03.18.2025

Market Insights – 3/18/25

Wholesale Prices, Week Ending March 15th, 2025

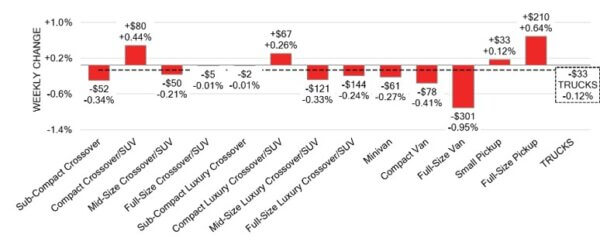

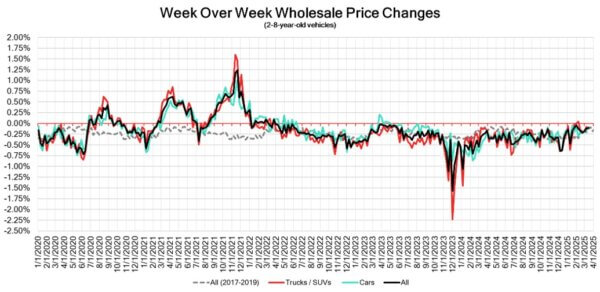

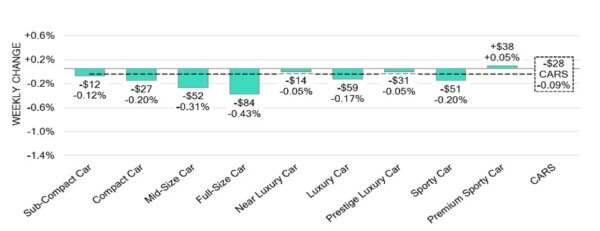

The Canadian used wholesale market experienced a decline of –0.10% in pricing for the week. Car segments prices decreased by –0.09% while the Truck/SUVs segments decreased by -0.12%. The largest increases were seen in Full Size Pickup at +0.64% and Compact Crossover/SUV at +0.44%. The largest declines in the car segments were seen in Full-Size Car at -0.43% and Mid-Size Car with -0.31%. The largest declines in the Truck/SUV segments were Full-Size Van at -0.95% followed by Compact Van with -0.41%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.09% | -0.16% | -0.12% |

| Truck & SUV segments | -0.12% | -0.08% | -0.13% |

| Market | -0.10% | -0.12% | -0.13% |

Car Segments

- There was an overall depreciation of –0.09% seen in car segments last week. This downturn was reflected across eight of the nine car segments.

- Segments with the largest reductions were Full-Size Car (-0.43%) and Mid-Size Car (-0.31%). Compact Car and Sporty Car had the same decrease (-0.20%).

- Premium Sporty Car was the only segment to show and increase (+0.05%).

Truck / SUV Segments

- Truck segments showed an overall decrease of –0.12% last week. Nine of the thirteen segments reflected this change.

- Segments with the largest declines were Full-Size Van (-0.95%), Compact Van (-0.41%) and Sub-Compact Crossover (-0.34%).

- Four segments had an increase in values. Those with the largest were Full-Size Pickup (+0.64%), Compact Crossover/SUV (+0.44%) and Compact Luxury Crossover/SUV (+0.26).

Wholesale

The Canadian market remains on a downward trend, with a decline far less pronounced compared to its previous week. Just under 19% of the market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell to –0.12%, while the decline of the car segments also experienced a decrease, bringing its change to –0.09%. Monitored auction sale rates ranged from 33.3 to 69.7% averaging at 51.7%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices and recent political variances. A slight increase in supply entering the wholesale market has been noted, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $35,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada reduced its key interest rate by 25 basis points to 2.75%

during its March meeting, as anticipated and previously indicated, bringing the

total rate reductions to 225 basis points since the beginning of its easing cycle in

June 2024. - Housing starts in Canada dropped by 4% in February 2025 to a seasonally

adjusted annual rate of 229,030 units, a decrease from the revised January figure

of 239,322 units and lower than the market expectations of 250,000 units. - The annual inflation rate in Canada rose to 2.6% in February 2025, up from 1.9%

the previous month. This marked the highest rate in eight months, significantly

surpassing market predictions of 2.2% and the Bank of Canada’s forecast of

2.5%. - The yield on the Canadian 10-year government bond increased to 2.99%.

- The Canadian dollar is around $0.699 this Monday morning, representing a slight

increase from $0.696 a week prior.

U.S. Market

- The market gained momentum last week, recording the largest single-week increase since early April of last year. Bidder activity was strong nationwide, driven by discussions about tariffs—despite the one-month reprieve for the auto industry—and typical signs of a robust spring buying season, resulting in larger-than-usual increases.

Industry News

- Minister Francois-Philippe Champagne is already in the ear of the organizations that have committed to investment in EV supply chain infrastructure within Canada to stay the course on their investment, urging them not to back away in the wake of U.S. tariffs. While news of the Stellantis facility in Brampton, and Ford’s Oakville plant slowing the transition on new electric vehicles, as well as the Northvolt facility in Sweden filing for bankruptcy.

- Mitsubishi Canada has named a new CEO in Kenichi Kawaji, who will succeed Kenji Harada, effective April 1st. The leadership change occurs after a banner sales year for the brand in 2024.

- The Bank of Canada has continued its cutting of the overnight interest rate by 25 basis points last week. The rate now stands at 2.75% as concerns of inflationary pressures and decreased consumer confidence fills the narrative due to trade woes pending U.S. tariffs.

- The B.C. government has pushed back on U.S. tariffs by eliminating the eligibility of Tesla EV’s and charging stations to qualify for the province’s rebates which offer $5,000 on battery storage systems and $350 towards EV charger installation.

- In an effort to safeguard pricing on parts supply, Ford has been stockpiling parts that comply with the U.S.-Mexico-Canada agreement (USMCA), communicating to those suppliers to keep shipping under its current contracts to offset price impacts from tariffs.

- Saskatchewan plans to double the vehicle registration cost on EV’s from $150 to $300, as an effort toward fixing roads. This is the second provincially imposed consumer cost on EV’s from Western Canada of note.