% respectively, gaining momentum compared to recent weeks. Additionally, the Mid-Size and Full-Size Crossover segments witnessed growth, with upticks of +0.04% and +0.39% respectively.

- The rate of decline for Compact Crossovers is decelerating, with a slight decrease of -0.04% last week, showing a slower pace than the previous week’s drop of -0.15%.

- Last week, the Full-Size Truck segment demonstrated stability, experiencing only a minimal depreciation of -0.02%.

Industry News

- After idling production for 2 months for a software issue on its latest EV, the Chevrolet Blazer EV, General Motors will now be cutting its price on the model in Canada by as little as 4.7% compared to 9% in the U.S. The least expensive trim now starts at $60,370 including freight & PDI.

- Toyota Motor Corp. is buying out its battery partner, Primearth EV Energy Co. which has supported the auto manufacturer for the last 28 years, producing batteries for many hybrids and plug-ins including the Prius. As the supplier gets up to speed on producing batteries for fully electric vehicles, Toyota looks to take full ownership as it typically wants total oversight over such key components in its vehicles.

- As demand for EV’s begins to weaken across North America, particular startups are enforcing plans to move through this transition, by not only making cheaper models and slashing prices, but lowering volume plans for production ramp-up as well as laying off substantial shares of employees to make it through.

- Analysts at U.S. based tech firm, Gartner, forecast that EV’s will become less expensive to build than ICE models by 2027. With battery costs continuing to fall and industry innovations around manufacturing, such as giga casting or mega casting, lend themselves to the simpler skateboard platform found in battery electric vehicles.